Investment in Cryptocurrency: Bitcoins & Altcoins

- Posted By Amritesh

- On July 23rd, 2021

- Comments: one response

Cryptocurrency is generating a lot of interest among millennials, the new generation of investors. Investment in Cryptocurrency does involve an element of risk but the potential of higher returns is attracting investors. Investment in Cryptocurrency like Bitcoins and Altcoins is unregulated in India & elsewhere, even though investing is not prohibited in India. Latest data suggests, many Indians are investing in Cryptocurrency and consider it as a viable asset for investment. More than 15 million Indians are investing in the digital currency, as a preferred choice over the conventional asset class such as Gold or Real Estate. According to Chainalysis, a blockchain analytics, India’s bitcoin market has grown over 600% in year-on-year basis. Investors are willing to take the risk as they expect the return to multiply in short period of time. Investment in cryptocurrency appears lucrative but risky, should you invest?

It is very important to understand cryptocurrency in detail before investing. Investment in Cryptocurrency such as Bitcoins & Altcoins may turn out to be rewarding but one needs to understand the risk before investing.

What is Cryptocurrency?

Cryptocurrency is encrypted decentralized digital asset which may be used as a medium of exchange and is considered as virtual currency. Cryptography is behind the emergence of these digital currency which is created using complex codes (to encrypt & secure communication) making it fairly difficult to counterfeit. It is peer to peer transaction and lacks intermediaries. Thus, the transaction is secure as no intermediary is required for the transfer. The cryptocurrency transactions are validated by the miners and same is entered in the blockchain system managed by Global Network of computers using digital ledgers to record these transactions. Blockchain is type of a distributed ledger, implying that database is managed by multiple participants across multiple nodes. The transactions are grouped in blocks interconnected with hash to form a block & chain like pattern, named Blockchain.

Cryptocurrencies relies on peer-to-peer based technology which is cost effective and eliminates the need for intermediaries to monitor the transactions. Moreover, it is decentralized, not governed by any Central Bank or any Regulator. Sender and Recipient are involved in a transaction which is not restricted by any geographic boundaries. The cryptocurrencies are stored in a digital wallet with a dedicated address which may be encrypted to enhance safety. One cannot complete transaction without the wallet address. The wallet address should be entered carefully during payments as it cannot be reversed once transaction is completed. The platform possesses potential threat of being used for illegal activities as it very difficult to track the transactions or identify the users in the network. The regulators need to develop a robust mechanism to curb any malpractices and keep the platform as clean as possible.

Emergence of Bitcoins & Altcoins

Bitcoin came into existence in 2008 and the network was launched in 2009. Satoshi Nakamoto is regarded as the brainchild behind Bitcoins. Not much is known about the originator and his existence remains a mystery till date. Satoshi also happens to be the smallest unit of bitcoin. In fact, 100 million Satoshi make one bitcoin. Currently, only 21 million bitcoins may be generated in the system out of which around about 18.6 million is already in circulation. However, system may be modified if required to create more bitcoins within the platform. Bitcoins is generated by the miners in the process of validating transactions.

Miners basically validate the transactions involving bitcoins by solving complex equations, puzzles and in return are rewarded in form of bitcoins which is again added in to the system. Now, mining bitcoins or any other cryptocurrencies requires enormous amount of electricity to continue the operation. As the number of bitcoins in circulation keeps on increasing, process of mining bitcoins gets more complex and requires enormous power. According to a report published by Cambridge Centre for Alternative Finance (CCAF), Bitcoin at present is consuming roughly around 110 terawatt hours per year. Transaction in Bitcoins is irreversible, implying once the transaction is completed it cannot be reversed.

Best Mutual Funds for Investment FY 2021-22

Bitcoins are stored in e-wallet which may be hardware wallet (storage device) or multi-signature wallet (multiple keys) or cold storage wallet (offline mode). The e-wallet may be stored in the mobile phones or laptops, but one needs to ensure that the bitcoins are well protected from all possible threats. The cold storage wallet is best in terms of safety as it is stored in offline mode. The wallet is stored on a platform not accessible to internet, making it difficult to compromise. Encrypting the e-wallet ensures protection against cyber thefts. Each e-wallet has a designated address which is used during transactions. Number of security measures are available to securely store the bitcoins. Since, it is decentralized and unregulated, bitcoins once lost or stolen is almost impossible to recover. Therefore, it is important to invest in good security system for storage purpose.

