State-wise Professional Tax (PT) Rates FY 22-23

- Posted By Amritesh

- On April 13th, 2022

- Comments: 4 responses

State-wise Professional Tax (PT) Rates & Slabs FY 2022-23 does not witness any massive change. The ongoing pandemic and related economic woes have deterred most of the State Governments from revising the Professional Tax rates in the respective states. However, Gujarat has increased the professional tax exemption limit for Individuals earning up to Rs 12,000/-. PT is levied in majority of the states barring Union Territories and few states. Professional Tax is levied on monthly or semi-annually basis depending on the income slab and source of income. Professional Tax is levied on Businesses as well as Salaried Individuals.

Enrolment & Registration: Tax on Profession

State Governments levy Professional Tax (PT) on all types of professions, trade and employment depending on the income threshold set for the same. Article 246 of the Constitution of India 1949, empowers the Parliament to introduce laws governing taxes on income. Whereas, Article 276 of the Constitution of India 1949, State Government is empowered to introduce and levy professional tax on professions, trades, callings & employment. Even though States are empowered to impose Professional Tax, not all States impose such tax. The maximum amount which may be levied as Professional Tax is Rs 2,500/- annually. As it is a state subject, State-wise Professional Tax Rates for Financial Year 2022-23 will vary from State to State.

Income Tax Slabs & Rates for Financial Year 2022-23

Professional Tax (PT) Rates & Slabs structure is at the complete discretion of the State Government, subject to cap of Rs 2,500/-. Individuals may claim tax deduction on the amount paid towards professional tax in accordance with Income Tax Act, 1961. Professional Tax is deducted by the employers for the salaried employees and same is deposited with the State Government. In case of others, they are required to directly pay it to the Government or through the Local Bodies appointed to do so. The tax has to be collected and deposited as per the timeline provided by the respective State Government. In case, one fails to do so, penalty and late fee is applicable as per the Act. The Tax may be paid to the Competent Authority on monthly, semi-annually or annually basis depending on nature of business and the respective State Laws.

Salaried Individuals will find the professional tax deduction in the payslips and Form-16 issued by the employer. Employers has the responsibility to the deduct the professional tax from the eligible employees and deposit the same with the State Government. In this post, we would glance through the State-wise Professional Tax (PT) Slabs & Rates FY 2022-23 levied by the respective State Governments.

