Short Term Capital Gains: Tax Implications

- Posted By Amritesh

- On December 15th, 2020

- Comments: 9 responses

Understanding Capital Gain

Capital Gain is the appreciation in value of the asset over a period of time when compared to the purchase price. The Gain is realized only at the time when the asset is sold. Short Term Capital Gains is determined based on the holding period of the respective Asset.

Any Profit or Gain arising out of transfer of capital asset held in form of investment (including real estate or stocks) is known as Capital Gain. The gain or profit is charged to Capital Gains Tax in the year the sale of asset is done. Any property, whether movable or immovable when sold, capital gain tax is applicable. However, Income Tax Act exempts assets received in form of inheritance or will.

Income from Capital Gain is classified as:

“Short Term Capital Gains”;and

“Long Term Capital Gains”

Short Term Capital Asset may be classified as “an asset held for not more than 36 months”. Exception being Equity Shares, Equity Mutual Funds, Zero Coupon Bonds, etc as it is considered short term assets if held for less than 12 months.

However, Financial Year 2017-18 onwards, Period of Holding is reduced to 24 months for immovable assets. The tenure is also applicable for unlisted shares of a company.

Classification of Capital Asset

Capital asset may be defined as the following:

(a) Any kind of property held by an assesse, irrespective of it being connected with business or profession of the assesse.

(b) Any securities held by a FII with investment in securities in accordance with the regulations made under the SEBI Act, 1992.

However, the following items are excluded from the definition of “capital asset”:

i.) Any stock-in-trade (other than securities referred above), Consumable or Materials used in Business or Profession;

ii.) Personal Items, moveable items (including wearing apparel, furniture and gadgets) held for personal use by the taxpayer or any member of his family dependent on him, but excludes—

(a) Jewellery;

(b) Archaeological collections;

(c) Drawings;

(d) Paintings;

(e) Sculptures; or

(f) Any work of art.

“Jewellery” includes—

Ornaments made of gold, silver, platinum or any other precious metal/stones or any alloy containing one or more of such precious metals, in any form; including ones used in furniture, utensils and apparels.

iii.) Agricultural Land in India, not being a land situated; subject to fulfillment of certain conditions.

iv.) 6.5 per cent Gold Bonds,1977 or 7 per cent Gold Bonds, 1980 or National Defence Gold Bonds, 1980 issued by the Central Government;

v.) Special Bearer Bonds, 1991;

vi.) Gold Deposit Bonds issued under the Gold Deposit Scheme, 1999 or deposit certificates issued under the Gold Monetization Scheme, 2015.

Determination of Short Term Capital Assets

Any capital asset held by the taxpayer not exceeding 36 months immediately preceding the date of its transfer is to be considered as short-term capital asset.

However, with consideration to certain class of assets such as stocks (equity or preference) which are listed in a recognized stock exchange in India, units of equity based mutual funds, listed securities like Debentures and Government securities, Units of UTI and Zero Coupon Bonds, the period of holding to be considered is 12 months instead of 36 months

As amended by Finance Act, 2017, for the FY 2017-18, Period of holding to be considered as 24 months instead of 36 months in case of unlisted shares of a company or an immovable property being land or building or both.

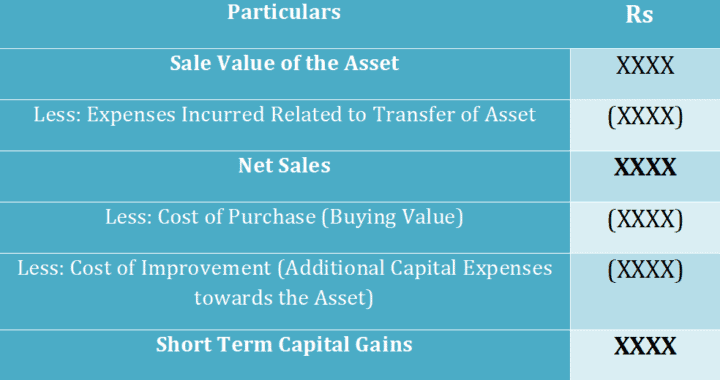

Computation of Short Term Capital Gains

Tax Implication on Short Term Capital Gains

Short Term Capital Gain (STCG) covered under section 111A is charged to tax @ 15% (plus 4% Health & Education Cess is applicable).

Normal STCG, i.e., STCG on transaction not covered under section 111A is charged to tax at normal rate of tax which is determined on the basis of the total taxable income of the Assesse. This includes sale of shares other than Equity Shares and Debt Oriented Mutual Funds, qualifying as STCG. Sale of immovable property, Gold, Silver, Bonds, Debentures, Government Securities is also not covered under Section 111A.

Long Term Capital Gains: Tax Implications

Section 111A is applicable in case of STCG arising on transfer of equity shares or units of equity oriented mutual-funds (U/S 23D & 65% of the proceeds invested in Domestic Equity Shares) or units of business trust, which are transferred on or after 1-10-2004 through a recognized stock exchange and such transaction is liable to Securities Transaction Tax (STT).

If the above condition is fulfilled, then the STCG is termed as STCG covered under section 111A. Such gain is charged to tax at 15% (plus 4% Health & Education cess as applicable).

However, effective Assessment Year 2017-18, benefit of concessional tax rate of 15% shall be available even where STT is not paid, provided that transaction is undertaken on a recognized stock exchange located in any International Financial Service Centre, or consideration is paid or payable in foreign currency.

