Income Tax Comparison New vs Old: FY 2022-23

- Posted By Amritesh

- On May 19th, 2022

- Comments: 9 responses

The Income Tax Slabs & Rates remains unchanged for the Financial Year 2022-23. Taxpayers have the option to pay the tax under the New or the Existing (Old) Tax Regime. The new tax regime and old tax regime are very different from each other. New Tax regime comes with concessional tax rates but without tax breaks. Whereas, old Tax Regime continues with the tax breaks but does not offer any concession. In view of the two-tax system existing simultaneously, it becomes prudent for the taxpayers to compare the tax liability under both the system. Income Tax comparison new vs old tax system helps to determine the best tax system for the respective Individuals to pay the tax.

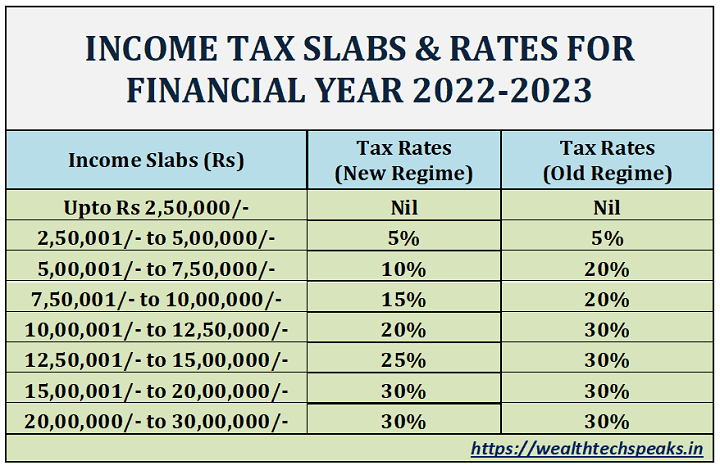

Income Tax Slabs & Rates Applicable for the FY 2022-23

New Tax Regime forgoes total of 70 Tax Deductions & Exemptions which are available under the existing (old) tax regime. Despite the exclusions, New Tax regime may appear attractive to young individuals as tax is levied at concessional rates with no compulsion to invest in tax savings schemes. The new tax system does look attractive but existing (old) tax system may prove beneficial if tax deductions are availed. Tax Deductions under old tax regime encourages Individuals to make tax saving investments and build a corpus for the future. However, the new tax system allows taxpayers to independently plan their investments without considering tax deduction benefits. Income Tax Comparison new vs old tax system allows tax payers to ascertain the tax liability under both the system and select the best in terms of tax savings.

Income Tax Calculation for the Financial Year 2022-23

In my opinion, selection of tax regime should be based on the financial objectives and not just for the sake of saving taxes.

Income Tax Comparison New vs Old: Slab & Rates

Under the new tax regime for the Financial Year 2022-23, new slabs and rates introduced in the Budget 2020 remain unchanged. Under the new system, tax is levied at concessional rate but without the deduction and exemption benefits under Chapter VIA of the Income Tax Act. The tax rate increases uniformly with the rise in income slab under the new tax system.

Under the Existing or Old Tax System, tax structure for the current financial year remains unrevised. Individuals opting to pay tax under the existing tax system will continue to enjoy the tax breaks available previously. Individuals aged 75 years or above with only interest and pension income have been exempted from filing Income Tax returns.

Existing Income Tax slabs & rates applicable in the current Financial Year.

