Long Term Capital Gains (LTCG): Tax Implications

- Posted By Amritesh

- On November 28th, 2020

- Comments: 3 responses

Gains arising from transfer of capital assets are considered as Capital Gains. Any Profit or Gain made on transfer of capital assets is liable to tax under the head “Capital Gains” of the Income Tax Act. “Sale Consideration” is an important component for determination of the Tax Liability under Capital Gain. Capital Gain Tax is not levied when there is a transfer of property, due to inheritance. However, Capital Gain Tax is levied on the Gain made by the heir on sale of such assets. Transaction involving Capital Asset is taxable under Short or Long Term Capital Gains, based on the classification of asset & holding period.

Gain from Sale of Capital Assets is classified into:

Short Term Capital Gains (STCG)

Long Term Capital Gains (LTCG)

Long Term Capital Asset may be defined as any asset held for 36 months or more is considered as Long Term Asset. However, effective from 1st April 2017-18, any immovable property held for 24 months or more is considered as Long Term Capital Asset. The holding period of 24 months is also applicable for the unlisted shares of a company. For certain asset class such as securities listed in recognized stock market, units of equity oriented mutual funds, Government Securities, Units of UTI and Zero Coupon Bonds the holding period is 12 months to qualify as Long Term Capital Asset.

Classification of Capital Asset

Capital asset may be defined as the following:

#Any kind of property held by an assesse, irrespective of it being connected with business or profession of the assesse.

#Any securities held by a FII with investment in securities in accordance with the regulations made under the SEBI Act, 1992.

However, the following items are excluded from the definition of “capital asset”:

#Any stock-in-trade (other than securities referred above), Consumable or Materials used in Business or Profession;

#Personal Items, moveable items (including wearing apparel, furniture and gadgets) held for personal use by the taxpayer or any member of his family dependent on him, but excludes—

#Jewellery;

#Archaeological collections;

#Drawings;

#Paintings;

#Sculptures; or

#Any work of art.

“Jewellery” includes—

Ornaments made of gold, silver, platinum or any other precious metal/stones or any alloy containing one or more of such precious metals, in any form; including ones used in furniture, utensils and apparels.

#Agricultural Land in India, not being a land situated; as per the stipulated provisions laid out for the same.

#6.5 per cent Gold Bonds,1977 or 7 per cent Gold Bonds, 1980 or National Defence Gold Bonds, 1980 issued by the Central Government;

#Special Bearer Bonds, 1991;

#Gold Deposit Bonds issued under the Gold Deposit Scheme, 1999 or deposit certificates issued under the Gold Monetization Scheme, 2015.

Determination of Long Term Capital Assets

An asset held for more than 36 months is regarded as Long term asset for the computation of Capital Gain. However, exceptions are applicable to certain class of assets which enjoy shorter holding period. Moveable assets such as bullion items, investment in debt oriented mutual fund, vehicles are classified as Long Term Capital Assets if held for more than 36 months. Immovable Assets such as Land, Building, House, holding period is 24 months (revised from 36 months from the Financial Year 2017-18). Some of the assets class if held for more than 12 months, it is considered as Long Term Capital Assets. These assets include Equity and Preference Shares, Securities (Bonds, Debentures) listed in recognized Stock Exchange, Units of UTI or Equity Oriented Mutual Funds, Zero Coupon Bonds.

Effective Assessment Year 2017-18, Holding period for unlisted shares has been reduced to 24 months from 36 months.

Computation of Long Term Capital Gain (Property/Capital Asset)

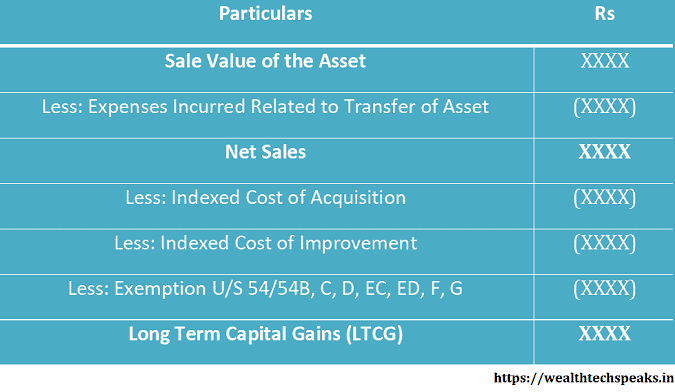

Long Term Capital Gains Tax Computation

Following points need to considered while calculating Index Cost of Acquisition/Improvement;

