Income Tax Slabs & Rates Financial Year 2018-19 (Assessment Year 2019-20)

- Posted By Amritesh

- On February 3rd, 2018

- Comments: 2 responses

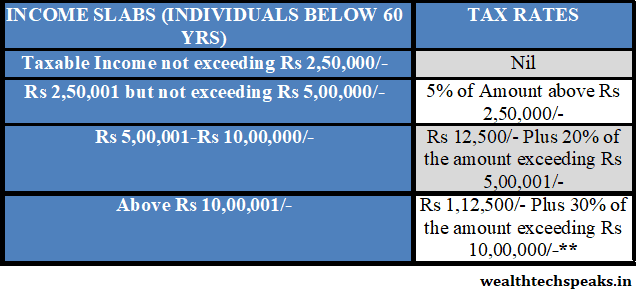

Income Tax Rates remain unaltered in the Budget 2018 for the next Financial Year. The chart above shows the latest Tax rates applicable for the FY 18-19 (Assessment Year 2019-20). However Cess has been revised to 4% from 3% and Standard Deduction reintroduced, details about the applicability on the Income along with exemption limit has been discussed below.

Impact of the minor changes to your Tax Liability will be discussed in the upcoming post. Income Tax Rates applicable for Senior citizens has also been discussed below.

Re-Introduction of Standard Deduction for Salaried Individuals: Standard Deduction of Rs 40,000/- has been provided in lieu of existing Conveyance Allowance (Transport) of Rs 19,200/- and Medical Reimbursement of Rs 15,000/-.

Thus the actual benefit extended is (Rs 40,000- Rs 34,200)= Rs 5,800/- for Salaried Class in this Budget.

Standard Deduction is to be deducted from the Salary Income, prior to the calculation of Taxable Income.

Taxable Salary Income = Annual Gross Salary Income – Standard Deduction

Tax Rebate of 10% (Rs 2500/- maximum) is available under Sec 87A to individuals whose Taxable Income is in the range of Rs 2,00,001- Rs 3,50,000/-. No Rebate is available on annual Income above Rs 3,50,000/-. This effectively implies that individuals with annual income of Rs 3,00,000/- will have zero tax liability. Whereas, Individuals with an annual taxable income of Rs 3,50,000 will have a tax liability of Rs 2,600/-.

Tax Payers may reduce their Tax Liability further by availing Deductions available under Chapter VI-A of the Income Tax Act (U/S 80C,D,E etc). I will post a separate article covering the same.

Surcharge of 10% will be applicable on Income between Rs 50 lacs to 1 crore.

Surcharge of 15% if the Income exceeds 1 Crore.

Health and Education Cess of 4% is additionally payable on Total Income Tax and on Surcharge if applicable.

Individual Residents who fall in the age bracket of 60-80 years (Senior Citizen) the exemption on Taxable Income is up to Rs 3,00,000/-. For Income above the exemption limit, normal tax rates will be applicable.

Individual Residents who are above 80 yrs of age (Super Seniors Citizens) the exemption on Taxable Income is up to Rs 5,00,000/-. For Income above the exemption limit, normal tax rates will be applicable.

Deductions available under various Sections of Income Tax Act for individuals would be discussed in the upcoming post on Tax Planning for the Financial Year 2018-19.