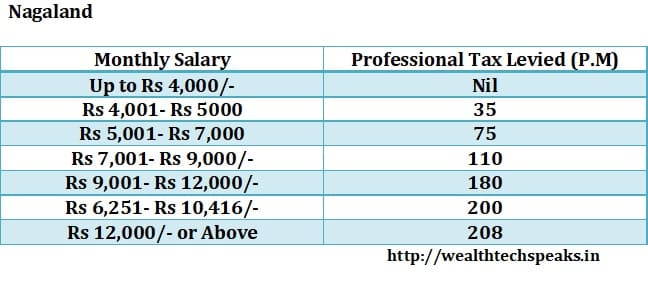

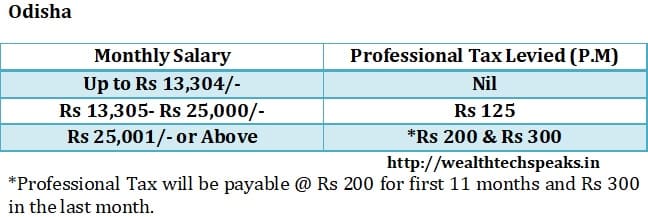

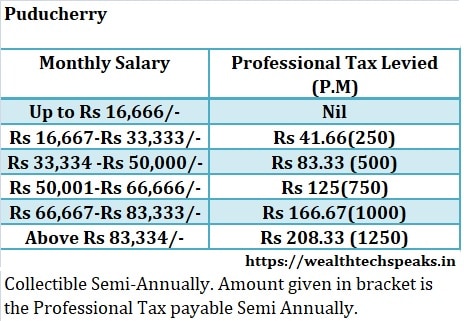

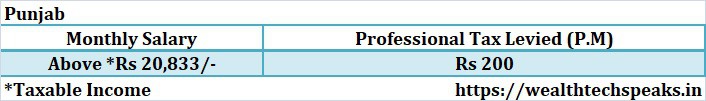

State Wise Professional Tax Slabs & Rates

- Posted By Amritesh

- On April 2nd, 2016

- Comments: 116 responses

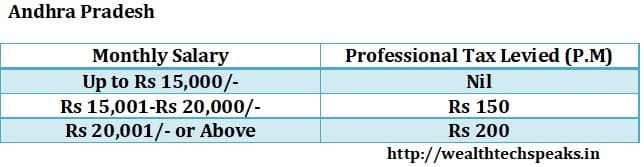

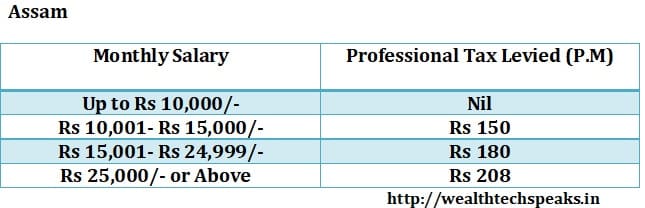

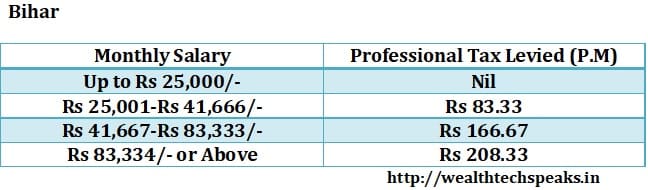

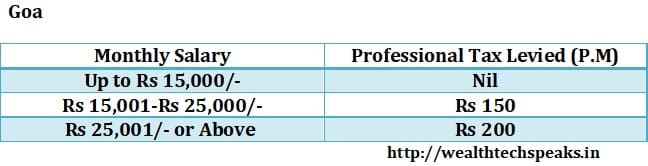

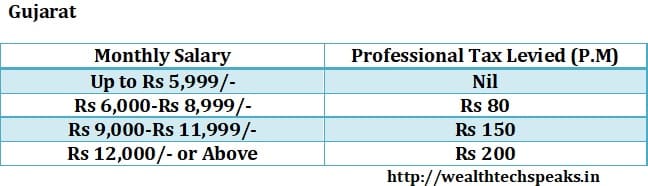

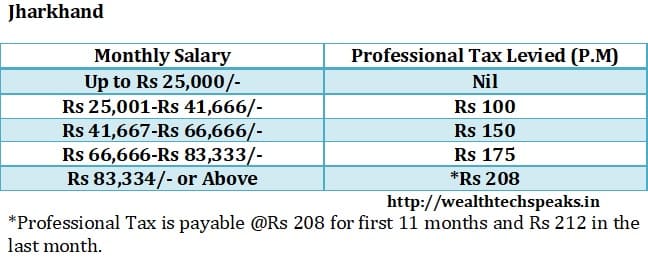

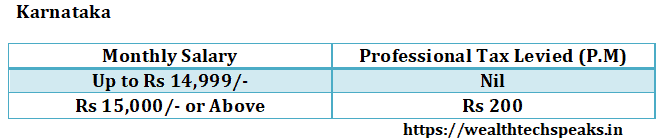

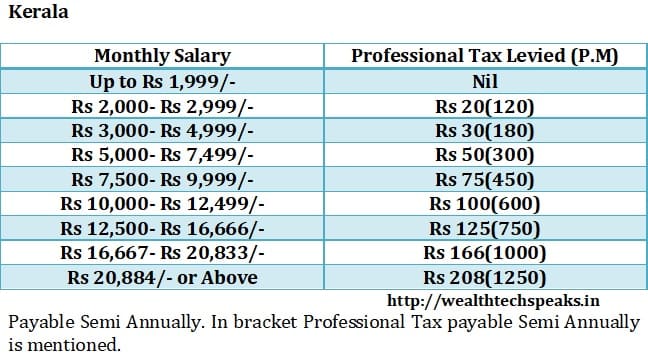

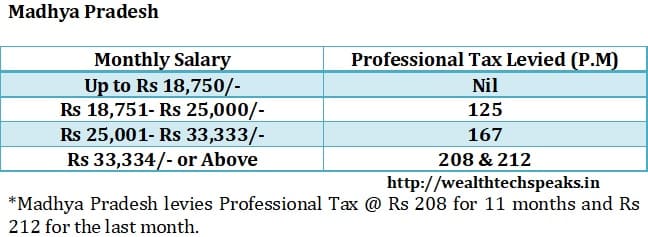

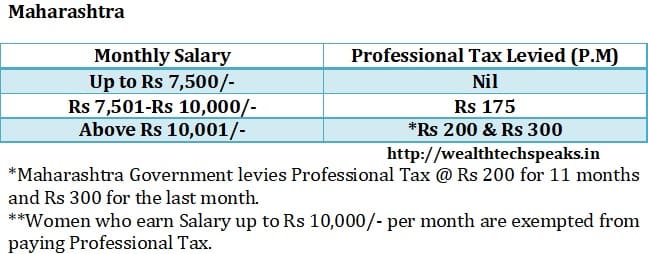

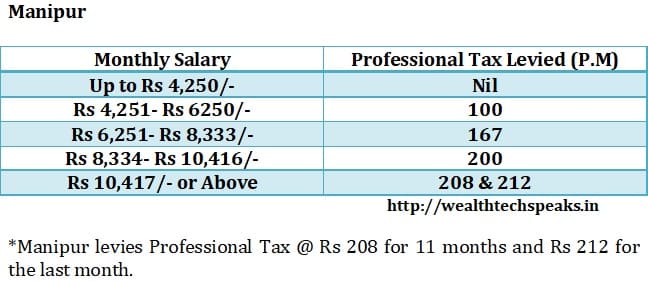

