Best Direct Mutual Fund Investment Platforms

- Posted By Amritesh

- On March 31st, 2019

- Comments: 6 responses

Investment in Mutual Fund is gaining significance as more and more Individuals are considering it as a viable investment avenue. Higher Return on Investment, Tax Efficiency and Shorter Lock in Period on Tax Saving Funds (ELSS) make Mutual Fund an attractive investment platform for the investors. With the increase in number of Individuals investing in Mutual Funds, regulatory authority decided to make the investment in Mutual Fund (MF) even more attractive more investors. Hence, In 2013 Securities Exchange Board of India (SEBI) ordered all Mutual Fund houses to introduce direct plans of all the existing schemes. Direct Mutual Fund plans may be directly purchased from the respective Mutual Fund house via online or offline mode, without paying brokerage/commission on such investment. The savings made on the brokerage is passed on to the Investors in form of lower expense ratio of the respective fund.

The return on such Direct Plans is slightly higher when compared to Regular Funds. Direct Mutual Fund plans may be directly purchased from the respective Asset Management Company (AMC) or from any of the MF aggregators offering Direct Mutual Fund plans online.

Difference between Direct and Regular Plan

Direct Mutual Fund Plans

Many of the Investors are unaware of the brokerages/commissions levied on investment in Regular Mutual Fund Plan. Mutual Fund Distributors, Brokers and Broking Firms levy brokerages on the investment in Regular Mutual Fund plans. These charges are included in the expense ratio of the fund. Brokerage charges vary from 0.1% to 1.5% depending on the size and nature of the fund. This may not sound significant, but in the long run it may turn out to be substantial amount. However, Mutual Fund houses (AMC) and few of the online portals do offer direct mutual fund plans for the investors. Therefore it is advisable for the investors to invest in Direct Mutual Fund Plans via platforms offering the same, provided the investor has good knowledge about Mutual Funds. Otherwise, seeking guidance of an experienced Financial Advisor is a wise option.

Reduced Total Expense Ratio (TER)

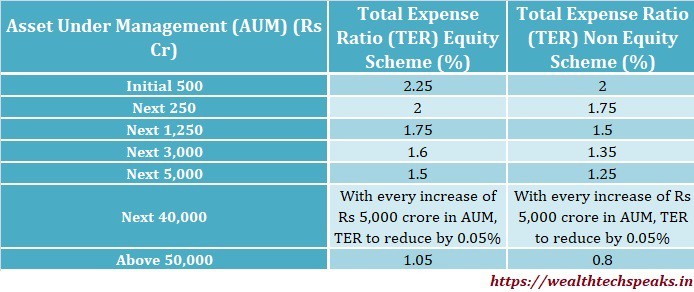

Total Expense Ratio (TER) comprises of Management Fee, Administrative Fee & Distribution Fee. SEBI has specified TER upper limit of 2.25% for Open Ended Equity Schemes, and 2% for other open ended schemes. TER of Mutual Funds is based on the size and nature of fund. TER of Regular Fund is higher when compared to Direct Fund as it includes the commission or brokerages payable to the intermediaries. In general, TER comes down as AUM size increases.

Direct Mutual Plan is available on the respective Fund portal and also on few of the other platforms, but Individual may be confused regarding the differentiating factor between Regular and Direct Plan.

Even though, it is very simple to differentiate between Regular and Direct Plan. Each AMC manages two separate Funds, Direct and Regular. The same is clearly spelled out in the Fund name itself.

Advantages of Investing in Direct Mutual Fund

Direct Platforms allows Individuals to easily invest in Mutual Funds and manage the Fund on their own. Individual is free to choose the investment product and invest as per his/her convenience. Most of the online investment portal is very easy to use and Individual may easily initiate investment online.

Low Expense Ratio

Expense Ratio of Direct Mutual Fund is lower when compared to Regular Mutual Fund as it excludes the commission paid to the intermediaries. The Expense Ratio varies depending on the Nature and Type of Fund.

Higher Net Asset Value (NAV)

Direct Mutual Fund plan NAV is higher in comparison to Regular Mutual Fund, as commission/brokerage paid to the intermediaries is excluded.

Comparatively Better Returns

Since the expense ratio is less, return under Direct Plan is comparatively higher. Investors stand to gain significantly in the long term under Direct Plan as returns get compounded.

Disadvantages of Investing in Direct Mutual Funds

Direct Mutual Funds may not be for all, as Individuals has to manage the investment on their own and without proper knowledge about mutual funds same may not be possible.

Lack of Expertise

In absence of proper guidance it may be difficult for first time investor or novice to invest in the right Mutual Fund plan. Thus in such a scenario opinion of the Broker/Agent may be helpful in taking the investment decision. However, in case the Investor has knowledge about Mutual Fund or has hired fee based SEBI registered Financial Advisor then it makes sense in investing in Direct Mutual Fund Plan.

Self Management of Investment

Individuals need to manage the investment and complete the documentation processes themselves which may be a problem for some as it requires bit of time, dedication and expertise. Moreover, in case of multiple investments Individual may be required to keep track of the investment on multiple platforms which may be a cumbersome task in itself.

