Understanding Income Tax Slabs & Rates for FY 2024-25 (AY 2025-26)

- Posted By Amritesh

- On September 30th, 2024

- Comments: no responses

The Union Budget 2024 introduced significant reforms to the income tax slabs & rates for FY 2024-25 under new regime and capital gains tax structure, affecting individual taxpayers and investors alike. Presented by Finance Minister Nirmala Sitharaman, this budget not only tweaked the new tax regime to make it more appealing but also introduced reforms in capital gains taxation, simplifying the holding periods and aligning tax rates. Here’s a deep dive into the income tax slabs & rates, the differences between the old and new regimes, and key capital gains tax updates for FY 2024-25 (AY 2025-26).

Income Tax Slabs & Rates – New vs. Old Regime

The Budget 2024 has brought updates to the income tax slabs under the new tax regime, while the old tax regime remains unchanged. Both tax regimes are available to taxpayers, with the new tax regime being the default option. Here are the specific updates and how they differ between the two regimes.

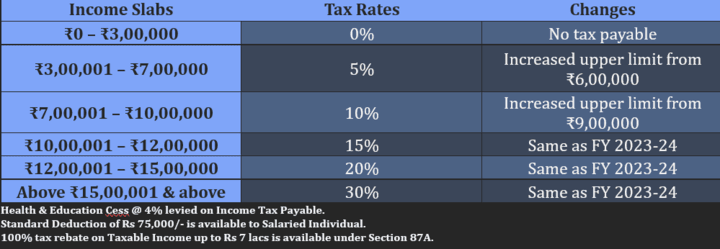

New Tax Regime (Default Regime for FY 2024-25)

The new tax regime is designed to offer simplified tax rates with fewer deductions and exemptions. Following the changes in Budget 2024, the income tax slabs have been expanded to cover broader income ranges, making the regime more attractive.

Updated Income Tax Slabs & Rates Under the New Tax Regime for FY 2024-25:

Key Changes in the New Tax Regime for FY 2024-25

– Expansion of the ₹3 lakh – ₹7 lakh slab: Individuals earning between ₹7 lakh and ₹10 lakh will now pay 10% tax, reduced from 15%.

– Standard Deduction: The standard deduction for salaried individuals and pensioners has been increased from ₹50,000 to ₹75,000.

– Standard Deduction for Family Pensioners: Family pensioners will now receive a higher standard deduction of ₹25,000, up from ₹15,000.

– Employer’s NPS Contribution: Deduction for the employer’s contribution to the employee’s NPS account has been increased from 10% to 14%, making the new tax regime even more beneficial for salaried employees.

– Tax Rebate under Section 87A: A tax rebate of up to ₹25,000 is available for taxpayers with taxable income up to ₹7 lakh, ensuring that no tax is payable for incomes below this threshold.

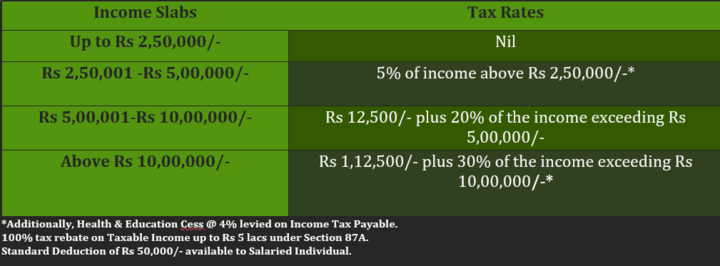

Old Tax Regime – No Changes for FY 2024-25

The old tax regime remains unchanged in Budget 2024, continuing to offer the traditional system of tax deductions and exemptions such as Section 80C for investments, Section 80D for health insurance premiums, and various other tax-saving provisions.

Income Tax Slabs & Rates Under the Old Tax Regime for FY 2024-25

– Individuals below 60 years of age:

– ₹0 – ₹2,50,000: 0% (no tax payable)

– ₹2,50,001 – ₹5,00,000: 5%

– ₹5,00,001 – ₹10,00,000: 20%

– Above ₹10,00,000: 30%

– Senior Citizens (60 to 80 years):

– ₹0 – ₹3,00,000: 0%

– ₹3,00,001 – ₹5,00,000: 5%

– ₹5,00,001 – ₹10,00,000: 20%

– Above ₹10,00,000: 30%

– Super Senior Citizens (above 80 years):

– ₹0 – ₹5,00,000: 0%

– ₹5,00,001 – ₹10,00,000: 20%

– Above ₹10,00,000: 30%

Key Differences Between the New and Old Tax Regime

– Deductions and Exemptions:

– The new tax regime offers lower tax rates but does not allow popular deductions like Section 80C (up to ₹1.5 lakh for specified investments), Section 80D (up to ₹75,000 for health insurance), or Section 80TTA (up to ₹10,000 on savings account interest).