#Year of Acquisition/Improvement

#Year of Transfer

#Cost Inflation Index of the Year of Acquisition/Improvement

#Cost Inflation Index of the Year of Transfer

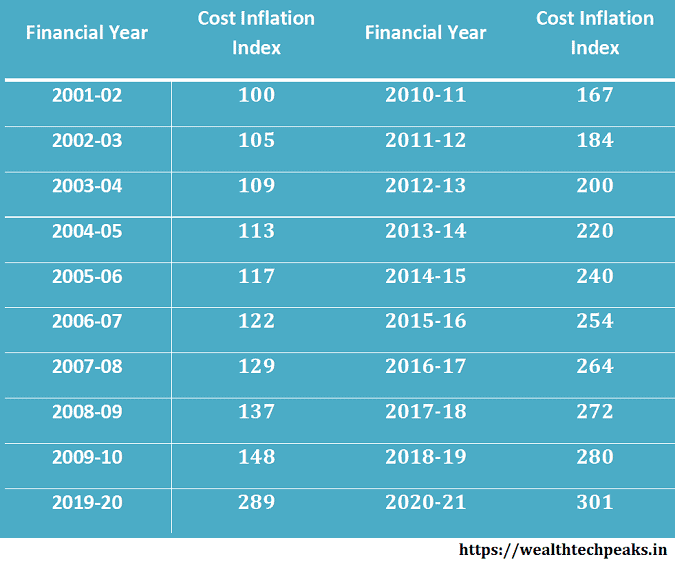

Cost Inflation Index (CII)

Base Year to calculate the indexation benefit changed from 1981 to 2001. The change was introduced from 1st April, 2017. The CII is issued every year by the Government, the index is used to calculate the Tax on Capital Gain.

The above table is used to calculate the Indexed Cost of Acquisition /Improvement.

Cost of Acquisition: Capital Expenses incurred at the time of acquisition of Capital Assets as transfer, which includes purchase price, expenses incurred towards registration, maintenance, transfer expenses till the date of such acquisition.

Indexed Cost of Acquisition: Actual Cost * Cost Inflation Index of Year of Sale/Cost Inflation Index of Year of Purchase

In cases, wherein the transfer of Capital Asset is executed due to any of the under mentioned reasons; the cost of acquisition is deemed as the value at which the previous owner had acquired the asset:-

#Total Partition of Hindu Undivided Family (HUF)/Distribution of Assets

#Under Gift or Will

#By Succession, Inheritance, or Devolution

#On distribution of Assets on Liquidation of a Company

#By transfer in a scheme of amalgamation

In cases, wherein the Cost for which the previous owner acquired the asset cannot be determined, the cost of acquisition to the previous owner shall be deemed as the Fair Market Value (FMV) on date the capital asset was acquired by the previous owner.

Cost of Improvement: Capital Expenses incurred towards addition or alterations to the Capital Asset by the Owner is deductible as Cost of Improvement. The Assessee is allowed to deduct expenses pertaining to development/repair of the property as the same will be considered as Cost of Improvement.

Indexed Cost of Improvement: Cost of Improvement * Cost Inflation Index of Year of Sale/Cost Inflation Index of Year of Improvement

However, Cost of Improvement excludes any expenditure which is deductible in computation of income under heads, such as Income from House Property, Profits and Gains from Business or Profession, or Income from Other Sources. Normal maintenance and repair work are not included in the Cost of Improvement as they do not increase the value of the Capital Asset.

Long Term Capital Gains Tax Implication

Tax on Long Term Capitals Gain (Transfer of Capital Assets)

Long Term Capital Gain on transfer of Capital Asset is taxable at 20% plus surcharge and education cess (total 4%) after indexation.

Tax Implication on Equity Oriented Funds (Mutual Funds) and Debt Funds

Equity Oriented Mutual Funds means Mutual Fund specified under section 10 (23D) wherein 65% of investible funds is vested in equity of domestic company. Investment in Equity and Equity Oriented Mutual Funds held for period of more than 12 months is exempted Capital Gain tax up to the limit of Rs 1 lac. Capital Gain in excess of Rs 1lac is taxed @ 10%. Indexation benefit is not available.

