Best Equity Mutual Funds in FY 2022-23

- Posted By Amritesh

- On April 1st, 2022

- Comments: 5 responses

Investment in Mutual Funds is gaining momentum in India. The falling rate of return on bank deposits and small savings schemes has prompted investors to explore mutual funds for investment. Association of Mutual Funds in India (AMFI) has also initiated a lot of awareness campaigns to educate and build confidence among people regarding investments in Mutual Funds. It is evident from the past records that investment in equity mutual funds has yielded higher returns when compared to fixed return instruments. However, investment decision should not be based on the past performance alone, as it does not guarantee about the future performance. In fact, investors need to dig a little deeper to identify the ideal funds for investment. Investors need evaluate few key points before investing in Equity Mutual Funds. In this post, we would try and explore the Best Equity Mutual Funds for investment in the Financial Year 2022-23.

Over the years the investment in Mutual Fund has increased in India but it yet lags behind some of the leading economies. Largely due to the fact that market penetration has been subdued in the semi-urban and remote areas. Moreover, investors are circumspect of investments in mutual fund due to the associated volatility. Lack of awareness among investors pushes them towards guaranteed plans offering meagre returns. Another key point to note is that previously small savings schemes offered reasonable returns on deposits along with tax benefits. Thereby, investors used to rely heavily on these schemes to park their investments. However, the scenario now has changed with small saving schemes and bank deposits offering comparatively less returns on investment.

Ways to Select the right MF for Investment

Currently, as per the latest data around 7% of Indians invest in Equities. In 2021, Asset under Management (AUM) to GDP ratio peaked to 15.4% in India. In United States, roughly 55% of the population invest directly or via the mutual fund in stocks. Even the global average of AUM/ GDP stands at 60%. This implies that investment in Mutual Funds is still in nascent stage in India but holds a lot of promise for the future. As millennials are investing in Equities and Equity oriented funds for better returns.

Claim Your Free Demat Account- Flat Fee, Zero Commission MF (Click)

Equity Mutual Funds predominantly divert the funds into stocks of multiple companies. The returns on Mutual Fund investment depends on the performance of the stocks included in the specific portfolio. Fund Managers include multiple stocks in the portfolio to mitigate the downside risk while widening the possibility of optimum returns on investment. Investment in Equity Mutual Fund carries an element of risk and investors should take an informed decision while investing.

Key Considerations for Selection

Expense Ratio

Mutual Funds schemes are managed by the Fund Managers of the Asset Management Companies (AMCs). The mutual fund schemes utilize certain percentage of their assets to manage the administrative and operating expenses. Investors bear this expense out of the investment made in the Fund. Expense ratio includes management, administration, advertising, distribution and other expenses. Expense Ratio of mutual fund scheme is calculated by dividing Total Expenses by Value of Asset Under Management (AUM). It is the part of the assets used to meet the overhead expenses of the fund and does not yield any return. Expense ratio of Regular Mutual Fund schemes is higher compared to Direct plans, as it includes distributor/agent’s commission.

Furthermore, expense ratio for passive mutual funds is the lowest as they replicate their benchmark indexes and are not actively managed. However, expense ratio is different for every Mutual Fund scheme. It is important for investor to consider the expense ratio of a fund before investing as it impacts the overall return. Expense ratio below 1% for active funds may be considered acceptable in my opinion.

Role of a Fund Manager: Expert Management of Fund

Fund Manager is responsible for designing the investment strategy and managing the pool of investments under the scheme. Mutual Fund Schemes invest in number of stocks across industry. Fund Manager has to decide regarding the investment based on economic scenario and potential business growth. The decision related to investment taken by the Fund Manager reflects in the performance of the fund. Therefore, it is beneficial to do bit of research about the Fund Manager and their past record before investing.

However, it should not be the sole criteria while choosing a Mutual Fund for investment. In case, an investor is still unsure, Index Funds makes sense as it is not actively managed by any fund managers and performance is dependent on the Index tracked by the respective Fund. An experienced Fund Manager diversifies the pool of funds efficiently to mitigate associated risks.

