Income Tax Deductions Financial Year 2022-2023

- Posted By Amritesh

- On February 23rd, 2022

- Comments: 9 responses

Income Tax slabs & rates remains unaltered for the Financial Year 2022-2023. No revision was announced in the Budget 2022 for the Individual taxpayers. Tax payers will have the option of paying the tax under the old or the new tax regime. Under new Tax Regime, tax is levied at concessional rates on the tax payers, but notable tax deductions and exemptions are not allowed. However, the income tax deductions and exemptions are available under the old tax system, but the tax rate is high. Individuals need to assess their tax liability under both the tax system in order to determine the ideal tax system for them. Old tax system may prove beneficial to the Individuals interested in availing majority of the deductions and exemptions. Whereas, new tax system may prove ideal for middle income group with small & non tax-oriented investments.

Budget 2022: Key Takeaways

Tax Rebate up to Rs 12,500/- under section 87A is still available for Individuals with taxable income up to Rs 5 lacs per annum. Implying, Individuals with Income up to Rs 5 lacs will have zero tax liability for the Financial Year 2022-23 & Assessment Year 2023-2024. Standard Deduction of Rs 50,000/- is also available under the Old Tax regime. Income Tax Deductions under Section 80C to 80U is available under the Old System for the Salaried Individuals.

Salaried Individuals may reduce their tax liability considerably by availing the tax deductions under the Old Tax System for the Financial Year 2022-23. In fact, Individuals with Income up to Rs 13 lacs may claim full exemption from paying tax by availing all the deductions eligible for the Financial Year 2022-23.

Income Tax Deductions under Section 80C

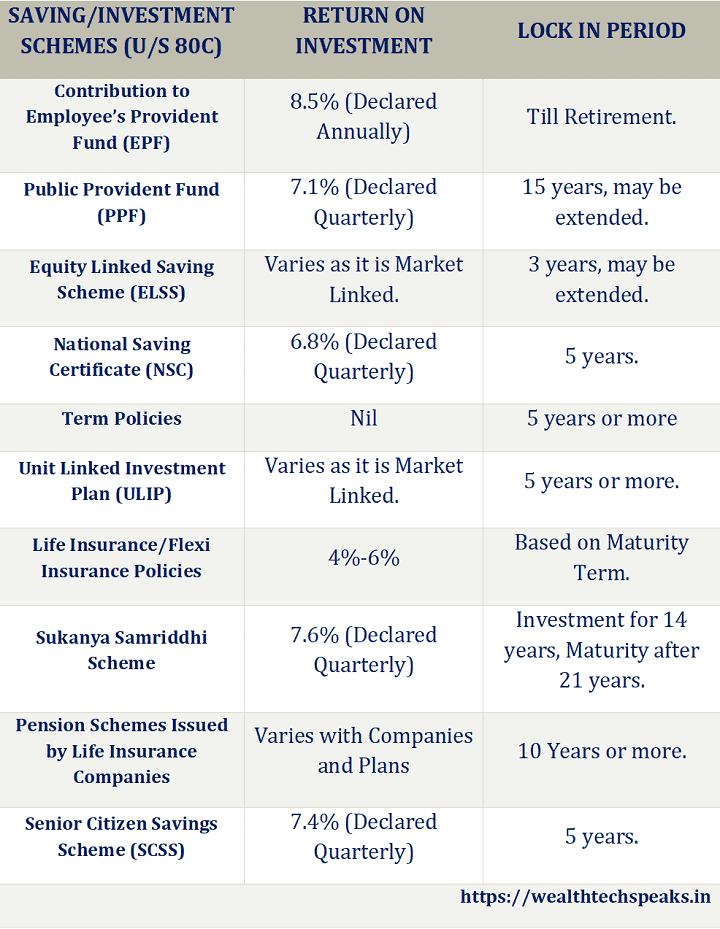

Income Tax Deduction & Exemption up to Rs 1,50,000/- is available to Individuals under section 80C. Section 80CCC & 80CCD (1) is clubbed under Section 80C with aggregate deduction ceiling of Rs 1,50,000/-. Investment qualifying for Tax Deduction & Exemption under Section 80C includes investment in Public Provident Fund (PPF), National Savings Certificate (NSC), Equity Linked Savings Scheme (Mutual Funds), Life Insurance, etc.

Public Provident Fund: One of the most popular small savings schemes among Individuals. PPF offers guaranteed return along with tax benefits. The interest is declared on quarterly basis and interest is compounded annually. The investment comes with 15-year lock-in-period.

