Best Equity Linked Savings Schemes FY 2022-23

- Posted By Amritesh

- On February 11th, 2022

- Comments: 11 responses

Equity Linked Savings Schemes (ELSS) is one of the popular tax saving investment options among Tax Payers. Not only does the investment offer possibility of higher return but also comes with the shortest lock-in period of just 3 years when compared to other tax saving investment products. ELSS Mutual Funds offer a lot of flexibility to the investors apart from offering higher yields when compared to conventional investment products such as Public Provident Fund (PPF), National Savings Certificate (NSC), Bank Deposits, etc. Best Equity Linked Savings Scheme (ELSS) for investment in FY 2022-23 may also be considered by investors who are yet to make the tax saving investment for Financial Year 2021-22.

Selection of Right Mutual Funds for Investment

ELSS Mutual Funds offer hassle free investment option to the investors. Individuals may invest in ELSS Mutual Funds from the comforts of their home and track the investments on their smartphones using a dedicated Mutual Fund tracker app. ELSS Mutual Fund allows investor to invest in Lumpsum or via Systematic Investment Plan (SIP). Millennials are turning to mutual funds for investment as it not only offers higher returns but also helps in tax savings.

In traditional investment products, liquidity is an issue as lock-in period is for a minimum of 5 years. Even though these schemes offer guaranteed returns but they do carry the interest rate risk as the rates gets adjusted on quarterly basis. On the other hand, ELSS comes with a lock-in period of 3 years, since the return is market linked it also carries a certain degree of risk. However, the past data clearly suggests that the Mutual Funds offer higher returns when compared to Traditional Investment Schemes. The benchmark return for ELSS Mutual Funds hovers around 16% for decade old investments. Moreover, Individuals falling under the highest tax bracket may save up to Rs 46,800/- in form of tax deductions. The tax deduction is available under Section 80C on investments up to Rs 1.5 lacs under the Old Tax Regime.

Best Equity Linked Savings Schemes (ELSS) in 2022-23 for Investors

Past performance by no means guarantees that the Fund will continue to outperform in the future as well. However, it does help the Investor to take an informed decision. Apart from past performance, Investors also need to consider few other factors as well before starting with their investment. Investment in Mutual Funds requires patience and investors should remain invested for minimum of 5-7 years to witness substantial appreciation of wealth. In this post, I will not only discuss the popular ELSS Mutual Funds for investment but also briefly highlight few new Funds which may outperform and offer good returns in the future. Investors need to take an informed decision and consult their financial advisors before investing.

The financial objectives should be clear in the mind of the investor before investing. One should bear in mind that investment in capital market is prone to volatility and patience is the key to earn good returns on investment.

Features of Equity Linked Savings Schemes (ELSS)

1. Investment in ELSS Mutual Funds offer tax benefit up to Rs 46,800/- under Section 80C.

2. ELSS Mutual Funds has the shortest lock-in period of 3 years.

3. Investment in ELSS Mutual Funds has the potential of offering higher returns when compared to conventional Investment products.

4. Since the investment is deployed in Capital Market it is prone to market volatility.

5. Investment in Mutual Funds is easy and hassle free.

6. ELSS enables Investor to plan and achieve long term financial objectives.

Selection of Equity Linked Savings Schemes (ELSS) Fund

Number of ELSS Mutual Fund schemes are on offer from various Asset Management Companies (AMCs). It often confuses the investor, interested in investing in Mutual Funds. However, some amount of research always helps in picking up the right Fund for investment. Past performance may serve as an indicator but does not assure of future performance. However, investors may consider following points while selecting ELSS Mutual Funds for investment. It is also very important to consult your Financial Advisor before investing.

Consistency

Consistency in performance is essential for mutual funds since investment is spread over a long period. Steady funds are less volatile compared to their benchmark index and peers. ELSS Mutual Funds performing consistently over a period of time (7-10 years) is considered ideal for investment. Since the capital market is highly volatile, funds with least downside risk restricts the possibility of capital erosion.

Asset under Management (AUM)

Even though larger AUM does not directly relate to the performance of the fund. It does provide necessary insights to the investor about the Fund. Larger AUM showcases the confidence of the investors in the particular fund. In general, these funds are consistent with their performance and expertise of the Fund Managers adds to the credibility of the funds.

Comparison with Benchmark Index

Benchmark Index helps to measure the performance of the respective Mutual Fund. Ideally, best performing Mutual Funds should match or outperform its respective benchmark. Investor should measure the Mutual Fund yield with the respective benchmark to have a clear idea about the performance. It is a very transparent way to analyze the performance of the respective fund.

