State-wise Professional Tax Rates Financial Year 2023-24

- Posted By Amritesh

- On April 30th, 2023

- Comments: 3 responses

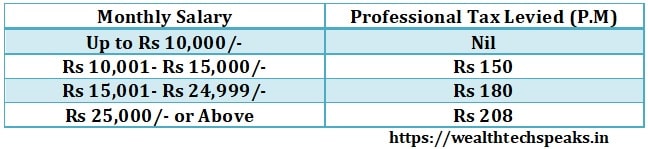

State Governments levy Professional Tax (PT) on all types of professions, trade and employment based on the income slab. Article 246 of the Constitution of India 1949, empowers the Parliament to introduce laws governing taxes on income. Whereas, Article 276 empowers State to levy professional tax on professions, trades, callings & employment. Even though States are empowered to impose Professional Tax, not all States impose such tax. Professional Tax may be levied up to maximum of Rs 2,500/- on any individual or entity in a Financial Year. Professional Tax being a state subject, State-wise Professional Tax Rates for Financial Year 2023-24 varies from State to State.

PT Enrolment & Registration: Guidelines

Professional Tax is levied by the State Government and is deducted from the Gross Salary by the employer. Since, Professional Tax is levied by the respective State, the tax rate varies from State to State. Moreover, not all state levies the Professional Tax. State-wise Professional Tax for Financial Year 2023-24 helps us to understand the tax implication in the respective State. Professional Tax deduction is allowed under the old tax regime but not under the new tax regime.