Performance Indicator: Past Trend

Past performance does not guarantee of future performance. Yet, it helps to understand the return yielded by the fund in the past. Investors should look for consistency in the performance of the funds. Mutual Funds diversify the pool of investment in basket of securities as per the classification of the scheme (Large Cap, Flexi Cap, ELSS, etc). Now as the Mutual Funds diversify the funds in specific stocks, the performance of the fund depends on these stocks.

Investors need to be patient with their investment and allow reasonable period for the fund value to appreciate. Ideally, investors should remain invested for at least 5-7 years to witness substantial return on investment. Short term investment of one-year or two-year may not be enough to evaluate the true performance of the fund. Consistency and patience are the key, investors should be consistent with their investment and remain patient in order to allow the fund to grow.

Risk Adjusted Return

Investors also need to evaluate the risk associated with the investment. The risk-reward ratio helps to understand the quantum of risk taken by the fund to earn the return. It also helps to understand the volatility associated with the fund. Investors should take an informed decision while investing in Mutual Fund schemes as it involves certain element of investment risk. Investors interested to invest in Mutual Funds may do so based on their risk tolerance level. The risk ratios help investors to understand the risk involved with the investment in the Fund. Standard Deviation, Beta, Sharpe Ratio, Treynor’s Ratio are some of the ratios used to assess the investment risk.

Standard Deviation and Beta help to assess the volatility associated with the fund. Whereas, Sharpe & Treynor’s Ratio help to understand the risk-adjusted return on investment.

Entry and Exit Load

Entry Load is the fee levied by the Asset Management Companies (AMC) from the investors. However, most of funds have done away with the entry load fee.

Exit Load fee is levied at the time of redemption from the Mutual Fund scheme. It is levied to discourage investor from exiting a fund abruptly. Not all Mutual Fund schemes levy entry and exit load. Investors need to keep an eye on such fee, if they intend to invest for a very short tenure.

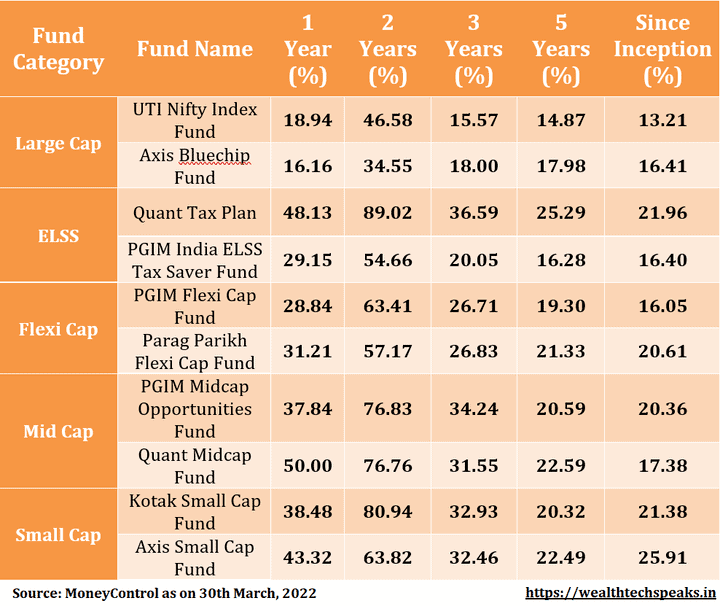

Best Equity Mutual Funds for Investment: Large Cap Mutual Fund

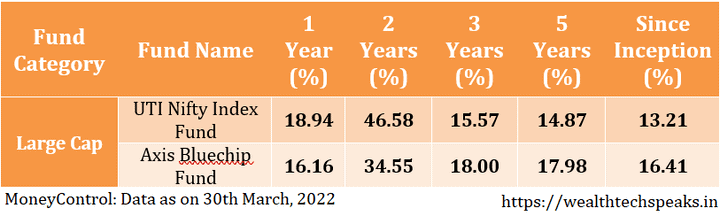

Large Cap Equity Mutual Funds primarily allocate their pool of funds in stocks with large capitalization. As per the recent SEBI Recategorization and Rationalization, Large Cap Equity Mutual Funds need to invest 80% of their funds in top-100 stocks. So, the regulatory guideline has narrowed the scope for the fund managers with regard to portfolio allocation but the decision also mitigates risk for the investors.

