Income Tax Slabs & Rates Financial Year 2022-23

- Posted By Amritesh

- On February 18th, 2022

- Comments: 6 responses

Income Tax Slabs & Rates remain unaltered for Financial Year 2022-23 (AY 2023-24). Budget 2022 presented recently did not propose any change to the existing income tax slabs. The prevailing tax systems will continue in the FY 2022-23. Taxpayers have the option pay tax under the Old Tax Regime (with deduction benefits) or the New Tax regime (at concessional rate).

Budget 2022: Key Highlights

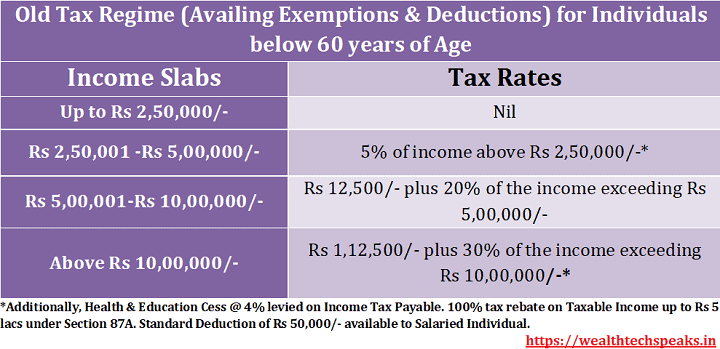

Under the Old Tax regime, Taxpayers may avail tax deductions under Chapter VI of the Income Tax Act. However, the tax rate is relatively higher when compared to the New Tax regime.

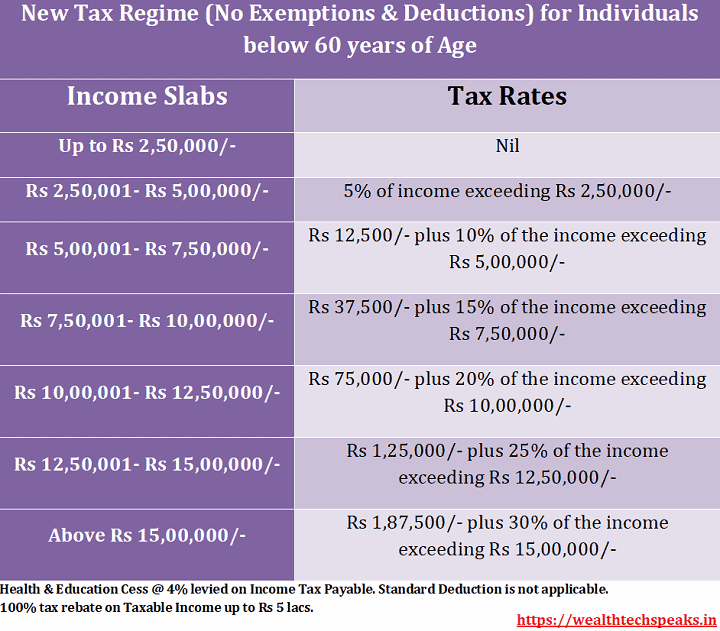

Effective from 1st April, 2020, Individuals have the option to pay tax at lower rate under the new tax system. But will need to forego most of the deductions and exemptions available under the old one.

Individuals looking to avail tax deduction benefits may opt for the old tax regime whereas the others could go with the new tax system.

New Tax Regime (Without Tax Deductions & Exemptions)

Individuals will have the option to file returns either under existing tax regime or the new tax regime. The new tax regime is beneficial for taxpayers not availing tax deductions & exemptions. Popular Income Tax Deductions U/S 80C, 80D, 80CCD (1b) & exemption such as Standard Deduction, House Rent Allowance, Children Education Allowance, etc. is not available under the New Tax regime. The tax deductions & exemptions are admissible under the Old Tax System. As many as 70 deductions & exemptions is not available under the New Tax Regime.

However, Tax Rebate U/S 87A is applicable for Individuals with Taxable Income up to Rs 5,00,000/-. In case the income exceeds Rs 5 lacs, the rebate under 87A is not available.

Additionally, Health & Education Cess @ 4% and Surcharge (if applicable) is levied on the Income Tax payable.