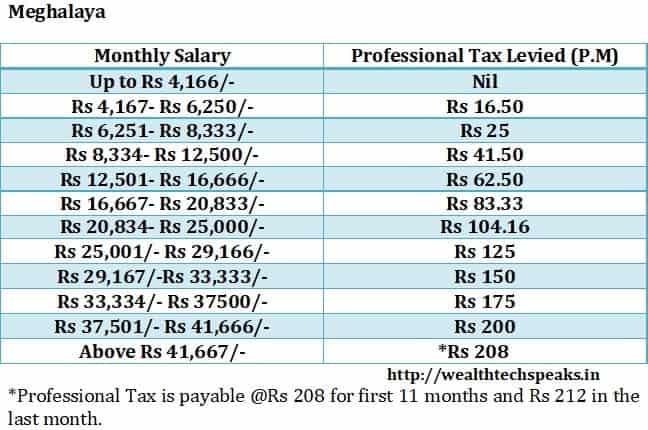

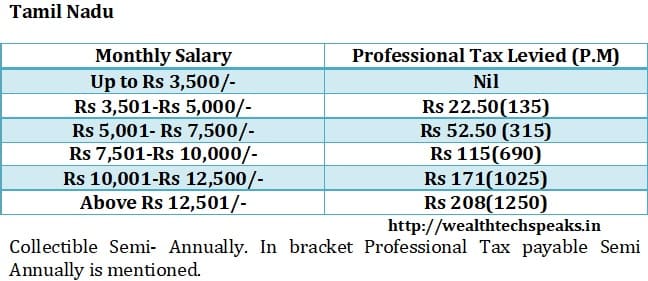

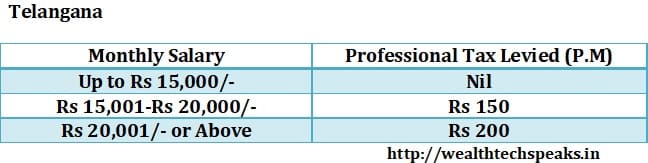

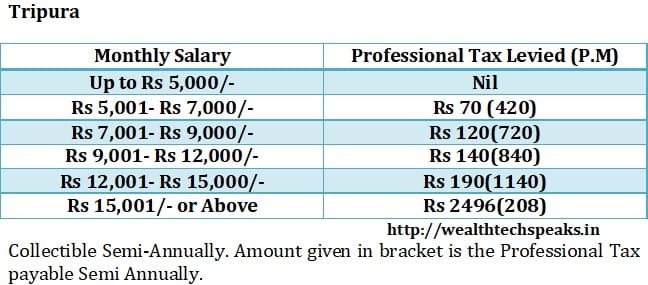

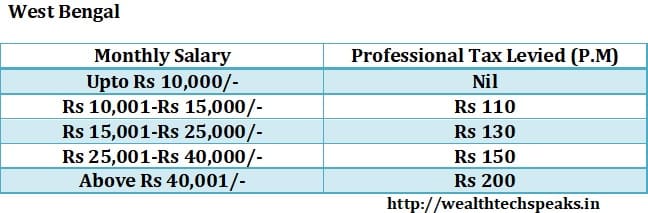

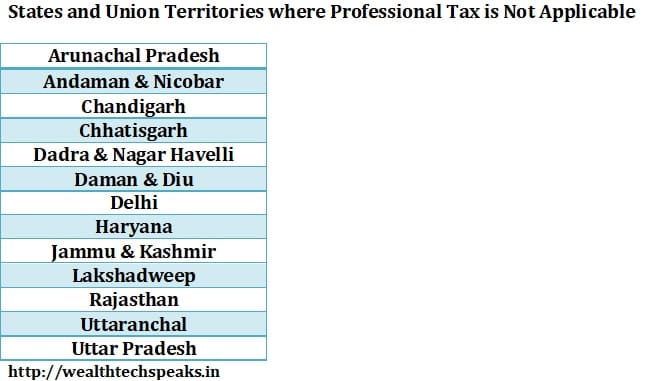

State wise Professional Tax Rates for the Financial Year 2020-21 has been updated. Professional Tax is levied by the State Government on salaried individuals, or in practice of any profession, or carry out some form of business. Professional Tax (PT) Rates and Slabs vary from State to State. Few of the States do not levy PT. Union Territories also do not levy Professional Tax.

State wise PT For the Current Financial Year 2020-21 is available in the link shared below.

Professional Tax For The Financial Year 2020-21

Professional Tax Procedure, Guidelines, Registration and Enrolment

State wise Professional Tax Rates and Slabs for the Financial Year 2018-19.

Exemption from Paying Professional Tax (As per the Act)

Any person suffering from a permanent physical disability (including blindness)

Parents or guardian of any person who is suffering from mental retardation.

Persons who have completed the age of 65 years.(60 years in case of Karnataka)

Parents or guardians of a child suffering from a physical disability as specified in clause (C) w.e.f 1.10.1996.

This article is for sharing personal views only. Readers are advised to research further and consult a Tax Expert to have more clarity on the topic. Please refer to the latest post on Professional Tax.