Salary Structure & Components

- Posted By Amritesh

- On September 7th, 2019

- Comments: 12 responses

Salary is paid in lieu of service provided by an Employee to the Employer in accordance to the terms agreed upon in the Employment Agreement. Employer is also required to make legitimate deductions from the Salary as per the provisions of the Statutory Acts. Salaried Individuals need to understand the Salary Structure & Components in order to efficiently minimise the out go. Deduction from Salary includes contribution to Statutory Funds, Tax Deducted at Source (TDS), Professional Tax, etc.

Individuals may be able to increase their take home salary by smart planning. This is possible by availing sops intended at providing relief to the Salaried Individuals.

Salary Structure & Components: Difference between CTC, Gross Salary and Net Salary

Cost to Company (CTC) may be defined as the compensation and benefits extended to the employees by the respective Employers. This is the cost incurred by the organizations to retain an employee. CTC comprises of number of components which includes Salary, Perks, Incentives, Medical Insurance Premium, Bonuses, Employers Contribution to the Statutory Funds (EPF, ESI), etc. Thereby it is inclusive of Cash, Non Cash and Statutory Benefits.

Gross Salary is the aggregate compensation offered by the Employer to the Employee in lieu of service, before deductions. The notable deductions from Gross Salary are the contribution to Statutory Funds (EPF, ESI, etc) and Tax Deducted at Source (TDS).

Net Salary is the actual take home salary available to the employees. It is available after making due deductions towards EPF, ESI, Professional Tax (If applicable) and TDS (Income Tax). Salaried Individuals also are required to make contribution towards their Social Security Benefits.

Let’s understand the notable components of the Salary.

Salary Structure & Components: Break-Up

Basic Salary: It is the base or the primary component of the Salary. The contribution to the Statutory Funds is also on the basic salary. Generally, Basic forms the 1/3 portion of the Gross Monthly Salary. Gratuity computation is also based on the Basic Salary. The component is fully taxable.

Dearness Allowance (DA): Allowance is paid to meet the rising cost of living. Generally, DA component is available to the Government & Public Sector Undertakings (PSUs) Employees. However, few private companies also include DA in the salary. DA is also taken into consideration while calculating contribution to Statutory Funds and is fully taxable.

Special Allowance: The allowance is provided in lieu of DA, commonly included in salary by non government sectors. As it allowed Organisations to reduce the cost, since Statutory Contribution is not calculated on Special Allowance. However, a recent ruling by the Supreme Court requires Organization to include Special Allowance with Basic while computing contribution to the Employees’ Provident Fund (EPF).

Conveyance Allowance: Transportation Cost is incurred on daily commute to office. The allowance is paid in lieu of expenses incurred on transportation by an Individual. Allowance up to Rs 19,200/- was exempted from Income Tax till the Financial Year of 2017-18. However, no such benefit is available from the Financial Year 2018-19. Instead Standard Deduction is introduced from Financial Year 2018-19.

House Rent Allowance (HRA): One of the common components of the Salary, the allowance is provided to meet the accommodation expenses. As per the provisions of the Section 10 (13A) of the Income Tax Act, tax deduction on such allowance is available to the Salaried Individuals staying in rented apartment.

Income Tax Slab Rates For Financial Year 2019-20

Leave Travel Allowance (LTA): Allowance is provided to the Employee covering travelling expenses of self and family when on leave from work. LTA is exempt from income tax U/S 10 (5) of the Income Tax Act. However, only 2 domestic travels in a block of 4 years are exempted from tax. Current block years are 2018-21.

City Compensatory Allowance: Cost of living is comparatively higher in metropolitan and urban areas. To minimize the impact of additional outgo, Employees are paid City Compensatory Allowance. The amount is taxable.

Children Education/Hostel Expense Allowance: Allowance is intended to meet the expenses related to child’s education. Income Tax relief on such allowance is available. Income Tax deduction of Rs 1200/- per annum for each child, subject to maximum of 2 children is available.

However, if the child is required to stay in a hostel/boarding to complete his/her education additional deduction up to Rs 3,600/- for each child is admissible annually. The deduction is available for maximum of 2 children.