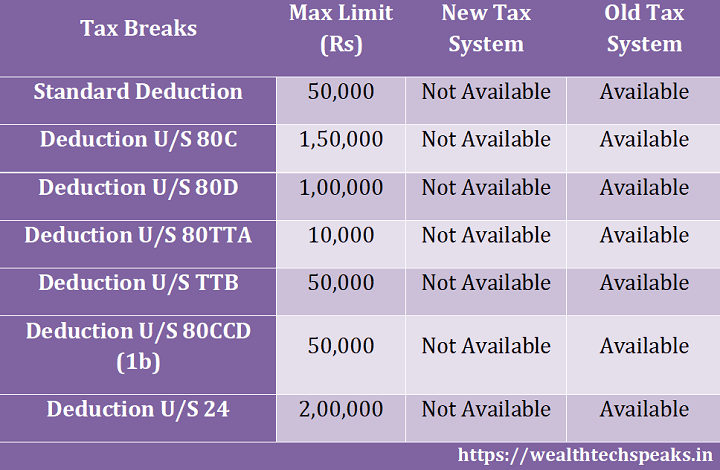

Tax Deductions and Exemptions: Applicability

New and Old Tax System not only differs in terms of tax slabs & rates but also in respect of tax breaks. Old Tax System continues to provide the tax breaks in form of deductions and exemptions. But under the New Tax System, as many as 70 tax deductions & exemptions have been excluded.

Standard Deduction & House Rent Allowance (HRA) deduction for rented accommodation is also not available under new system. Even, Professional Tax payment and EPF Contribution is not eligible for deduction under the new tax system.

Benefits under Old Tax System

#Tax Breaks enable Tax Payers to reduce their tax liability. Tax Payers may claim deduction to the tune of Rs 2,25,000/- on the investments.

#Interest on Home Loan up to Rs 2,00,000/- is also eligible for deduction under the Old Tax System.

#Instills financial discipline and encourages Financial Planning.

#Standard Deduction of Rs 50,000/- is a flat deduction from the Salary Income.

#Tax Rebate up to Rs 12,500/- U/S 87A is available to Individuals with Taxable Income up to Rs 5,00,000/- per annum.

Benefits under New Tax System

#Tax implication is easy to ascertain.

#Tax Payer is free to look beyond the Tax Saving schemes for investment.

#Income Tax is levied at concessional rates in accordance with the revised tax slab.

#Tax Rebate up to Rs 12,500/- U/S 87A is available to Individuals with Taxable Income up to Rs 5,00,000/- per annum.

#Tax Implication is comparatively less under new tax system.

Income Tax Comparison New vs Old: FY 2022-23

We have already discussed the key differences between the New & Old Tax System. Now let’s compare the tax liability under both the system for better understanding.

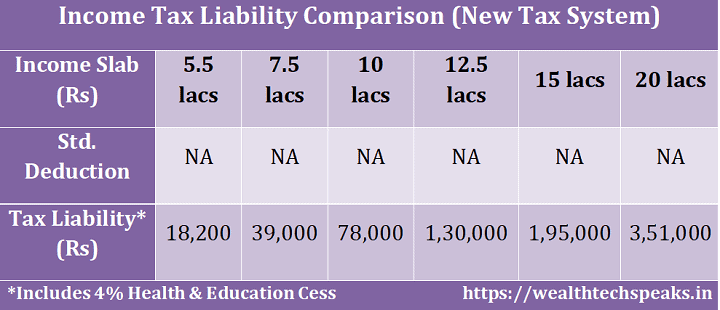

Tax Implication under New System (Concessional Tax Rates)

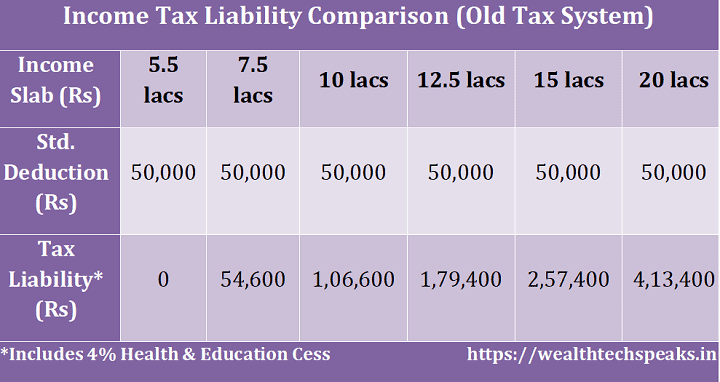

Tax Implication under Old Tax System (Qualifies for Tax Deductions)

Clearly, New Tax Regime is beneficial for the Tax Payers, purely on the basis of the new tax slabs & concessional rates at which the Tax is levied. However, for the Individuals with income up to Rs 5.5 lacs, the old tax system is beneficial. As even without availing any additional tax deductions, income is exempted from tax on account of Standard Deduction & tax rebate u/s 87A. Taxpayers with income up to Rs 8,00,000/- do not need to pay any tax, in case they utilise the maximum tax deductions under sections 80 available under the old system.

