Income Tax Return Filing for Salaried Individuals

- Posted By Amritesh

- On August 6th, 2019

- Comments: one response

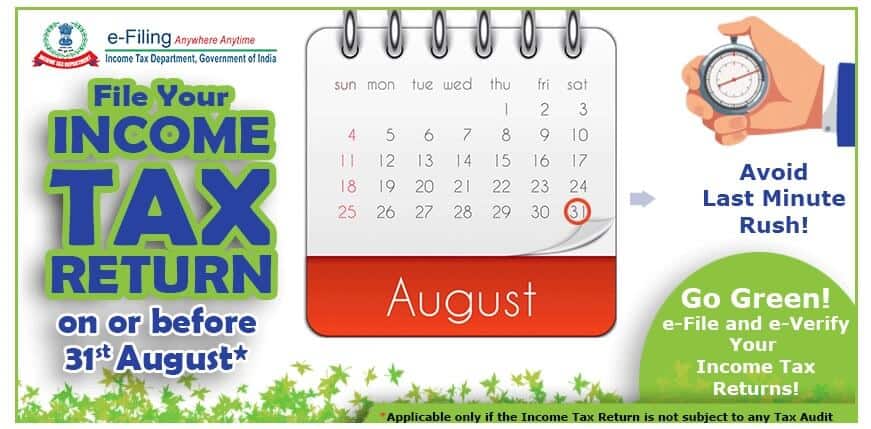

Last Date for Income Tax Return Filing for Financial Year 2018-19 (Assessment Year 2019-20) is 31st August, 2019. The filing date was extended from 31st July,’19 to allow Individuals sufficient time to file their returns. It is very important for the Tax Payers to file the returns on time, as missing the deadline will result in penalty of up to Rs 10,000/- or even prosecution in case one fails to file the ITR altogether. Now, everyone needs to file their returns online except for Super Senior Citizens above 80 years of age.

Income Tax Department: ITR-1 Filing Instructions

Income Tax Slabs and Rates for Financial Year 2018-19 (AY 2019-20)

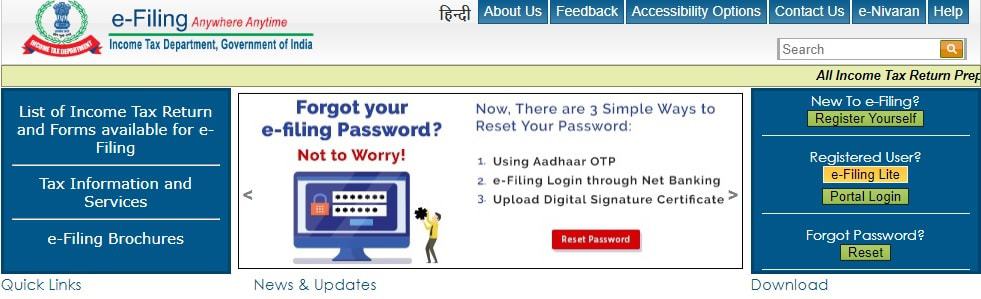

Income Tax Department has also launched the “e-filing lite” version to make e-filing simple and easy for the Tax Payers.

Individuals should keep the following documents for reference with them at the time of Income Tax Return Filing.

#Form 16 (Tax Deducted at Source by the Employer)

#Investment Proofs

#Capital Gains ( in case of Capital Gains ITR-2 Form is applicable)

#TDS Certificates/Form 16A (From Banks)

#Bank Statements

#PAN & Aadhaar ID

#Form 26AS (TDS Details)

The New Form 16 format provides details of specific nature of tax exempted allowances and tax breaks claimed by an Individual. The scope of declaring non salary income has also been restricted to Income from House Property & Income from Other Sources.

Individuals with “Salaried Income” are required to file the ITR-1 (Sahaj). Do note only ITR-1 and ITR-4 may be prepared and filed online, other forms need to be downloaded in Java or Excel format.

Please refer to the link below to know the correct ITR Form applicable for Income Tax Return Filing.