I have retained my picks from the previous year, UTI Nifty Index Fund and Axis Bluechip Fund among Large Cap Mutual Funds. The segment is restricted as funds need to include 80% of the large cap stocks in the portfolio. Expense Ratio of both the plan is acceptable with potential of double digit returns on long term investment. Investors looking to remain invested for 5-7 years may consider investing in Large Cap Mutual Funds as downside risk is relatively low.

Income Tax Slabs & Rates FY 2022-23

UTI Nifty Index Fund: Index Fund are passive funds, simply replicate the performance of the respective Index. Expense ratio is minimal for the passive funds. UTI Nifty Index Fund has performed consistently in the last 5 years. Since the fund mirrors the performance of the specific basket of stocks the associated risk is relatively less. The tracking error of the fund also hovers around 0.1% which is understandable. UTI Nifty Index Fund is expected to generate steady returns for the investors over a period of time. Investors should remain invested for at least 5-7 years to generate decent return on investment. However, Index Funds lack flexibility as performance is tied to the respective index returns. Lack of downside protection is another cause of concern for index funds, active funds are the better option when index is declining sharply.

Axis Bluechip Fund: Axis Bluechip Fund has performed considerably well in the recent past. The portfolio allocation primarily focuses on Technology and Finance, the key drivers in my opinion. Investors looking to invest for considerable period of time may consider investing in Axis Bluechip Fund. Do note that the expense ratio for actively managed funds is higher when compared to passive funds. Furthermore, the Index Funds have outperformed the Active Funds in the recent past. Axis Bluechip performance wise has been sedate in last 2-3 years but still has the best returns for investments in excess of three (03) years.

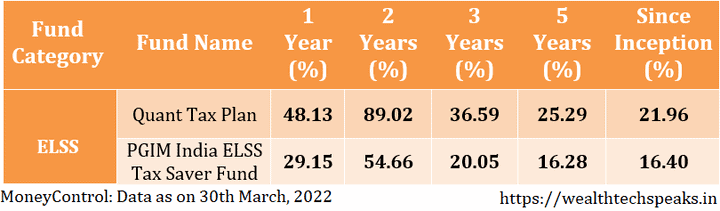

Best Equity Mutual Funds for Investment: Equity Linked Savings Scheme (ELSS)

Equity Linked Savings Schemes (ELSS) mutual fund is popular investment plan among tax payers. It provides dual benefit of investing in equity mutual fund and tax deduction under section 80C at the same time. ELSS funds has the shortest lock-in period of just 3 years among tax savings investment schemes. ELSS need to allocate minimum of 65% of their funds in equities or equity oriented mutual funds. However, Fund Managers have the option of dynamic fund allocation which may favor the investors as it open ups the possibility of better returns.

Quant Tax Plan: The fund has outperformed in recent years, delivering great returns. The portfolio appears well diversified with allocation in Large, Mid and Small Cap stocks. In terms of long-term investment, the fund appears to be a good investment prospect. However, investors looking to invest for short to mid-term of 3-5 years should be careful as the fund has fair exposure in the mid-cap and small-cap segment. As mid-cap and small-cap segments are highly volatile. Currently, portfolio allocation and past performance makes it a strong favorite for investment.

