Regular Income Plans for Retired & Senior Citizens

- Posted By Amritesh

- On July 3rd, 2021

- Comments: no responses

Retirement is the period wherein Individuals quit their career and permanently withdraw from their active work life. Individuals may retire for various reasons but primarily the retirements are due to age, prevailing health conditions, inability to work for desired duration and so on. Everyone will retire at some point of time irrespective of the fact whether they are in job or business. Very few are able to work as consultant or in advisory role post their retirement, subject to their health conditions & work profile, respectively. One of the significant shifts which comes with retirement is the change in regular source of income for the concerned individual. Regular Income Plans for Retired and Senior Citizens is very much required to meet the basic expenses.

Post retirement, Individuals largely depend on pension (if available) or their hard-earned savings for survival. The ever-rising expenses plus increasing risk of medical exigencies due to advancing age makes it prudent for the retired and senior citizens to plan their finances. Moreover, as the age increases the source of income also tends to dwindle. Furthermore, increase in life expectancy increases the risk of outliving the retirement fund. Senior Citizens need to plan for regular source of income without exhausting the accumulated savings. It is very important for non-pension holders as well as pension holders to park their savings in schemes offering regular source of income without eroding the capital in hand. Ideally, guaranteed regular income plans suits best for the retired and senior citizens as they are risk free, offering periodic returns to the investors.

In addition to the regular income plans for retired and senior citizens, one should ideally invest in comprehensive health cover plan and also create a contingency fund out of the savings to meet any unforeseen expenses.

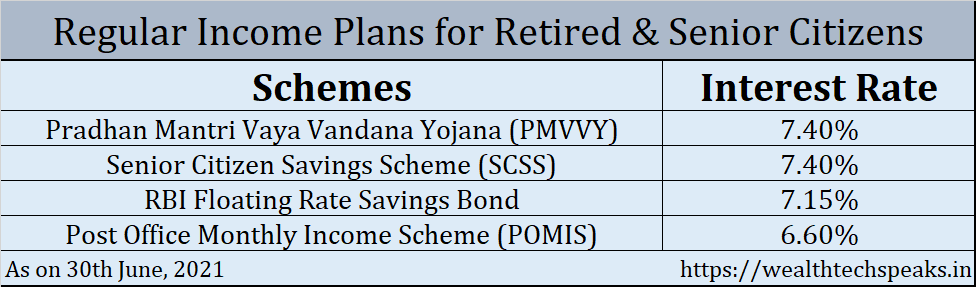

Regular Income Plans for Retired and Senior Citizens

Pradhan Mantri Vaya Vandana Yojana (PMVVY)

PMVVY is a government sponsored scheme which provides guaranteed pension to the Subscribers for a period of 10 years. The scheme is available with Life Corporation of India (LICI) till 31.03.2023. Under PMVVY, Senior Citizens will receive minimum monthly pension of Rs 1,000/- while the maximum monthly pension goes up to Rs 9,250/-. The pension is paid on monthly, quarterly, semi-annually and annually basis as per the preference of the subscriber. The pension is paid out for 10 years and on completion the purchase price (investment amount) is returned to the subscriber. The current rate of interest for the period ending 31st March, 2022 is 7.40% per annum. The minimum subscription amount is Rs 1,56,658/- while maximum limit goes up to Rs 15,00,000/-.

Senior Citizen Savings Scheme (SCSS)

SCSS is another Government backed savings scheme for senior citizens and retired individuals above the age of 60 years. The interest rate offered under the scheme is 7.4% for the period ending 30th September, 2021. The deposit is locked for a period of 5 years with the option to extend the same for another 3 years. The interest is paid out on quarterly basis. Individual may open multiple SCSS account but maximum deposit ceiling is restricted to Rs 15 lacs inclusive of all the accounts. Investment is eligible for deduction under section 80C up to the permissible limit.

The maximum quarterly interest which an Individual may earn is Rs 27,750/-, on maximum deposit of Rs 15,00,000/-.

RBI Floating Rate Savings Bond (FRSB)

Floating Rate Savings Bond (FRSB) introduced by Reserve Bank of India (RBI) offers floating rate of interest to the bondholders. Any Indian citizen is eligible to invest in the FRSB. The minimum investment in these bonds is of Rs 1,000 and there is no maximum limit on investment. The interest is paid out on semi-annual basis, effectively on 1st of January and 1st July. The tenure of the bond is for seven years and interest rate is reset at the interval of every 6 months. Current interest rate is 7.15% for the period ending 30th June, 2021.

The interest on Bond is pegged at additional 35 basis points over the prevailing National Savings Certificate (NSC) interest rate.

Post Office Monthly Income Scheme (MIS)

POMIS is a conventional monthly income plan which is pretty popular among investors. The scheme offers 6.6% interest currently on investment. Depositor needs to have Post Office Savings Account to deposit in POMIS. Again, just like FRSB any Indian citizen may invest in the scheme. The maximum deposit limit for individual account is Rs 4.5 lacs and for joint account the deposit amount limit goes up to Rs 9 lacs. The minimum lock-in period for investment in POMIS is 5 years. Individual deposit holder will receive monthly interest of Rs 2,475/- on maximum investment limit of Rs 4.5 lacs.

Immediate Annuity Plans

Life Insurance Companies also provide retirement annuity plans. However, the returns on these plans are comparatively less. Annuity plans provide various payout option to the policyholder. The annuity received by the annuitant is taxable. Senior Citizens and Retired Individuals may consider these annuity plans only after exhausting all the other regular income plans, provided the returns offered is higher than Bank Term Deposits. Annuity plan suffers from liquidity issue plus mediocre returns on the investment. If an annuitant opts for “Life Annuity with Return of Purchase Price” payout model the return is further depleted. Therefore, Bank Term Deposits may turn out to be a viable option for the Senior Citizens.

Post Retirement Planning

Senior Citizens need to be meticulous with their retirement plans. Regular Income Plans definitely help in meeting the day-to-day expenses. However, the rising cost of living and medical expenses may require retired individuals to plan for additional source of income. Government backed schemes offer risk-free returns on investment for Senior Citizens.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated.

WealthTech Speaks is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in the video is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information and without warranty of any kind, expressed or implied, including, but not limited to warranties of performance, merchantability and fitness for particular purpose.