Withdrawals And Advances Under EPF

- Posted By Amritesh

- On March 5th, 2018

- Comments: no responses

Subscribers to Employees’ Provident Fund (EPF) are eligible for Withdrawals and Advances subject to fulfillment of certain conditions relating to service and purpose for availing it. Subscribers may also apply for Withdrawals and Advances online through the EPFO’s unified portal. Members of EPF are required to log on to the EPF Members portal using their UAN and Password. After logging on to the Member Interface, Subscriber is required to go to “Online Services” Section and apply for claim under the same. However, to be able to apply for the Withdrawals and Advances online, Subscriber is required to seed his/her Aadhaar ID, PAN and Bank Account Number with the respective UAN (Universal Account Number). Once all the details are uploaded it may take a week’s time to verification before one can apply for the withdrawal.

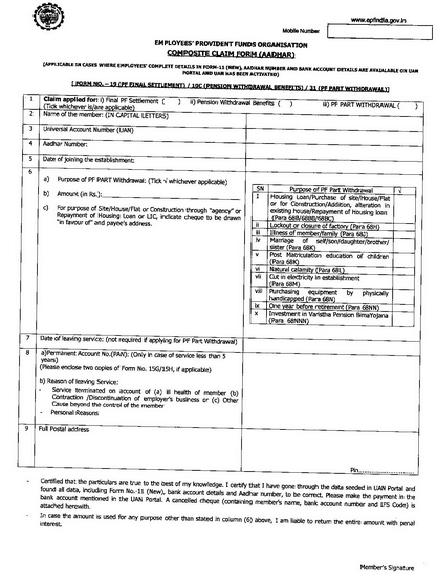

Composite Claim Form (CCF) has been issued for the same along with relaxation in the document requirements for the withdrawal. Simplification of EPF Withdrawal Process is a boon for the Subscribers. This enables Subscribers to withdraw the funds from the comforts of their home or office. More importantly it removes unnecessary hassles of routing the application through employer.

Steps for Online Application For Withdrawal and Advances

Please refer to the form shared below.

Withdrawal and Advances are available to the Employees’ for the following Purposes:-

