Income Tax Slabs & Rates Financial Year 2021-22

- Posted By Amritesh

- On February 16th, 2021

- Comments: 7 responses

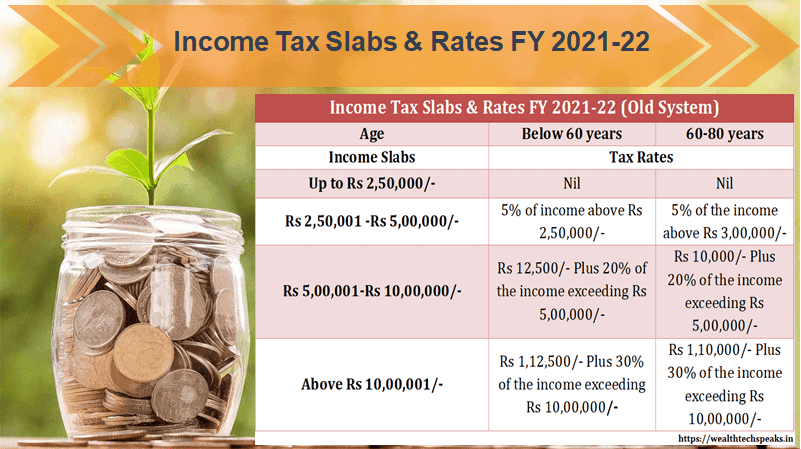

Income Tax Slabs & Rates remain unchanged for Financial Year 2021-22 (AY 2022-23). Budget 2021 presented recently did not propose any change to the existing income tax slabs. No changes in the income tax slabs or tax deductions & exemptions has been introduced. But Senior Citizens aged 75 years & above with pension and interest income do not need to file the return for FY 2021-22. As announced in the previous Budget 2020, Individuals need to pay tax under old tax system (with tax deductions) or new tax system (reduced tax rates, foregoing tax deductions & exemptions).

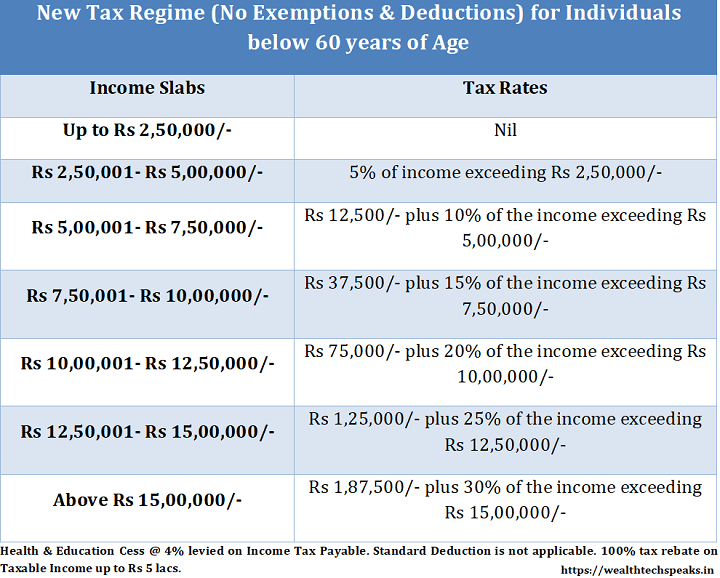

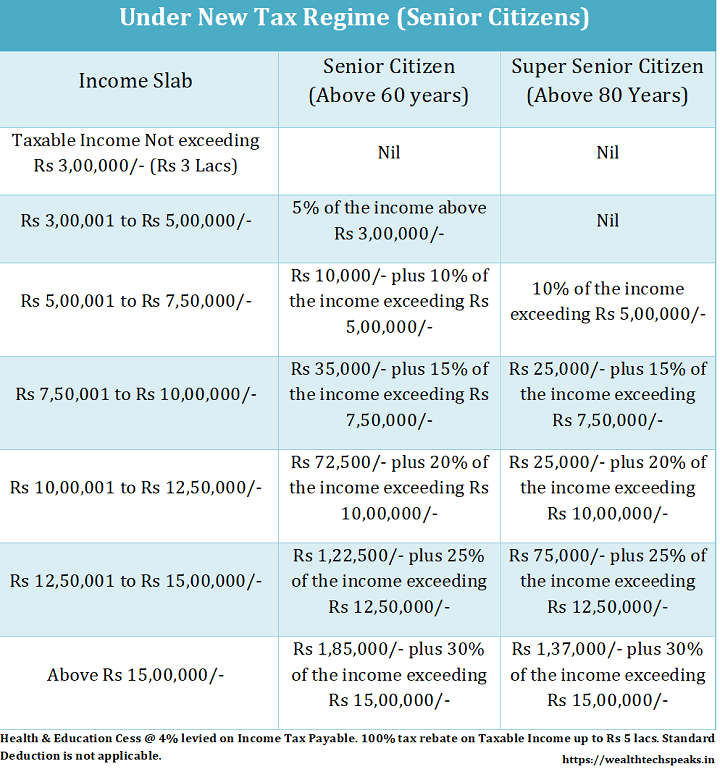

Under New Tax Regime (Without Tax Deductions & Exemptions)

