Benefits Under Employees’ Pension Scheme (EPS)

- Posted By Amritesh

- On August 25th, 2017

- Comments: 10 responses

Employees Pension Scheme (EPS) is extended to the Subscribers of Employees’ Provident Fund (EPF). The Scheme aims to provide regular income to the respective Individuals post retirement to meet his/her basic necessities.

The Applicability, Coverage and other provisions of the Act have been discussed in my previous post.

You may read my Introductory Post on Employees’ Pension Scheme (EPS) in the link given below:

Employees’ Pension Scheme (Series-1): EPS Guidelines

Employees’ Pension Scheme (Series-3): Calculation of Pension

Employees’ Pension Scheme (EPS): Increase Your Pension with Deferred Withdrawal

Benefits Under Employees’ Pension Scheme (EPS) is discussed below.

Monthly Member’s Pension: Any member shall be entitled to pension:-

On Superannuation if he/she has rendered eligible service for 10 years or more and retires on attaining the age of 58 years.

Early Pension, if he/she has rendered eligible service for 10 years or more and retires or ceases to be in employment before attaining the age of 58 years. Early pensions may be availed between 50-57 years of age. However, the pension will be reduced by 4% for each year falling short of 58 years.

Latest Amendment, provides a provision to the Employee to defer his/her pension up to the age of 60 years with or without contribution. Deferment of pension will earn an additional interest of 4% for each year respectively.

Any Member eligible for pension is entitled to minimum pension of Rs 1,000/- per month.

Leaving Service before being Eligible for Pension: Any member who has not rendered the stipulated 10 years of service on the date of exit or retirement, he/she shall be entitled to withdrawal of benefits.

In case he /she has not attained 58 years of age, they can opt for scheme certificate for continuation of the benefit.

Pension Scheme Certificate

Pension Scheme Certificate is issued who individuals who have not attained 58 years of age while leaving an organization and has requested for the certificate. Member may submit the certificate while joining any new organization and the previous years of service stated in the certificate will be added with the new one. A member can also submit the certificate on completion of 50 years to apply for pension provided he/she has completed at least 10 years of service. Nominee of an Individual holding the certificate is also eligible for pension in case of holder’s death.

Benefits on Permanent and Total Disablement during Service

A member, who is permanently or totally disabled during the employment shall be entitled to pension subject to minimum pension of Rs1,000/- per month, notwithstanding the fact that he/she has not rendered the pensionable service provided that he/she has made at least one month’s contribution to the pension fund.

Benefits to Family On the Death of a Member

Pension to the family shall be admissible from the date following the date of death of the member if the member dies;

While in service, provided that at least one month’s contribution has been paid into Employees Pension Fund, or

After the date of exit but before attaining 58 years of age, from the employment having rendered service entitling him/her to monthly member’s pension, or

After commencement of payment of the Member’s Monthly Pension.

Monthly Widow Pension

The monthly widow pension shall be:-

Equal to the Pension admissible in case the Member had retired on the date of death or exit (as the case may be subject to minimum of Rs 1000/- per month).

In case the member had not fulfilled the eligibility norms for pension still then minimum pension of Rs 1,000/- per month is admissible.

In case the member was already drawing Pension at the time of death then the Pension payable to the Widow will be 50% of the amount subject to minimum of Rs 1,000/- per month.

The monthly pension will be payable till the death of the widow or remarriage whichever is earlier.

Monthly Children Pension

If there are any surviving children of the deceased member, falling within definition of a family, they shall be entitled to a monthly children pension in addition to the monthly widow/widower pension.

Monthly Children Pension for each child shall be equal to 25 percent of the amount admissible to the Widow/Widower.

Minimum monthly pension should not be less than Rs 250/- per month.

Monthly Children Pension will be admissible until the child attains 25 years of age.

Monthly Children Pension will be admissible to maximum of two children at a time and will run from oldest to youngest in that order.

Monthly Orphan Pension

If the deceased member is not survived by any widow but is survived by a child falling within the definition of family or if the widow pension is not payable, the children shall be entitled to minimum monthly pension of Rs 750 per month or 75% of the amount of the monthly widow pension payable.

Monthly orphan pension shall be admissible to maximum of 2 orphans at a time and shall run in order from the oldest to youngest.

If a member dies leaving behind a family having son or daughter who is permanently or totally disabled such son or daughter shall be entitled to payment of monthly children or orphan pension as the case may be, irrespective of age and number of children in the family.

No Nomination or Family

In case the member dies leaving behind no spouse or eligible child then the pension would be paid to dependent father or mother as the case maybe of the member. If the pension is granted to dependent father and in case of death of the father, the pension admissible shall be extended to mother lifelong.

If the deceased had not rendered pensionable service on the date of exit from employment but was a member of EPS then nominee or dependent father or mother is entitled to return of capital contributed.

A person who is not married may nominate a person to receive the benefits, however in due course the member acquires a family subsequently, nomination so made shall become void.

Payment of Pension

The claims complete in all respects submitted along with necessary documents shall be settled and benefit amount paid to beneficiaries within 30 days from the date of receipt by the commissioner.

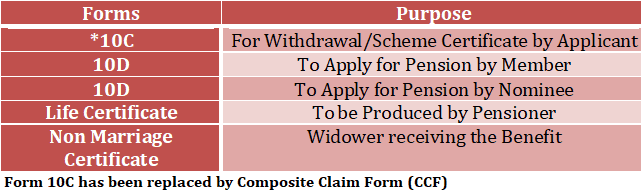

Forms related to Employees’ Pension Scheme (EPS)

EPF: Composite Claim Forms: All You Need To Know

I will discuss the pension calculation in my next post.