Income Tax Return (ITR) Forms Applicable for AY 2019-20 (FY 2018-19)

The ITR-1 (Sahaj) is applicable only for following class of Individuals whose total Income includes:

#Income from Salary/Pension (Up to Rs 50 lacs)

#Agriculture Income not exceeding Rs 5,000/-

#Income from House Property (Only 1 House)

#Income from Other Sources (Interest Income from Savings, Term Deposits, Family Pension, etc)

However, following class of Salaried Individuals cannot file ITR-1.

#Income from more than 1 House Property

#Winnings from Lotteries or Horse Races

#Income from Capital Gains Not Exempt from Tax (Short or Long Term)

#Agriculture Income exceeding Rs 5,000/-

#Individual holding unlisted equity share during the FY

#Income from Business or Profession

#Losses brought forward from previous years or Other Head Sources

#Hold position of Director in a Company

#Not Ordinarily Resident (NOR), Non Resident Individual (NRI) or Any Resident holding Assets or Income from any Source outside India

#Relief Claimed under International Tax Norms (Sec 90 & 91)

#Deduction claimed against “Income from other Sources”

#Earned Income from Business or Profession

#Aggregate Dividend Income taxable at Special Rates

Ordinarily Resident Individual may only file the return using ITR-1.

Steps for Online Income Tax Return Filing

Log on to Income Tax e-filing website

https://incometaxindiaefiling.gov.in/

Register, in case filing for the 1st time. Provide valid e-mail id and mobile number to complete the registration process.

Registered users need to log in providing their PAN, Password & Captcha.

Register the Aadhaar ID if not done already. The option is available under “Profile Settings” tab.

E-filing of Income Tax Return

Click on My Account>Form 26AS to check out the Tax Credit Statement (Tax Deducted At Source (TDS), TCS & Refund). Also verify the same with your Form 16 and TDS Certificate. Now you may file the return in the following manner.

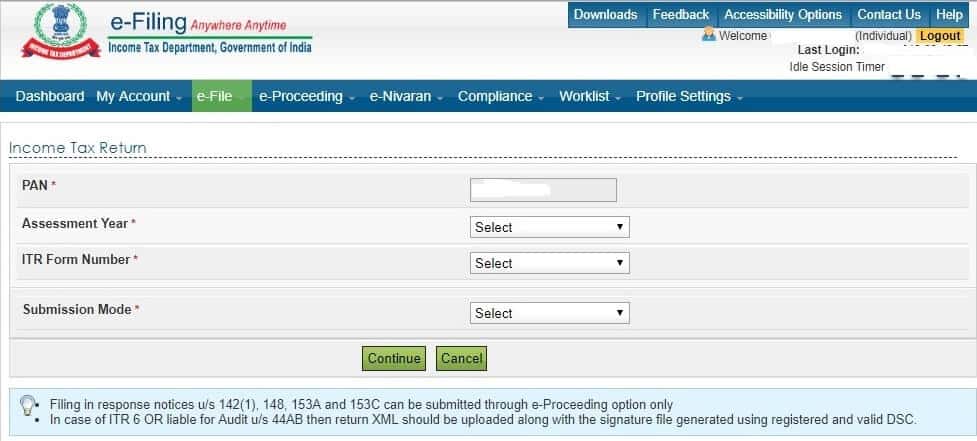

Click e-File tab and select “Income Tax Return”

PAN Details is Auto Selected

Select “Assessment Year”: 2019-20

Choose ITR Form Name: ITR-1

Filling Type: Original/Revised Return

Submission Mode: Prepare and Submit Online

Select the Bank Account for Refund Credit (If provided previously)

Pre-fill Details from Last Year’s Return Filing (Auto Filled)

Click Agree to Cross Check Pre-filled data and Proceed.

Also it is advised to click “Save Draft” option to keep the data safe.

