Intraday Trading Income Tax Reporting

- Posted By Amritesh

- On June 6th, 2019

- Comments: 2 responses

Equity Investors classify gains/losses as capital gains based on the holding period. Equity or Equity Oriented Funds held for more than 1 day but less than 12 months, the gains is classified as Short Term Capital Gain (STCG). In case, Equity Investment is held for more than 12 months, the gain is classified as Long Term Capital Gain (LTCG). However, Gain/Loss incurred in intraday trading is not treated as Capital Gains for taxation purpose. Intraday Trading Income Tax is treated differently as Gains are not considered as Capital Gains but as Business Income. Again, such Business Income is of two types, Speculative Business and Non Speculative Business.

Long Term Capital Gain (LTCG) Tax

Short Term Capital Gain (STCG) Tax

Speculative Business Income: Gains from intraday Equity trade is regarded as Income from Speculative Business. The trade is squared off on the same day. Since the intraday trade does not translate into delivery of the contract, the transaction is considered as Speculative.

Non Speculative Business Income: Gains from F&O (Futures & Options) trading inclusive of intraday and overnight positions is regarded as Non Speculative Business Income. F&O is intended to hedge risk, underlying the contract. Hence, Gain is classified as Non Speculative Business.

Intraday Trading Income Tax: Set-off & Carry Forward Business Losses

Speculative Losses cannot be set-off against any other Income. However, Speculative Loss can be set off only against Speculative Gains. Speculative Losses can be set off against future speculative gains (up to 4 Assessment Years).

However, Business Losses can only be carried forward if the return is filed with the stipulated due date of 31st July for unaudited return and 30th September for audited return of the respective Assessment Year.

Non Speculative Losses may be set-off against any other income expect salary income in the same year. This implies that set-off is allowed against Bank Interests, Capital Gains, Income from Business or Profession, Rent Income, etc in the same assessment year. Non Speculative Gains may be carried forward for next 8 years but only to be set-off against Non Speculative Gains.

Capital Losses cannot be set off against any other Income Heads. Capital Losses can only be set off against Capital Gains. Long Term Capital Loss is allowed to be set off only against Long Term Capital Gain. Short Term Capital Loss is allowed to be settled against both Long & Short Term Capital Gain. Capital Loss may be carried forward for 8 Assessment Years.

Preparation of Financial Statement: Intraday Trading Income Tax

Financial Statement for the Intraday Equity Trading needs to be prepared by the Individual to record financial transactions. This is similar to other forms of business income. Financial Recording includes preparation of Trading Account, Profit & Loss Account and Balance Sheet.

Intraday Trading Income Tax Implications

Based on the business turnover, financial audit for the concerned financial year may or may not be required. Individuals also have the option of adopting Presumptive Tax Scheme provided eligibility condition is satisfied. In case of Business turnover being less than Rs 2 crores audit is not required as per the provisions of Section 44AD. However, if the profit is less than 8% (6% in case of digital receipts) or turnover is above the exemption limit, Financial Audit is mandated. Deduction under provisions of Section 30 to 38 is not admissible under Presumptive Tax Scheme.

Individual is allowed to deduct expenses pertaining to business income which reduces the actual tax outgo, provided normal provisions of tax calculation is adopted. Provision is available for deductions of Trading related expenses such as;

#Brokerages, Security Transaction Tax (STT) levied on the transactions and other charges as applicable.

#Depreciation of assets related to the business.

#Other Business related Expenses (Administration, Salary, etc).

Intraday Trading is done with the intent to make gains in the volatile capital market. Therefore, Gain/Loss of such nature is considered as Speculative Business Income. Capital Gain tax rates are not applicable on such income.

Speculative Business Income is clubbed with the Other Sources of Income (Salary, Business/Profession Income, Rent, Interest, etc). Tax implication is based on the existing Income Tax Slabs & Rates applicable for the concerned Financial Year.

Income Tax Return may be filed using ITR-3 in case the Income includes Capital Gains. Whereas, return filing for Business Income under Presumptive Tax Scheme could be done using ITR-4 Form. Please refer to the link shared below on Applicability of ITR Forms.

ITR Forms Applicable For Assessment Year 2019-20

Income Tax Slab and Rates For Financial Year 2019-20

BTST Intraday Trading Income Tax

Buy Today Sell Tomorrow (BTST) or Sell Today Buy Tomorrow (STBT) is another form of trading popular among Equity Traders. However, the delivery contract does not take place in this scenario. The trade is considered as Non Speculative in nature. However, Security Transaction Tax (STT) is applicable on such trade, so it becomes slightly confusing for the traders. Thus ideally, if these trades are not undertaken regularly it may be regarded as Short Term Capital Gain (STCG). However, in case of frequent trade, it is better to record transactions as Speculative Business Income.

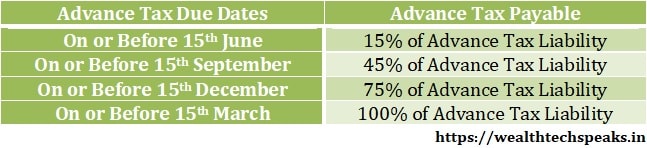

Payment of Advance Tax

In case of Tax Liability in excess of Rs 10,000/-, Advance Tax needs to be paid by the Individual. Advance Tax is to be paid on quarterly basis based on the income/gains made during the respective Financial Year.

Tax Harvesting

Tax Harvesting allows Individual to reduce their tax liability by booking unrealized loss and setting it off against realized gains for the concerned financial year. This enables Individual to reduce their tax outgo. Stocks and Units are sold at a loss to reduce the tax liability. The loss is set off against the gains made during the respective Financial Year.

This article is for informational purpose only, aiming to provide brief idea about Tax Implications on Intra Day Trade, in personal capacity of the author. Readers are advised to research further to have more clarity on the topic. Blog or the Author does not claim expertise on the subject. It is very important to do your own study and consult your Tax Advisor before arriving at any conclusion.