Small Savings Schemes Interest Rates for the Q3 of Financial Year 2024-25

- Posted By Amritesh

- On October 12th, 2024

- Comments: no responses

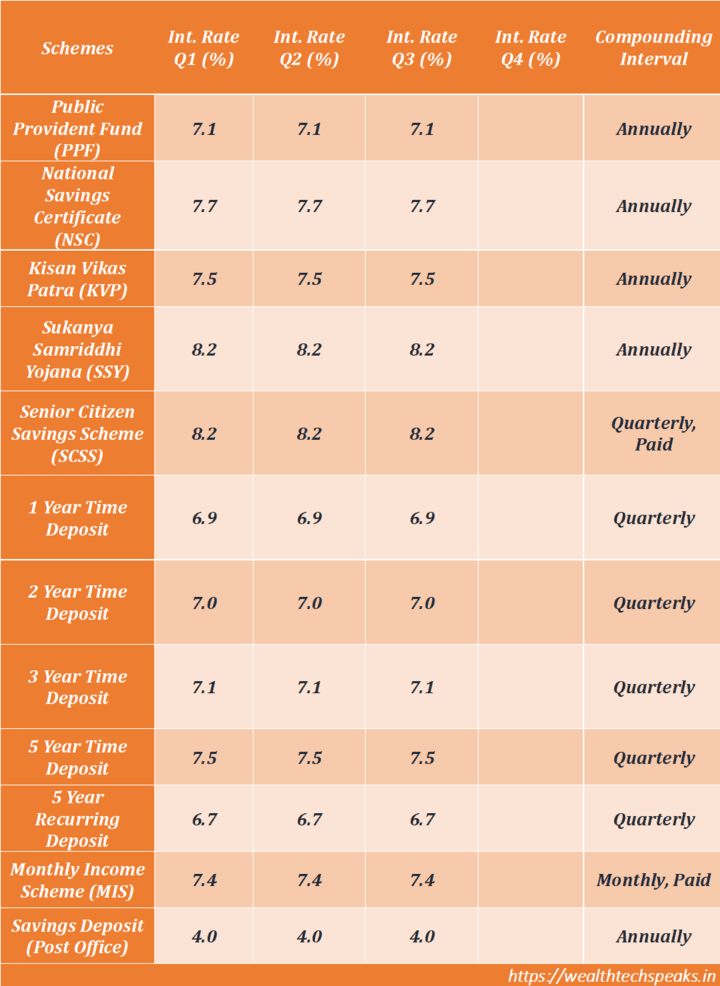

As the third quarter of FY 2024-25 (October to December 2024) kicks off, the Government of India has continued its focus on offering stable returns to small savings schemes investors. These schemes have long been a preferred choice for those seeking secure, risk-free investments that provide predictable returns. With most rates remaining unchanged, investors can count on consistent returns, even amid a fluctuating economic landscape.

Small Savings Scheme Interest Rate for FY 2023-24

In a time of economic uncertainties, small savings schemes remain a reliable option for those seeking a secure and steady source of returns. While market-driven investments such as equities and mutual funds may offer higher potential gains, the guaranteed and government-backed nature of these savings schemes ensures that your capital is safeguarded, regardless of market fluctuations. The stability in interest rates this quarter reflects the government’s objective to protect small investors, offering them predictable returns without exposing their savings to undue risk.

Steady Returns Across Most Schemes

For the October to December 2024 quarter, the government has maintained most of the interest rates for small savings schemes at their previous levels. This consistency allows investors to plan their finances confidently, knowing their returns will not be affected by short-term economic changes. Whether you are saving for the long term, looking for tax-saving options, or simply want a safe investment with guaranteed returns, these schemes continue to be a cornerstone of secure financial planning.

Public Provident Fund (PPF) – 7.1%

The PPF continues to offer 7.1%, making it a favorite for long-term investors aiming to grow their wealth over time. This tax-saving scheme, compounded annually, is an excellent choice for individuals seeking both safety and growth over the 15-year lock-in period. With tax exemptions on interest earned, it is a go-to for those planning for the long haul.

National Savings Certificate (NSC) – 7.7%

The NSC, with its 7.7% interest rate, remains a robust option for those looking to benefit from assured returns. A 5-year maturity period and Section 80C tax benefits make it ideal for risk-averse investors. With interest compounded annually, this fixed-income scheme helps your money grow without market-linked volatility.