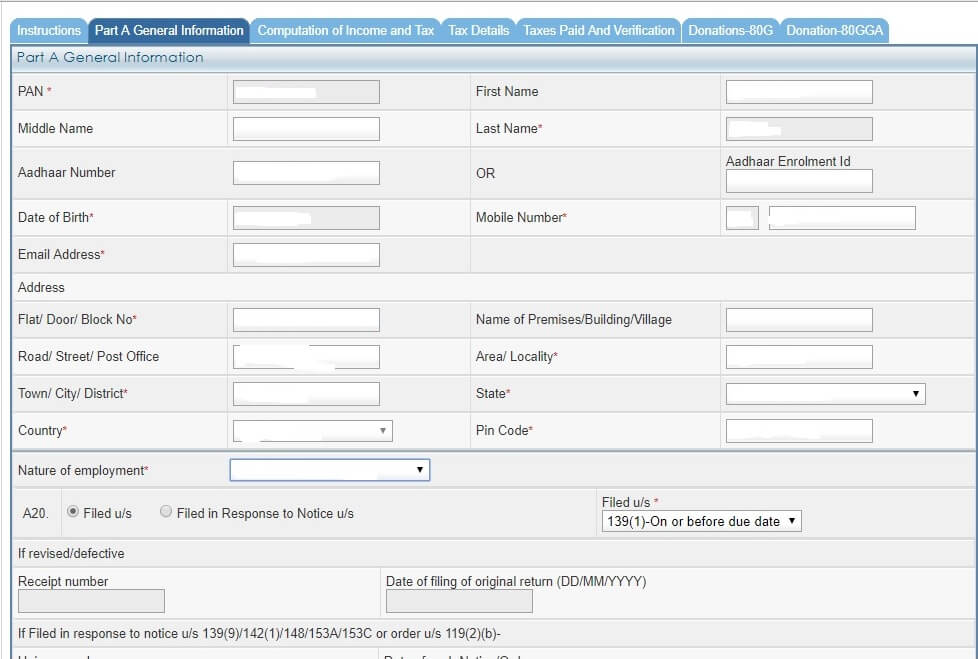

General Information Part A of ITR-1 Form

Check and Update General/Personal Information and “Save” the same.

Part A20: Select 139 (1) On or Before Due Date. (Only, If done before the due date)

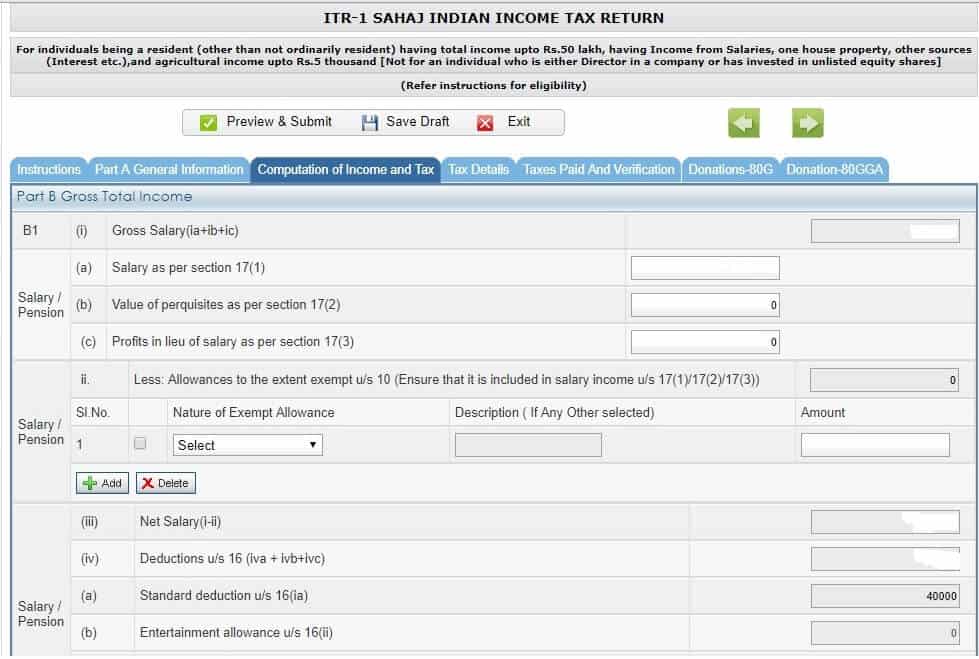

Income Details Part B of ITR-1 Form

“Income from Salary” details along with Exemptions applicable to be updated as per the Form 16. (In General these information is pre-filled from Form-16).