State-wise Professional Tax Rates for Financial Year 2023-24

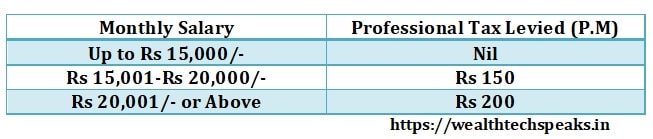

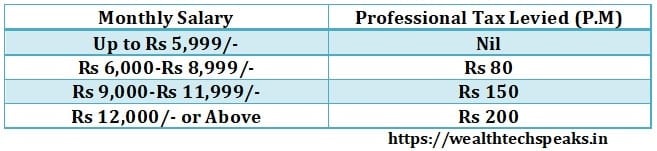

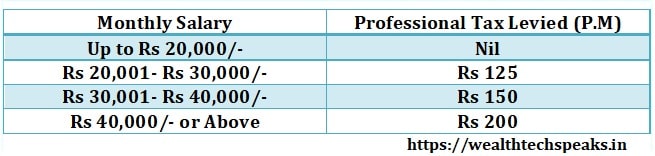

Andhra Pradesh Professional Tax Slab & Rates for Financial Year 2023-24

Assam Professional Tax Slab & Rates for Financial Year 2023-24

Bihar Professional Tax Slab & Rates for Financial Year 2023-24

Goa Professional Tax Slab & Rates for Financial Year 2023-24

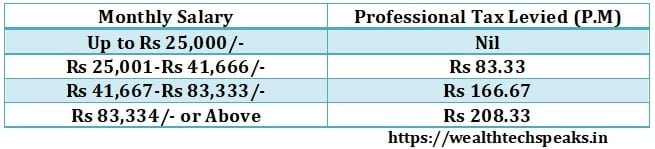

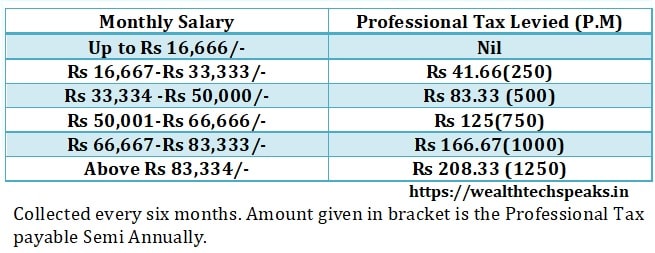

Gujarat Professional Tax Slab & Rates for Financial Year 2023-24

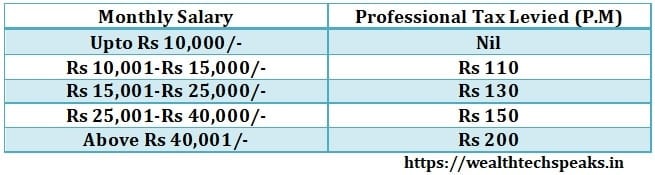

Jharkhand Professional Tax Slab & Rates for Financial Year 2023-24

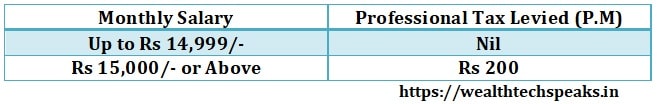

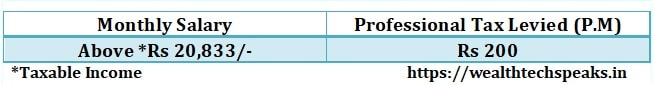

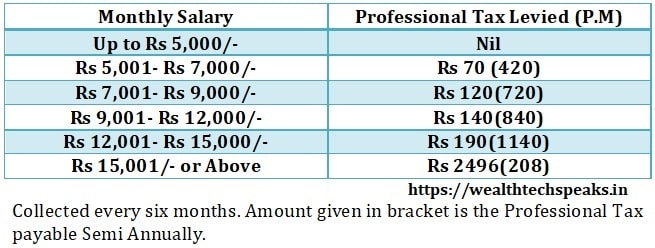

Karnataka Professional Tax Slab & Rates for Financial Year 2023-24

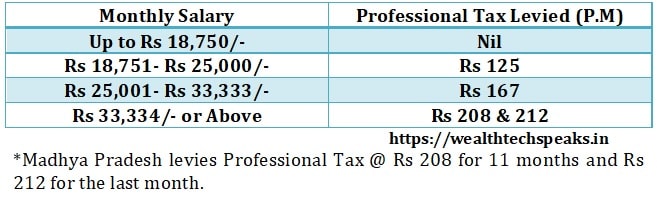

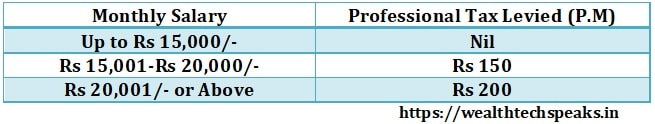

Madhya Pradesh Professional Tax Slab & Rates for Financial Year 2023-24

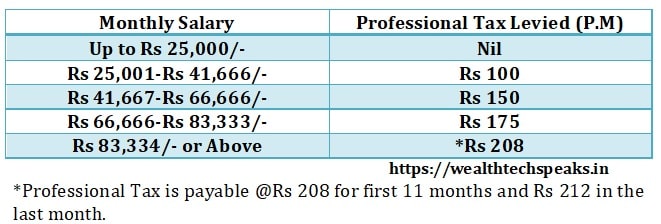

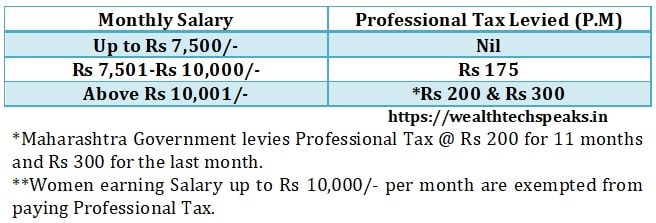

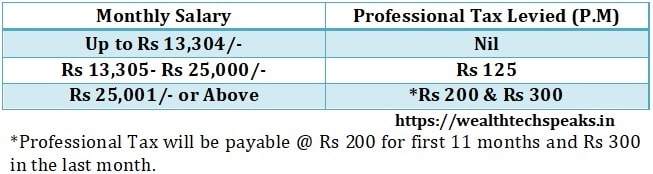

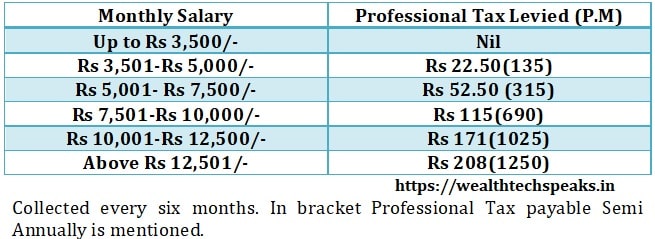

Maharashtra Professional Tax Slab & Rates for Financial Year 2023-24

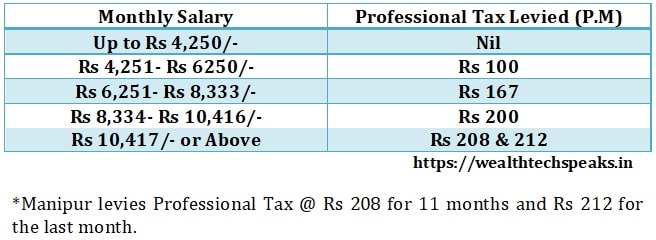

Manipur Professional Tax Slab & Rates for Financial Year 2023-24

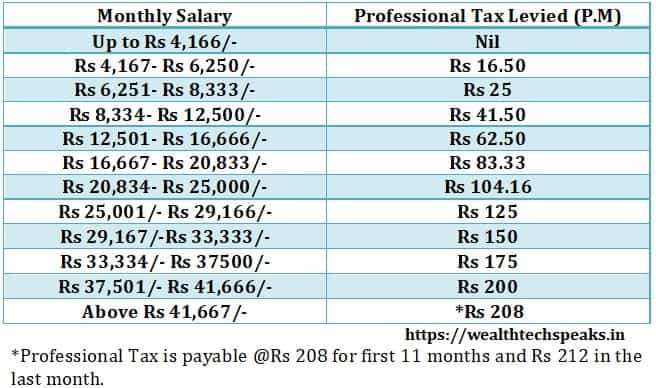

Meghalaya Professional Tax Slab & Rates for Financial Year 2023-24

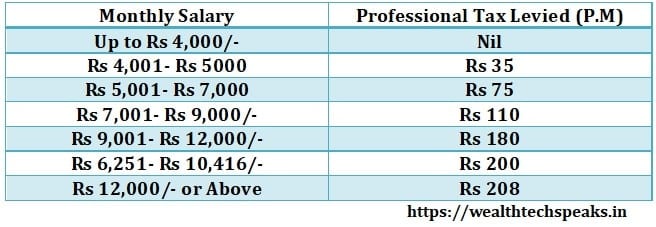

Nagaland Professional Tax Slab & Rates for Financial Year 2023-24

Odisha Professional Tax Slab & Rates for Financial Year 2023-24

Puducherry Professional Tax Slab & Rates for Financial Year 2023-24

