Income Tax Calculation FY 2019-20

- Posted By Amritesh

- On July 7th, 2019

- Comments: one response

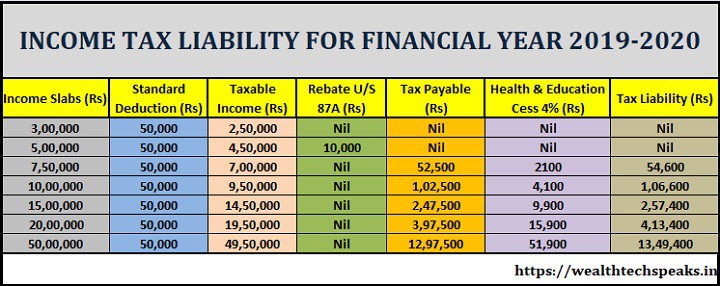

Income Tax calculation for Salaried Individual (below 60 years of age) for the Financial Year 2019-20 has been discussed below, post Budget 2019. The Income Slabs and Rates remain unchanged for the Assessment Year 2020-21 (FY 2019-2020). Standard Deduction has been raised to Rs 50,000/-, Tax Rebate under Section 87A has been increased to Rs 12,500/- from Rs 2,500/-. Thereby, Individuals with Taxable Income up to Rs 5 lacs will not be required to pay any income tax.

Income Tax Slab Rates For Financial Year 2019-20

Income Tax Deductions and Exemptions

Standard Deduction is a flat deduction from the Salary Income of an Individual. Health & Education Cess @ 4% is levied on Income Tax Payable.

Income up to Rs 2,50,000/- is exempted from Tax.

Tax Rebate U/S 87A up to Rs 12,500/- is available to Individuals with Taxable Income up to Rs 5,00,000/-.

Individuals with income above Rs 5,00,000 may avail Deductions available under 80C, 80D and 80 CCD (1B) to reduce their Tax Liability. This would enable Individuals with income up to Rs 8,25,000/- pay no tax on their earnings. (Additional Rs 50,000/- Tax Deduction is available on Health Insurance premium paid for Senior Citizen Parents).

Tax Deductions Available To The Individuals

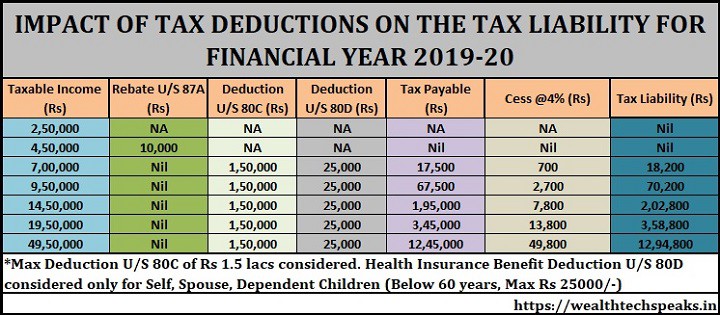

Tax Deduction U/S 80C: Tax Deduction up to Maximum of Rs 1,50,000/- is available on Investment in Life Insurance policies, Public Provident Fund (PPF), Equity Linked Saving Schemes (ELSS), National Savings Certificate (NSC) and other notified instruments.

Tax Deduction U/S 80D: Tax Deduction up to Rs 25,000/- is available on Health Insurance Premium paid for Self, Spouse and Dependent Children. Tax Deduction benefit increases to Rs 50,000/- for Senior Citizens on the premium paid towards Health Insurance.

U/S 80CCD (1b): Tax Deduction up to Maximum of Rs 50,000/- is available on investment made towards National Pension Scheme (NPS). This is also applicable on Contribution made towards the Atal Pension Yojana (APY).

Income Tax Calculation after Availing Tax Deductions

I have compared the Tax Liability for the Financial Year 2019-20, when Tax Deductions is availed. Hereby, Individual may ascertain the Benefits of availing Tax Deductions. To make understanding simple, popular Tax Deduction options have been taken into consideration.

This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

What you see there is a life of celebrity rather than a life ofruling or work generic for cialis