Expense Ratio of the Fund

Every Mutual Fund has certain percentage set aside to cover the administrative, management and other relevant charges related to the fund. The allocation to meet such expenses is known as the Expense Ratio. The expense ratio is borne by the investors. High expense ratio impacts the profitability. Therefore, low expense ratio is favorable for the investor.

ELSS Mutual Fund Portfolio

Mutual Fund schemes basically invest the pool of funds in large number of equities. On an average, a Mutual Fund scheme invests in 40-50 stocks and the performance of these stocks reflect in terms of Mutual Fund returns. Therefore, a little research about the stocks included in the portfolio will further enable the investor to assess the performance of the fund.

Risk Adjusted Return

Risk adjusted return helps us to measure the risk taken by a fund to earn the actual return. Sharpe Ratio is one of the ways to measure the risk-adjusted returns. This helps to analyze the Fund performance and indicates the risk associated with the investment. This may sound confusing for young investors, but experienced and veteran investors may evaluate the risk adjusted return before investing.

Research about the Fund Managers

Mutual Funds are primarily managed by the Fund Managers. Therefore, it is very important to check the profile of the Fund Managers. Experienced Fund Managers have a track record which helps us evaluate their past performance. Since they are responsible for managing large pool of funds, it is important to do a bit of research about the Fund Manager.

Best ELSS Mutual Funds for Investment in Financial Year 2022-23

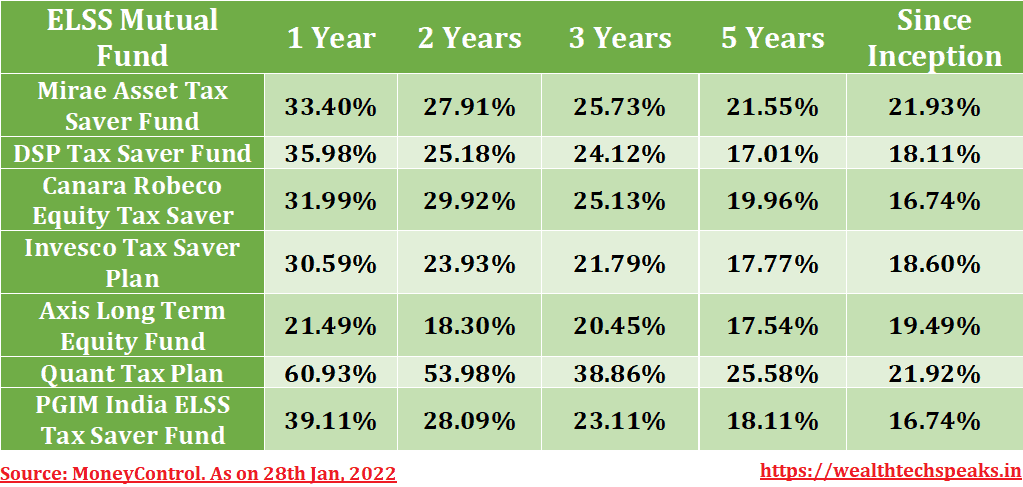

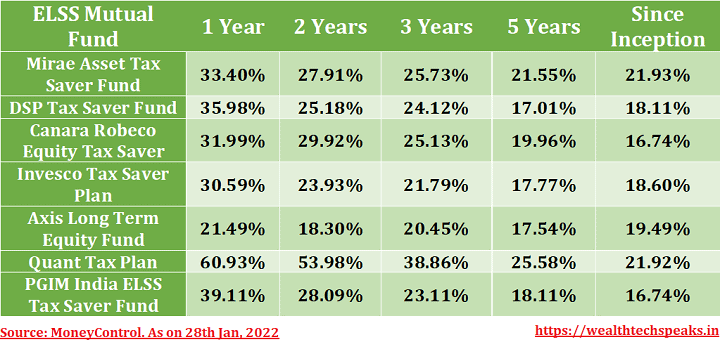

Following ELSS Mutual Funds have delivered consistently for the investors. Apart from tax saving, these funds have generated good returns in the past.

Mirae Asset Tax Saver Fund has been a consistent performer for few years now. The fund has consistently delivered good returns to the investors. Even the risk-return ratios appear favorable for the Fund. Individual looking to invest in ELSS Mutual Fund may consider investing in the fund. Rest of the mutual fund schemes in the list have also performed well and delivered decent returns in the past. Individuals may diversify their investments in more than one schemes but ensure that the Fund’s portfolio is diversified. Implying, if an investor is investing in Fund which predominantly includes large cap stocks, then for diversification, he or she should select another Fund which focuses on stocks from mid or small cap space. Most of the ELSS Funds primarily invest in large cap stocks, one should look for Funds which are different in terms of investing in Mid or Small cap funds.

