Best Equity Mutual Funds FY 2021-22

- Posted By Amritesh

- On June 20th, 2021

- Comments: 13 responses

Investment in Mutual Funds is gaining momentum in India. The falling rate of interest in Bank Deposits and Small Savings Schemes has prompted investors to explore mutual funds for investment. Association of Mutual Funds in India (AMFI) has also initiated a lot of awareness campaigns to educate and build confidence among people regarding investments in Mutual Funds. The past performance also suggests investment in equity mutual funds yield higher returns in comparison to fixed return instruments. However, investment decision should not be based only on the past performance alone, since it does not guarantee about the future performance. In this post, we look at potentially the Best Equity Mutual Funds for investment in Financial Year 2021-22.

Ways to Select the right MF for Investment

Currently, around 4% of the Indians invests in Equities while Asset under Management (AUM) to GDP ratio stands at 12% in India. In United States, roughly 55% of the population invest directly or via the mutual fund in stocks. Even the global average of AUM/ GDP stands at 60%. This implies that investment in Mutual Funds is rising but it is still behind the global trend. However, the millennials are turning to mutual funds which is promising for the industry.

Free Demat Account- Flat Fee, Zero Commission MF (Click)

Equity Mutual Funds predominantly invest the pool of funds in equity stocks. The Mutual Funds performance depends on the Securities in which the fund is invested. Investment in Equity Mutual Fund carries an element of risk and investors should take an informed decision while investing. In my previous article, I have discussed about key points to keep in mind while selecting best Mutual Funds for investment.

Key Considerations for Best Mutual Funds for Investment

Expense Ratio

Mutual Funds is pool of funds managed by respective Fund Managers. Now expenses are incurred in operation & management of the fund. Expense Ratio is the percentage of the fund required to meet management, administration, advertising, distribution and other expenses. Expense Ratio of mutual fund scheme is calculated by dividing Total Expenses by Value of Asset Under Management (AUM). It is the percentage of the investment used to meet the overhead expenses of the fund and does not yield any return.

Expense ratio of Regular Mutual Fund plan is higher than Direct Mutual Fund plan, as it includes distributor/agent’s commission. Furthermore, expense ratio for passive mutual funds is the lowest as they replicate their benchmark indexes. However, expense ratio is different for every Mutual Fund scheme. It is important for investor to consider the expense ratio of a fund before investing as it impacts the overall return. Expense ratio below 1% for active funds may be considered acceptable in my opinion.

Fund Manager Expertise

Fund Manager plays a pivotal role when it comes to management and performance of the mutual fund scheme. Therefore, it is very important to do a bit of research regarding the track record and the experience of the Fund Manager. Mutual Fund Schemes invest in number of stocks from various industry. Fund Manager has to decide regarding the investment with respect to Industry and Stocks to be included in the investment basket. The decision related to investment taken by the Fund Manager reflects in the performance of the fund.

Investors need to evaluate the performance of the Fund Manager before investing in the particular Mutual Fund Scheme.

Past Performance

Even though past performance is not the guarantee of future performance. It still helps to form an idea about the fund. Investors should look for consistency in the performance of the funds. Funds will offer returns depending on the market sentiments but inconsistent funds should be avoided. Just one- or two-year performance is not enough, minimum 5 years performance helps to understand the volatility associated with the Fund.

Portfolio Allocation- Diversification

Mutual Funds allocate funds in number of stocks belonging to different sectors. The idea is to diversify the portfolio to mitigate risks and maximize returns. A study regarding the same helps the investor to understand the exposure level of any particular Mutual Fund scheme, sector & stock wise.

Even though the allocation may undergo few changes, it helps the investor to take an informed decision regarding the Fund.

Risk Ratios

Investors also need to evaluate the risk associated with the investment. The risk-reward ratio helps to understand the quantum of risk taken by the fund to earn the return. It also helps to understand the volatility associated with the fund. Investors should take an informed decision while investing in Mutual Fund schemes as it involves certain amount of investment risk. Investors interested to invest in Mutual Funds may do so based on their risk tolerance level. The risk ratios help investors to understand the risk involved with the investment in the Fund. Standard Deviation, Beta, Sharpe Ratio, Treynor’s Ratio are some of the ratios used to assess the investment risk.

Standard Deviation and Beta help to assess the volatility associated with the fund. Whereas, Sharpe & Treynor’s Ratio help to understand the risk-adjusted return on investment.

