Minimum Amount Due on Credit Card Payment

- Posted By Amritesh

- On May 31st, 2021

- Comments: 4 responses

Credit Cards are widely being used with increasing number of individuals availing the facility offered by the Banks for free or at nominal charges. The ease of transactions, interest-free credit period, discounts, cashback benefits and reward points encourage millennials to use credit card for transactions. Furthermore, push for digital economy coupled with the influx of e-commerce portals has further fueled the use of credit cards. However, individuals need to judiciously use the credit cards to avoid falling in the debt trap. As credit cards offer interest free credit period of 25-50 days, post which financial charges is levied on the outstanding bill amount. The financial charges on credit cards are among the highest. Many of the individuals believe that clearing the “Minimum Amount Due on Credit Card” on monthly basis relieves them of the financial obligation, but this is not true.

Every month credit card statement is issued to the card holders containing particulars of the transaction made during the particular billing cycle. Apart from transaction details, three critical information also appear in the statement. It includes Total Outstanding Amount, Minimum Amount Due on Credit Card & Payment Due Date. Now, credit card holders have the option to clear the total outstanding amount or the minimum amount due on credit card by the due date. In case the total outstanding amount is cleared within the due, no interest will be levied in the next statement. However, if only minimum amount due on credit card is paid within the due date, interest will be charged on the remaining balance in the next statement. Let’s understand the concept of minimum amount due on credit card in detail.

Minimum Amount Due on Credit Card: Concept & Calculation

Credit Cards is used by the card holders to make purchases on credit. The entire purchases made during the billing period is added in the credit card statement, generated at the end of the billing cycle. The credit card holders are required to pay the outstanding amount by or on the due date. However, credit card companies also provide an additional option to the card holder of clearing certain percentage of the bill within the due date. The unpaid balance is carried forward to the next billing cycle. The credit card company in return of the service levies interest on the carried forward outstanding amount. The interest rate levied on the outstanding amount varies from 3% to 4% every month. The Annual Percentage Rate (APR) comes to 36% to 48% on the outstanding dues.

Credit Card holders normally get free credit period of 25-50 days, post which interest is levied on the dues. Normally, Minimum Amount Due is 5% of the total outstanding amount plus any existing EMI availed on the Credit Card. The minimum amount due goes up further if any additional purchase is made in the current billing period.

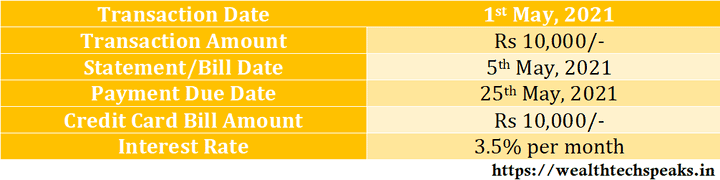

Calculation of Interest and Minimum Amount Due

Interest Calculation on Credit Card: [{No. of Days from the Date of Transaction*Outstanding Amount*(Monthly Interest Rate*12 month)}/365]

Case 1: Total Amount cleared on or before 25th May, 2021. No interest is levied.

Case 2: Minimum Amount Paid on 25th May, 2021. Interest to be levied on the Outstanding Amount and it is included in the next billing cycle.

Case 3: No payment made by the Due Date. Interest on total bill plus late fee will be charged in the next Credit Card Statement.

Advantages of paying the Minimum Amount Due

#Payment of Minimum Due on Credit Card helps the cardholder to avoid paying late fees & related charges.

#Protects the credit card holder from any adverse impact on the Credit Score.

#Saves the Credit Card for getting deactivated on account of non-payment of dues.

#Minimum Due payment allows the card holder more time to clear the full dues and manage their finances better. In case of financial constraint, credit card holder may defer the full payment for later period.

Drawbacks of only paying the Minimum Amount Due or missing it completely

#Paying just the Minimum Due Amount every month will push the individual into the debt trap.

#Interest levied on the Outstanding Amount further depletes the financial position of the card holder.

#Credit Card holders need to pay 3%-4% interest on monthly basis on the outstanding balance, if they decide to only pay the Minimum Due Amount.

#Non-payment of Minimum Due within the Due Date may result in deactivation of the credit card. Late Fees along with Interest and other charges is levied on the outstanding amount.

Ideal Scenario

Credit Card holders should clear the total outstanding amount on or within the due date to avoid paying any additional charges. Individuals need to be meticulous with their financial planning in order to save themselves from falling into the debt trap. Credit Card does offer a lot of benefits which should be availed by the card holders but one should refrain from over spending & financial mismanagement. No Cost EMI and other benefits offered by credit cards should be availed to reduce the financial burden. Minimum Amount Due option should only be explored when faced with deep financial crisis. Financial Discipline is must for every Individual.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content. In case you are interested in investing in Stocks, get your free Demat today (Click Here).

Wealthtech Speaks is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this site is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information and without warranty of any kind, expressed or implied, including, but not limited to warranties of performance, merchantability and fitness for particular purpose.