State-wise Professional Tax Rates for Financial Year 2022-23

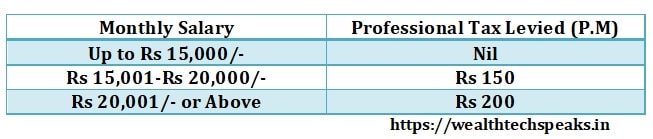

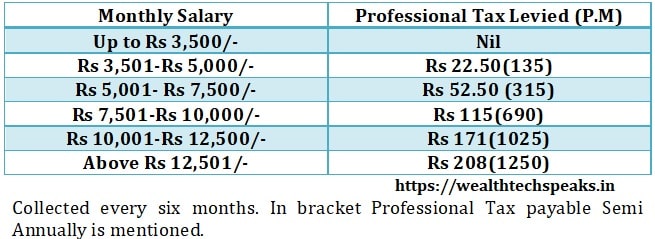

Andhra Pradesh Professional Tax Rates

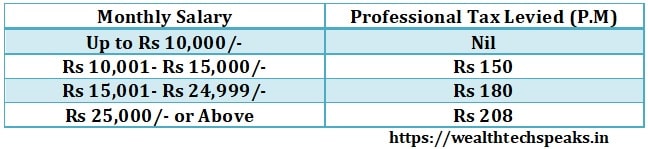

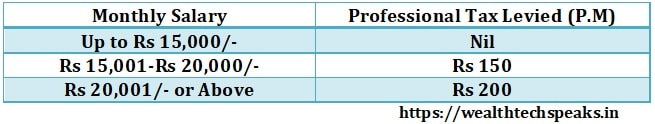

Assam Professional Tax Rates

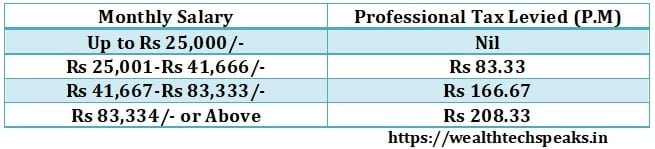

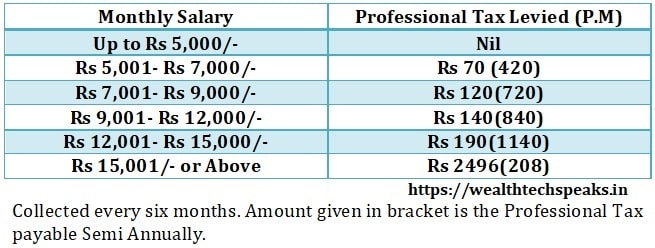

Bihar Professional Tax Rates

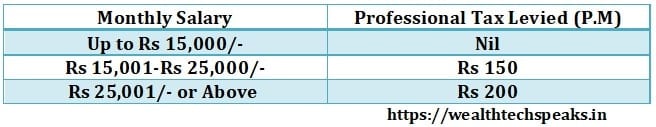

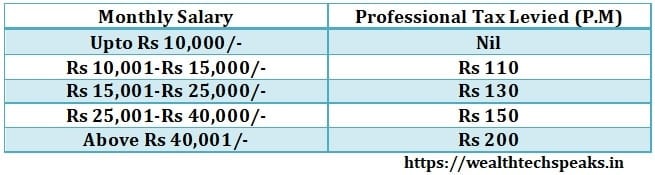

Goa Professional Tax Rates

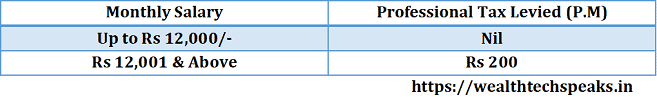

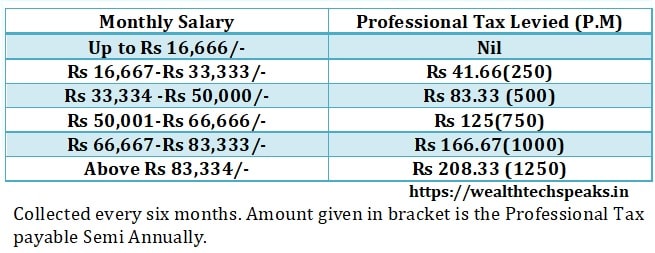

Gujarat Professional Tax Rates

Jharkhand Professional Tax Rates

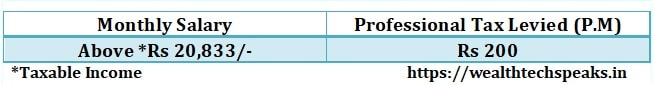

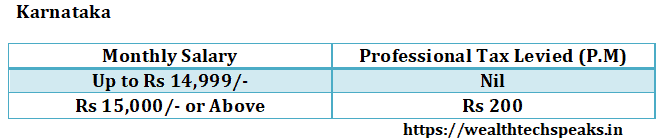

Karnataka Professional Tax Rates

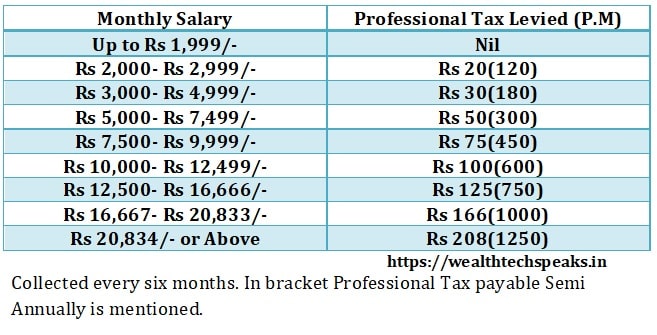

Kerala Professional Tax Rates

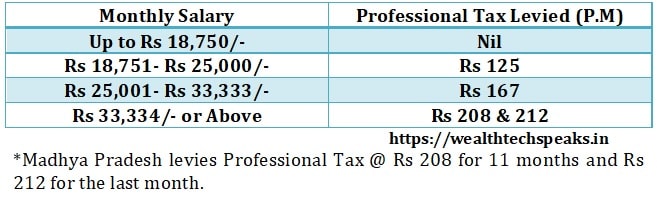

Madhya Pradesh Professional Tax Rates

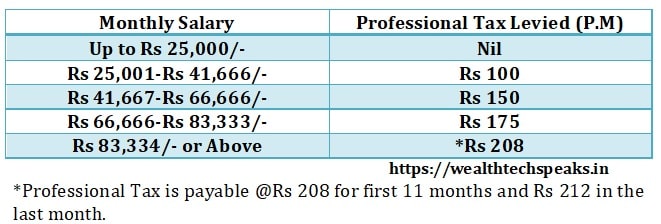

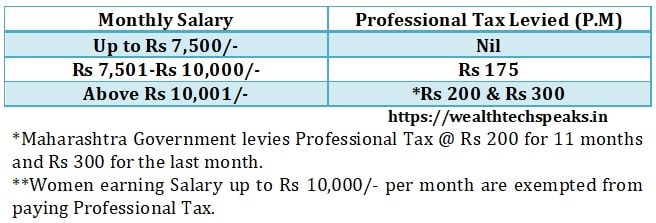

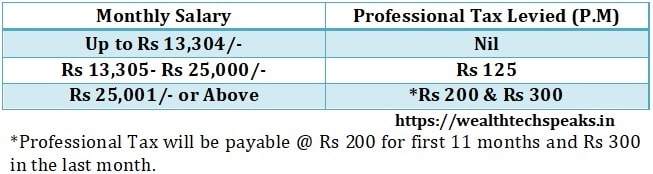

Maharashtra Professional Tax Rates

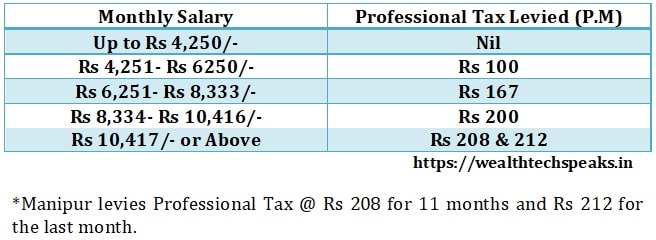

Manipur Professional Tax Rates

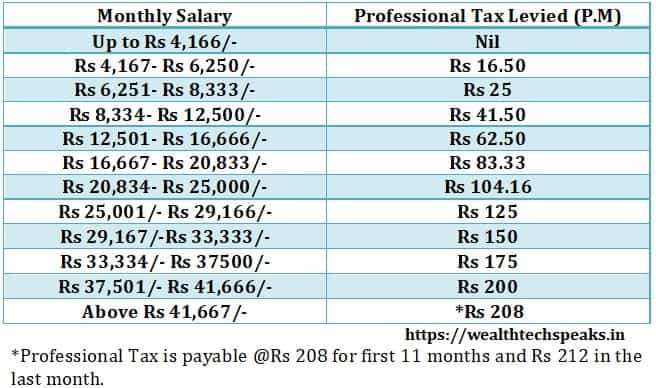

Meghalaya Professional Tax Rates

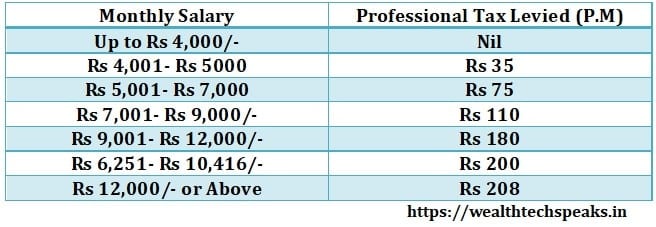

Nagaland Professional Tax Rates

Odisha Professional Tax

Puducherry Professional Tax

Punjab Professional Tax (State Development Tax)

Sikkim Professional Tax

Tamil Nadu Professional Tax

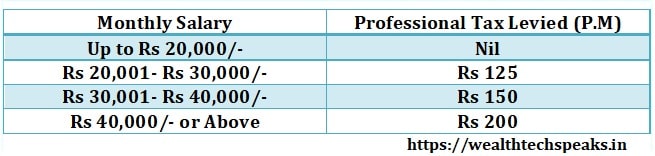

Telangana Professional Tax

Tripura Professional Tax

West Bengal Professional Tax

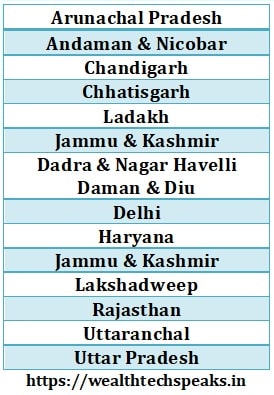

States and Union Territories : Exempted from Professional Tax

Exemption from paying Professional Tax (As per the Act)