Filing of Salary details in ITR-1

Deductions available U/S 16 from the Salary Income is also pre-filled. It includes Standard Deduction, Entertainment Allowance (if applicable), & Professional Tax (paid).

Income from One House Property details to be updated, if applicable. In case of Self Occupied, select the option from drop down menu.

“Income from Other Sources” details to be updated. Nature of such income needs to be disclosed by the Individual. Interest earned on Bank Deposits is eligible for tax deduction U/S 80TTA*/B**.

Filing of Income from Other Sources Details in ITR-1

*Deduction U/S 80 TTA is available for Individuals below 60 years of age and is applicable only on Savings Account on interest earned up to Rs 10,000/-.

**Deduction U/S 80 TTB is available for Individuals aged 60 years & above and is applicable on earned interest on all types of deposits up to Rs 50,000/-.

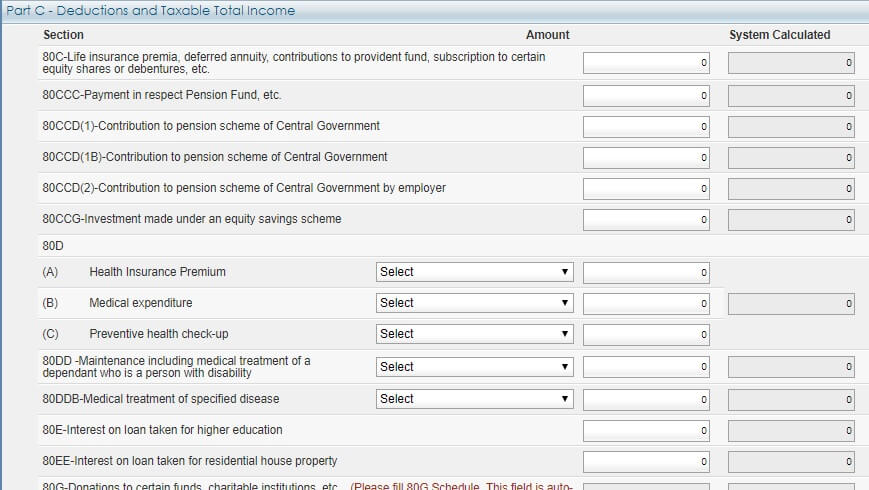

Eligible Tax Deductions Part C of ITR-1 Form

Tax Saving Deductions is available under Section 80C to 80 U. Individuals are required to provide the details of investment or expenditures eligible for Tax Deductions in the Form. Donations U/S 80G & U/S 80GGA may be updated in the Section provided for it, same will be auto filled in the Part C of the Form. The deduction applicable U/S 80 TTA/B also needs to be updated in the section provided for it.

Tax Deductions Available for FY 2018-19 (AY 2019-20)

Any Exempted Income received during the Financial Year also needs to be reported in Part C of the Form.

Part D of the ITR-1 Form will reflect the Computation of Tax Payable.

