Mutual Fund Taxation-Capital Gains

- Posted By Amritesh

- On September 13th, 2018

- Comments: 4 responses

Capital Gain Tax is levied on transfer (sale) of Capital Assets. Investment in Mutual Funds is ideally done with the aim to earn decent returns which would enable Investors to meet future financial objectives. Capital Gain Tax on Mutual Fund gain is levied as per the provisions under the Income Tax Act. In this article we would try and understand the Mutual Fund Taxation-Capital Gains and Tax Implications.

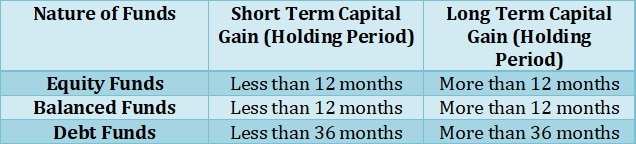

Classification of Mutual Funds (Long or Short Term Gains)

Capital Gain may be classified as Short Term Capital Gain (STCG) or Long Term Capital Gain (LTCG) based on the holding period of the respective asset. Equity oriented Mutual Funds, Balanced Mutual Funds (More than 65% diversified in to Equity), holding period of more than 12 months is regarded as long term. Whereas, in case of Debt Mutual Funds the holding period of more than 36 months is regarded as Long Term for Capital Gain Tax Computation.

Mutual Fund Taxation-Capital Gains and Tax Implications Equity Oriented Mutual Funds

Capital Gain Tax is levied on the Equity Oriented Mutual Funds, based on the holding period of the respective funds. Amendment to Long Term Capital Gain (LTCG) on Sale of Equity Share/Equity Oriented Mutual Fund is proposed in the Budget 2018, the same is applicable from the Financial Year 2018-19.

Non Tax Saving Equity Oriented Mutual Funds held for more than 12 months is considered as LTCG, gain up to Rs 1lac in a financial year is tax free. LTCG above Rs 1lac is taxed @ 10% without indexation benefit.

Short Term Capital Gain (STCG) Tax of 15% is levied on part of the Fund redeemed before completion of 12 months.

Equity Linked Savings Scheme (ELSS) is tax saving mutual fund product. ELSS Fund comes with mandatory 3 years lock in period. Investment in ELSS is eligible for Tax Deductions under section 80C up to the maximum limit of Rs 1,50,000/-. ELSS gain up to Rs 1lac is exempted from tax, while gain in excess of Rs 1 lac is taxed @ 10% without indexation benefit.

Systematic Investment Plan (SIP) is a fixed regular investment in Mutual Fund. Investment in SIP may be done on a Monthly, Quarterly or Annual basis. Each investment is treated as fresh investment for the computation of capital gain tax.

Balanced Mutual Funds

Balanced Funds are Equity oriented hybrid funds with at least 65% of the investment in Equities to avail the tax benefit. Capital Gain Tax on Balanced Fund is similar to the Equity Fund.

Balanced Mutual Funds held for more than 12 months is considered as LTCG, gain up to Rs 1lac in a financial year is considered tax free. LTCG above Rs 1lac is taxed @ 10% without indexation benefit. Units of Balanced Fund redeemed before 12 months is considered as Short Term Capital Gain (STCG) taxed at 15%.

Debt Mutual Funds

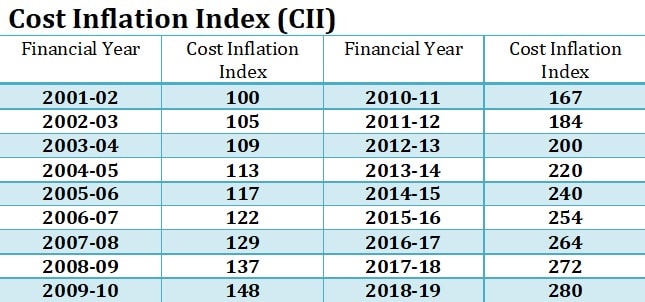

Capital Gain Tax implication on Debt Mutual Fund is different from Equity and Balanced Mutual Funds. In terms of Debt Mutual Funds, holding period of more than 36 months is regarded as Long Term. Long Term Capital Gain is taxed @ 20% after indexation. Indexation allows factoring in inflation for the period between debt fund acquisition and redemption. In case of Short Term Capital Gain from Debt Mutual Funds, the gain is included in the income of the individual for the respective financial year and STCG is levied as per the income slab applicable.

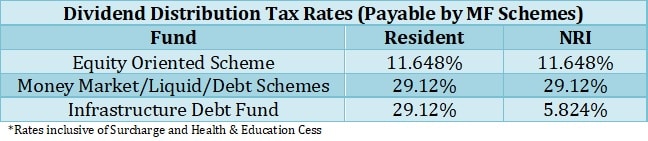

Dividend Distribution Tax (DDT) on Mutual Fund

Dividend is paid to the investors out of the interest earned by the Mutual Fund Scheme. Dividend Distribution Tax (DDT) is introduced for Equity Investors in the Budget 2018. The investors are exempted from paying tax on the dividend received. However, the Mutual Fund Schemes are required to pay DDT on the dividend to be distributed to the respective Investors.

Equity Oriented Mutual Funds (including Balanced Mutual Funds) is taxed @10% (11.648% including surcharge and cess).

Debt Mutual Fund is taxed @ 25% (29.12% including surcharge and cess).

DDT is subject to provisions under the Section115-O.

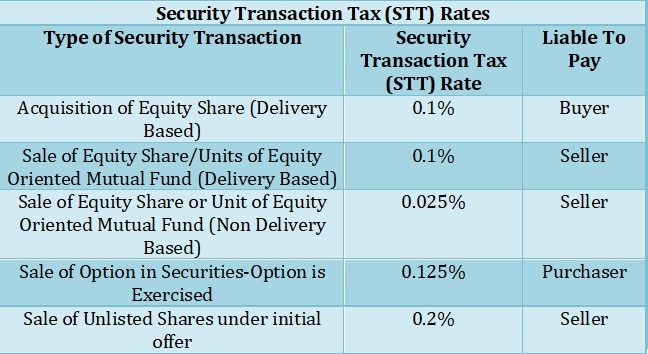

Security Transaction Tax (STT)

STT is levied on any transaction (buy or sell) in Securities via any recognized Stock Exchange (excluding trade in commodities and currency).

Tax on Mutual Fund Investment by Non Resident Individuals (NRIs)

NRIs are permitted to invest in Mutual Fund and need to pay Capital Gain Tax on the same. However, tax implication for NRIs has few changes, the same will be discussed in my upcoming post.

In brief, LTCG from Equity and Equity Oriented Mutual fund is same for Residents and Non Residents. However, in case of non equity fund the rule is different. NRI’s are not allowed to avail indexation benefit in case of gains arising from unlisted Debt Mutual Fund. Furthermore, the NRIs are also subject to Tax Deducted at Source (TDS) on the Capital Gain at the rate applicable on such gains.

TDS on Mutual Fund Capital Gain is not applicable on Resident Individuals.

Income Tax Slabs & Rates Financial Year 2018-19 (Assessment Year 2019-20)