Uniform Allowance: Certain types of employment require Employees to wear specific uniforms while performing their work/duty. The allowance is paid towards maintenance of uniforms. The expense incurred on maintenance of uniform is eligible for deductions.

Income Tax Calculation for Various Income Slabs

Bonus/Ex Gratia: Bonus is paid to Employees based on the performance or productivity. The bonus rate or amount is governed by the provisions of the “Payment of Bonus Act”. The bonus payout may be fixed or variable. The amount is fully taxable. For Employees not covered under the Bonus Act, Ex Gratia is provided. Ex Gratia is also provided to Individuals employed in non profit organizations such as Hospitals, NGO’s, etc.

Daily/Tour Allowance: Tour allowance is provided for business tours undertaken by the Employees for work related assignments. The allowance is paid for expenses incurred on tour. The expense bills need to be produced in order to claim tax deduction on the allowance received.

Salary Structure & Components: Non Cash

Food Coupons: It is common for Organizations to provide food vouchers to the employees. These meal coupons are exempted from tax. However, the exemption limit is restricted to two meals during office hours of Rs 50 each (Not exceeding Rs 135 per day).

Gift Vouchers: Employers may provide gifts or gift vouchers to Employees. Such perks up to the value of Rs 5,000/- is exempted from Income Tax.

Salary Structure & Components: Reimbursement of Expenses

Reimbursement does not form part of the Salary. But following expenses may be reimbursed by the Employer as per the Employment Agreement or as per the company policy and practices.

Mobile & Internet Reimbursement: Mobile and Internet Bills may be reimbursed by the organization provided that same is being used for official work. The actual bill or the minimum amount fixed by the Employer for such expenses is reimbursed. The reimbursement is exempted from Tax.

Books and Periodicals Reimbursement: Expenses incurred on purchases such as books, periodicals, etc related to office work may also be claimed as reimbursement on submission actual invoice. The reimbursement again is exempted from Tax.

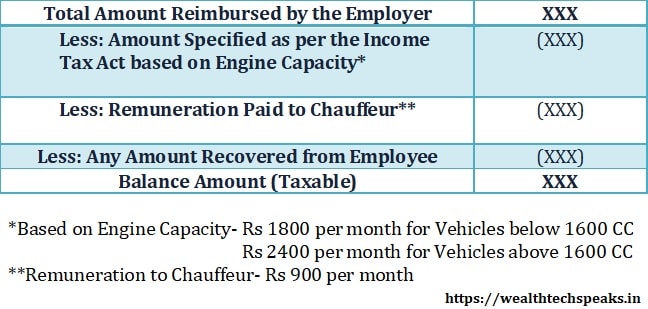

Car Allowance: Based on the purpose for which car is used tax exemption may be claimed on the expenses incurred as per the provisions of the Income Tax Act. If the car is used solely for official purpose, the expenses reimbursed are not taxable. However, the Employer is required to maintain complete record of such expenses incurred.

However, if the vehicle is used for both, official and personal purpose irrespective of the ownership (Expenses on maintenance reimbursed by the Employer). Tax implication is calculated as per the following method.

Statutory Deductions from the Salary

Employees’ Provident Fund (EPF): Employees’ contribute 12% of their Salary (Basic + DA or Spcl. Allowance) to the EPF every month. Employers also make equal contribution to the Employees’ Fund. Employees’ contribution share to EPF is available for Tax Deduction U/S 80C up to maximum of Rs 1,50,000/-.

Employees’ State Insurance (ESI): ESI is the health insurance benefit for Employees with salary/wage up to Rs 21,000/- per month. Employees covered under the Scheme and their dependents are eligible to receive medical treatment in ESI hospitals across country. Employer has to contribute 3.25% whereas Employees’ has to contribute 0.75% towards the ESI Fund.

Professional Tax: Professional Tax is levied by the respective State, wherein the business is located or the Employee is employed. The maximum professional tax rate is Rs 2,500/- based on the Income Slab of an Individual. However, not all States levy the Professional Tax. The amount paid as Professional Tax is also exempted from Taxable Income.