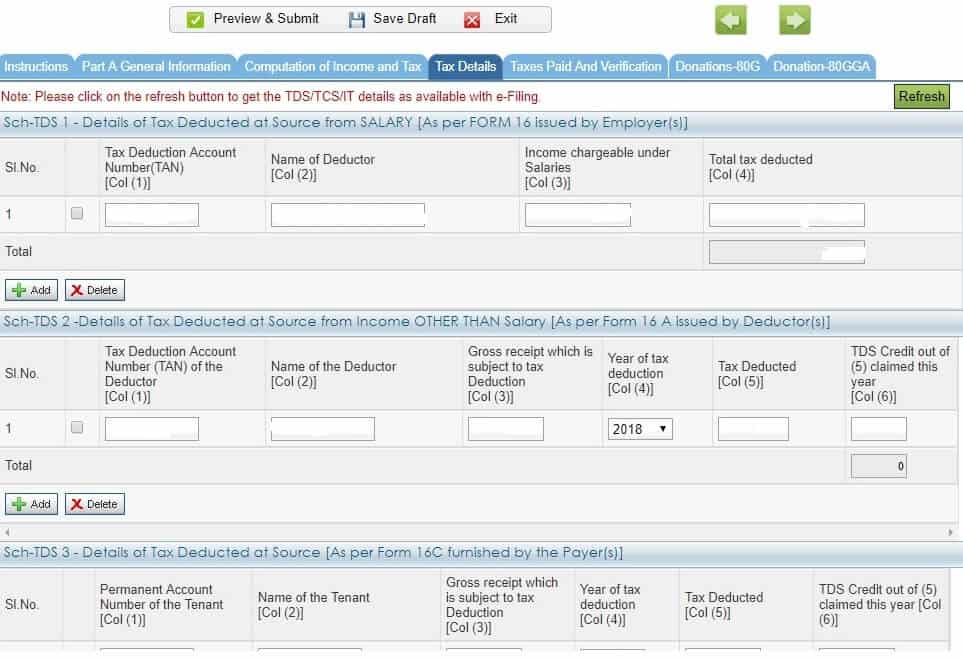

Tax Details related to Income Tax Return Filing

Details of TDS deducted on Salary, Banks Deposits, Rent of Property, etc is available in the Section.

Individuals will find the details of the TDS in this Section and match the same with the Form 16 & Form 16A.

Details of Advanced Tax and Self Assessment Tax are also available on this part of the Form. In case additional tax is required to be paid the details of the same need to be provided here.

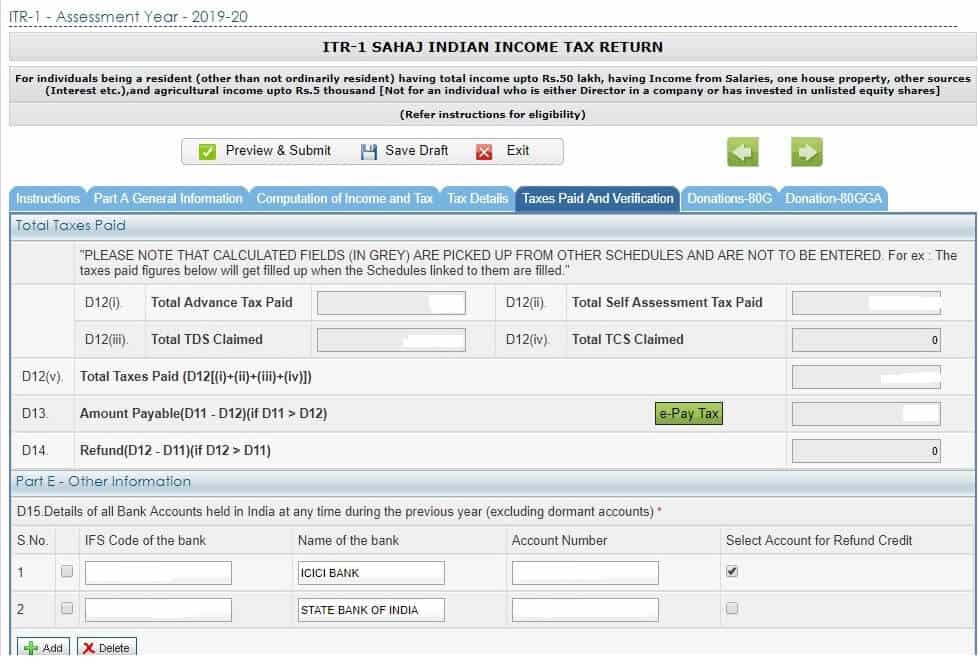

Tax Paid & Verification Part D of ITR-1 Form

TDS, Total Taxes Paid, Any Tax Refund or Additional Tax Payable is reflected in this Section of the Form.