– The old tax regime, on the other hand, allows taxpayers to claim these deductions, making it suitable for those who have significant investments or expenditures that qualify for tax relief.

– Tax Rebate under Section 87A:

– Under the new regime, individuals with taxable incomes up to ₹7 lakh can avail of a rebate of ₹25,000.

– Under the old regime, individuals with taxable incomes up to ₹5 lakh can avail of a rebate of ₹12,500.

– Age-Specific Exemption:

– The old regime offers varying basic exemption limits depending on the age of the taxpayer, whereas the new regime has a flat exemption of ₹3 lakh for all individuals, irrespective of age.

Capital Gains Tax Changes in Budget 2024

In addition to the income tax slab changes, Budget 2024 introduced reforms in capital gains tax, aimed at simplifying the structure and harmonizing rates. This impacts not just individual investors but also those invested in mutual funds, equities, gold ETFs, and other financial instruments.

Key Capital Gains Tax Updates

i. Simplification of Holding Periods:

– The Budget 2024 has introduced two holding periods for capital gains classification: 12 months and 24 months.

– All listed securities (stocks, equity mutual funds, InvITs, REITs) will be treated as long-term capital assets if held for more than 12 months.

– Unlisted assets like bonds, debentures, and certain mutual funds will qualify as long-term if held for 24 months.

ii. Uniform Long-Term Capital Gains (LTCG) Tax Rate:

– A uniform 12.5% tax rate has been introduced for all long-term capital gains, effective July 23, 2024.

– The indexation benefit—which allowed adjustment for inflation—has been removed. Earlier, certain assets were taxed at 20% with indexation or 10% without indexation. The removal simplifies tax calculations but increases tax liability for long-term investors.

iii. Short-Term Capital Gains (STCG) Rate for Equities and Mutual Funds:

– The tax on short-term capital gains from stocks, equity mutual funds, InvITs, and REITs has been increased to 20% (from 15%), applicable from July 23, 2024.

– No changes have been made to the STCG rates for other asset classes.

iv. Debt Mutual Funds and Bonds:

– Profits from debt mutual funds, debt ETFs, market-linked debentures, unlisted bonds, and debentures will no longer be classified as short-term capital gains, regardless of the holding period.

v. LTCG Exemption on Domestic Equity:

– Only domestic equity investments are eligible for the LTCG exemption of ₹1.25 lakh per financial year, raised from ₹1 lakh in Budget 2024. Foreign equity investments are ineligible for this exemption.

vi. Gold ETFs and Gold Funds:

– Gold ETFs, being listed products, qualify for LTCG after 12 months of holding.

– Gold funds, however, are unlisted, and investors must hold them for 24 months to avail of LTCG. These rules apply to transactions made after April 1, 2025.

Surcharge and Marginal Relief Updates

No changes were made to the surcharge rates in Budget 2024 for income up to ₹ 2 crores, but the implementation of the new tax regime leads to a reduction in the surcharge rate from 37% to 25%. This is applicable for individuals with income exceeding ₹ 2 crores.

The concept of marginal relief continues to apply when the surcharge amount exceeds the additional income. Marginal relief ensures that the surcharge does not exceed the extra income that pushes the taxpayer into the surcharge slab.

For example, if an individual has an income of ₹51 lakh, the 10% surcharge applies on income above ₹50 lakh. If the surcharge amount exceeds the extra income over ₹50 lakh, marginal relief kicks in to reduce the overall tax burden.

Final Thoughts

The Budget 2024 has reshaped the income tax landscape and significantly altered the capital gains tax structure. Whether you’re a salaried professional or an active investor, these reforms will have a direct impact on your tax planning for FY 2024-25.

Taxpayers must carefully evaluate whether the new tax regime or the old regime suits their financial circumstances, as the choice will influence their overall tax liability. Similarly, investors should assess the implications of the new capital gains tax rules, particularly those involved in equity markets, mutual funds, and debt instruments.

Staying informed and consulting a financial advisor is key to navigating these changes effectively.

Individuals looking to invest in Mutual Funds may connect at admin@wealthtechspeaks.in for investment related guidance.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content. In case you are interested in investing in Stocks, get your free Demat today (Click Here).

WealthTech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational and promotion purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.