Income Tax Computation Financial Year 2021-22

- Posted By Amritesh

- On March 21st, 2021

- Comments: one response

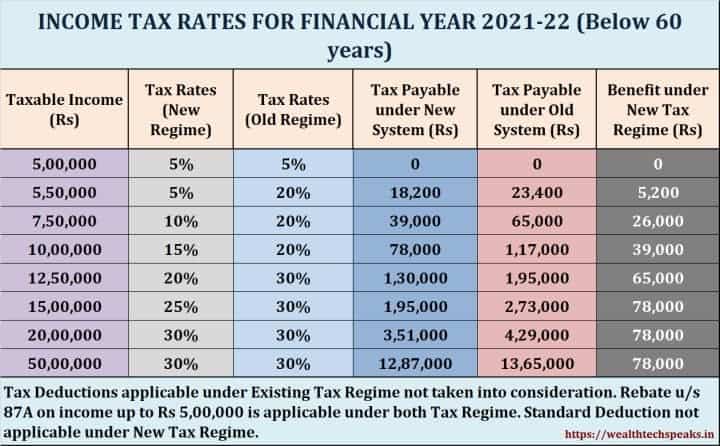

Direct Income Tax slabs & rates remain untouched for the Financial Year 2021-22. The new tax system will continue along with the existing (old) tax system. Individuals now have the option to opt for either of the tax system based on their preference. Under the existing tax regime Individuals will continue to enjoy the Tax Breaks, but new tax system does not have provision for such tax breaks. However, under the new Tax Regime, the tax rates & slabs are revised to provide relief to the Individual Taxpayers. This would be beneficial to Taxpayers not interested to avail deductions. Income Tax Computation Financial Year 2021-22 under both regimes will help taxpayers in taking an informed decision.

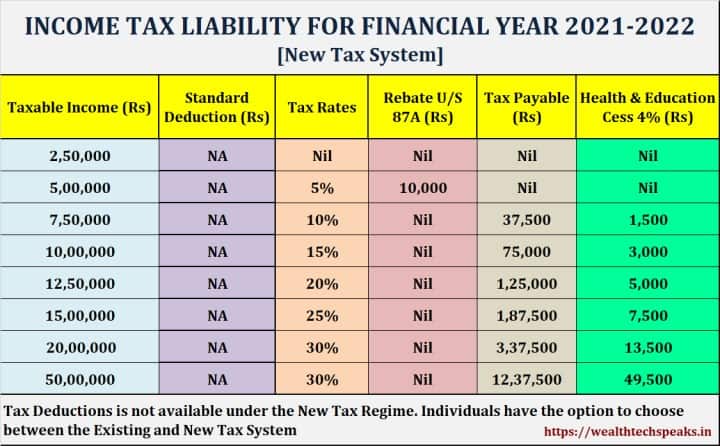

Income Tax Computation Financial Year 2021-22 under the New Tax System

Income Tax Liability calculation is simple under the New Tax System and the Taxpayer benefits from paying tax at a reduced rate. However, as many as 70 tax exemption is not available under the New Tax System. Taxpayers have the option to choose between the New Tax System and the Existing Tax System, for filing their income tax returns for the FY 20201-22.

Income Tax Slabs & Rates for Financial Year 2021-22

Individuals need to analyze their financial goals as well as tax out go under each system and opt to file returns under the most viable tax regime. New Tax System is simple and ideal for Individuals not interested in claiming Tax Deductions.

Deductions which Taxpayers need to forego under the New Tax Regime

1.) Standard Deduction of Rs 50,000/-

2.) Leave Travel Allowance

3.) House Rent Allowance

4.) Deduction u/s 80 TTA & B (Interest Income)

5.) Deduction on Entertainment Allowance

6.) Deduction under Family Pension up to Rs 15,000/-

7.) Deductions under Chapter VIA which includes Tax Deductions U/S 80C, 80D, 80CCD (1B), 80E, etc is not available.

8.) Interest paid on Home Loan is not available for Deductions.

Taxpayers need to calculate the income tax implications under both tax system to identify the ideal tax regime for themselves.

However, Tax Rebate u/s 87A is applicable to the Individuals under the Existing and as well as New Tax Regime.