Best Mutual Funds for Investment FY 2022-23

Under the Old system, Income Tax deductions is available under Chapter VI of the Income Tax Act under Section 80C to 80U.

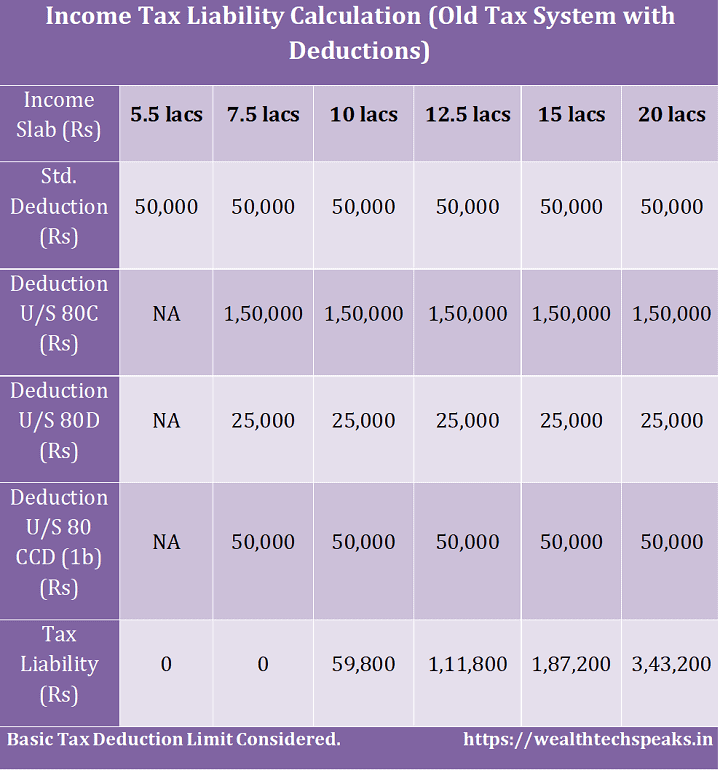

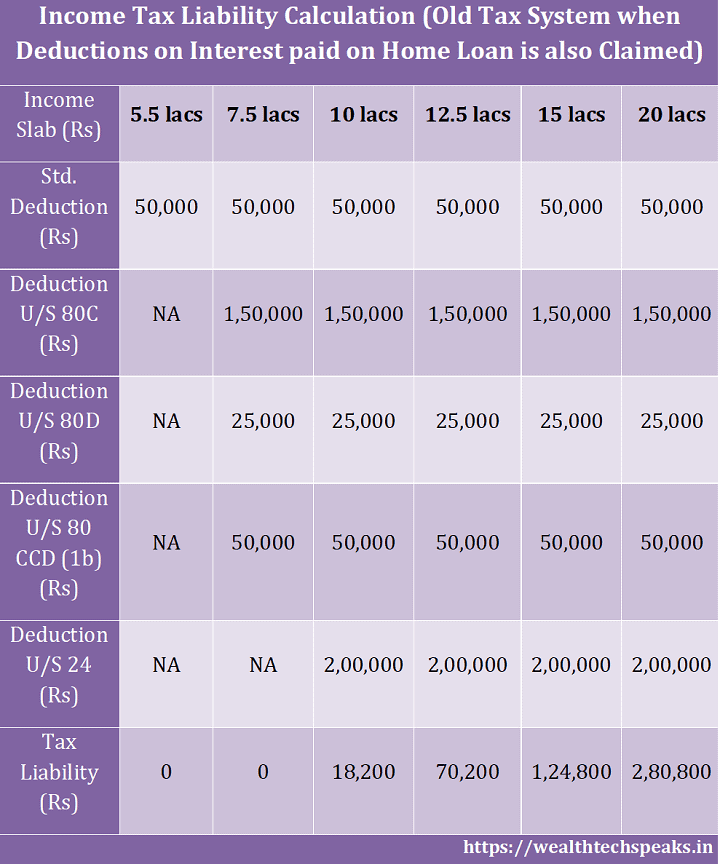

Income Tax Liability under Old Tax System with Tax Deductions

As evident from the figures above, Tax Liability reduces significantly when Tax Deductions is availed under the Old Tax System. Standard Deduction along with Tax Deductions under Chapter VI of the Income Tax Act contribute significantly in reducing the tax outgo. Individuals in each tax bracket may reduce their tax liability to the minimum by availing the eligible deductions.