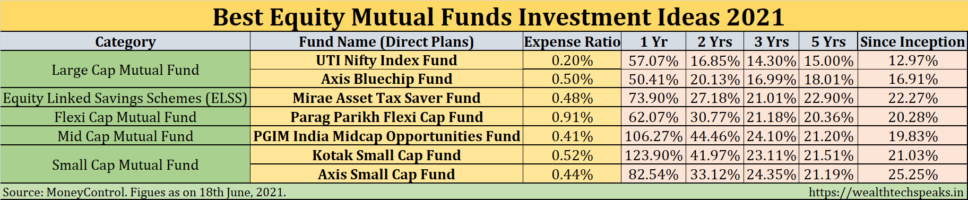

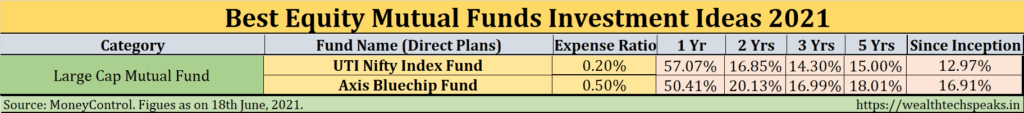

Best Equity Mutual Funds for Investment: Large Cap Mutual Fund

Large Cap Equity Mutual Funds allocate majority of their fund in the companies with large capitalization. Primarily, as per the recent SEBI Recategorization and Rationalization, Large Cap Equity Mutual Funds need to invest minimum of 80% of their funds in top-100 stocks. So, the recent regulation has narrowed the scope for the fund managers with regard to portfolio allocation but the decision also mitigates risk for the investors.

In my opinion, UTI Nifty Index Fund and Axis Bluechip Fund are decent picks for investment. Expense Ratio of both the plan is pretty low and is expected to offer good returns on investment. Investors looking to remain invested for 5-7 years may consider investing in Large Cap Mutual Funds as downside risk is relatively low.

UTI Nifty Index Fund: Index Fund replicate specified stock market index such NSE Nifty, Sensex, etc. Index Funds are passive funds. The expense ratio is very less for these funds. UTI Nifty Index Fund has performed consistently in the last 5 years. The expense ratio for the Fund is also very low. Since the fund mirrors the performance of the specific basket of stocks the associated risk is relatively less. UTI Nifty Index Fund is expected to generate steady returns for the investors over a period of time. Investors should remain invested for at least 5-7 years to generate decent return on investment. However, Index Funds lack flexibility as performance is tied to the respective index returns. Lack of downside protection is another cause of concern for index funds, active funds are fare relatively better when index is declining sharply.

Income Tax Slabs & Rate for Financial Year 2021-22

Axis Bluechip Fund: The fund is offered by one of the trusted players in the Mutual Fund industry. Axis Bluechip Fund has performed considerably well in the recent past. The expense ratio for the fund is merely 0.5% which is commendable for an active fund. The allocation of investment is across sectors with primary focus on Technology and Finance, the key drivers in my opinion. Investors looking to invest for considerable period of time may consider investing in Axis Bluechip Fund. However, one should keep in mind that even though the expense ratio is less, it is still considerable higher when compared to Index Funds. Furthermore, the Index Funds have outperformed the Active Funds in past 2-3 years.

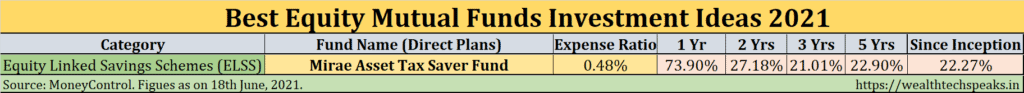

Best Mutual Funds for Investment: Equity Linked Savings Scheme (ELSS)

Equity Linked Savings Schemes (ELSS) mutual fund is popular investment plan among tax payers. It provides dual benefit of investing in equity mutual fund and tax deduction under section 80C at the same time. ELSS funds has the shortest lock-in period of just 3 years among tax savings investment schemes. ELSS need to allocate minimum of 80% of their funds in equities or equity oriented mutual funds. However, Fund Managers have the option of dynamic fund allocation which may be in favor of the investors as it increases the potential of higher returns.

Mirae Asset Tax Saver Fund: ELSS Tax Saving Plan from Mirae has outperformed the benchmark on consistent basis. The expense ratio for the fund is less than half a percent which is good for an ELSS fund. The portfolio is well diversified in the Large Cap, Mid Cap and Small Cap space. The noticeable holdings are in the Banking & IT sector which again is expected to do well in coming years. Individuals looking for ELSS fund may consider Mirae Asset Tax Saver Fund as investment option provided one is looking to remain invested for at least 6-8 years.

