Income Tax Slabs & Rates for Financial Year 2023-24 (AY 2024-25)

- Posted By Amritesh

- On February 2nd, 2023

- Comments: 268 responses

Income Tax Slabs & Rates for Financial Year 2023-24 will surely bring relief to majority of the taxpayers in the mid-income group. Budget 2023 was expected to be a populist one, not only because it was the last full-fledged budget before the general election in 2024 but also since the Government had not announced any major tax reforms or relief for the middle-income group in the recent past. As pandemic coupled with the economic slowdown worldwide had propelled the Government to be cautious in their approach.

Top Performing Mutual Funds for Investment in FY 2022-23

However, Government has tried to address the issues and provide relief to the taxpayers in the Budget 2023. Even though the old tax regime remains unchanged but the new tax regime has been revised to make it lucrative for the tax paying individuals. Moreover, the New Tax regime replaces the Old Tax regime as the default tax system, but individuals have the option to continue with the old tax system. Furthermore, Government has revised the slabs and rates to make the new tax system more viable for the taxpayers.

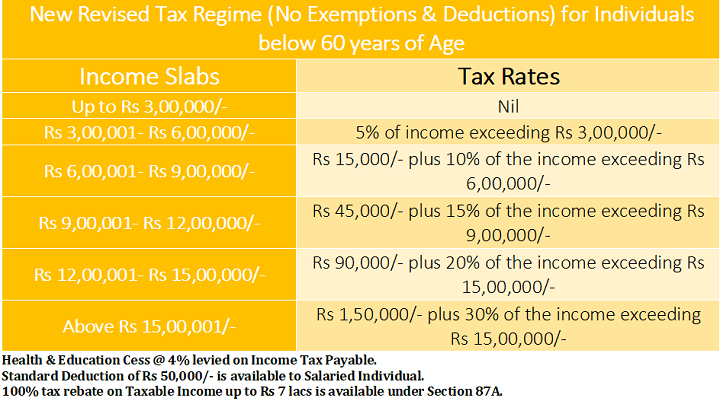

Income Tax Slabs & Rates under New Tax Regime for Financial Year 2023-24

New Tax regime has been made more attractive for the taxpayers with tax rebate being extended to income up to Rs 7 lacs with basic exemption limit increased to Rs 3 lacs. The total number of tax slabs under the new scheme has been reduced to 5 from 6 along with revision in the tax slabs for higher income group. In order to provide further relief to taxpayers, Standard Deduction of Rs 50,000/- has also been introduced under the New Tax system.

Tax Rebate under section 87A is also introduced under the new tax system for the Financial Year 2023-24. The benefit will be available to individuals with income up to Rs 7 lacs only, incase income exceeds the prescribed limit the rebate will not be available. Rebate under Section 87A increases to Rs 25,000/- under the new tax system. Furthermore, Surcharge of 10% & 15% is levied on annual income above Rs 50 lakhs and Rs 1 crore, respectively. Higher Surcharge of 25% is levied on the income range between Rs 2-5 crores, while the surcharge on income above Rs 5 crore has been slashed to 25% from existing 37%.

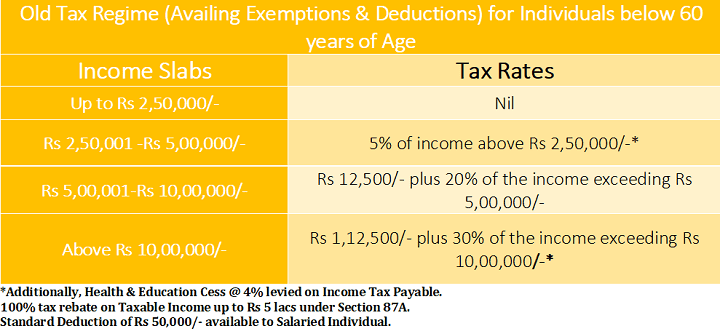

Income Tax Slabs & Rates under the Old Tax System for Financial Year 2023-24

Tax Slab Rates under the old tax regime (with income tax deductions & exemptions) remains unaltered in the Union Budget 2023 for the Financial Year 2023-24. Tax Rebate U/S 87A up to maximum of Rs 12,500/- is available to the Individuals with income up to Rs 5 lacs. Individuals with Taxable Income up to Rs 5 lacs will enjoy 100% tax rebate, implying nil tax liability. Income Tax Slab & Rates applicable for the Financial Year 2023-2024 (Assessment Year 2024-25) is same as the previous year. Health & Education Cess is levied @ 4% on Income Tax payable. Standard Deduction of flat Rs 50,000/- is available under the old tax regime. Surcharge of 10% & 15% is levied on annual income above Rs 50 lakhs and Rs 1 crore, respectively. Higher Surcharge of 25% & 37% is levied on income range between Rs 2-5 crores & above Rs 5 crores respectively.

Relief for the Income Taxpayers and Mid-Income Group

Government Budget 2023 is on the expected lines as far as personal tax regime is concerned. The old tax system will gradually be replaced by more simpler direct tax system with limited scope of deductions and exemptions. Government has made a conscious attempt to encourage taxpayers to move to the new tax regime. The announcements at this budget has been kind to the middle class segment, promising to bring relief in majority of the households post pandemic and surging inflation.

Comparison and Benefits of the revision in the tax slabs and rates will be shared after detailed analysis of the same.

Individuals looking to invest in Mutual Funds may connect at admin@wealthtechspeaks.in for investment guidance and advice. We do offer investment in regular Mutual Fund schemes for the interested investors.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content. In case you are interested in investing in Stocks, get your free Demat today (Click Here).

WealthTech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational and promotion purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.