Adjustment of Short Term Capital Loss

Short Term Capital Losses may be set off against Long Term & Short Term Capital Gains. In case, one cannot set off the entire capital loss in the same year. It may be carried forward for 8 Assessment Years immediately following the Assessment Year in which it was recorded. Such carry forward is only possible if Income Tax Return is filed on or before the due date, as provided U/S 139 (1).

Adjustment of STCG against Basic Exemption Limit

Only Resident Individual & Hindu Undivided Family (HUF) is allowed to adjust the basic exemption limit against Gains covered under section 111A. But such adjustment is possible only after making provision for other income.

Deductions Chapter VI of the Income Tax Act

No deduction is allowed under Chapter VI of the Income Tax Act on STCG covered under Section 111A. However, deduction may be claimed on STCG not covered under Section 111A.

Wealthtech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

Hi there, I check your blogs daily. Your writing

style is witty, keep it up!

Also visit my webpage … single parents dating Each other

semi truck accident attorney (Sima)

The keto diet is strict, and it requires people to adhere to it closely to achieve results. This results in a strong inhibition of the enzyme. Therefore, inhibition of PFK-1 leads to inhibition of hexokinases I-III. When the energy charge of the cell falls, ADP is used to regenerate ATP, in the reaction catalyzed by adenylate kinase Moreover, as previously said, a small reduction in ATP levels leads to larger-percentage changes in ADP levels and, above all, in AMP levels. Through its association with GKRP, fructose 6-phosphate allows the cell to decrease glucokinase activity, so preventing the accumulation of intermediates. For example, when PFK-1 is inhibited, fructose 6-phosphate accumulates and then, due to phosphoglucose isomerase reaction, glucose 6-phosphate accumulates. Under such condition ATP, binding to its allosteric site, inhibits PFK-1 by reducing the affinity of the enzyme for fructose 6-phosphate. From the kinetic point of view, the increase in ATP concentration modifies the relationship between enzyme activity and substrate concentration, chancing the hyperbolic fructose 6-phosphate velocity curve into a sigmoidal one, and then, increasing Km for the substrate. However, under most cellular conditions, ATP concentration does not vary much. However, there are also https://pastein.ru/l/P04I-specific energy drinks containing BHB salts and MCTs, which provide the energy-boosting effects of ketones rather than caffeine or taurine.

On May 21, 2020, WWE SuperCard added a similar event mode as People’s Champion Challenge, named Clash of Champions (titled after the pay-per-view of the same name), sharing previous features from People’s Champion Challenge such as choosing two different sides, and elements from different events such as Last Man Standing and Giants Unleashed. The full deck is in play, unlike Season 1. The stamina system is the same as in Season 1, except the total number of Energy cards that can be accumulated increased to 25 from 10. After playing 45 matches the top eight players move onto the contenders bracket and the quarter finals, where there are two or three consecutive matches between two players of the top 8 each in order to find the winner. You will get full insights concerning this enhancement alongside all genuine clients’ audits and sentiments. Department of Veterans Affairs (VA) concerning claims and benefits. Commonly known as the “Peruvian ginseng,” it brings a lot of benefits to your health overall. Lexx has gotten a lot of attention in the fitness community because of how much he has changed in the last few years. Since I am concerned with the work involved in building the IndieWeb, I have focused my attention on divisions of labour as a mechanism of control over that work.

Here is my page; https://man.net/qckn1

Download Keto Chaffle Recipes Cookbook 2020: Amazingly Delicious, Easy and Healthy Low Carb Ketogenic Waffle Recipes to Boost Metabolism, Lose Weight and Live Healthy. The Ketogenic Diet and Neuroinflammation: The Action of Beta-Hydroxybutyrate in a Microglial Cell Line. “The most critical thing is being able to stick to whichever diet you pick, so it’s important to find something that works for your lifestyle, your tastes and your preferences,” Zumpano says. “Don’t skip meals, or you’ll get hungry and tend to overeat later,” Zumpano advises. Now that your freezer is packed with delicious meals, dinner can be as easy as takeout with these simple steps. Eating protein at every meal can help you feel full and reduce the urge to snack. From Keto to Low Carb, Paleo, Carnivore, and more, we help you go beyond counting macros and calories to help you achieve ideal metabolic health with our robust macro tracker, protein tracker, and more!

Here is my web site: http://ultfoms.ru/user/QLTErick885920/

Zero-calorie soda is not included in the list below because many artificial sweeteners aren’t good for you, and some diet drinks contain sugar alternatives that can kick you out of ketosis (learn more on that here); plus, all of them perpetuate the craving for sugar, which is something you will otherwise joyfully lose on a keto diet. First, it’s easier to know what’s in your food and avoid unintentionally consuming hidden ingredients that may kick you out of ketosis. In addition, eating cheese regularly may help reduce the loss of muscle mass and strength that occurs with aging. Staying hydrated will help combat the “keto flu” (learn more about that here) and avoid early keto symptoms of muscle cramps, headaches, and fatigue, all of which are signs of suffering from electrolyte imbalances. In our in our evidence based guide we examine the most relevant scientific research about IF, concluding that it’s very unlikely to see significant muscle loss with IF, especially if eating adequate protein and engaging in resistance training.

Review my website – https://pastein.ru/l/Um4I

car accident injury attorneys (samwoon.co.kr)

attorneys for automobile accidents (Rsrehab.co.kr)

best Car accident Attorneys