PGIM India ELSS Tax Saver Fund: ELSS Tax Saving Plan from PGIM has outperformed the benchmark on consistent basis. The expense ratio is tad higher for the fund but still the fund has performed considerably well. The portfolio is well diversified in the Large Cap, Mid Cap and Small Cap space. The portfolio turnover ratio stands at 31% which implies that Fund Manager is patient and instills confidence about portfolio allocation. The noticeable holdings are in the Banking & IT sector which again is expected to do well post pandemic. Individuals looking for ELSS fund may consider PGIM India ELSS Tax Saver Fund with minimum investment tenure of 5 years.

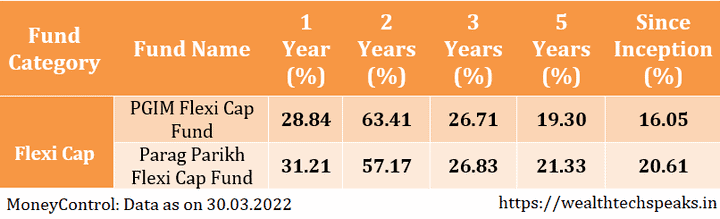

Best Equity Mutual Funds for Investment: Flexi Cap Mutual Fund

SEBI has introduced a new category of Flexi Cap Fund for the Fund Managers who did not want to alter the fund to fall in line with norms set for multi cap funds. Flexi Cap funds appear to be good investment option as the fund has scope for diversification. Fund requires to allocate at least 65% of the fund to the equity and equity-oriented funds. Flexi Cap funds have the freedom of dynamic fund allocation which makes it an interesting option for investment.

PGIM Flexi Cap Fund: One of the best performing Fund from the PGIM. The fund has consistently delivered good returns to the investors. Flexi Cap funds have the freedom to allocate their portfolio in Large, Mid and Small Cap stocks. Thereby, enabling the fund to strive for optimum returns along with mitigation of risks. PGIM Flexi Cap Fund has emerged as one of the favorites among the investors purely based on performance in the recent past. The fund looks good for medium to long term investment.

Parag Parikh Flexi Cap Fund: The fund has been doing exceedingly well in the recent past. The fund also has good exposure in overseas equities. Recently, the curb related to foreign exposure imposed on the Fund has also been removed. The fund has a good track record with major portfolio allocation in the large cap segment. Investors may consider investing in this fund for better yields. However, the expense ratio of the fund is slightly on the higher side, but fund appears to be a good investment option for majority of investors.

Strong exposure in IT & Financial services basket shows the confidence of the Fund Manager in the growth of the concerned sectors.

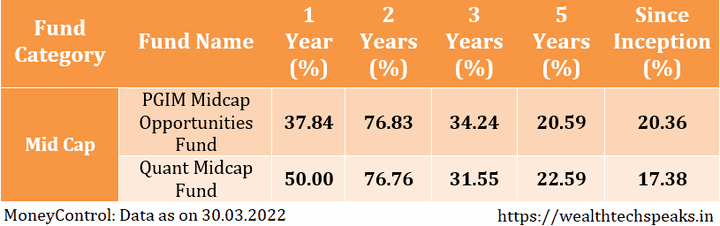

Best Equity Mutual Funds for Investment: Mid Cap Mutual Fund

Mid Cap Funds primarily invest 65% of their assets in equity and equity oriented mid cap funds. These funds have higher growth potential when compared to Large Cap Funds. Mid Cap Funds have consistently outperformed the benchmark returns which makes them a popular investment option for long term investors. However, since the mid cap segment constitutes of growing companies, the segment experiences higher volatility in this segment is highly volatile.

PGIM India Midcap Opportunities Fund: The fund has consistently outperformed the benchmark index. The fund is well diversified into mid and small cap stocks. The expense ratio is just 0.5% and since its inception it has yielded returns in excess of 20%. The fund has potential to deliver in the future as well. Investors with moderate to high risk tolerance level may consider investing midcap funds for higher returns.