Short Term Capital Gains Tax

Long Term Capital Gain (LTCG) on transfer of Debt Fund is taxable at 20% plus surcharge and education cess (total 4%) after indexation. The investment in Debt Fund should be held for a period of more than 36 months to qualify as LTCG.

LTCG Tax Treatment on Equity till Financial Year 2017-18 (Assessment Year 2018-19)

Long Term Capital Gains arising out of trade in Equity Shares listed in recognized stock exchanges or Equity Oriented Mutual Funds, exempted under Section 10 (38) till the Financial Year 2017-18 (Assessment Year 2018-19), if following conditions is satisfied;

#Sale of Equity Shares or Equity Oriented Mutual Fund should be liable to Securities Transaction Tax (STT).

#Equity Shares/Equity Mutual Fund should qualify as Long Term Capital Asset.

#Transfer should have taken place on or after 1st October, 2004.

LTCG Tax Treatment on Equity effective from Financial Year 2018-19 (Assessment Year 2019-20)

Exemption under Long Term Capital Gains (LTCG) arising from transfer of listed Equity Shares/Equity Mutual Funds under section 10 (38) has been withdrawn.

Section 112A has been introduced, Long Term Capital Gains arising from transfer of Equity/Equity Mutual Funds shall be taxed at 10% without indexation on gains exceeding Rs 1 lakh (1,00,000).

Long Term Capital Gain Tax @10% (plus surcharge and cess) under Section 112A is applicable in the following cases;

# STT is paid on transfer and acquisition of Capital Asset, in case of equity share of a company.

#STT is paid on transfer of capital asset, in case of equity oriented mutual fund.

Cost of Equity Share acquired before 1st February, 2018, shall be least of the following.

#Actual Cost of Acquisition of such Assets;

#Lower of the following:-

Market Value of the respective Equity Share as on 31st January, 2018 or

Actual Sales consideration accruing on the transfer

Tax Payment Option available to Individuals

Tax Payer liable to pay Long Term Capital Gain Tax from transfer of any listed Security, unit of UTI, Mutual Fund (listed or unlisted), Zero Coupon bonds, not covered under section 112A, have the following two options;

#Capital Gains Tax @20% (plus surcharge and cess) with indexation benefit: or

# Capital Gains Tax @10% (plus surcharge and cess) without indexation benefit

Computation of tax liability may be done under both options, lower tax liability option may be availed.

Exemption under Various Sections from Capital Gains

Section 54: Exemption on Sale of House Property when the capital gains is reinvested in purchasing another House Property, but the new property has to be purchased one year before or within 2 years after such transfer. However, the tax benefit will be reversed if the new property is sold within 3 years of purchase. As per Budget 2019, Tax Payers may claim deduction up to maximum of Rs 2 crore and sale proceeds may be used to buy 2 house properties. Earlier, investment in only one house was allowed for exemption.

Section 54F: Exemption on Sale of any other Capital Asset (other than House Property), the entire sale proceeds is reinvested in purchasing a House Property, but the new property has to be purchased one year before or within 2 years after such transfer. However, the tax benefit will be reversed if the new property is sold within 3 years of purchase.

Section 54EC: Exemption on proceeds from Sale of House Property being reinvested in National Highway Authority of India (NHAI) or Rural Electrification Corporation (REC) bonds, up to 50 lakhs within 6 months of sale, before the deadline for tax filing ends. The investment cannot be withdrawn before 3 years.

Tax Deducted at Source (TDS) on House Property

Capital Gains Tax is levied on the proceeds from sale of a property. Tax Deduction at Source (TDS) is also applicable in some cases. Individuals should be aware of the applicability of TDS on the concerned property.

If the property is valued more than Rs 50 lacs, it is the responsibility of the Purchaser to deduct a percent of the property’s value as TDS. The seller should also ensure that Buyer deposits the TDS deducted with the Competent Authority.

This would prove very useful when the seller wants to claim tax exemption at the time of reinvesting the proceeds on acquiring a property.

Wealthtech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.