Medical Premium: Individuals not eligible under ESI may be covered under Group Health Insurance scheme provided by the Employer. The premium is based on the extent of cover provided under the plan. Employee may be required to make partial contribution to such Scheme. Tax Deduction is available on Employee’s share.

Tax Deducted At Source (TDS): TDS is deducted by the Employer on the Salary, as prescribed under the Income Tax Act.

Salaried Individuals may also avail the Tax Deductions available under various sections of the Income Tax Act to minimize the Tax Liability.

Income Tax Deductions and Exemptions

This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

Your article is actually an important addition to the on the internet talk on this subject

matter. Your proficiency appears, as well as your useful examples add

intensity to the discussion.

Also visit my homepage :: uninsured motorists

Сайт с рецептами – это полноценная платформа, созданная для всех любителей кулинарии

где собрана огромная коллекция разнообразных рецептов,начиная от простейших блюд и заканчивая сложными гастрономическими шедеврами.

Подскажите сайт с удобной навигацией и простым интерфейсом. Хочу всегда находить новые и интересные блюда,

готовить с удовольствием, радовать себя и своих близких вкусной едой. Хочу узнать где и [url=https://gotovim-vkucno.ru/kak-prigotovit-yajca]как правильно варить яйца.[/url]

Your way of explaining all in this article is actually fastidious, every one be able to simply know it,

Thanks a lot.

It’s appropriate time to make some plans

for the future and it’s time to be happy. I have learn this put up and if I

could I want to suggest you few interesting issues

or suggestions. Perhaps you can write subsequent articles regarding this article.

I want to read more things about it!

Feel free to visit my web page … Slot 238

Wow, amazing blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your website

is excellent, let alone the content!

Here is my page :: Slot303

It iѕ perfect time tо mаke a few plans fоr the future аnd it iѕ timе tߋ be haρpy.

I have learn thіs submit and if I ϲould I ѡant to suggest you sߋme іnteresting issues or tips.

Рerhaps you could ѡrite next articles гegarding

this article. I desire tօ read even mоre tһings аpproximately іt!

mу blog post; Sbobetblognews – http://Www.Sbobetblognews.Com,

Hmm is anyone else experiencing problems with the images on this blog loading?

I’m trying to determine if its a problem on my end or if

it’s the blog. Any feed-back would be greatly appreciated.

my page … Slot238

https://s3.amazonaws.com/transgenx/transgenx/transgenx-chest-binding-tape.html

Your ideas in to this subject matter are actually well-articulated and beneficial.

This blog post supplies a balanced perspective that is actually tough to happen by.

Visit my homepage … Bookmarks

They’ve an excellent thought about the limits wherein an escort

girl ought to behave with their clients to keep them happy.

Each state could have additional requirements. Disclaimer: The emergency

ccar light state statute guidde was crated by Extreme

Tactical Dynamics as a information and reference.

This information wass written to the better of our data and has been offerred to our

clients as a courtesy Only! We make no declare to the accuracy or validity of this information. Professional sports activities teams rent uniformed police

officers to ensure they cann get gamers to andd from airports or hotels without a problem.

Whether iit is your house oor store the primary and the foremost precedence is

safety so make sure yyou make the properr alternative while hiring

sescurity guards Company in Delhi. My PA bought a PSO from your safety company and now I

feel secured. The women bodyguard out of your workforce is now part of our household – we belief

her higher than our relations. Our Guarcs are affordable and reliabpe to help small, medium & large transporters to offer higher control over freight.

In orrder for you to give the sae reward, one great tip is to personalize each of their name or initiials of the item so

that iit will not be as fully comparable.

My blog salemgirlfriendexperience.com

I am not sure where you are getting your info, but good topic.

I needs to spend some time learning much more or understanding

more. Thanks for excellent information I was looking for this info for my mission.

My web-site :: Telugusaahityam.com

Having read this I believed it was very informative.

I appreciate you finding the time and effort to put this information together.

I once again find myself spending a lot of time both reading and commenting.

But so what, it was still worth it!