Understanding of Total Expense Ratio

Most Investors fail to understand the Total Expense Ratio associated with the investment. Many of the Funds have a higher expense ratio when compared to other Funds, thus the return is impacted due to such deductions. Thus one requires clear understanding of TER before investing. In fact, one should compare the TER and Performance of Direct and Regular plan of the respective Fund to understand the difference. SEBI has put a cap on the Expense Ratio for the funds. In some cases it has been observed, the difference between Direct and Regular Plan is nominal.

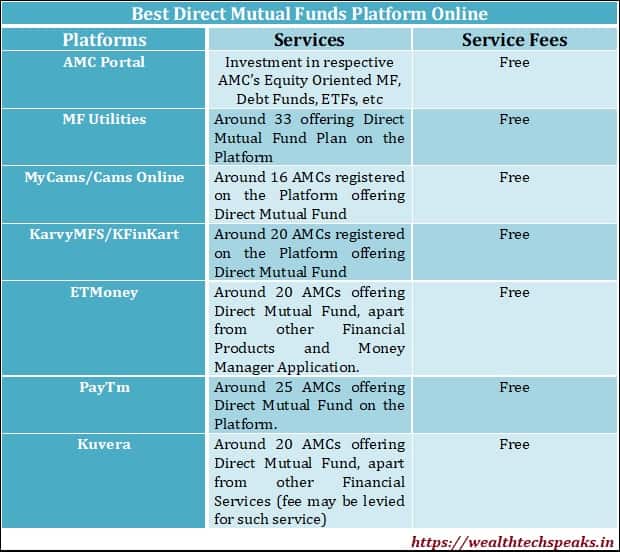

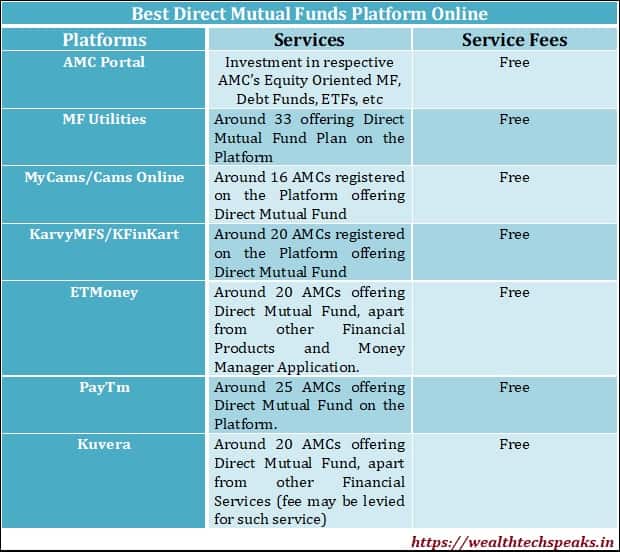

Direct Mutual Fund Investment Platforms

Direct Mutual Fund Plans is available for the investors online through various platforms. Investors may visit any of the following site/s and register themselves to start directly investing in Mutual Fund plans. These platforms do not charge any fee for the service provided. Currently, more than 20 platforms offer Direct Mutual Funds. However, I have considered free & nominal cost platforms available to the Investors.

In my opinion, Individuals may opt for respective AMC portal for investment as better customer support is available through them. In case, Individual is interested in investing in multiple funds, platforms such as MF Utilities/My Cams/Karvy MFS/ET Money/PayTm Money will be ideal for such purpose. Apart from the above mentioned Platforms, some of Discount Broker Firms also offer Direct Mutual Fund plans. However, such Discount Brokering Firms levy nominal charges for the service provided. Zerodha and Invezta are examples of such types of firms. Some of the platforms also extend Robo Advisory support the Investors at nominal cost to enable Individual make the right choice of investment.

Personally, I did use MyCams for investment and my experience was good on the platform. I have also used some of the AMC specific portal, found the end user experience to be pretty smooth.

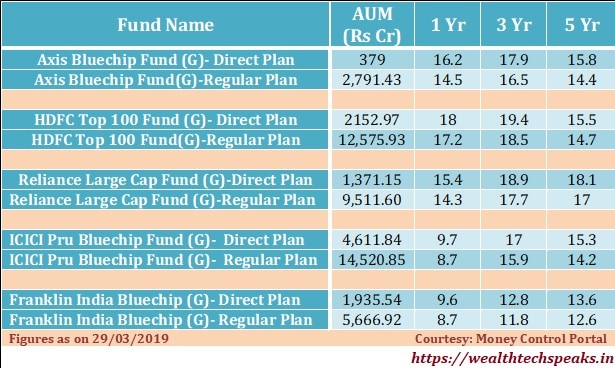

Comparison of Investment in Direct and Regular Mutual Fund

Chart provided below is the Performance comparison of the Direct and Regular Mutual Fund Plan. This clearly points out the advantage of investing in Direct Mutual Fund plan.

The return on Direct and Regular Plan is clearly stated in the chart above. This should help Individuals to understand the difference and help them with their investment decision. It should be noted, Individuals new to Mutual Funds or facing difficulty with their financial decisions should take guidance from certified Financial Advisor before investing.

This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.