Individuals will have the option to choose between existing tax regime or the new tax regime. The new tax regime is beneficial for taxpayers not availing tax deductions & exemptions. Popular Income Tax Deductions U/S 80C, 80D, 80CCD (1b) & exemption such as Standard Deduction, House Rent Allowance, Children Education Allowance, etc. is not available under the New Tax regime. The tax deductions & exemptions are admissible under the Old Tax System. As many as 70 deductions & exemptions is not available under the New Tax Regime.

However, Tax Rebate U/S 87A is applicable for Individuals with Taxable Income up to Rs 5,00,000/-.

Additionally, Health & Education Cess @ 4% and Surcharge (if applicable) is levied on the Income Tax payable.

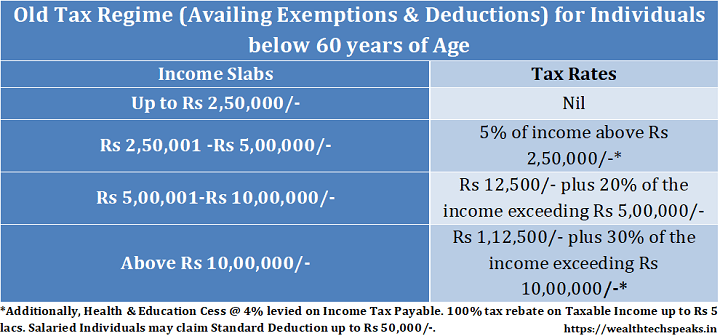

Under Existing Tax Regime (With Tax Deductions & Exemptions)

Income Tax Slabs & Rates under the existing tax regime (availing income tax deductions & exemptions) remain unaltered in the Union Budget 2021 for the Financial Year 2021-22. Tax Rebate U/S 87A up to maximum of Rs 12,500/- is available to the Individuals with income up to Rs 5 lacs. Individuals with Taxable Income up to Rs 5 lacs will enjoy 100% tax rebate, resulting in zero tax liability. Income Tax Slab & Rates applicable for the Financial Year 2021-2022 (Assessment Year 2022-23) is same as the previous year. Health & Education Cess is levied @ 4% on Income Tax payable. Standard Deduction of Rs 50,000/- is available under the existing tax regime. Surcharge of 10% & 15% is levied on annual income above Rs 50 lakhs and Rs 1 crore, respectively. Higher Surcharge of 25% & 37% is levied on income slabs of Rs 2-5 crore & above Rs 5 crore respectively.

Union Budget 2021: Highlights

#Tax Deductions or Tax Breaks under Section 80C, 80D, 80CCD (1b), exemption on HRA will be available to Individuals opting for the existing Tax Regime, in accordance with Chapter VI-A of the Income Tax Act.

#Health and Education Cess of 4% is levied on Total Income Tax and on Surcharge if applicable.

#Surcharge of 10% will be levied on the Total Income between Rs 50 lacs to Rs 1 crore.

#In case of Total Income above Rs 1 crore, Surcharge will be levied @ 15%.

#Surcharge of 25% is to be levied on the Total Income between Rs 2-5 crore. Effective Tax Rate comes to 39%.

#In case of Total Income exceeds Rs 5 crore, Surcharge will be levied @ 37%. Effective Tax Rate comes to 42.7%.

#The surcharge for super rich will increase the effective tax rate for income category between Rs 2-5 crores by 3.12%, similarly for income category above 5 crores effective tax rate will increase by 6.86%.

Standard Deduction for Salaried Individuals (Under Existing Tax Regime): Standard Deduction of Rs 50,000/- is available to Individuals for the Financial Year 2021-22. It was introduced in the Financial Year 2018-19 in lieu of Conveyance Allowance and Medical Reimbursement.

Standard Deduction is to be deducted from the Salary Income, prior to the calculation of Taxable Income.