Similar to Bitcoins, Altcoins are cryptocurrencies which came into existence after the emergence of bitcoins. They are identical to bitcoins but the technology capabilities applied are different which distinguishes them from Bitcoins. Ethereum & Dogecoin, Litecoin, are some of the known alternatives of bitcoin. Many cryptocurrencies have emerged ever since the release of bitcoins. However, Ethereum looks the most promising among altcoins with the potential of overtaking Bitcoin in the future.

Future of Bitcoins & Altcoins: Investment in Cryptocurrency

Bitcoins and Altcoins is gaining prominence as alternative investment asset. The recent surge in valuation fueled with hope of exponential growth in the coming years is driving investors towards the cryptocurrencies. Investors are investing in cryptocurrencies to diversify their investments with expectation of earning decent returns on investment. Over the years, the cryptocurrencies have gained in terms of valuation. Many cryptocurrency exchanges have come up facilitating investment and trading in bitcoins & altcoins. In India too, number of exchanges are in operation allowing investors to invest in cryptocurrency. However, regulators are still trying to figure out a mechanism to regulate investments in cryptocurrencies. The future of cryptocurrencies will depend on the stance adopted by the leading economies along with the regulations introduced to curb illegitimate activities.

In my opinion, Cryptocurrency is here to stay and could well turn out to be a viable investment alternative to Equity market, Gold, Derivates, Bonds, etc. But will not be able to replace equity market or any of the other investment assets. Once the clarity regarding the regulation emerges the valuation is expected to rise even further. However, Investors need to be very cautious with their investment in cryptocurrencies.

Income Tax Slabs & Rates for Financial Year 2021-22

As Investors explore alternative investment options to diversify their investments. The cryptocurrencies appear to be a viable option but a lot will depend on the stance taken by the different nations pertaining to trading and recognition as legal tender, in order to be widely accepted as a medium of exchange. Regulators are still trying to device a way to regulate the cryptocurrencies. In order to minimize the use of platform for illegal and unethical practices.

Bitcoins or for that matter even the altcoins are very volatile in nature. Investment in Bitcoins may only be considered by individuals after exhausting other investment options. Cryptocurrency in my opinion is here to stay, investors will invest in cryptocurrencies to diversify their investments. Just like investment in Equities, Bonds, Commodities, etc, investors will invest in cryptocurrencies. The first movers are likely to benefit in the long run but a lot will depend on the stance taken by the leading economies and regulations introduced to govern the trade or even use as legal tender.

Legal Status of Cryptocurrency in India

In India currently, Bitcoins or Altcoins is not accepted as legal tender. However, it is not illegal to trade in cryptocurrencies, but it is unregulated as of now. This implies it cannot substitute the fiat currency (Rupee) but just like stocks one may trade in cryptocurrency via the Cryptocurrency Exchanges operating in the country. Unlike the stock market, Cryptocurrency Exchanges operate in 24*7 mode. The cryptocurrency is very volatile in nature with drastic fluctuations in price it remains a risky proposition to invest.

Currently, new framework and guidelines is expected to be released soon regulating the trade in Cryptocurrencies. In March 2020, the Court had affirmed cryptocurrency exchanges right to trade, setting aside RBI order of 2018 which restricted banking facilities to cryptocurrencies exchanges. Even if government decides to restrict the cryptocurrencies in future, I believe the investors interest will be protected.

Investment in Cryptocurrency, Bitcoins: Alternative Investment Assets

In India, a lot of cryptocurrency exchanges has emerged in the recent past. This highlights the interest among individuals to invest in cryptocurrency. It does offer an alternative investment option to the investors. However, risk adverse investors should avoid investing in cryptocurrency, due to volatile nature of the digital currency. Cryptocurrency is still it is in nascent stage and proper framework is required to govern the digital currency market. Investors with moderate to high-risk tolerance level may diversify 1%-3% of their investment in cryptocurrency.