Sukanya Samriddhi Yojana (SSY)– 8.0%

Parents of young daughters can breathe easy as the Sukanya Samriddhi Yojana continues to offer a lucrative 8.0% interest rate. Compounded annually, this scheme is crafted to provide substantial returns for the future educational and personal needs of a girl child. Its tax exemptions add further value, making it one of the most rewarding savings plans in India.

Kisan Vikas Patra (KVP) – 7.5%

With a maturity period of 115 months, the KVP offers an interest rate of 7.5%, allowing investors to double their money over time. While it doesn’t provide tax benefits like some other schemes, its guaranteed returns make it a reliable choice for those looking to grow their savings steadily.

Senior Citizens Savings Scheme (SCSS) – 8.2%

Senior citizens can continue to enjoy financial security with an impressive 8.2% interest rate on the SCSS. This scheme, designed to provide regular income, offers quarterly payouts—perfect for retirees who need a dependable, risk-free income stream. With an upper investment limit of ₹30 lakh, this is one of the best options available to senior citizens today.

Post Office Monthly Income Scheme (POMIS) – 7.4%

If you’re looking for monthly returns, the POMIS offers 7.4% interest, ensuring a stable monthly income. Although interest from this scheme is taxable, it remains a preferred option for those seeking steady cash flow from their investments, especially retirees and conservative investors.

Recurring Deposits (RD) – 6.2%

The 5-year Post Office RD continues with an interest rate of 6.2%, compounded quarterly. For those who prefer smaller, monthly investments but want assured returns, RDs remain a popular choice. Even though the rate is lower than others, it offers a disciplined approach to saving.

Post Office Time Deposits (TD)

Time deposits remain a top pick for those who prefer the certainty of fixed interest rates. With options ranging from 1 to 5 years, investors can select the tenure that best aligns with their financial goals. Here’s a quick look at the rates:

– 1-Year TD: 6.9%

– 2-Year TD: 7.0%

– 3-Year TD: 7.0%

– 5-Year TD: 7.5% (eligible for Section 80C tax benefits)

5-Year National Savings Time Deposit – 7.5%

For those looking for a slightly longer-term investment with tax benefits, the 5-year National Savings Time Deposit offers 7.5% interest, making it an attractive option for investors who want steady growth alongside tax savings.

Savings Deposit – 4.0%

Lastly, the interest rate on Post Office Savings Accounts remains at 4.0%. While this rate is lower than other savings schemes, the liquidity it offers makes it an ideal short-term savings vehicle for those who want easy access to their funds.

What Do These Rates Mean for Investors?

The stability in small savings rates for this quarter is a sign that the government remains committed to providing risk-averse investors with a dependable source of income and capital growth. Unlike market-linked investments, small savings schemes ensure your principal is protected while offering modest but assured returns.

Why Small Savings Schemes?

Small savings schemes play a crucial role in the financial portfolios of millions of Indians. Their government-backed nature ensures a level of safety unmatched by most other investment options. Moreover, they offer a range of benefits:

– Guaranteed Returns: Investors can rest assured that they will receive fixed returns, irrespective of market performance.

– Tax Savings: Many of these schemes, like PPF and NSC, come with tax exemptions under Section 80C, helping reduce your taxable income.

– Diverse Options: From long-term growth vehicles like PPF and SSY to short-term income-generating schemes like SCSS and POMIS, there’s a plan for every financial goal.

– Accessible to All: With low minimum investments, these schemes cater to a wide audience, from small savers to high-net-worth individuals seeking stability.

Stay Secure, Grow Steady

In today’s unpredictable financial markets, small savings schemes continue to stand out as beacons of security and steady returns. While they may not offer the same high returns as equity markets or mutual funds, their safety net, tax benefits, and guaranteed interest make them indispensable in any investment portfolio. As we navigate through FY 2024-25, these schemes provide the financial stability and peace of mind that investors, particularly conservative ones, seek.

Whether you’re saving for retirement, your child’s future, or just looking for a safe place to park your funds, the consistent rates for small savings schemes ensure that you’re on a steady path to financial security. Consider reviewing your investment strategy and ensuring that these dependable schemes are part of your portfolio for balanced growth and risk management.

Individuals looking to invest in Mutual Funds may connect at admin@wealthtechspeaks.in for investment related guidance.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content. In case you are interested in investing in Stocks, get your free Demat today (Click Here).

WealthTech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational and promotion purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.