Income Tax Applicability For The Financial Year 2018-19

- Posted By Amritesh

- On February 6th, 2018

- Comments: 5 responses

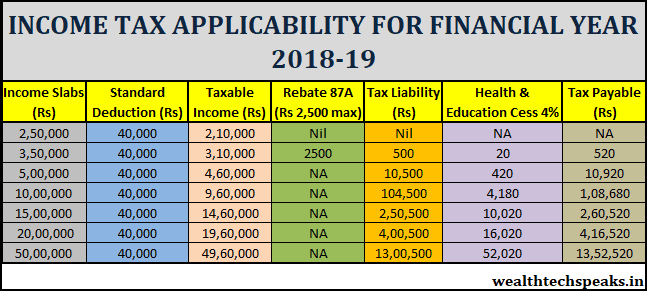

The Tax Implications shown above is applicable for Salaried Individuals below 60 years of age. For the Financial Year 2018-19, Standard Deduction of Rs 40,000/- is available to the Salaried Individuals in lieu of Conveyance Allowance of Rs 19,200/- and Medical Reimbursement of Rs 15,000/- available in the Financial Year 2017-18.

Standard Deduction is a flat deduction from the Salary Income of an Individual. However, the Cess on the Income Tax Payable has been increased by 1%.

Income upto Rs 2,50,000/- is exempted from Tax.

Tax Rebate U/S 87A of Rs 2,500/- is available to Individuals with Taxable Income up to Rs 3,50,000/-.

Health and Education Cess of 4% is additionally levied on the Income Tax payable for the Financial Year 2018-19. This replaces the Education Cess of 2% and Senior Education Cess of 1% levied in the Financial Year 2017-18.

Investments Available Under Various Sections To Reduce Tax Liability

U/S 80C: Tax Deduction up to Maximum of Rs 1,50,000/- is available on Investment in Life Insurance policies, Public Provident Fund (PPF), Equity Linked Saving Schemes (ELSS) Mutual Funds, National Savings Certificate (NSC) and other notified instruments.

U/S 80D: Tax Deduction up to Rs 25,000/- is available on Health Insurance Premium paid for Self, Spouse and Dependent Children. Deduction is extended up to Rs 50,000/- for Senior Citizens on the premium paid towards Health Insurance.

U/S 80CCD (1b): Tax Deduction up to Maximum of Rs 50,000/- is available on investment made towards National Pension Scheme (NPS). This is also applicable on Contribution made towards the Atal Pension Yojana (APY).

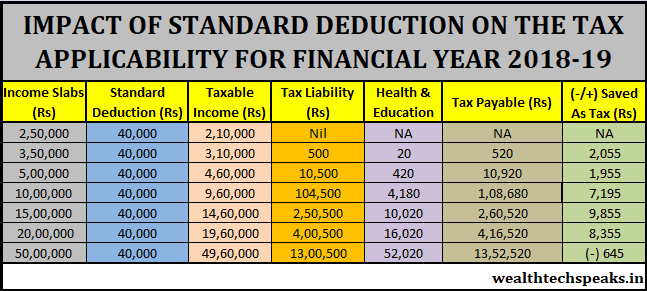

I have compared the Tax Liability for the Financial Year 2018-19 against the Financial Year 2017-18. Hereby, Individual can ascertain the Gains/Loss, one stands to make due to introduction of Standard Deduction. To make understanding simple, Tax exemption on Conveyance Allowance and Medical Reimbursement is not taken into consideration.

Please do note that I have only mentioned commonly available Tax Deductions. I will discuss the exhaustive list of tax deductions for the Financial Year 2018-19 in my upcoming posts.