Understanding the Government’s Retention of Small Savings Schemes’ Interest Rates in Q4 FY 2023-24

- Posted By Amritesh

- On January 15th, 2024

- Comments: 8 responses

Introduction

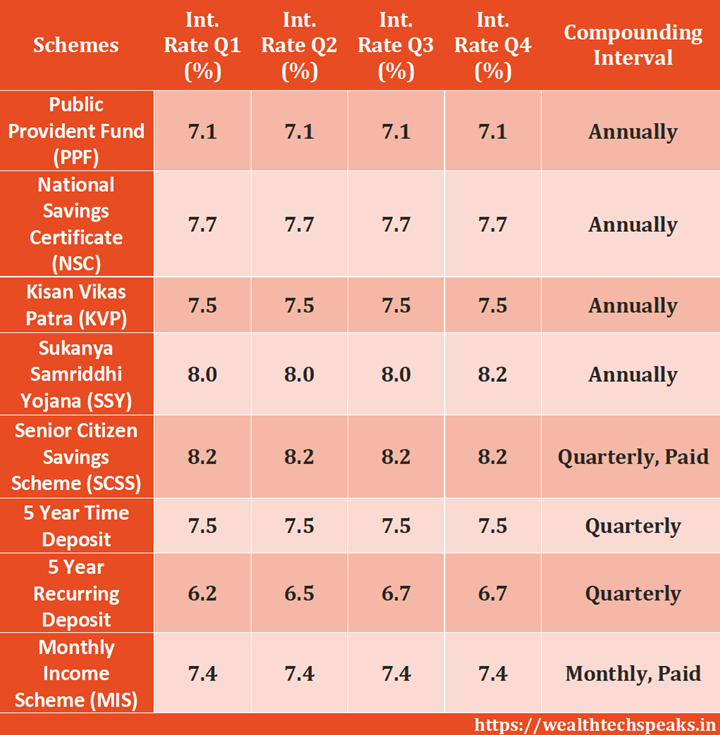

The recent announcement by the government retaining the small savings schemes’ interest rates for the last quarter of the financial year 2023-24 has left investors seeking clarity on the decision-making process. Despite an nominal increase in the 3-year recurring deposit scheme & Sukanya Samriddhi Scheme, the rates for other popular schemes like Public Provident Fund (PPF) and National Savings Certificate (NSC) remain unchanged. Let’s delve deeper into the reasons behind this decision and its implications for investors.

Background

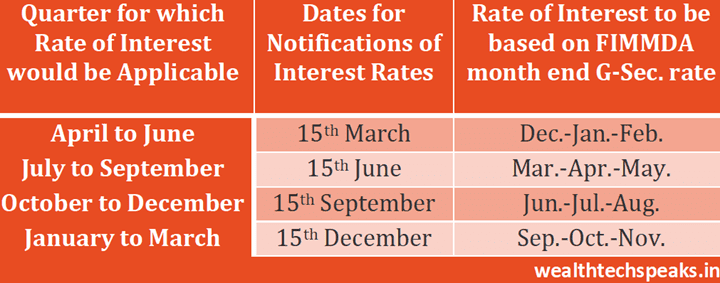

The decision to maintain the interest rates comes in the wake of inflationary pressures and an increase in Government Security (G-Sec) yields, prompting the need for a careful reassessment of the rates. The alignment of small savings interest rates with market rates and the quarterly recalibration aims to establish a level playing field, ensuring that these rates remain on par with the rates of bank deposits.

Impact on Small Savings Schemes

While the government refrained from increasing the interest rate on PPF, aligning it with the rates of other provident funds such as Employees’ Provident Fund (EPF) and General Provident Fund (GPF), the decision has sparked discussions about the implications for investors relying on these popular investment options. It’s important to note that the interest rate on PPF has remained unchanged since the second quarter of the Financial Year 2020-21, signaling stability but potentially impacting returns in the current market scenario.

Key Small Savings Scheme Interest Rates for Q3 FY 2023-24

- Public Provident Fund (PPF): 7.1% return for the quarter ending 31st March, 2024, with a 15-year investment tenure and penalties for premature closure under certain circumstances.

- National Savings Certificate (NSC): 7.7% interest on a 5-year NSC for investments made from 1st April, 2023, with annual compounding and eligibility for deduction under section 80C.

- Kisan Vikas Patra (KVP): 7.5% return on fresh investments made after 1st April, 2023, with annual compounding over a 115-month maturity period, but without tax benefits.

- Sukanya Samriddhi Yojana (SSY): 8.2% interest for the quarter ending 31st March, 2024, catering to the empowerment of the girl child, with eligibility for deduction under section 80C.

- Senior Citizen Savings Scheme (SCSS): Offering 8.2% interest on deposits, with the deposit limit raised to Rs 30 lacs from Rs 15 lacs in FY 2023-24.

Conclusion

The government’s decision to retain the small savings schemes’ interest rates for the final quarter of FY 2023-24 emphasizes stability in the current economic climate. While the alignment with market rates ensures a level playing field, investors must carefully assess their investment options, considering the impact of inflation and the broader economic landscape. Consulting with financial advisors and conducting thorough research is crucial to making informed decisions about small savings schemes.

Seeking expert guidance for Mutual Fund investments? Connect with us at admin@wealthtechspeaks.in. Stay updated with our latest investment insights and tips by subscribing to our WealthTech Speaks YouTube Channel and Blog.

Looking to explore the world of stocks? Open your free Demat account today! [Click Here]

WealthTech Speaks and its authors strive for accuracy and completeness in our content. However, we advise readers to conduct their own research and consult with a Financial Advisor before making any investment decisions. Our content is for informational and promotional purposes only.

Your place is valueble for me. Thanks!?

Hello my friend! I wish to say that this article is amazing, nice written and include almost all important infos. I?d like to see more posts like this.

Great write-up, I?m regular visitor of one?s blog, maintain up the nice operate, and It’s going to be a regular visitor for a long time.

Thanks for discussing your ideas. I might also like to state that video games have been actually evolving. Technology advances and improvements have served create practical and fun games. These kind of entertainment video games were not actually sensible when the concept was being experimented with. Just like other designs of know-how, video games way too have had to develop by way of many generations. This itself is testimony towards the fast growth of video games.

Hello! This is my first visit to your blog! We are a team of volunteers and starting a new initiative in a community in the same niche. Your blog provided us valuable information to work on. You have done a outstanding job!

Your passion for your subject is evident.

Your blog is a goldmine of information.

[…] Small Savings Scheme Interest Rate for FY 2023-24 […]