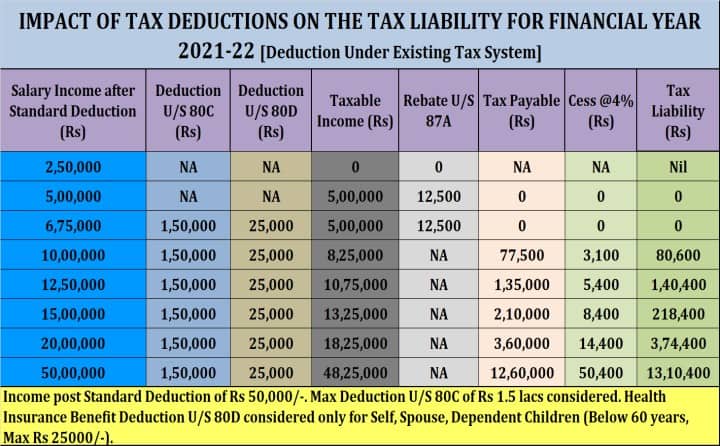

Income Tax Computation Financial Year 2021-22 under the Existing (Old) Tax System

Income Tax Slabs & Rates remain unchanged for Financial Year 2021-22 under the Existing (Old) Tax System. Salaried Individuals may avail deductions to reduce their tax liability. Standard Deduction of Rs 50,000/- along with deductions under Chapter VIA is applicable under the Old Tax system. Tax Rebate under Section 87A up to Rs 12,500/- is available to Individuals with Taxable Income up to Rs 5 lacs. Implying, Individuals with Taxable Income up to Rs 5 lacs need not pay any tax on their income.

Income Tax Deductions & Exemptions FY 2021-22

Standard Deduction of Rs 50,000/- is a flat deduction from the Salary Income of an Individual. Health & Education Cess @ 4% is levied on Income Tax Payable.

Income up to Rs 2,50,000/- is exempted from Income Tax.

Tax Rebate U/S 87A up to Rs 12,500/- is available to Individuals with Taxable Income up to Rs 5,00,000/-.

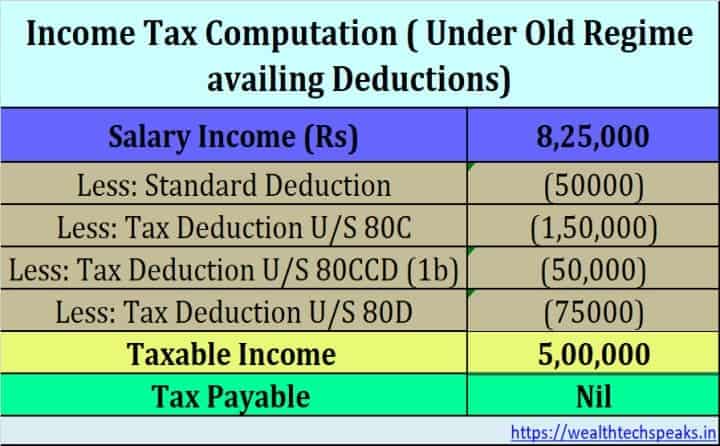

Income Tax Computation Financial Year 2021-22: Availing Tax Deductions

Individuals with income above Rs 5,00,000 may avail Tax Deductions under 80C, 80D and 80 CCD (1b) to reduce their Tax Liability. Individuals with income up to Rs 8,25,000/- may reduce their tax liability to nil by availing notable deductions under Chapter VIA of the Income Tax Act. Furthermore, Individuals repaying home loans may claim additional deduction on the interest paid towards the home loan.

Income Tax Deductions under section 80C

Tax Deduction U/S 80C: Tax Deduction up to maximum of Rs 1,50,000/- is available on investment in Life Insurance policies, Public Provident Fund (PPF), Equity Linked Saving Schemes (ELSS), National Savings Certificate (NSC) and other notified instruments.

Tax Deduction U/S 80D: Tax Deduction up to Rs 25,000/- is available on Health Insurance Premium paid for Self, Spouse and Dependent Children. Additionally, Individuals may claim additional deduction up to Rs 50,000/- on Health Insurance premium paid for dependent parents.

U/S 80CCD (1b): Tax Deduction up to Maximum of Rs 50,000/- is available on investment made towards National Pension Scheme (NPS). Contribution to Atal Pension Yojana (APY) is also eligible for tax deduction.

I hope this article helps the Salaried Individuals in their tax planning. I would also request readers to subscribe to my YouTube Channel and Blog for updates on Personal Finance, HR & Tech.

Wealthtech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.