Investments qualifying for Tax Deductions

U/S 80C (Up to Rs 1,50,000): Investment/Contribution in EPF, PPF, ELSS, Insurance, etc. Employee contribution in EPF is eligible for deduction under section 80C. Investment in small savings schemes such as PPF, NSC, and Tax saving ELSS Mutual Fund is also eligible for deduction.

U/S 80D (Up to Rs 100,000): Health Insurance Premium for Self & Family (up to Rs 25,000/- for less than 60 years of age & Rs 50,000/- for above 60 years of age). However, one may claim additional deduction of up to Rs 50,000/- if Health Insurance premium is paid for dependent Elderly Parents (above the age of 60).

U/S 80CCD (1b) (Up to Rs 50,000): Contribution to retirement scheme such as to National Pension Scheme (NPS) is eligible for deduction. Even contribution to Atal Pension Yojana is eligible for tax deduction. Maximum deduction of Rs 50,000/- up and above the deduction under 80C is available to the taxpayers.

U/S 24 (Up to Rs 2,00,000/-): Interest paid on home loan is eligible for tax deduction. The interest part of the Equated Monthly Installment (EMI) paid during the Financial Year may be claimed as deduction from the income up to the maximum admissible limit of Rs 2 lacs.

Taxpayers may further reduce their tax liability by availing tax deductions available on House Rent Allowance and interest paid on loan taken for higher education, if eligible.

Income Tax Comparison New vs Old: Which regime should you choose?

In the detailed comparison, both the tax system has their own merits. Taxpayers need to assess their tax implications under both the regimes to choose the ideal option, in accordance with their financial goals. Individuals not keen in availing tax deductions may file their returns under the new tax system. Old Tax System makes sense for Individuals looking to avail the tax breaks. Ideally, taxpayers with investments qualifying for deductions under 80C to 80U in addition to home loans should file their returns under the old regime.

Individuals looking to invest in Mutual Funds may connect at admin@wealthtechspeaks.in for investment guidance and advice. We do offer investment in regular Mutual Fund schemes for the interested investors.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content. In case you are interested in investing in Stocks, get your free Demat today (Click Here).

WealthTech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational and promotion purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

Hey! This post could not be written any better! Reading through this post reminds me of my good old room mate! He always kept chatting about this. I will forward this post to him. Fairly certain he will have a good read. Thank you for sharing!

I have learn some good stuff here. Certainly value bookmarking for revisiting. I wonder how much effort you put to create one of these wonderful informative web site.

рабочий промокод 1хбет https://justinekeptcalmandwentvegan.com/wp-content/pages/code_promo_76.html

Hello! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing a few months of hard work due to no backup. Do you have any methods to protect against hackers?

החברה ממוקמת בפתח תקווה ומעניקה שירות בכל רחבי הארץ.

рабочий промокод 1xbet на сегодня https://justinekeptcalmandwentvegan.com/wp-content/pages/code_promo_76.html

I seriously love your site.. Very nice colors & theme. Did you make this amazing site yourself? Please reply back as I’m wanting to create my own personal site and would love to know where you got this from or exactly what the theme is called. Thanks!

Its like you read my mind You appear to know a lot about this like you wrote the book in it or something I think that you could do with some pics to drive the message home a little bit but instead of that this is fantastic blog An excellent read I will certainly be back

certainly like your website but you need to take a look at the spelling on quite a few of your posts Many of them are rife with spelling problems and I find it very troublesome to inform the reality nevertheless I will definitely come back again