Taxable Income = Gross Total Income – Deductions (Standard Deduction + Deduction Allowed Under Chapter VI-A of Income Tax Act)

Gross Total Income

Gross Total Income includes the aggregate income under the 5 heads of income, namely, Salary Income, Income from House Property, Income from Business or Profession, Capital Gains and Income from Other Sources.

Taxable Income

Taxable Income is derived from the Gross Total Income after subtracting eligible Deductions (Standard Deduction & Deductions allowed U/S 80C to U, etc).

Tax Rebate under Section 87A

Individuals with Taxable Income up to Rs 5,00,000/- (5 lacs) will be eligible for tax benefit up to Rs 12,500/-. This implies that no tax is payable on taxable income up to 5 lacs. Tax Rebate U/S 87A is not available if Taxable Income exceeds Rs 5,00,000/-. Individuals may also reduce their Tax Liability by availing Deductions available under Chapter VI-A of the Income Tax Act (U/S 80C,D,E etc). Tax Deductions available for the Financial Year 2020-21 (Assessment Year 2021-22) will be updated shortly.

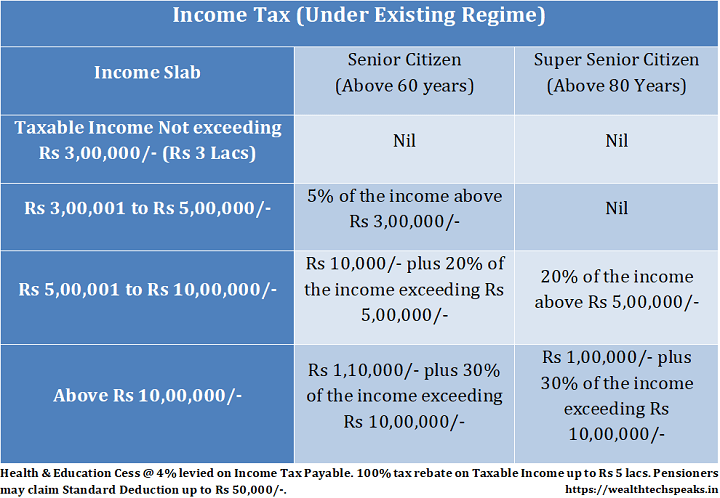

Income Tax Slabs & Rates for Senior & Super Senior Citizens

Individual Residents in the age bracket of 60-80 years (Senior Citizen) the exemption on Taxable Income is up to Rs 3,00,000/- (Rs 3 lacs). For Income above the exemption limit, normal tax rate will be applicable. However, if the taxable income is below Rs 5 lacs, Rebate under 87A is available. Individuals will also have the option to pay tax as per the new tax regime.

Senior Citizens aged 75 years or above with only pension & interest income are exempted from filing tax return for FY 2021-22. Paying Bank needs to deduct the tax on their income.

Individual Residents above 80 years of age (Super Senior Citizens), Taxable Income up to Rs 5,00,000/- (5 lacs) is exempted from income tax. For Income above the exemption limit, normal tax rate will be applicable. New Tax regime is also applicable on Super Senior Citizens.

Do subscribe to our WealthTech Speaks Blog & YouTube Channel and show your support for us.

Wealthtech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

My developer is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using Movable-type on several websites for about a year and am concerned about switching to another platform. I have heard excellent things about blogengine.net. Is there a way I can import all my wordpress content into it? Any kind of help would be greatly appreciated!

One other issue is when you are in a scenario where you do not have a cosigner then you may want to try to make use of all of your money for college options. You’ll find many funds and other scholarships that will supply you with money to aid with classes expenses. Thanks a lot for the post.

Excellent blog here! Also your website loads up very fast! What host are you using? Can I get your affiliate link to your host? I wish my web site loaded up as fast as yours lol

Incredible! This blog looks just like my old one! It’s on a completely different subject but it has pretty much the same page layout and design. Wonderful choice of colors!

Thanks for your strategies. One thing I’ve got noticed is always that banks as well as financial institutions know the dimensions and spending behavior of consumers and understand that a lot of people max out their real credit cards around the holiday seasons. They prudently take advantage of that fact and begin flooding your current inbox plus snail-mail box using hundreds of Zero APR credit cards offers shortly after the holiday season closes. Knowing that when you are like 98 in the American open public, you’ll rush at the opportunity to consolidate credit debt and move balances for 0 rate credit cards.

Generally I do not read post on blogs, but I wish to say that this write-up very forced me to try and do it! Your writing style has been surprised me. Thanks, quite nice post.

Hello There. I found your weblog the use of msn. That is a really neatly written article. I will make sure to bookmark it and return to learn more of your useful info. Thank you for the post. I will definitely comeback.