2-in-1 NiyoX Digital Savings Account

- Posted By Amritesh

- On March 31st, 2021

- Comments: one response

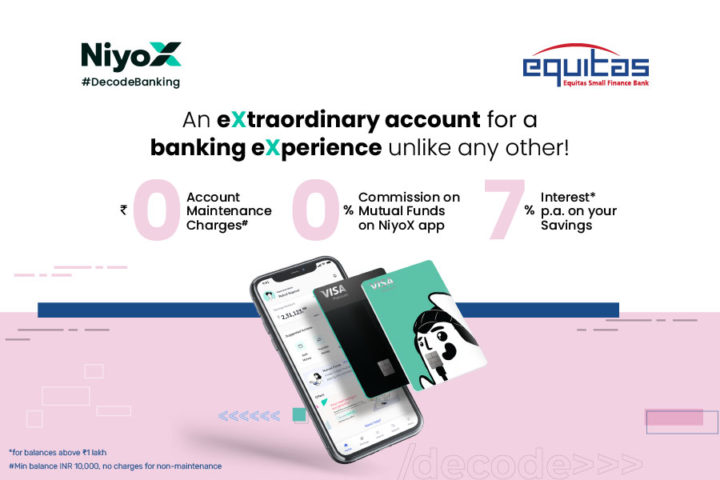

Digital Banking is digitization of conventional banking systems. It is important to take it a step further and use the technology to improve the banking experience for the end customers. The advancement and acceptance of technology has allowed the banking system to expand its services and offer value added services to the end consumers. 2-in-1 NiyoX Digital Savings account is customized to provide banking plus investment solution to the clients via a dedicated mobile application.

NiyoX Savings Account Decode Banking (Try out the App & Signup Today)

In my previous article, I had discussed the NiyoX Savings Account and the features offered under it. In this post, I will carry the discussion forward and highlight the key aspects which makes it a lucrative product in the Digital Banking space.

2-in-1 NiyoX Digital Savings Account in partnership with Equitas Small Finance Bank: Not A Conventional Savings Account

NiyoX Savings Account is a modern approach to banking while retaining the traditional essence of Banking System. It may appear as Savings Account app, but ideally it is a wealth management app which allows Individuals to manage their finances. Let’s look at the key offerings which makes it a compelling product in comparison to others.

Higher Interest Rates on Savings Fund & Zero Maintenance Charges

Traditionally, A Savings Account is an operational Bank Account wherein money is kept to be utilized later or it is a surplus money which an Individual is not keen to invest. Most banks offer nominal interest on such deposits but NiyoX Savings Account offers interest rate comparable or even better than returns on Fixed Deposits & Recurring Deposits. On balance up to Rs 1 lac, the account offers up to 3.5% return which is higher than interest offered by most of the leading banks. Any amount in excess of Rs 1 lac will earn an interest of 7% which is unthinkable in the current scenario.

NiyoX Savings Account Decode Banking (Mobile Banking Platform)

Additionally, even though the minimum balance requirement for the account is of Rs 10,000/-. But in case the balance falls below the threshold, no maintenance charge is levied on the account. Most of the banks levy maintenance charge in case balance falls below the threshold limit. Again, a huge bonus for the customers.

NiyoX 2-in-1 Platform (Savings cum Investment Account): With Equitas Small Finance Bank & Niyo Money

Individuals are not required to create a separate account for investment. The 2-in-1 NiyoX Savings account allows Individuals to invest in mutual funds through the same account. Even KYC will be completed online for the Savings as well as Mutual Fund account. So, Customers will be able to make investments in mutual funds with the same account. This saves the Individual from opening multiple accounts and tracking them through different mobile applications & portals. Investment and Savings are enabled through a single platform for the convenience of the customers.

No Commission Mutual Funds

Most of the Banks allow investment in Mutual Funds. However, most do not offer investment in Mutual Funds via Direct Plan. Now, Direct Plans come with zero commission. Direct plans have a low expense ratio when compared to Regular plans. As no commission is required to be paid to the intermediary/agents for the investment.

So, customer benefits in two ways; firstly, savings account offers higher rate of returns. Second, customers save on investment as he/she is not required to pay commission on investment.

State of Art Mobile Application

Niyo is a known name in the Banking technology space. Hence, the Niyo Mobile Application is a comprehensive offering. Right from Savings account details to Investment Statement, everything is available on the application. This makes it very easy for the customer to manage their finance. The application comes with a host of features & security which makes banking simple & easy.

This was my understanding of the 2-in-1 NiyoX Savings Account, offering a wide range of benefits to the end customer. The features discussed above clearly have raised our expectation from the product. We hope that the product lives up to the promise and offers the best banking service in the digital space.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content.

Wealthtech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational and promotion purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.