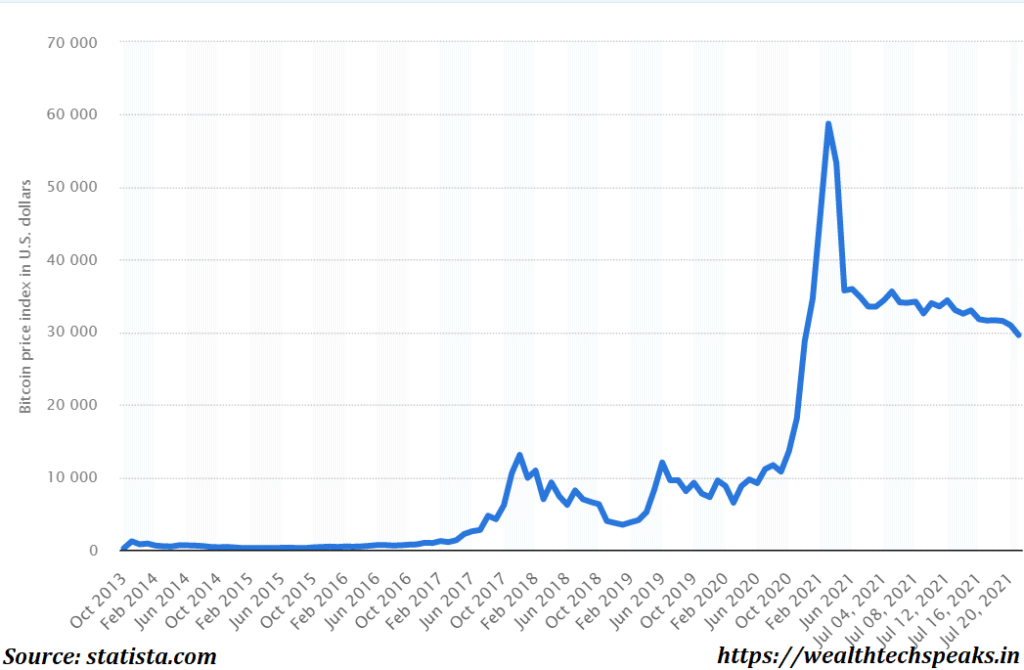

Bitcoin in the span of just 16 months has seen both sides of the pole. As it touched the low of US $ 5,000 (Rs 3.75 lacs approx) on 16th March, 2020, but staged an incredible recovery to reach $ 60,000 (Rs 45 lacs approx) on 10th April, 2021. Currently, Bitcoin is trading in the range of US $ 29,000- $ 33,000. This explains the volatility associated with the cryptocurrencies. In fact, not only Bitcoin, Altcoins too have followed identical trajectory during the same period. Investors need to be cautious while investing in these kinds of volatile assets.

Tax on Gains from Investment in Cryptocurrency: Bitcoins & Altcoins

As of now, it is a grey area which is expected to be addressed very soon. Most likely, Indians trading in cryptocurrencies will be required to pay capital gain tax but no confirmation is available as of now. On 24th March, 2021, Government had issued a note to cryptocurrency companies & exchanges to disclose their business-related dealings and financial statements. Thereby, initiating the first step to regulate the cryptocurrencies. Cryptocurrencies are yet to be classified in any segment for the purpose of taxation. In case cryptocurrency is classified as currency, it is not eligible for taxation under the Income Tax Act, 1961. However, if Bitcoins & Altcoins get classified as assets, it may be taxed under Capital Gains or even under Income from Business or Profession.

If gains arising from transfer of cryptocurrency is subject to tax under any of the income heads, depending on the nature of holding the same, it may be tax as Capital Gain or as Income from Business or Profession based on nature of transactions. Government & RBI are expected to come out with a framework soon. So, let’s not speculate anything as of now, clearer picture will emerge soon.

Diversification of Portfolio: Investment in Cryptocurrency, Bitcoins?

In terms of investment, cryptocurrency is a risky investment option considering the volatility surrounding it. Furthermore, a lot of grey areas needs to be addressed before one can consider it as a safe investment asset. However, Individuals interested to invest in cryptocurrency may do so using their idle funds or diversifying 1%-3% of their investments. Number of cryptocurrency exchanges are available to facilitate trade/investment in Cryptocurrency. Cryptocurrency is still evolving so potential of making good returns on investment cannot be ruled out. Moreover, cryptocurrencies are gaining acceptance globally. So, keep track of developments & take an informed decision. In my humble opinion, Bitcoins, Ethereum and Dogecoin will be the ones for the future. One needs to do a detail research before arriving at any conclusion.

Claim Your Free Demat Account- Zero Commission Mutual Funds (Click)

Wealthtech Speaks or any of its creators/authors is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in the video is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information and without warranty of any kind, expressed or implied, including, but not limited to warranties of performance, merchantability and fitness for particular purpose. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

You actually make it seem so easy with your presentation but I

find this topic to be actually something that I think I

would never understand. It seems too complex and very broad for me.

I’m looking forward for your next post, I will try to get the hang of it!