Income Tax Comparison New vs Old: FY 2021-22

- Posted By Amritesh

- On February 21st, 2021

- Comments: 44 responses

The Income Tax Slabs & Rates remain unchanged for the Financial Year 2021-22. In the Financial Year 2021-22 (Assessment Year 2022-23), Salaried Individuals may pay tax under the New or the Existing (Old) Tax Regime. The new tax regime and old tax regime are very different from each other. New Tax regime comes with concessional tax rates but without tax breaks. Old Tax Regime allows tax breaks but the tax rates are comparatively higher.

Income Tax Slabs & Rates Applicable for the FY 2021-22

New Tax Regime forgoes total of 70 Tax Deductions & Exemptions available under the existing (old) tax regime. However, New Tax regime may appear attractive to young individuals as tax outgo is less and one is not compelled to take up tax saving investments. The new tax system does look attractive but existing (old) tax system may prove beneficial if tax deductions are availed. Tax Deductions under Old Tax regime encourages Individuals to invest and indulge in financial planning to achieve financial objectives.

Selection of tax regime should be based on the financial objectives and not just for saving tax.

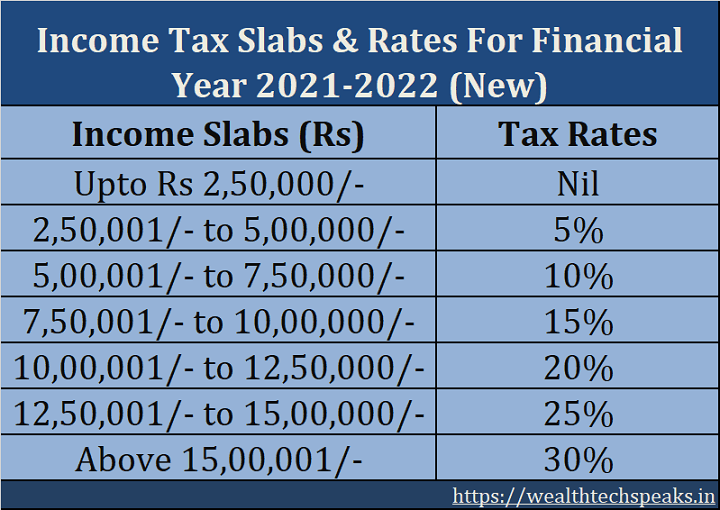

Income Tax Slabs & Rates under New Tax Regime FY 2021-22

Under the new tax regime for the Financial Year 2021-22, New Slabs and Rates introduced in the previous year remain unchanged. Income Tax Slabs were revised and rates reduced in the previous financial year. But the notable tax breaks are not available under the New Tax regime.

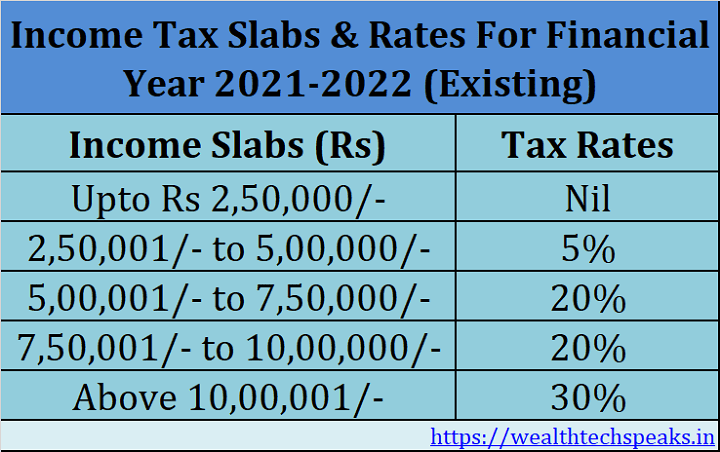

Income Tax Slabs & Rates under Old Tax Regime FY 2021-22

Old or the Existing Tax System also remains unchanged. No major changes have been introduced. Individuals opting to pay tax under the Old Tax System will continue to enjoy the tax breaks available in the previous year. Individuals aged 75 years or above have been exempted from filing Income Tax returns.

