Top ELSS Mutual Funds FY 2019-20

- Posted By Amritesh

- On May 2nd, 2019

- Comments: 23 responses

Mutual Fund is gaining popularity among Investors looking for higher returns. In this post I will share my Top ELSS Mutual Funds FY 2019-20 for the Financial Year 2019-20. Equity Linked Savings Scheme (ELSS) is Tax Saving Mutual Fund Investment Scheme. The investment in the scheme is eligible for Income Tax Deduction U/S 80C up to the maximum limit of Rs 1,50,000/-. However, the maximum limit is inclusive of tax benefits available on other investment instruments eligible for deduction under Section 80C of the Income Tax Act.

ELSS has the shortest lock in period of 3 years among other tax saving investment plans. The return on the ELSS Fund is linked to capital market which makes investment moderately volatile, but investment over long period is considered safe. Investment in ELSS Fund for at least 5 years is considered safe in terms of returns by the industry experts. ELSS Mutual Fund has potential to earn higher returns when compared to fixed return instruments, as the fund is diversified across capital market in a bid to maximize returns. Furthermore, In Fixed Income Schemes returns are comparatively less which may not be sufficient to counter the inflationary trend. Thus ELSS provides the opportunity for better returns.

Income Tax Slab Rates FY 2019-20

ELSS is preferred Investment option for many as interest rate on Small Savings Schemes is pretty modest. Based on the past performance, it is observed that Mutual Funds have provided better returns compared to Fixed Return instruments.

Investment in Equity Linked Savings Schemes (ELSS)

#At least 80% of the fund is invested in Equity or Equity Oriented Instruments which opens opportunity for higher returns for investors.

#Investment in ELSS is locked for 3 years.

#Capital Gains up to Rs 1lac exempted from tax, 10% tax levied on gains in excess of Rs 1lac in a Financial Year.

#Better returns when compared to fixed return instruments.

#Mutual Funds is managed by the Professional Fund Managers who prudently utilize the fund to fetch higher returns on investment.

#Diversification of fund mitigates the risk associated with investment.

#Promote Financial Discipline and helps Individual to achieve financial objectives.

Top ELSS Mutual Funds FY 2019-20: Tax Benefit

Equity Linked Savings Scheme (ELSS) is tax saving mutual fund product. ELSS Fund comes with mandatory 3 years lock in period. Investment in ELSS is eligible for Tax Deductions under section 80C up to the maximum limit of Rs 1,50,000/-. ELSS gain up to Rs 1lac is exempted from capital gain tax, while gain in excess of Rs 1 lac is taxed @ 10% without indexation benefit.

Capital Gain Tax on Mutual Fund

Individuals/Investors are advised to consult their respective Financial Advisor before investing.

Investing in Mutual Funds

Investment in Mutual Funds should not be done with the sole objective of saving tax, one should be clear about his/her financial objectives.

Investment in Mutual Funds carries risk, Individuals with no risk appetite should avoid mutual funds as equity market is volatile in the short term.

Investing in Mutual Fund should be done by setting realistic Financial Goals and providing reasonable time horizon to achieve the same.

Investment may be done in lump sum or regular instalments via Systematic Investment Plan (SIP). SIP is an ideal option to invest as it helps to average out in case of adverse market scenarios.

Patience is the key to achieve decent returns on Investment. One should not panic when market under performs and should consult their respective financial advisor before taking any decision. Ideally, investment should be allowed at least 7-10 years to grow.

Investing in numerous plans should be avoided as it may prove to be counterproductive and one may end up investing in identical funds.

Top ELSS Mutual Funds FY 2019-20: Selection

Following parameters were considered while selecting the Top Equity Linked Savings Scheme (ELSS) Mutual Funds for recommendation.

Consistency: Funds which has performed consistently over a period of time has been taken into consideration. In Mutual Fund, consistency is very important due to the volatile nature of the capital market. Funds with consistent returns and favorable risk ratios are the safest option for the investors.