DSP Tax Saver Fund and Axis Long Term Equity Fund have been consistent performers, with large AUMs. Thus, investors have ample choices for investment in ELSS space.

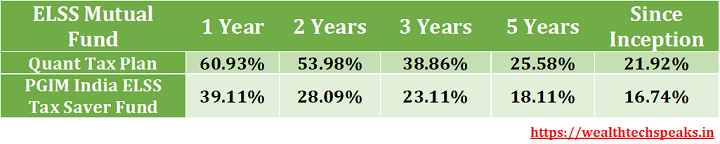

Promising ELSS Mutual Funds for Investment in FY 2022-23

In my opinion Quant Tax Plan and PGIM India ELSS Tax Saver FUND have shown promise and may continue to outperform in the coming few years. The funds have performed well in the recent past and the current asset allocation and trajectory looks good for the future. Investors looking for alternative ELSS funds to invest, may consider investing in any of these funds as they have outperformed many of the established funds in the last few years. Quant Tax Plan and PGIM India ELSS Tax Saver Fund portfolio also appears diversified. As Quant Tax plan has fair amount of exposure in the Small Cap space while PGIM is largely centered around the Large cap stocks. Therefore, investors may take a serious look at these two funds for investment.

Investment Guide: Equity Linked Savings Schemes (ELSS)

Experienced Investors may not face much problem while investing in Mutual Funds. But young individuals who do not have much idea about the financial market should consult a Financial Advisor before investing. Investment in Direct Mutual Fund Plan may prove beneficial. However, if one is confused about investment then consulting an investment advisor makes sense.

In my opinion, investors should look beyond traditional plans for tax savings. Equity Linked Savings Schemes (ELSS) is a great option for tax saving as well as wealth creation. Short lock-in period combined with decent returns makes it an ideal financial product for investment. However, investor should allow adequate time for the investment to grow. Ideally, period of 5-10 years is required for the investment to grow.

Individuals looking to invest in ELSS Mutual Funds may connect at admin@wealthtechspeaks.in for investment guidance and advice. We do offer investment in regular ELSS mutual funds for the interested investors.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content. In case you are interested in investing in Stocks, get your free Demat today (Click Here).

Wealthtech Speaks is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this site is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information and without warranty of any kind, expressed or implied, including, but not limited to warranties of performance, merchantability and fitness for particular purpose.

Great ? I should certainly pronounce, impressed with your website. I had no trouble navigating through all tabs as well as related info ended up being truly simple to do to access. I recently found what I hoped for before you know it in the least. Quite unusual. Is likely to appreciate it for those who add forums or something, web site theme . a tones way for your client to communicate. Excellent task..

Thank you a bunch for sharing this with all of us you actually know what you are talking approximately! Bookmarked. Please additionally consult with my site =). We could have a hyperlink alternate contract among us!

There are some attention-grabbing deadlines in this article but I don?t know if I see all of them heart to heart. There may be some validity however I will take maintain opinion till I look into it further. Good article , thanks and we want extra! Added to FeedBurner as effectively

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You definitely know what youre talking about, why throw away your intelligence on just posting videos to your weblog when you could be giving us something informative to read?

This is very interesting, You are a very skilled blogger. I have joined your rss feed and look forward to seeking more of your great post. Also, I’ve shared your website in my social networks!

Hi there, just became aware of your blog through Google, and found that it’s truly informative. I?m going to watch out for brussels. I will appreciate if you continue this in future. Numerous people will be benefited from your writing. Cheers!

Magnificent beat ! I wish to apprentice at the same time as you amend your web site, how could i subscribe for a blog site? The account helped me a appropriate deal. I have been tiny bit acquainted of this your broadcast offered vivid transparent concept

I’ve observed that in the world nowadays, video games are classified as the latest trend with kids of all ages. Periodically it may be extremely hard to drag young kids away from the games. If you want the very best of both worlds, there are various educational games for kids. Interesting post.

Thanks for discussing your ideas here. The other thing is that whenever a problem takes place with a laptop motherboard, people today should not have some risk associated with repairing it themselves for if it is not done properly it can lead to permanent damage to all the laptop. In most cases, it is safe to approach any dealer of that laptop for any repair of its motherboard. They have got technicians that have an competence in dealing with laptop computer motherboard challenges and can make the right analysis and undertake repairs.

I just could not leave your web site before suggesting that I really enjoyed the standard information a person supply to your visitors Is gonna be again steadily in order to check up on new posts

Your blog is a testament to your dedication to your craft. Your commitment to excellence is evident in every aspect of your writing. Thank you for being such a positive influence in the online community.