Old Tax Regime (With Tax Deductions & Exemptions)

Income Tax Slabs & Rates under the existing tax regime (with income tax deductions & exemptions) remain unaltered in the Union Budget 2022 for the Financial Year 2022-23. Tax Rebate U/S 87A up to maximum of Rs 12,500/- is available to the Individuals with income up to Rs 5 lacs. Individuals with Taxable Income up to Rs 5 lacs will enjoy 100% tax rebate, implying nil tax liability. Income Tax Slab & Rates applicable for the Financial Year 2022-2023 (Assessment Year 2023-24) is same as the previous year. Health & Education Cess is levied @ 4% on Income Tax payable. Standard Deduction of flat Rs 50,000/- is available under the existing tax regime. Surcharge of 10% & 15% is levied on annual income above Rs 50 lakhs and Rs 1 crore, respectively. Higher Surcharge of 25% & 37% is levied on income range of Rs 2-5 crores & above Rs 5 crores respectively.

Best Equity Linked Savings Scheme (ELSS) Funds for Investment

#Tax Deductions or Tax Breaks under Section 80C, 80D, 80CCD (1b), exemption on HRA is available to Individuals opting for the existing Tax Regime, in accordance with Chapter VI-A of the Income Tax Act.

#Health and Education Cess of 4% is levied on Total Income Tax and on Surcharge if applicable.

#Surcharge of 10% is levied on the Total Income between Rs 50 lacs to Rs 1 crore.

#In case of Total Income above Rs 1 crore, Surcharge will be levied @ 15%.

#Surcharge of 25% is levied on the Total Income between Rs 2-5 crore. Effective Tax Rate comes to 39%.

#In case of Total Income exceeds Rs 5 crore, Surcharge will be levied @ 37%. Effective Tax Rate comes to 42.7%.

#Surcharge for super rich increases the effective tax rate for income category between Rs 2-5 crores by 3.12%, similarly for income category above 5 crores effective tax rate will increase by 6.86%.

Standard Deduction for Salaried Individuals (Under Existing Tax Regime)

Standard Deduction of Rs 50,000/- is available to Individuals for the Financial Year 2022-23. It was introduced in the Financial Year 2018-19 in lieu of Conveyance Allowance and Medical Reimbursement.

Standard Deduction is flat deduction from the Salary Income, prior to the calculation of Taxable Income.

Taxable Income = Gross Total Income – Deductions (Standard Deduction + Deduction Allowed Under Chapter VI-A of Income Tax Act)

Gross Total Income

Gross Total Income includes the aggregate income under the 5 heads of income, namely, Salary Income, Income from House Property, Income from Business or Profession, Capital Gains and Income from Other Sources.

Taxable Income

Taxable Income is derived from the Gross Total Income after subtracting eligible Deductions (Standard Deduction & Deductions allowed U/S 80C to U, etc).

Tax Rebate under Section 87A

Individuals with Taxable Income up to Rs 5,00,000/- (5 lacs) will be eligible for tax benefit up to Rs 12,500/-. This implies that no tax is payable on taxable income up to 5 lacs. Tax Rebate U/S 87A is not available if Taxable Income exceeds Rs 5,00,000/-. Individuals may also reduce their Tax Liability by availing Deductions available under Chapter VI-A of the Income Tax Act (U/S 80C,D,E etc). Tax Deductions available for the Financial Year 2022-23 (Assessment Year 2023-24) will be updated shortly.

