How to e-File Income Tax Return (ITR1-Sahaj)?

- Posted By Amritesh

- On July 26th, 2018

- Comments: 2 responses

The last date to file income tax return for the Financial Year 2017-18 (Assessment Year 2018-19) is 31st July, 2018 (Date extended till 31st August,2018 for certain categories of tax payers). Previously, I had shared details of the Income Tax Return (ITR) Forms applicable for different class of income, link for the same is provided below.

Income Tax Filing: Types of Income Tax Forms

Income Tax Slabs For Financial Year 2017-18 (Assessment Year 2018-19)

In this post I will discuss the probable steps to file return using ITR-1 (Sahaj) form in a nutshell. The detailed instruction related to file income tax return is provided in the link below.

Income Tax (ITR-1) Instructions: Income Tax Department

ITR-1 (Sahaj) is applicable for following class of Income for the Individuals:

#Income from Salary/Pension (Up to Rs 50 lakhs)

#Income from House Property (Only 1 House)

#Income from Other Sources (Term Deposit & Savings Interest, etc)

This form is not applicable for following class of Income for Individuals:

#Income from more than 1 House Property

#Winnings from Lotteries or Horse Races

#Income from Capital Gains Not Exempt from Tax (Short or Long)

#Income from Agriculture Income in excess of Rs 5,000/-

#Income from Business or Profession

#Losses brought forward from previous years or Other Head Sources.

#Any resident having income or asset outside India. [Non Ordinarily Resident (NOR) & Non Residents included]

#Individual claiming Double Taxation Relief

Reference to the following documents may be required file income tax return:

#PAN Card/Form 16

#Investment Details (Applicable U/S 80C, 80D, etc)

#Bank Account Details (Account Number/IFSC/Interest Earned, etc) during the respective Financial Year 2017-18.

#Aadhar ID (If not linked with PAN as yet)

How to Link PAN with Aadhaar ID (If not done)?

Log onto e-Filing portal with the login credentials and submit the Aadhaar ID in the link shared below.

Steps to e-File Income Tax Return (ITR1-Sahaj)

Log onto http://incometaxindiaefiling.gov.in/

Now, Registered Users need to Login using their respective PAN as user ID and password.

For New Users: After Clicking Register Yourself

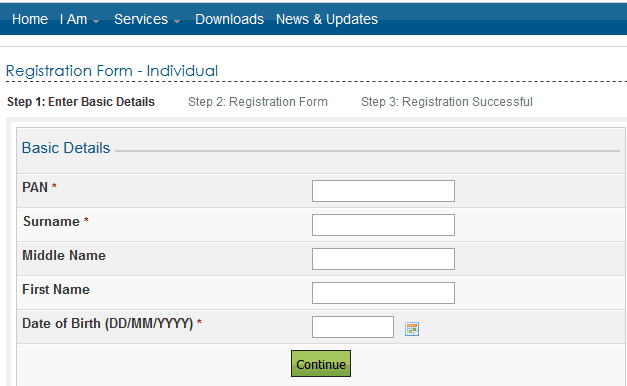

New Users are required to register on the portal to begin with the e-Filing process.

Select User type details and continue.

Enter the Basic details and click Continue to go to the Registration Form.

Fill up the Registration Form carefully and provide valid mobile number and email id to successfully complete the registration process.

Following which you will receive an activation link on your mail to activate your profile.

e-Filing of Return

Log onto the respective Profile and Select “Prepare and Submit Online ITR” Option, make following Selections:

ITR Form Name: ITR1

Assessment Year: 2018-19

Submission Mode: Prepare and Submit Online

Prefill Details from Last Year’s Return Filing (Select as Applicable)

Select option to e-Verify Return as deemed appropriate

Click on My Account>Form 26AS to check out the Tax Credit Statement (Tax Deducted at source TDS,TCS and Refund). Also verify the same with your Form 16 Statement. Now you may file the return in the following manner.

Fill in the Personal Information and Income Details.

Check the Tax Paid and Verification Details.

80G in case you have made donations eligible for Deductions.

