Tax Deductions For Financial Year 2018-19

- Posted By Amritesh

- On February 8th, 2018

- Comments: 4 responses

Salaried Individuals with Annual Income above Rs 2,50,000/- per annum are liable to pay Taxes on the earnings above the Income slab. However, Individuals with Taxable Income up to Rs 3,50,000/- per annum may avail Tax Credit up to Rs 2,500/- under Section 87A on the Income Tax payable. Thereby, implying that Individuals with Income up to Rs 3,40,000 will not have any Tax Liability for the Financial Year 2018-19 and Assessment Year 2019-2020. Since the newly introduced Standard Deduction provides flat deduction of Rs 40,000/- on the Salary Income.

Income Tax Applicable for Various Income Slabs

Income Tax Slabs and Rates For Financial Year 2018-19

In this post we would look at the Tax Deductions available under various Sections as per the Income Tax Act and the investment options available to the Individuals.

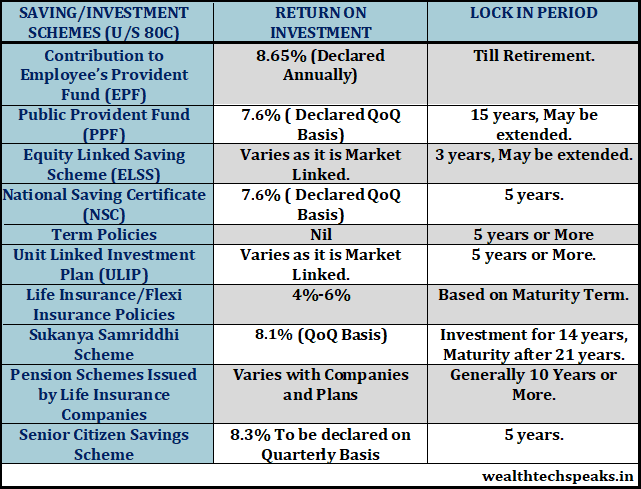

DEDUCTIONS U/S 80C

Tax Deductions are available to the Individuals under Section 80C, 80CCD, 80CCC up to the extent Rs 1,50,000/-. These are now effectively clubbed under Section 80C with the aggregate deduction ceiling of Rs 1,50,000/-. The table shared above provides the probable investment options available to Individuals under the various Sections. Please note the returns mentioned are approximate figures. Articles on investment plans have been shared previously.

Repayment of Principal of House Loan taken is also eligible for Deduction along with Registration Fee and Stamp Duty paid towards the same. However, the benefit is restricted to the maximum deduction limit of Rs 1,50,000/-. Provided the Individual does not transfer the property before expiry 5 years from the Financial Year in which it was obtained.

The deduction on Registration Fee and Stamp Duty is also available to Individuals who have not availed Home Loan.

DEDUCTIONS U/S 80 CCD (1b)

Investment up to Rs 50,000/- is eligible for deduction up and over the deduction available U/S Section 80C on Contribution made to National Pension Scheme (NPS) and Atal Pension Yojana (APY).

Individuals may invest in both the schemes and avail cumulative deduction upto Rs 50,000/- on the investment.

DEDUCTIONS U/S 80D

Further deductions up and above the Deductions availed U/S 80C & 80CCD (1b) is available U/S 80D on payment made towards Health Insurance Premium. It covers the premium paid on the Health Insurance cover for self and family. Deduction of Rs 25,000/- can be availed for the premium paid for Self, Spouse and dependent children. Deduction is enhanced to Rs 50,000/- on premium paid towards the Mediclaim Insurance for Senior Citizens.

DEDUCTION U/S 80DDB

Deduction to the extent of Rs 40,000/- on Medical Expense of Self and dependent relative can also be availed. In case of Senior Citizens the limit goes up to Rs 1,00,000/-.

This deduction is available only in cases of specified diseases such as Cancer, Kidney Failure, AIDS, Haemophilia, AIDS, Dementia, Neurological Disorder, etc.

DEDUCTIONS U/S 80E

Deduction is also available on the education loan for higher studies (Graduation or Post Graduation) in the fields of Medicine, Engineering, Management, or Science. The deduction is available from the 1st year and subsequently for next 7 years. Deduction available is Rs 40,000/- p.a on the EMI paid as interest.

DEDUCTIONS U/S 80G

Deductions are also available for the donations made to notified NGO’s, Charitable Institutions are eligible for 50% or 100% deduction as provided under the act. However the maximum limit to the deduction claimed is 10% of the Adjusted Gross Total Income after claiming other deductions.

Some of the Prescribed Notable Institutions where 100% Deduction is available without qualifying limit:

National Defence Fund

Prime Minister Relief Fund

Swacch Bharat Kosh

National Sports Fund

National Children’s Fund

Clean Ganga Fund and many more….

DEDUCTIONS U/S 80GG

Deduction available in respect of House Rent Paid, the least of the following:

Rent paid less 10% of the total income.

Rs. 5000/- per month. (Maximum Deduction available is 60,000/-)

25% of total income, provided that

Assessee or the spouse or minor child should not own residential accommodation at the place of employment, or anywhere else and is not receipt of House Rent Allowance. The deduction is available provided the Individual, does not receive any benefit of deduction U/S 10 (13A) for House Rent Allowance.

DEDUCTIONS U/S 24(b)

Deductions up to Rs 2,00,000/- is available on the interest paid on the Loan availed for purchase/construction of self occupied House Property. However the acquisition and construction of such house property should be completed within 5 years from the end of Financial year in which Home Loan was taken. The sum should be borrowed on or after 01/04/1999 to be eligible for deduction.

DEDUCTION U/S 80DD & U

Deduction of Rs 75,000 U/S 80DD is available to meet the expenses and medical treatment of disabled dependent person. In case of severe disability (more than 80%) the Deduction limit is Rs 1,25,000/-.

Deduction of Rs 75,000 U/S 80U is available to meet the expenses and medical treatment of Resident Individual (Self). In case of severe disability (more than 80%) the Deduction limit is Rs 1,25,000/-.

DEDUCTION U/S 80TTA/B

Deduction from Gross Total Income up to a maximum of Rs. 10,000/-, in respect of interest on deposits in savings account (not time deposits) with a bank, co-operative society or post office.

The interest free income has been extended up to Rs 50,000/- in case of Senior Citizens under Section 80TTB.