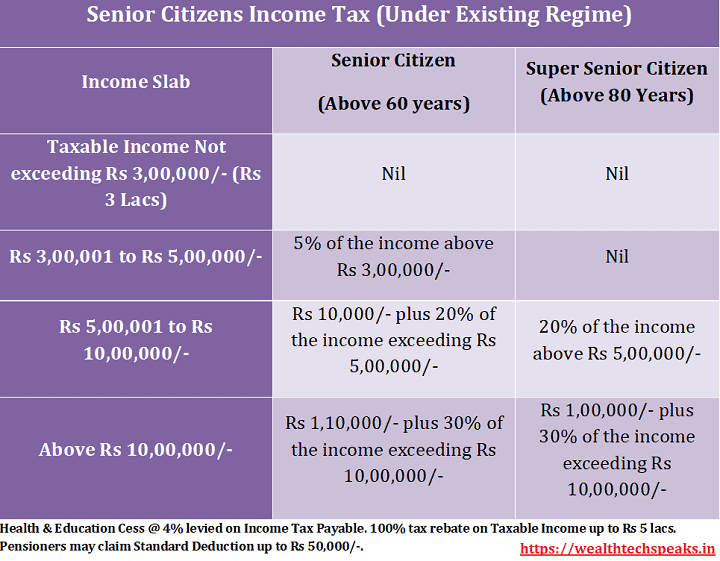

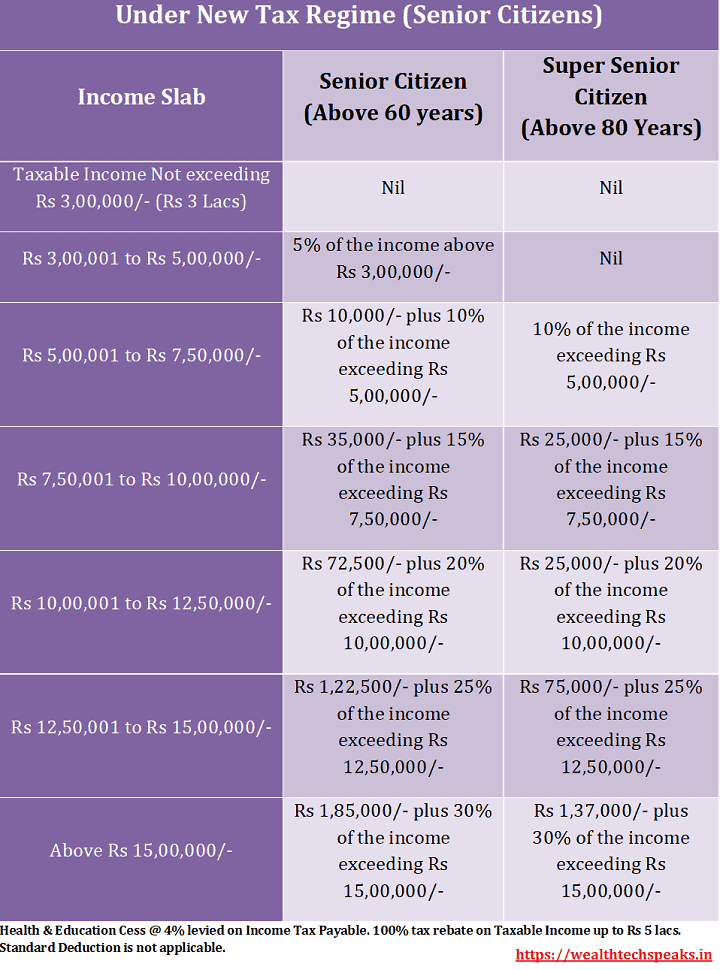

Income Tax Slabs & Rates for Senior & Super Senior Citizens

Individual Residents in the age bracket of 60-80 years (Senior Citizens) the exemption on Taxable Income goes up to Rs 3,00,000/- (Rs 3 lacs). For Income in excess of the exemption limit, normal tax rate will be applicable. However, if the taxable income is below Rs 5 lacs, Rebate under 87A is available. Senior Citizens also have the option to pay tax as per the new tax regime.

Senior Citizens aged 75 years or above with only pension & interest income are exempted from filing tax return for FY 2022-23. Disbursing Bank needs to deduct the tax on their income.

Individual Residents above 80 years of age (Super Senior Citizens), Taxable Income up to Rs 5,00,000/- (5 lacs) is exempted from income tax. For Income above the exemption limit, normal tax rate will be applicable. New Tax regime is also applicable on Super Senior Citizens.

Individuals look to invest in Mutual Funds may connect at admin@wealthtechspeaks.in for investment guidance and advice. We do offer investment in regular Mutual Fund plans for the interested investors.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content. In case you are interested in investing in Stocks, get your free Demat today (Click Here).

Wealthtech Speaks is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this site is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information and without warranty of any kind, expressed or implied, including, but not limited to warranties of performance, merchantability and fitness for particular purpose.

http://rentry.co/9cn6s

Oh my goodness! Impressive article dude! Thank you, However I am experiencing troubles with your RSS. I don’t understand why I cannot subscribe to it. Is there anyone else getting identical RSS issues? Anybody who knows the answer will you kindly respond? Thanks!!

It is indeed my belief that mesothelioma can be the most lethal cancer. It’s got unusual traits. The more I actually look at it the harder I am certain it does not respond like a real solid tissues cancer. In the event that mesothelioma is usually a rogue virus-like infection, therefore there is the chance of developing a vaccine plus offering vaccination for asbestos exposed people who are vulnerable to high risk connected with developing potential asbestos linked malignancies. Thanks for discussing your ideas on this important health issue.

Wow, I never considered this angle before. Thanks for enlightening me.

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

Your blog is a testament to your dedication to your craft. Your commitment to excellence is evident in every aspect of your writing. Thank you for being such a positive influence in the online community.