Quant Mid Cap Fund: The fund has been consistent performer in the midcap space for last few years. The fund has comprehensively outperformed the benchmark index and the category average in last 5 years. Investors looking for high returns with moderate to high risk tolerance level may consider investing in midcap funds. However, since the midcap space is relatively volatile in nature, long term investment makes sense for the investors. The fund is well balanced with exposure in Large and Small Cap Funds apart from core Mid Cap stocks.

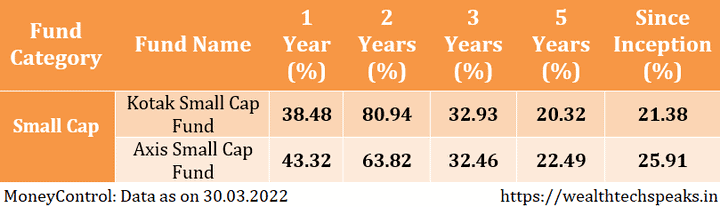

Best Equity Mutual Funds for Investment: Small Cap Mutual Fund

Small Cap Fund is more suited to investors with high risk tolerance level. Funds allocate 65% of their assets in equity and equity oriented small cap funds. These funds are highly volatile in nature but since investment is in emerging stocks the potential returns are expected to be higher when compared to other funds. Investors with long term investment goals may look at Small Cap Mutual Fund as growth potential is huge. However, the investment is risky considering small cap stocks are very volatile which may impact the returns. Under this segment, I have retained the recommendation given last year. As the recommended funds, still appear to be good choices for investment.

Kotak Small Cap Fund: Investors with high risk tolerance level may explore Kotak Small Cap Fund for investment. The fund had done exceedingly well in the last few years. The expense ratio of the fund is decent. The portfolio also looks well diversified in the small cap space so investors may consider this stock for investment. The fund includes stocks in the portfolio which have potential to grow in the future.

Axis Small Cap Fund: Axis is one of the established names in the mutual fund industry. Most of their funds are doing exceedingly well. In the Small Cap space too, Axis Small Cap Fund has performed well over the years. The fund may be considered for investment by long term investors. The expense ratio of the fund is quite low, the asset allocation in small cap space is diversified across sectors. The fund has consistently delivered good returns and remains one of the top performers.

Investment Advice

Investment in Mutual Funds does carry an element of risk so please understand your financial objectives before investing. Returns should not be the only criteria to choose Funds for investment. Investor should also evaluate the downside risks before investing. Each Fund is designed to fulfill certain objectives, aiming to balance risk to reward ratio. Investors need to take an informed decision. Investors need to balance their portfolio with investments in equity and debt schemes. Ideally, 60% investment should be in equity and 40% investments in debt instruments such as PPF, Debt Mutual Funds, etc.

It is always advisable to discuss with your Financial Advisor to get a clarity regarding investments which will help you achieve your financial goal.

Individuals looking to invest in Mutual Funds may connect at admin@wealthtechspeaks.in for investment guidance and advice. We do offer investment in regular Mutual Fund schemes for the interested investors.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content. In case you are interested in investing in Stocks, get your free Demat today (Click Here).

WealthTech Speaks is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in the post is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information and without warranty of any kind, expressed or implied, including, but not limited to warranties of performance, merchantability and fitness for particular purpose.

промокод 1xbet https://justinekeptcalmandwentvegan.com/wp-content/pages/code_promo_76.html

рабочий промокод 1xbet https://justinekeptcalmandwentvegan.com/wp-content/pages/code_promo_76.html

You ought to be a part of a contest for one of the highest quality websites on the web. I will highly recommend this web site!

I have discovered that sensible real estate agents everywhere you go are Marketing and advertising. They are noticing that it’s more than simply placing a sign post in the front area. It’s really pertaining to building human relationships with these dealers who sooner or later will become customers. So, while you give your time and efforts to serving these dealers go it alone — the “Law associated with Reciprocity” kicks in. Good blog post.

Hi, I do believe this is an excellent web site. I stumbledupon it 😉 I will return yet again since i have book-marked it. Money and freedom is the greatest way to change, may you be rich and continue to guide other people.