Interest Rates on Small Savings Schemes 2022-23

- Posted By Amritesh

- On February 26th, 2023

- Comments: 2 responses

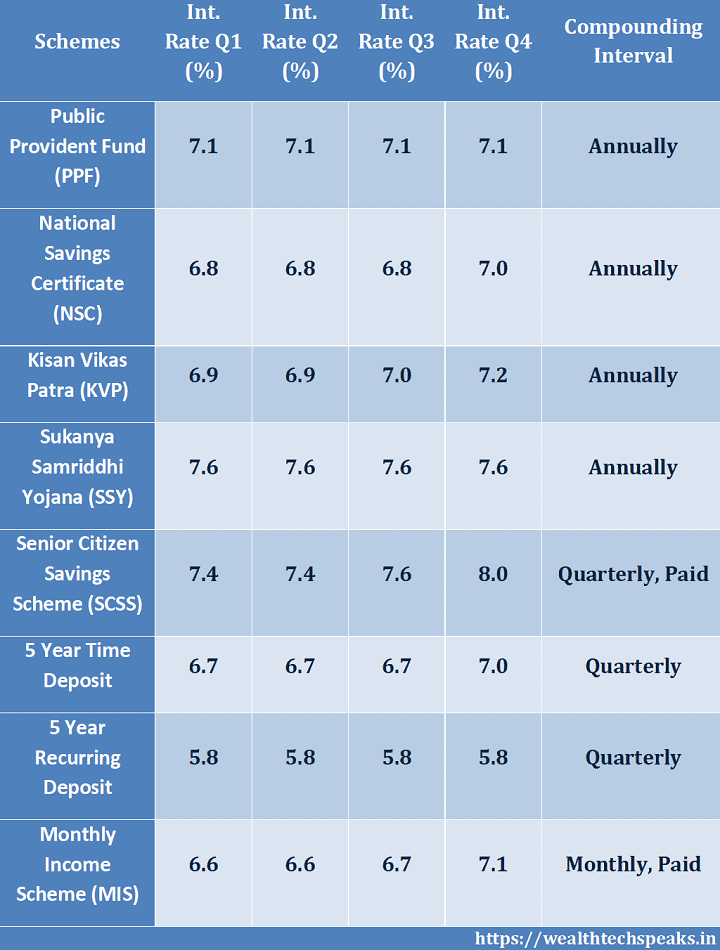

Government has increased the interest rates on selected small savings schemes for the last Quarter (ending 31st March, 2023) of the Financial Year 2022-23. The current inflationary trend and rise in yield on Government Security (G-Sec) has prompted the Government to revised the interest rates much to the relief of the investors relying heavily on the Small Savings Schemes.

Revision in repo rates coupled with ongoing inflationary trend strongly indicated tweaks in the interest rates for the Small Savings Scheme. However, Government for the time being has shied away from increasing the rates on two of the most popular savings schemes, Public Provident Fund (PPF) and Sukanya Samriddhi Scheme (SSS).

Sukanya Samriddhi Scheme (SSS) and Public Provident Fund (PPF) will continue to earn 7.6% and 7.1% return, for the quarter ending 31st March, 2023. The interest rate on these schemes have not been revised since 2nd Quarter of Financial Year 2020-21. However, Senior Citizens Savings Scheme (SCSS), Monthly Income Scheme (MIS) and 3 Year Time Deposit interest rates has been increased by 40 and 110 basis points, respectively. Increase in SCSS and MIS is good news for the individuals depending on them for regular income.

Income Tax Slabs & Rates for Financial Year 2023-24

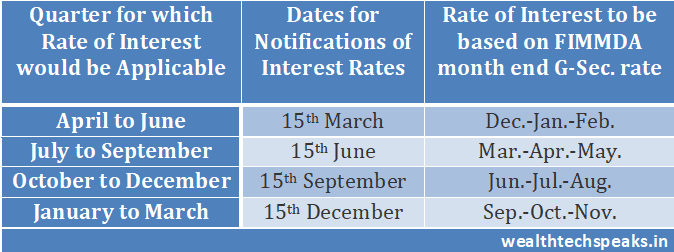

Government had decided to align the small savings interest rates with the relevant market rates of Government Securities. The rates are now recalibrated every quarter in order to maintain it at par with the current market rates. Recently, Repo rate has been revised to 6.50% while maintaining reverse repo rate at 3.35%.

