Tax Benefits on Health Insurance

- Posted By Amritesh

- On August 31st, 2018

- Comments: 114 responses

Health Insurance is aimed at providing the Insured with financial cover in case of any medical exigency. Health Insurance covers the medical cost incurred on treatment undergone by the policy holder or any of the member covered under the policy. The Health Insurance plans have been discussed in my previous articles. However, in this post I will discuss about the Tax Benefits on Health Insurance available to the Individuals on the premium paid towards the same. These tax benefits are available on the Mediclaim (Cashless) and Critical Illness Insurance Plans.

Health Insurance: Importance & Need

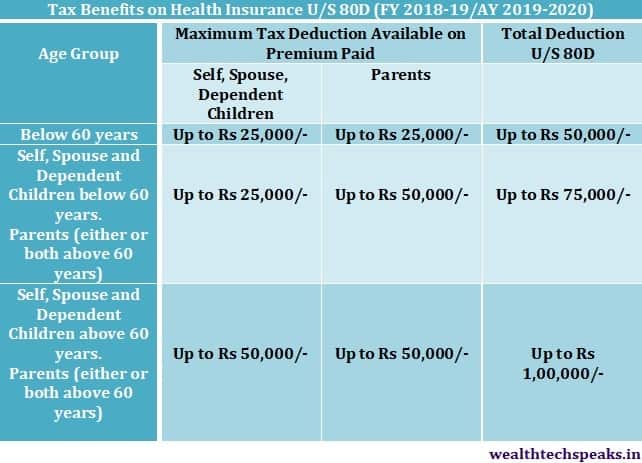

Budget 2018, Tax Deduction for current Financial Year (FY) 2018-19 on premium paid towards medical insurance for senior citizens (above 60 years of age) is enhanced to Rs 50,000/- from Rs 30,000/- available in the previous Financial Year. This is a welcome move as the Government formulates plan to extend health care benefits to maximum individuals in the country.

Tax Deduction may be claimed on the Health Insurance premium paid for;

Self

Spouse

Parents

Dependent Children

Tax Benefits on Health Insurance

Tax Deduction is available on the Premium paid towards Health Insurance U/S 80D up to Rs 25,000 in case the age of policy holder, spouse and the dependent children is below 60 years, the tax benefit is enhanced to Rs 50,000/- in case the eldest member covered under the policy is a senior citizen. Additional Tax Deduction of Rs 25,000/- is available on health insurance premium paid for the Parents, the benefit is increased to Rs 50,000/- in case of parents (either father or mother, or both) is above 60 years.

Senior Citizens themselves may also claim the Tax Benefit up to Rs 50,000/- on the premium paid towards the Health Insurance plan.

Tax Benefits on Health Insurance Premium Paid For Multiple Years

In case of Health Insurance policies with premium paid for cover for more than one year, the deduction is allowed on proportionate basis for the number of years covered, subject to maximum deduction available in the each Financial Year.

Tax Benefit on Medical Expenditure

Senior Citizens above the age of 60 years who are not eligible or do not have any Health Insurance may claim maximum deduction up to Rs 50,000/- incurred towards the medical expense.

This article is for informational purpose only. Readers are advised to research further to have more clarity on the topic. It is very important to do your own analysis and consult your Financial Advisor before making any investment based decision.