Punjab Professional Tax Slab & Rates for Financial Year 2023-24 (Development Tax)

Sikkim Professional Tax Slab & Rates for Financial Year 2023-24

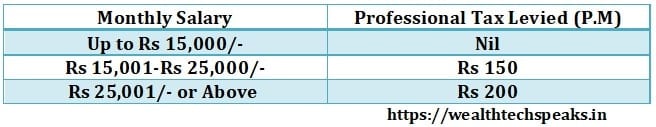

Tamil Nadu Professional Tax Slab & Rates for Financial Year 2023-24

Telangana Professional Tax Slab & Rates for Financial Year 2023-24

Tripura Professional Tax Slab & Rates for Financial Year 2023-24

West Bengal Professional Tax Slab & Rates for Financial Year 2023-24

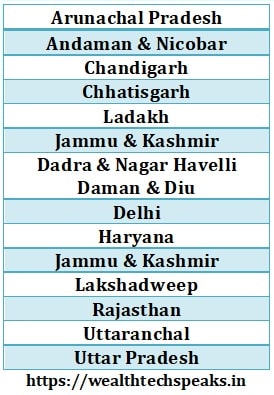

States & Union Territories : Professional Tax is Not Applicable

Exemption from paying Professional Tax (As per the Professional Tax Act)

- Any person suffering from a permanent physical disability (including blindness) depending on provisions of PT of the respective State.

- Parents or guardian of any person who is suffering from mental retardation, if the PT Act provides provision for the same.

- Persons who have completed the age of 65 years. Subject to exemption provided by respective State. (60 years in case of Karnataka).

- Parents or guardians of a child suffering from a physical disability as specified in clause (C) w.e.f 1.10.1996, applicable as per State provisions.

Do subscribe to our WealthTech Speaks YouTube Channel and also our Blog as it keeps us motivated to post new content.

WealthTech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. Consequently, this article is for informational and promotion purpose only. Hence, readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

I’m genuinely grateful for the information you’ve shared here.

I admire your commitment to providing such thorough and engaging content.

The examples you chose perfectly illustrate your points.