On 04th May, 2022 repo rate was revised for the first time since May, 2020 to 4.40%. Subsequently, the repo rate has been raised on multiple occasions. Repo rate has been increased by 250 basis points since May, 2020 in an attempt to control the inflationary pressure. The Government has been conservative in tweaking the small savings interest rates for a while now. As pandemic coupled with fear of meltdown in the global economy has raised multiple economic concerns. However, if yields on G-Sec bonds keeps going up one may witness further increase in the interest rates in the near future.

Top Performing Mutual Funds for Investment in FY 2022-23

Small Savings schemes are aligned with Government Securities interest rates to provide level playing field to the Banks. Banks have adjusted their interest rates (lending/borrowing) on deposits and loans in alignment with the tweaks in the rates. The interest rates on Small Savings Schemes are currently at par with the Bank deposit rates, but tax benefits are available on selected Small Savings Schemes. The Central Bank (RBI) had clamored to bring parity in terms of the interest rate structure. However, retail inflationary pressure is a concern for the investors banking on these investment products. Savings Interest Rates FY 2022-23 is revised on quarterly basis.

Interest Rates on Small Savings Schemes for Financial Year 2021-22

The most popular tax saving scheme Public Provident Fund (PPF) will earn 7.1% interest on deposits for the period ending 31st March, 2023. Similarly, 5 Year National Savings Certificate (NSC) will earn 7.0% return on the investment. Small Savings Schemes such as PPF, NSC, SSY offer risk free return along with tax benefits, making them popular investment avenue among risk-averse investors. Whereas, Senior Citizens Savings Schemes (SCSS) & Monthly Income Scheme (MIS) is aimed at providing regular income to the retired Individuals.

The Government announces the deposit rates across all Small Savings Scheme on quarterly basis. The current interest rates are applicable from 1st January, 2023 till 31st March, 2023. The interest rates are now determined at par with rates of Government Securities.

Interest Rate on Small Savings Schemes

Public Provident Fund (PPF): Investment in PPF will earn 7.1% return for the quarter ending 31st March, 2023. The investment tenure is of 15 years. Premature closure of PPF account is allowed in genuine cases, such as serious ailment, higher education of children, etc applicable to accounts which have completed 5 years from the date of opening. However, a penalty of 1% in interest payable on whole deposit is imposed in case of premature withdrawal.

National Savings Certificate (NSC): The 5-year NSC will earn an interest of 7.0% on fresh investment made on or after 1st January, 2023. The same will continue for the period ending 31st March, 2023. The interest is compounded annually. The investment is eligible for deduction under section 80C. However, the interest earned is taxable on maturity.

Kisan Vikas Patra (KVP): KVP investment will fetch 7.2% return on fresh investment made on or after 01st September, 2021. The interest is compounded annually. Maturity period is 120 months. The investment is not eligible for tax deductions and the interest earned is taxable at the time of maturity.

Income Tax Slabs & Rates for Financial Year 2022-23

Sukanya Samriddhi Yojana (SSY): Scheme introduced for empowerment of the Girl child will earn 7.6% interest on investment for quarter ending 31st March, 2023. The scheme is available to the parents of a girl child. The investment is eligible for deduction under section 80C. The scheme offers best return amongst small savings schemes.

Senior Citizen Savings Scheme (SCSS): The interest rate offered to the senior citizen is a lucrative scheme, offering 8% interest on deposits for the quarter ending 31st March, 2023. The scheme is aimed towards welfare of the senior citizens, SCSS provides risk free return to the Senior Citizens.

Post Office Schemes: Interest Rates on Post Office Term Deposits of 1 year, 2 years and 3 years will be 6.6%, 6.8% and 6.9% respectively in the final quarter of the current FY. Term Deposits of 5 years will earn interest at 7% for the concerned period. Monthly Income Scheme (MIS) will fetch 7.1% return on deposits. Savings deposit will offer 4% return on deposits.

Individuals looking to invest in Mutual Funds may connect at admin@wealthtechspeaks.in for investment guidance and advice. We do offer investment in regular Mutual Fund schemes for the interested investors.

https://www.youtube.com/watch?v=xpeee1_AUOg

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content. In case you are interested in investing in Stocks, get your free Demat today (Click Here).

WealthTech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational and promotion purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

Thank you for another great article. The place else could anyone get

that type of info in such an ideal method of writing?

I’ve a presentation next week, and I am at the search

for such information.

Your posts are a great source of inspiration.