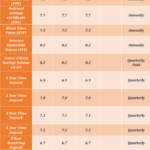

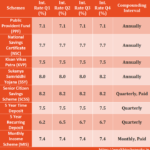

Small Savings Schemes Interest Rates for the Q3 of....

12 October 2024

12 October 2024

30 September 2024

1 September 2024

26 August 2024

1 August 2024

15 January 2024

Personal Finance- Consultant

Amritesh is an experienced professional in the field of Finance, HR & Compliance with multiple Master’s Degree under his belt and a registered SEBI Distributor. He has been Blogging about Personal Finance, Capital Market, Human Resource, Compliance & Fintech for more than a decade. Many of his articles has been published on some of the leading online business platforms. Educating investors and helping them with their investment is one of the prime objectives behind the creation of WealthTech Speaks.