ELSS Funds: Equity Linked Savings Scheme comes with shortest lock-in period of 3 years. The investment is eligible of deduction under Section 80C. Investment in Mutual Funds has the potential of fetching higher returns when compared to debt instruments. However, the investment in capital market is subject to volatility. Therefore, Investors need to take an informed decision.

Best Equity Linked Savings Scheme for Investment: FY 2022-23

National Savings Certificate (NSC): NSC has a 5-year lock-in period. The investment is eligible for Tax Deductions. However, the interest earned is liable to Tax. The interest on investment is declared on Quarterly basis.

Life Insurance Plans : Premiums paid towards life insurance policies is also eligible for deduction under section 80C. Premium paid for Self, Spouse, Dependent Children and any member of Hindu Undivided Family is eligible for deduction. The maturity benefit is exempted from tax in most cases.

Senior Citizens Savings Scheme (SCSS): The scheme is specially for Senior Citizens and offers highest return among Small Savings Schemes. The tenure of the scheme is 5 years, extendable up to 8 years. Individuals above the age of 60 year is eligible to deposit under the scheme.

Sukanya Samriddhi Yojana (SSY): The scheme is aimed at the welfare of a girl child. Parent or Guardian of a girl child below the age of 10 years is eligible to join the scheme. The scheme is extended to maximum of 2 girl child (3 in case of twins). The maximum deduction available is Rs 1,50,000/- under the scheme.

Income Tax Slabs & Rates for Financial Year 2022-23

Repayment of Principal on House Loan taken is also eligible for deduction along with Registration Fee and Stamp Duty paid for the property. However, the benefit is restricted to the maximum deduction limit of Rs 1,50,000/-. Provided, Individual does not transfer the property before completion of 5 years from the Financial Year in which it was acquired. The deduction on Registration Fee and Stamp Duty is also available to Individuals who have not availed Home Loan.

Income Tax Deductions U/S 80 CCD (1b)

Contribution up to Rs 50,000/- is eligible for deduction under the section. Deduction is up and over the deduction available U/S Section 80C on deposits made to National Pension Scheme (NPS) and Atal Pension Yojana (APY).

Individuals may invest in these retirement schemes to avail tax deduction up to maximum of Rs 50,000/-.

Income Tax Deductions U/S 80D

Additional deductions up and above the Deductions availed U/S 80C & 80CCD (1b) is available U/S 80D on payment made towards Health Insurance Premium. It covers the premium paid on the Health Insurance cover for self and family. Individuals below the age of 60 years, may claim deduction up to Rs 25,000/- on premium paid for Self, Spouse and dependent children. The deduction increases to Rs 50,000/- in case the age of any of the family member is above 60 years. Additional deduction of Rs 50,000/- is available on premium paid towards the Health Insurance for dependent parents above the age of 60 years. Thus, Individuals may claim maximum tax deductions up to Rs 1 lac under the section.

Income Tax Deduction U/S 80DDB

Tax Deduction up to the extent of Rs 40,000/- is available on account of expenses incurred in treatment for specified medical disease for Self or dependent family members. In case of Senior Citizens (above 60 years) the limit goes up to Rs 1,00,000/- (Rs 1 lac).

This deduction is available only in cases of specified diseases such as Cancer, Kidney Failure, AIDS, Haemophilia, Dementia, Neurological Disorder, etc.

Income Tax Deductions U/S 80E

Deduction is also available on the education loan for higher studies (Graduation or Post Graduation) in the fields of Medicine, Engineering, Management, or Science. The deduction is available from the 1st year and subsequently for next 7 years. Deduction is available on the EMI paid as interest on the loan.

Income Tax Deduction U/S 24

Deductions up to Rs 2,00,000/- (Rs 2 lacs) is available on the interest paid on the Loan availed for purchase/construction of self-occupied House Property. However, the acquisition and construction of such house property should be completed within 5 years from the end of Financial year in which Home Loan was taken. The sum should be borrowed on or after 01/04/1999 to be eligible for deduction.

Income Tax Deduction U/S 80EEA (Not Extended for FY 2022-23)

Additional deduction of Rs 1,50,000/- available on affordable housings up to the value of Rs 45 lakhs. The deduction is applicable on loans taken between 1st April, 2020 and 31st March 2022. However, the benefit has not been extended for the Financial Year 2022-23.

Income Tax Deduction U/S 80EEB

The deduction is available only to Individuals, on loan availed to purchase an Electric Vehicle. Interest payable on such loan would qualify for deduction, subject to maximum of Rs 1,50,000/-. The loan should be availed between 01/04/2019 to 31/03/2023. The loan has to be sanctioned by a Financial Institution and should only be used to for purchase of an electrical vehicle.