Relook at the Old Income Tax slabs & rates applicable in the current Financial Year.

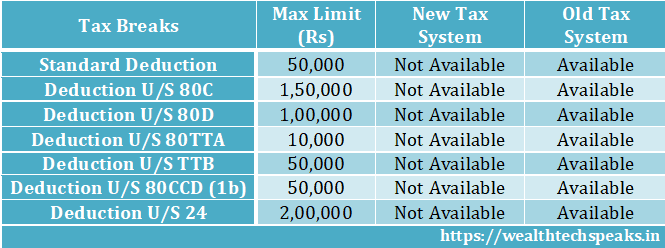

Applicability of Tax Breaks under New and Old Tax System

The major difference between the New and Old Tax System is in terms of Tax Breaks. Old Tax System continues to provide the Tax Breaks in form of deductions and exemptions. But under the New Tax System, as many as 70 tax deductions & exemptions have been removed.

Income Tax Deductions & Exemptions such as Standard Deduction & deduction on House Rent Allowance (HRA) for rented accommodation is also not available. Even Professional Tax payment and Individual’s EPF Contribution is not eligible for deduction under the New Tax System.

Benefits under Old Tax System: Income Tax Comparison New vs Old

Tax Breaks enable Tax Payers to reduce their tax liability.

Instills financial discipline and encourages Financial Planning.

Straightaway Standard Deduction of Rs 50,000/- admissible.

Tax Rebate up to Rs 12,500/- U/S 87A is available to Individuals with Taxable Income up to Rs 5,00,000/- per annum.

Benefits under New Tax System: Income Tax Comparison New vs Old

Income Tax implication is easy to calculate.

Tax Payer is free to look beyond the Tax Saving schemes for investment.

Income Tax Liability reduces due to reduced income tax rate and new slabs introduced.

Tax Rebate up to Rs 12,500/- U/S 87A is available to Individuals with Taxable Income up to Rs 5,00,000/- per annum.

Income Tax Comparison New vs Old: FY 2021-22

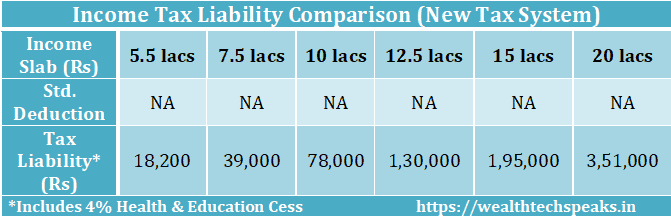

We have already discussed the differences between the New & Old Tax System. Now let’s compare the tax liability under both the system for better understanding.

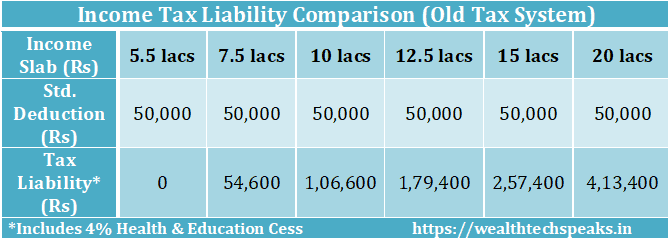

Clearly, New Tax Regime is beneficial for the Tax Payers, if we purely compare the system on the basis of the Slabs and Rates at which the Tax is levied. However, for the Individuals with income up to Rs 5.5 lacs, the old tax system is beneficial. As even without availing any additional tax deductions, income is exempted from tax on account of Standard Deduction & tax rebate u/s 87A.