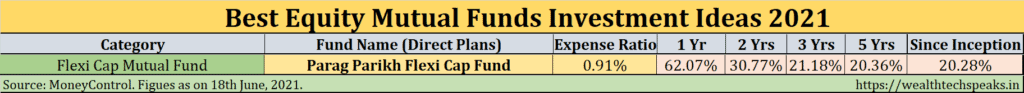

Best Equity Mutual Funds for Investment: Flexi Cap Mutual Fund

SEBI introduced a new category of Fund for the Fund Managers who did not want to alter the fund to fall in line with norms set for multi cap funds. Flexi Cap funds appear to be good investment option in the long run as the allocation is distributed in the large, mid and small cap which exposes the fund to potential high return investments. Funds need to allocate at least 65% of the fund to the equity and equity-oriented funds. Flexi Cap funds have the freedom of dynamic fund allocation which makes it an interesting option for investment.

Parag Parikh Flexi Cap Fund: The fund has been doing exceedingly well in the recent past. The fund also has good exposure in overseas equities. The fund has a good track record with major portfolio allocation in the large cap segment. Investors may consider investing in this fund for better yields. However, the expense ratio of the fund is slightly on the higher side, but fund appears to be a good investment option for most of the investors.

Portfolio Allocation of more than 55% of the fund in IT & Financial services basket shows the confidence of the Fund Manager in the growth of the concerned sectors.

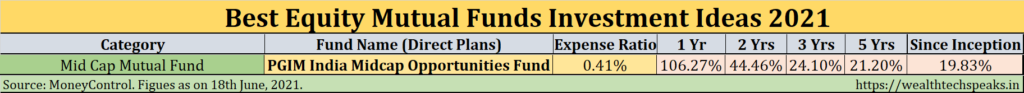

Best Equity Mutual Funds for Investment: Mid Cap Mutual Fund

Mid Cap Funds primarily invest 65% of their assets in equity and equity oriented mid cap funds. These funds have higher growth potential when compared to Large Cap Funds. Mid Cap Funds have consistently outperformed the benchmark returns which makes them a popular investment option for long term investors. However, since the mid cap segment constitutes of growing companies, the funds experience higher volatility in this segment.

PGIM India Midcap Opportunities Fund: The fund has consistently outperformed the benchmark index. The fund is well diversified into mid and small cap. The expense ratio is just 0.5% and since its inception it has yielded returns in excess of 20%. The fund has potential to deliver in the future as well. Investors with moderate to high risk tolerance level may consider investing midcap funds for higher returns.

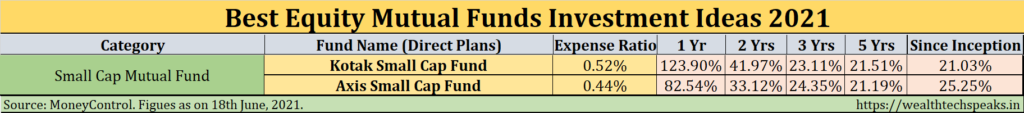

Best Equity Mutual Funds for Investment: Small Cap Mutual Fund

Small Cap Fund is more suited to investors who are interested in high risk, high return investment options. Funds allocate 65% of their assets in equity and equity oriented small cap funds. These funds are highly volatile in nature but since investment is in emerging stocks the potential returns are expected to be higher when compared to other funds.

Kotak Small Cap Fund: Investors with high risk tolerance level may explore Kotak Small Cap Fund for investment. The fund had done exceedingly well in the last few years. The expense ratio of the fund is also acceptable. The portfolio also looks well diversified in the small cap space so investors may consider this stock for investment.

Axis Small Cap Fund: Axis is one of the established names in the mutual fund industry. Most of their funds are doing exceedingly well. In the Small Cap space too, Axis Small Cap Fund has performed well over the years. The fund may be considered for investment by long term investors. The expense ratio of the fund is quite low, the asset allocation in small cap space is diversified into wide range of sector.

Get Your Free Demat Account- Flat Fee, Zero Commission MF (Click)

Investment Advice

Investment in Mutual Funds does carry an element of risk so please understand your financial objectives before investing. Returns should not be the only criteria to choose Funds for investment. Investor should also evaluate the downside risks before investing. Each Fund is designed to fulfill certain objectives, aiming to balance risk to reward ratio. Investors need to take an informed decision. Investors need to balance their portfolio with investments in equity and debt schemes. Ideally, 60% investment should be in equity and 40% investments in debt instruments such as PPF, Debt Mutual Funds, etc.

It is always advisable to discuss with your Financial Advisor to get a clarity regarding investments which will help you achieve your financial goal.

WealthTech Speaks is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in the video is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information and without warranty of any kind, expressed or implied, including, but not limited to warranties of performance, merchantability and fitness for particular purpose.