Only Interest paid is allowed as deduction.

Income Tax Deduction U/S 80EE

Tax Deduction of Rs 50,000/- on interest paid on home loan is available for 1st time home buyers on loans up to 35 lacs, provided the value of property does not exceed 50 lacs. This deduction is up and above the Rs 2,00,000/- available on account of interest paid on loan. Deduction is available per Financial Year till the period the loan has been fully repaid.

Loan should be sanctioned by a Financial Institution or Housing Finance Company. Furthermore, Loan must be sanctioned between 01/04/2016 to 31/03/2017 to be eligible for the deduction.

Income Tax Deductions U/S 80G

Deductions is also applicable for the donations made to notified NGO’s, Charitable Institutions are eligible for 50% or 100% deduction as provided under the act. However, on institution wherein “the upper limit” clause is applicable, the maximum deduction allowed is either 50% or 100% (as applicable) of 10% of the Adjusted Gross Total Income after claiming other deductions. Contribution has to be made via digital platform or cheque to claim the deduction.

Some of the scheduled Funds wherein 100% Deduction is available without qualifying limit;

#National Defense Fund

#PM Cares Fund

#Prime Minister Relief Fund

#Swacch Bharat Kosh

#National Illness Assistance Fund

#National Children’s Fund

#Clean Ganga Fund

(List not exhaustive)

Income Tax Deductions U/S 80GG

Deduction available in respect of House Rent Paid, the least of the following:

- Rent paid less 10% of the total income.

- 5000/- per month. (Maximum Deduction available is 60,000/-)

- 25% of total income, provided that;

Assessee or the spouse or minor child should not own residential accommodation at the place of employment, or anywhere else in occupation of the Assessee and is not receipt of House Rent Allowance.

Furthermore, the deduction is available provided the Individual, does not receive any benefit of deduction U/S 10 (13A) for House Rent Allowance.

Income Tax Deductions U/S 80TTA/B

Deduction from Gross Total Income up to a maximum of Rs. 10,000/- is allowed, in respect of interest earned on deposits in savings account (not time deposits) with a bank, co-operative society or post office.

Interest earned on Savings & Time Deposits is eligible for deduction in respect of Senior Citizens. The deduction limit is enhanced to Rs 50,000/- under Section 80TTB.

Income Tax Deductions U/S 80DD & U

Deduction of Rs 75,000 U/S 80DD is available to meet the expenses and medical treatment of disabled dependent person. In case of severe disability (more than 80%) the Deduction limit is raised to Rs 1,25,000/-.

Deduction of Rs 75,000 U/S 80U is available to meet the expenses and medical treatment of any disability suffered by Resident Individual (Self). In case of severe disability (more than 80%) the Deduction limit is Rs 1,25,000/-.

Income Tax Deductions Financial Year 2022-23 under Section 80C to 80U applicable under the Old Tax Regime has been discussed. These tax deductions are provided to encourage Individuals plan their finances in order to reduce their tax liability. Individuals interested to invest in tax saving Mutual Funds may connect at admin@wealthtechspeaks.in for investment related guidance. Free demat account is also available for investors interested in stock market (Link-Free Demat).

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content.

WealthTech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

F*ckin? tremendous issues here. I am very glad to see your post. Thanks a lot and i am looking forward to touch you. Will you kindly drop me a mail?

Spot on with this write-up, I really assume this web site wants way more consideration. I?ll most likely be once more to read far more, thanks for that info.

This site is really a walk-by way of for all the information you wished about this and didn?t know who to ask. Glimpse here, and you?ll positively uncover it.

Great post. I was checking continuously this blog and I am impressed! Very useful information specifically the last part 🙂 I care for such information a lot. I was looking for this particular information for a very long time. Thank you and good luck.

I have realized that of all kinds of insurance, medical care insurance is the most questionable because of the clash between the insurance company’s duty to remain adrift and the customer’s need to have insurance coverage. Insurance companies’ profits on wellbeing plans are certainly low, thus some organizations struggle to gain profits. Thanks for the ideas you talk about through this website.

Usually I do not read post on blogs, but I wish to say that this write-up very compelled me to check out and do so! Your writing style has been amazed me. Thank you, quite great article.

It?s exhausting to seek out knowledgeable individuals on this matter, but you sound like you already know what you?re speaking about! Thanks

My brother suggested I might like this web site. He was entirely right. This post truly made my day. You can not imagine just how much time I had spent for this info! Thanks!

This has given me a lot to think about, in a good way.