Size of Asset under Management (AUM): It may not appear as a critical factor. However, it lends creditability to the Fund which is crucial for the Investment. It provides cue about the performance of the Fund. Some of the top funds may witness slow growth in the short term but tend to perform well in the long term. Only funds with AUM above Rs 1,500 crores have been considered.

Income Tax Deductions and Exemptions FY 2019-20

Future Potential: Past Performance is one of the determinants in selection of the fund. However, it does not ensure that the fund would continue to perform in the future as well. Thus one should look into the detailed portfolio of the respective Fund to have a clear understanding of the fund. Asset Management Companies (AMC) diversify majority of the investments into Large, Mid and Small Cap equities. Thus Equity Mutual Fund may be considered as high risk high reward investment. The equities with strong fundamentals included in the Funds have the higher probability of outperforming the market.

Standard Deviation: It is the measurement of the volatility of the fund’s return with respect to the average. It determines the deviation in fund’s return with respect to the mean return of the scheme. Lower deviation means less volatility in the Fund.

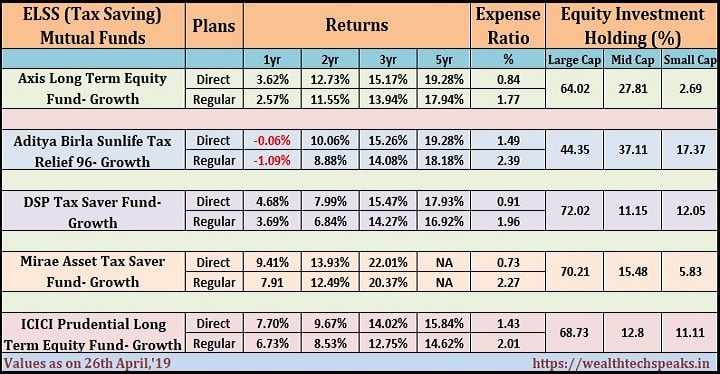

Expense Ratio: It is one of the key factors Investor should keep in mind while investing. The table shows the returns under Regular and Direct Plans in order to help individuals take an informed decision. Direct Plans offer better returns as compared to Regular plans as it excludes the brokerage charges from expenses.

Difference between Direct and Regular Mutual Fund Plan

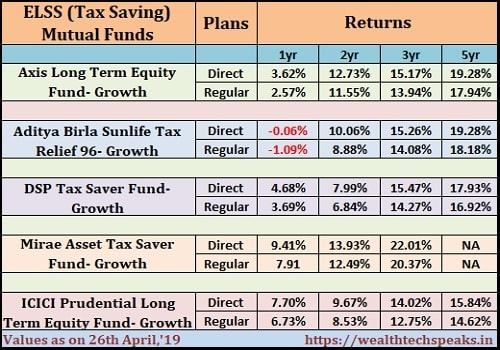

Top ELSS Mutual Funds FY 2019-20

The list includes majority of the Schemes recommended last year. However, I have included Mirae Asset Tax Saver as it has been performing consistently in last 3 years and returns are good. ICICI Prudential Long Term Equity Fund has also been included in the list. However, I believe the top 4 funds may be considered for investment. The list is not exhaustive; one may come across Funds offering similar or little higher returns. Therefore, it is important to do your analysis and consult your Financial Advisor before investing.

In the table shared above, one will find the Investment holding pattern for the recommended Funds. This would help Investors avoid investing in similar types of fund lending better balance to the Portfolio. Out of the top 5 ELSS Funds shared, I would recommend Investors to consider the Top 4 funds for investment. In case investment has been made in ICICI Prudential Long Term Fund, one may continue with the investment. Fund Returns should be compared with the “Benchmark Index” of the respective scheme in order to understand the performance of the Fund.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Readers are advised to research further to have more clarity on the topic. It is very important to do your own analysis and consult your Financial Advisor before making any investment based decision.