Income Tax Liability under Old Tax System with Tax Deductions

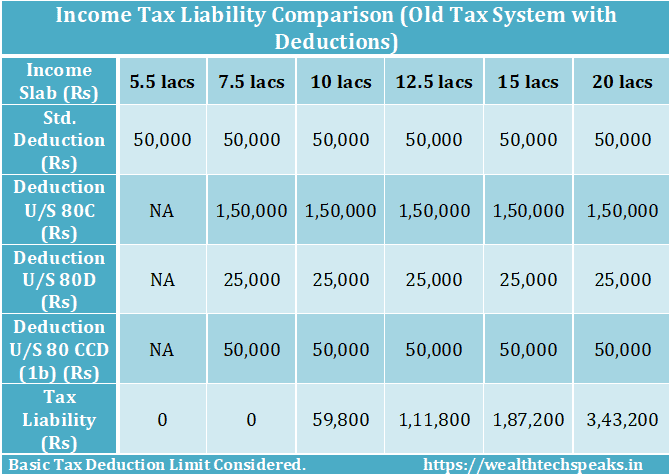

As evident in the chart below, Tax Liability reduces significantly when Tax Deductions is availed under the Old Tax System. Now with Standard Deductions along other Tax Deductions, the Old Tax System appears to be tax efficient.

Following Investments qualify for Tax Deductions

U/S 80C (Up to Rs 1,50,000): Investment in EPF, PPF, ELSS, Insurance, etc.

U/S 80D (Up to Rs 100,000): Health Insurance Premium for Self & Family (up to Rs 25,000/- less than age of 60 & Rs 50,000/- above age 60). However, one may claim additional deduction of Rs 50,000/-. Only in case of Health Insurance premium is paid for Elderly Parents (above the age of 60).

U/S 80CCD (1b) (Up to Rs 50,000): Contribution to National Pension Scheme (NPS) is eligible for Deduction. Even contribution to Atal Pension Yojana is eligible for Deduction.

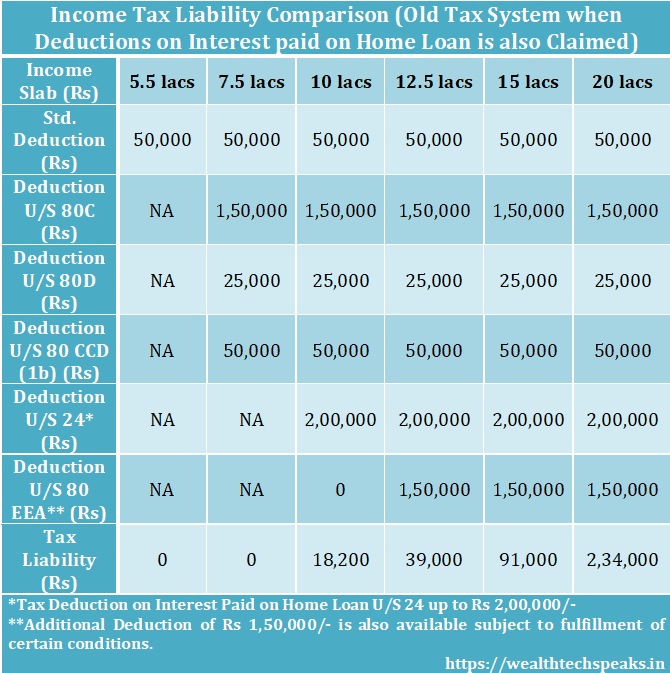

The old tax system looks even more lucrative if one avails Deductions on Interest paid on Home Loan. Maximum up to Rs 3,50,000/- may be claimed as deduction on interest paid on home loan.

U/S 24 up to Rs 2,00,000/- paid as interest on home loan is eligible for ax Deduction.

U/S 80EEA additional deduction of Rs 1,50,000/- allowed on home loan sanctioned between 1st April, 2019 to 31st March, 2022. Applicable only for 1st time home buyers. However, the stamp value of the property should not exceed Rs 45 lacs. The property area should not exceed 60 sq meters in the metropolitan cities and 90 sq meters in any other cities.

Income Tax Comparison New vs Old: Which regime One choose?

In the detailed comparison, both the tax regime has their own advantages. Individuals need to assess their tax implications under both the regimes to identify the best option, in accordance with their financial goals. Individuals not keen to availing Tax Deductions may opt for the new tax system. Old Tax System is ideal for Individuals availing the tax breaks. It would enable them to reduce their tax liability.

In case the content was helpful, request you all to Subscribe to WealthTech Speaks YouTube Channel & Blog.

Wealthtech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational purpose only.