Income Tax Implication For The Financial Year 2017-18

- Posted By Amritesh

- On February 24th, 2017

- Comments: no responses

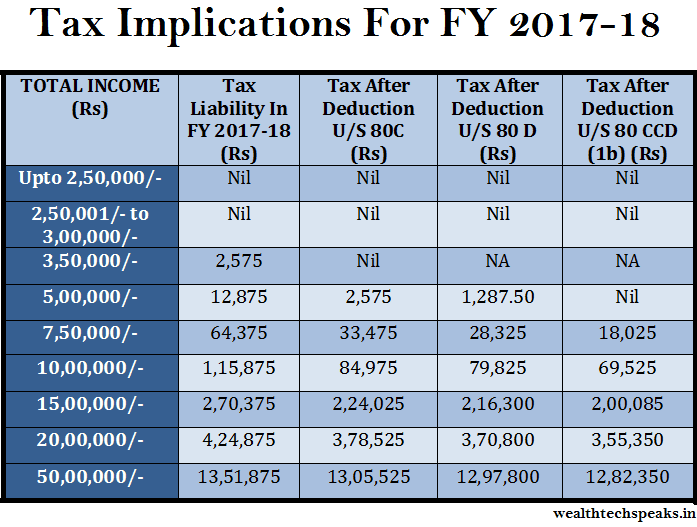

FY stands for Financial Year. The Tax Implications shown above is applicable for Individuals below 60 years of age. In the above illustration, I have used the maximum deduction applicable under each income group to minimize the Tax Liability.

Income Tax Slabs & Rates Financial Year 2017-18 (Assessment Year 2018-19)

BUDGET 2017-18: Things To Know

Income upto Rs 2,50,000/- is exempted from Tax.

Tax Rebate U/S 87A of Rs 2,500/- is available to Individuals with Income upto Rs 3,50,000/-.

Education Cess (2%) and Secondary Higher Education Cess (1%) totaling up to 3% is additionally levied on the Income Tax payable.

U/S 80C: Tax Deduction up to Maximum of Rs 1,50,000/- is available on Investment in Life Insurance policies, Public Provident Fund (PPF), Equity Linked Saving Schemes (ELSS) Mutual Funds, National Savings Certificate (NSC) and other notified instruments.

U/S 80D: Tax Deduction up to Maximum of Rs 25,000/- is available on Health Insurance Premium paid for Self, Spouse and Dependent Children. You may avail further deduction of Rs 30,000 for the Health Insurance premium paid for parents (provided they are Senior Citizens or else Deduction up to Rs 25,000/- is applicable).

U/S 80CCD (1b): Tax Deduction up to Maximum of Rs 50,000/- is available on investment made towards National Pension Scheme (NPS). This is also applicable on Contribution made towards the Atal Pension Yojana (APY).

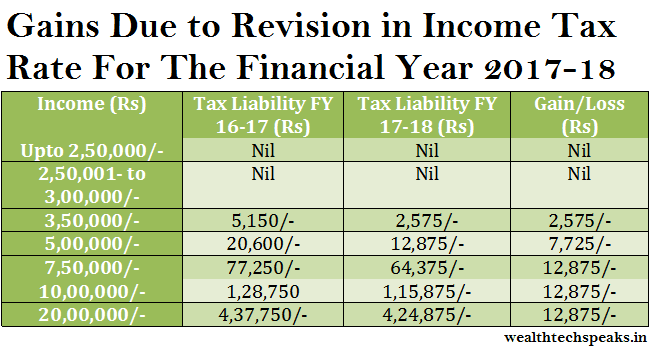

I have also compared the Tax Liability for the Current Financial Year with the Previous Financial Year. Hereby, Individual can ascertain the Gains, one stands to make due to the revision in Tax rates for the next Financial Year.

Please do note that I have only used the most commonly availed deductions for the calculation of the Tax Liability. I will discuss the exhaustive list of deductions under various sections available during the Financial Year in my upcoming posts.