Income Tax Slab Rates FY 2019-20 (AY 2020-21)

- Posted By Amritesh

- On July 5th, 2019

- Comments: 767 responses

Income Tax Slab Rates remain unaltered in the Union Budget 2019 for the current Financial Year. Tax Rebate U/S 87A increased in the Interim Budget 2019 from Rs 2,500/- to Rs 12,500/- is available to the Individuals with income up to Rs 5 lacs. Thereby, Individuals with Taxable Income up to Rs 5 lacs will enjoy 100% tax rebate. Income Tax Slab Rates in the chart above shows the latest Slabs applicable for the Financial Year 2019-2020 (Assessment Year 2020-21). Health & Education Cess is levied @ 4% on Income Tax payable. Standard Deduction re-introduced last year is increased to Rs 50,000/-. Higher Surcharge to be levied on income slabs of Rs 2-5 crore & above Rs 5 crore.

Health and Education Cess of 4% is levied on Total Income Tax and on Surcharge if applicable.

Surcharge of 10% will be levied on the Total Income between Rs 50 lacs to Rs 1 crore.

In case of Total Income above Rs 1 crore, Surcharge will be levied @ 15%.

Surcharge of 25% is to be levied on the Total Income between Rs 2-5 crore. Effective Tax Rate comes to 39%.

In case of Total Income exceeds Rs 5 crore, Surcharge will be levied @ 37.5%. Effective Tax Rate comes to 42.7%.

The increase is surcharge for super rich will increase the effective tax rate for income category between Rs 2- 5 crores by 3.12%, similarly for income category above 5 crores effective tax rate will increase by 6.86%.

Increase in Standard Deduction for Salaried Individuals

Standard Deduction has been raised from Rs 40,000/- to Rs 50,000/- for the Financial Year 2019-2020. This was introduced in the Financial Year 2018-19 in lieu of Conveyance Allowance and Medical Reimbursement.

Standard Deduction is to be deducted from the Salary Income, prior to the calculation of Taxable Income.

Taxable Income = Gross Total Income – Deductions (Standard Deduction + Deduction Allowed Under Chapter VI-A of Income Tax Act)

Gross Total Income

Gross Total Income includes the aggregate income under the 5 heads of income, namely, Salary Income, Income from House Property, Income from Business or Profession, Capital Gains and Income from Other Sources.

Taxable Income: Income Tax Slab Rates

Taxable Income is derived from the Gross Total Income after subtracting eligible Deductions (Std.Deduction and Deductions allowed U/S 80C to U).

Tax Rebate under Section 87A

Individuals with Taxable Income up to Rs 5,00,000/- (5 lacs) will be eligible for tax benefit up to Rs 12,500/-. This implies that no tax is payable on taxable income up to 5 lacs. No Tax Rebate is available if Taxable Income exceeds Rs 5,00,000/-. Individuals may also reduce their Tax Liability by availing Deductions available under Chapter VI-A of the Income Tax Act (U/S 80C,D,E etc). Tax Deductions available for the Financial Year 2019-20 (Assessment Year 2020-21) is available in the link shared below.

Income Tax Deductions & Exemptions for Financial Year 2019-2020

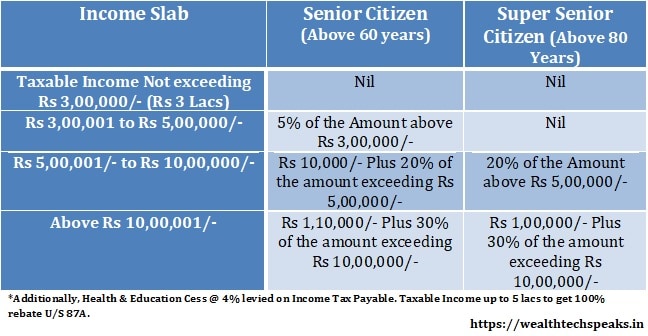

Income Tax Slab Rates For Senior & Super Senior Citizens

Individual Residents who fall in the age bracket of 60-80 years (Senior Citizen) the exemption on Taxable Income is increased to Rs 3,00,000/- (Rs 3lacs). For Income above the exemption limit, normal tax rate will be applicable. However, if the taxable income is below Rs 5 lacs, Rebate under 87A is available.

Individual Residents who are above 80 yrs of age (Super Senior Citizens) the exemption on Taxable Income is increased to Rs 5,00,000/-. For Income above the exemption limit, normal tax rate will be applicable.

This article is for informational purpose only. Readers are advised to research further to have more clarity on the topic. It is very important to do your own analysis and consult your Tax Advisor before arriving at any conclusion.