Under General Information:

Column A22: Will be on or Before Due Date 139 (1) till 31st July, 2018

Column A23: Will be “No” for most, Unless Governed by Portuguese Civil Code (Applicable for Goa)

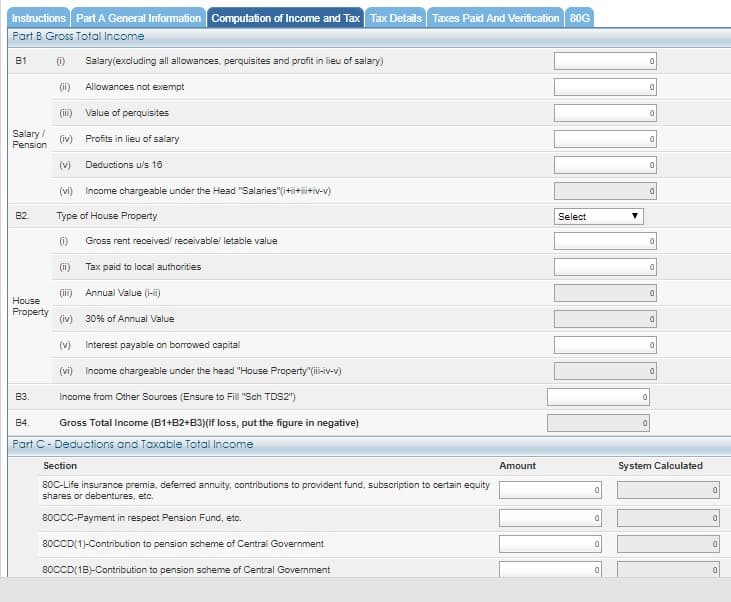

Under Income Details:

Income from Salary (Income Chargeable under the head “Salaries” should be considered)

#Provide Salary breakup- Basic Salary, Perquisites, Profit in Lieu of Salary, Un-exempted Allowances under the Allowance Column (Exempted Allowances need to be provided in the Exempted Income column)

“Income from House Property” (Only 1 house), Select as Self Occupied or Let Out

#Gross Receipts, Municipal Taxes Paid, Interest Paid on Borrowed Capital details (if applicable).

Provide the Cumulative Bank interest earned under “Income from Other Sources”.

#Only Interest earned on Savings Account is eligible for Deduction U/S 80TTA up to maximum limit of Rs 10,000/-). Interest earned on Fixed and Recurring Deposits is taxable.

Deductions Available under Various Sections 80C, 80D etc. (Please refer to the link below for various deductions available). Provide Deductions as applicable for the Financial Year, same is available in Form 16 as well.

Tax Deductions Available Under Various Sections For Financial Year 2017-18

Interest earned on Savings Account is eligible for deduction up to Rs 10,000/-, so provide the actual interest earned in the column next to 80TTA.

Under Tax Details: Check the Tax Deducted from Income from Salary and Other Sources as per Form-16 details.

Under Tax Paid and Verification: Check the TDS, Total Taxes Paid, Any additional tax required to be paid (e-pay) or the Refund which may be claimed.

In case of e-payment of tax, provide the BSR Code, Challan Number and other details under “Details of Advanced Tax and Self Assessment Tax”.

Also, one needs to declare the Exempted Incomes earned in this Section itself. (Includes Exempted Allowances, Gifts from Family Members, Gratuity, PF or Insurance/Investment Maturity, etc amount which is exempted as per Income Tax Act)

Provide the Bank Details of all the active Bank accounts held by you.

Preview the Details and Submit the Form.

Now Click Save Draft, Review the details and Submit.

On Submission, You will be asked to e-Verify your return by following any of the steps mentioned below:

E-verification through Netbanking, Aadhaar OTP generation, E-Verification(EVC Bank Account Validation) Or

Download the ITR-V and send the same to Income Tax Office in Bangalore to complete the process within 120 days of Filing.

On verification, download the acknowledgement receipt, confirmation will also be shared on registered email id and mobile number.

Disclaimer: The information related to file income tax return online is just for discussion purpose only, and should not be misconstrued to be as tax filing advice. Under no circumstances does this information represent a legal opinion, or any sort of recommendation. Readers are advised to research further to have more clarity on the topic. It is very important to do your own analysis and consult your Tax Advisor for expert guidance on return filing.

I am really impressed with your writing skills as well as with the layout on your blog.

Is this a paid theme or did you customize it yourself?

Anyway keep up the nice quality writing, it is rare to

see a great blog like this one nowadays.

Hey there would you mind stating which blog platform you’re working with?

I’m looking to start my own blog soon but I’m having a

hard time selecting between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design and style seems different then most blogs and I’m looking

for something unique. P.S My apologies for being

off-topic but I had to ask!