Marriage/Education

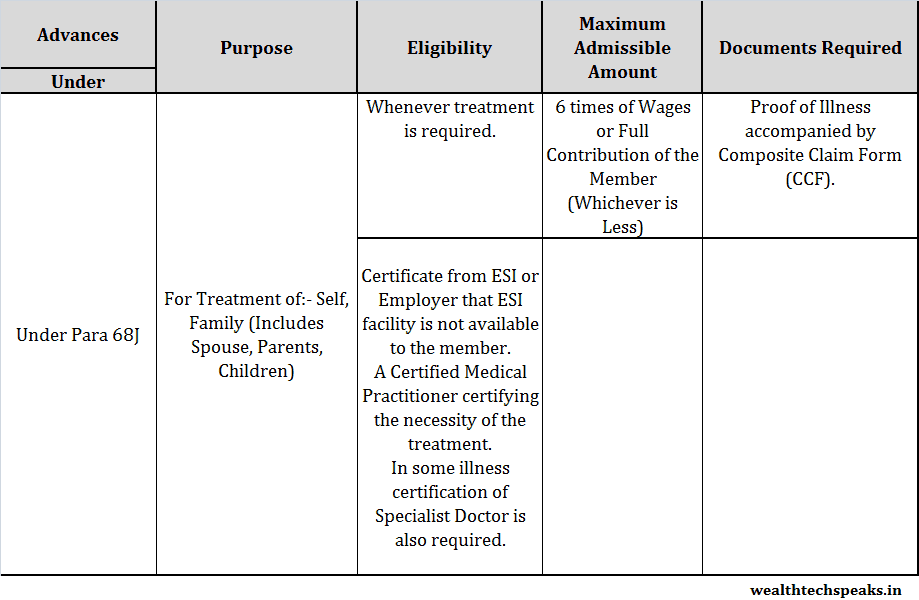

Treatment

Purchase or Construction of Dwelling House

Repayment of Housing Loan

Addition/Alteration of House

Repair of House

Lockout

Withdrawal Prior Retirement

Other Advances

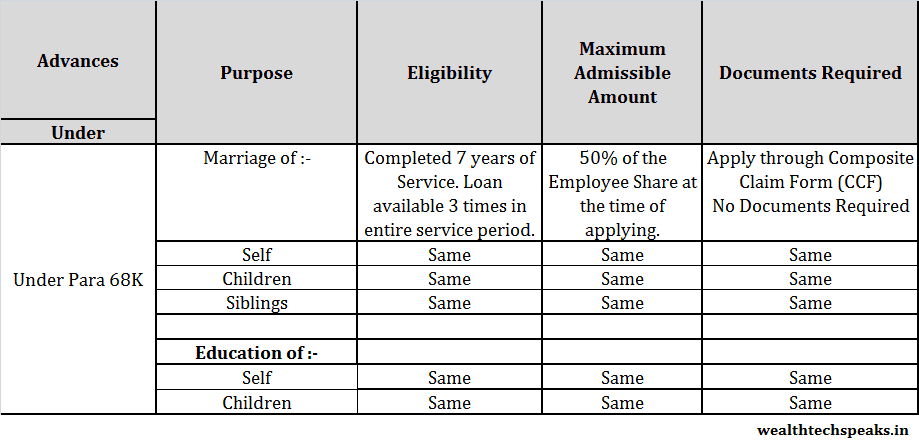

For Marriage/Education

Medical Treatment

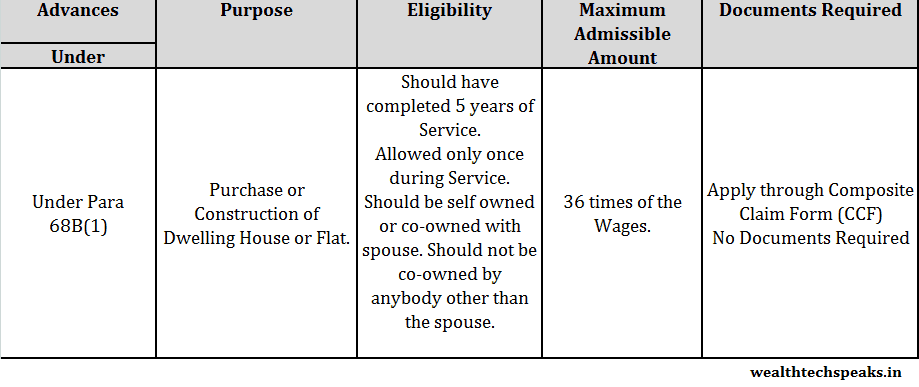

Purchase or Construction of Dwelling House

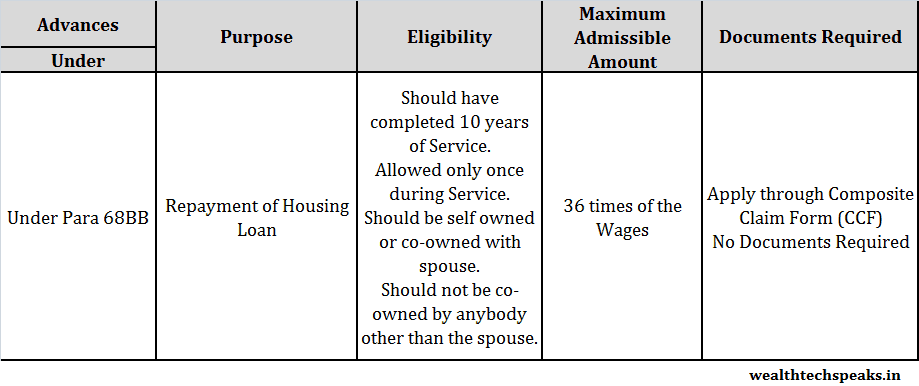

Repayment of Housing Loan

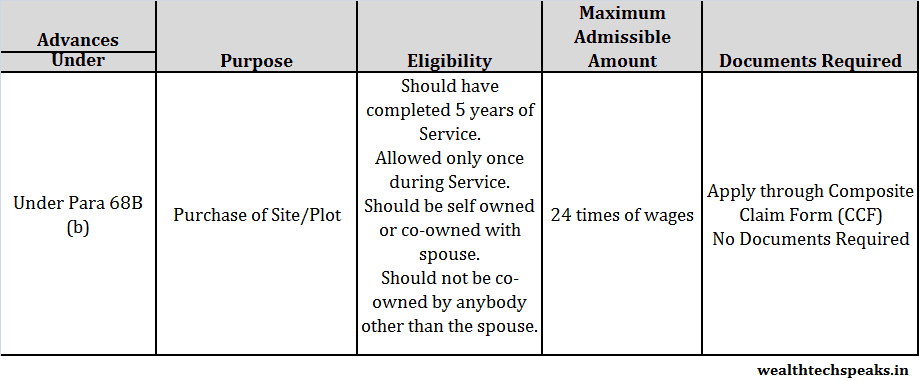

For Purchase of Site/Plot

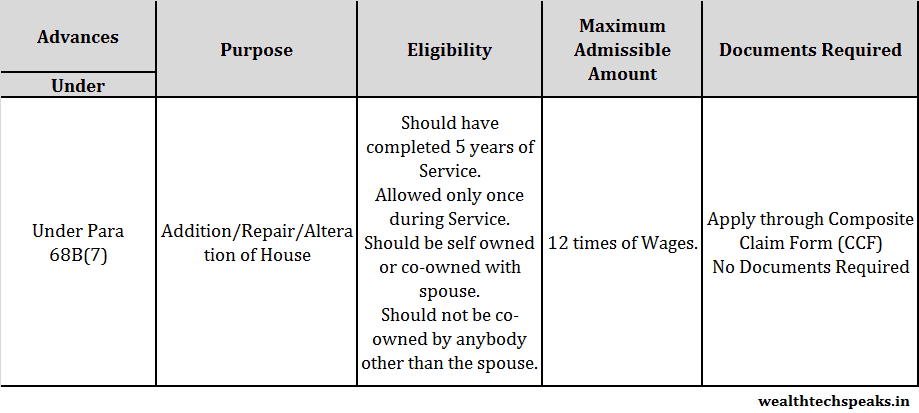

Addition/Repair/Alteration of House

Lockout

If the company is closed for more than 15 days and wages have not been paid for last 2 months then Advance equivalent to wages multiplied by no of months the firm is closed can be availed. Application through Composite Claim Form (CCF).

Withdrawal Prior Retirement

Withdrawal can be made 1 year before retirement when Subscriber’s age is above 54 years. 90% of the Total share can be withdrawn and one can apply through Composite Claim Form (CCF) along with retirement age certificate.

Other Advances

Some advances are also admissible in case of Power Supply Cut and upto 50% in case of any Natural Calamities. In case of latter application through Composite Claim Form (CCF) should be made within 4 months.

Important Points

The amount allowed as advance/withdrawal is not required to be refunded under normal circumstances. If the amount is not used, the same should be refunded with penal interest. A minimum balance in the account is kept before arriving at the amount of advance admissible subject to the above conditions.

You can also read about Employees’ Provident Fund in the Link provided below:-

Employees’ Provident Fund Scheme: Composite Claim Forms For Fund Withdrawal (CCF)

Universal Account Number (UAN): Guidelines for Subscribers

Employee Deposit Linked Insurance Scheme (Amended)

Employees’ Provident Fund Scheme

Employee State Insurance (ESI)

Employees’ Pension Scheme (Series-1)

Employees’ Provident Fund (EPF) Reforms: Online PF Withdrawal/Settlement