In case one is required to make the Tax Payment. The details of the same should be provided in the “Tax Details” section in the Advance Tax and Self Assessment Tax row of the Form. BSR Code, Challan Number, Date and Amount Paid needs to be updated.

Update Other Information Part E of ITR-1 Form

Details of all the active Bank accounts held in India at any time during the Previous Year are to be provided here.

Individuals should provide the details of all the Bank accounts held by them during the concerned period. Individual also need to select the Preferred Bank Account for Auto Credit of Refund.

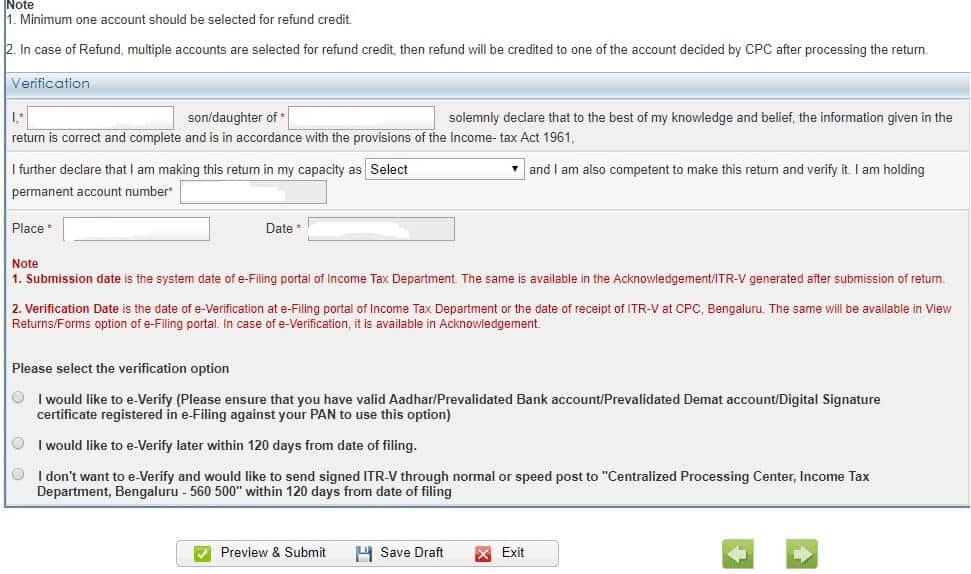

Submission & Verification of Income Tax Return Filing

Complete the verification process, select Self/Representative (as applicable) in the declaration part of the Form.

Select the Verification Process as per Convenience.

Preview & Submit the Return.

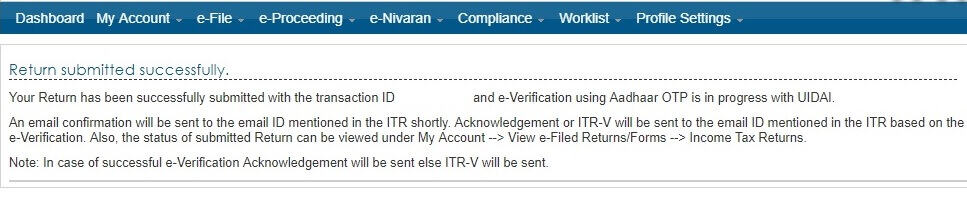

Confirmation of Income Tax Return Filing

On successful submission of the Form, confirmation mail is sent on the registered e-mail id of the concerned Individual.

Acknowledgement or the ITR V will be shared on e-mail on successful e-verification.

Disclaimer: The information related to filing of income tax return online is just for discussion purpose only, and should not be misconstrued to be as tax filing advice. Under no circumstances does this information represent a legal opinion, or any sort of recommendation. Readers are advised to research further to have more clarity on the topic. It is very important to do your own analysis and consult your Tax Advisor for expert guidance on return filing.