Any person suffering from a permanent physical disability (including blindness) depending on provisions of PT of the respective State.

Parents or guardian of any person who is suffering from mental retardation, if the PT Act provides provision for the same.

Persons who have completed the age of 65 years. Subject to exemption provided by respective State. (60 years in case of Karnataka)

Parents or guardians of a child suffering from a physical disability as specified in clause (C) w.e.f 1.10.1996, applicable as per State provisions.

Individuals looking to invest in Mutual Funds may connect at admin@wealthtechspeaks.in for investment guidance and advice. We do offer investment in regular Mutual Fund schemes for the interested investors.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content. In case you are interested in investing in Stocks, get your free Demat today (Click Here).

WealthTech Speaks is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in the post is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information and without warranty of any kind, expressed or implied, including, but not limited to warranties of performance, merchantability and fitness for particular purpose.

1xbet промокод на депозит https://justinekeptcalmandwentvegan.com/wp-content/pages/code_promo_76.html

Thanks for your information on this blog. A single thing I would choose to say is always that purchasing electronics items through the Internet is not new. In truth, in the past ten years alone, the marketplace for online electronic devices has grown substantially. Today, you will discover practically any kind of electronic device and devices on the Internet, which include cameras as well as camcorders to computer pieces and gambling consoles.

The examples you chose perfectly illustrate your points.

Your blog is a goldmine of information.