Top Equity Mutual Funds Investment in FY 2019-20

- Posted By Amritesh

- On May 20th, 2019

- Comments: 7 responses

Investment in Mutual Fund in India has gained momentum in the last decade, a report by Association of Mutual Funds of India (AMFI) and Global Analytics Firm Crisil confirms the same. Mutual Fund industry has grown @12.5% on an average in last 10 years as per reports and future remains robust as SEBI introduces new changes in the interest of the investors. The industry has gained pace with the investment friendly schemes such as Systematic Investment Plans (SIP) and Tax Saving (ELSS) Mutual Funds. Mutual Fund offers wide range of investment options based on the risk tolerance & planning horizon of the Individuals. Planned Investment in Mutual Funds allows Investor to achieve the desired financial objectives. In this post I would pick the Top Equity Mutual Funds Investment in FY 2019-20 in my opinion.

However, Individuals need to be cautious while investing in Equity Oriented Funds and should take an informed decision in order to achieve the financial objectives. Recently a report published in a leading financial daily quoted SIP returns at 10.26% in the last 5 years which easily beats the return on Fixed Deposits, PPF, NSC and Endowment Insurance Plans.

Investment in Mutual Funds

Investors invest in Mutual Funds with the aim to maximize returns to meet future financial obligations and objectives. Apart from being an attractive investment product, tax benefits and short lock in period makes it a popular investment option, especially among millennial. ELSS Funds come with just 3 years lock-in period while Equity Oriented Mutual Funds held for 12 months or more qualify as Long Term Capital Gains, with regard to computation of tax. However, Investment in Mutual Funds is prone to fluctuations in the capital market so Investors need to carefully evaluate the Funds before investing. Investor may opt for investment based on their risk appetite, financial objectives, inflationary trend, etc.

Investors also need to understand diversification of fund is important. However, excessive diversification of fund is not good for investors. Hence, instead of investing in numerous schemes one should restrict self to 3-4 funds covering maximum sectors and market caps.

Investment Planning

Investors need to develop a proper financial planning before investment. Without proper plan Individual will not be able to achieve his/her financial objectives. Investment in Equity Mutual Funds provides better returns but one needs to patient and remain invested for minimum of seven years. Investment should be planned in accordance with the time horizon for the same, short term investment should be focused more on Debt Funds and Fixed Return Plans.

Parameters used for Selection of Top Equity Mutual Funds

Selection of the right fund is very important for Investors. Individuals need to be careful while investing in Equity and Equity Oriented Funds, as the returns vary heavily based on the volatility in the Capital Market. Even though, past performance cannot be a foolproof indicator of the future performance but it would enable investor to take an informed decision.

Equity Mutual Funds allocates its asset in diversified stocks and returns on these investments impact the performance of the Fund.

Risk Ratios

Evaluation of risk associated with Mutual Fund schemes is very important. Mere comparison of fund returns with its benchmark index may not be sufficient to determine the viability of the Fund. Risk Ratios helps in analyzing the risk-reward relation and volatility associated with any particular Fund enabling investors to pick the right fund for investment.

Standard Deviation is the measurement of the volatility of the fund’s return with respect to the average. It determines the deviation in fund’s return with respect to the mean return of the scheme. Lower deviation means less volatility for the Fund.

Asset under Management (AUM)

It may not appear as a critical factor. However, it lends creditability to the Fund which is crucial for the Investment. It provides cue about the performance of the Fund. Some large AUM may witness slow growth over short duration but they do tend to perform well over the long term. In my opinion Funds with AUM above Rs 1,000 crore lends more credence to the Funds.

Fund Performance: Consistency

Consistent Performance instills confidence among the Investors regarding investment in the particular Fund. Any mutual fund outperforming the benchmark indices and category average consistently is bound to gain favor among investors. It also speaks well about the fund managers managing the respective fund.

Expense Ratio

Expense Ratio is the percentage of fund charged as operating expense by the Asset Management Companies (AMC) to manage the pool of funds. Expense Ratio comprises of administrative cost, management fee, marketing & distribution expenses. Expense Ratio impacts the return on investments. Expense Ratios ranges from 0.1% to 2.5% in India. Moreover the Expense Ratio on Direct Mutual Fund plan is considerably lower when compared to the Regular Plan.

Passively managed funds such as Index Fund have the lowest expense ratio among Mutual Funds.

Thus, Individual needs to take all these aspects into consideration before investing.

Mutual Fund Ratings

Credit Rating agencies rank the Mutual Funds based on set criterion. Ratings may not always accurately reflect the future performance of the fund. But it provides an insight about the fund performance and stability in comparison to its peers. These ratings are based on certain parameters such as Past Performance, Returns, Volatility, etc.

Thus, Mutual Fund Ratings is helpful in taking investment decision.

Tax Implications

Tax Saving Mutual Funds (ELSS) come with 3 years lock-in period and capital gains up to Rs 1,00,000/- is exempt from tax, but gains exceeding Rs 1 lac is subject to Long Term Capital Gain (LTCG) levied @10% without the indexation benefit. Investment in ELSS Fund is eligible for tax deduction U/S 80C up to the maximum limit of Rs 1,50,000/- (Rs 1.5 lacs).

Non Tax Saving Equity Mutual Funds need to be held for 12 months or more in order to qualify as Long Term Investment. Long Term Capital Gain (LTCG) tax is applicable on such investments. LTCG in excess of Rs 1 lac is taxed @10% without the indexation benefit.

In case, the investment in Equity Mutual Funds is redeemed before completion of 12 months, the gains is regarded as Short Term Capital Gain (STCG). Thus STCG tax @15% is levied on such gains.

Top Equity Mutual Funds Investment in FY 2019-20

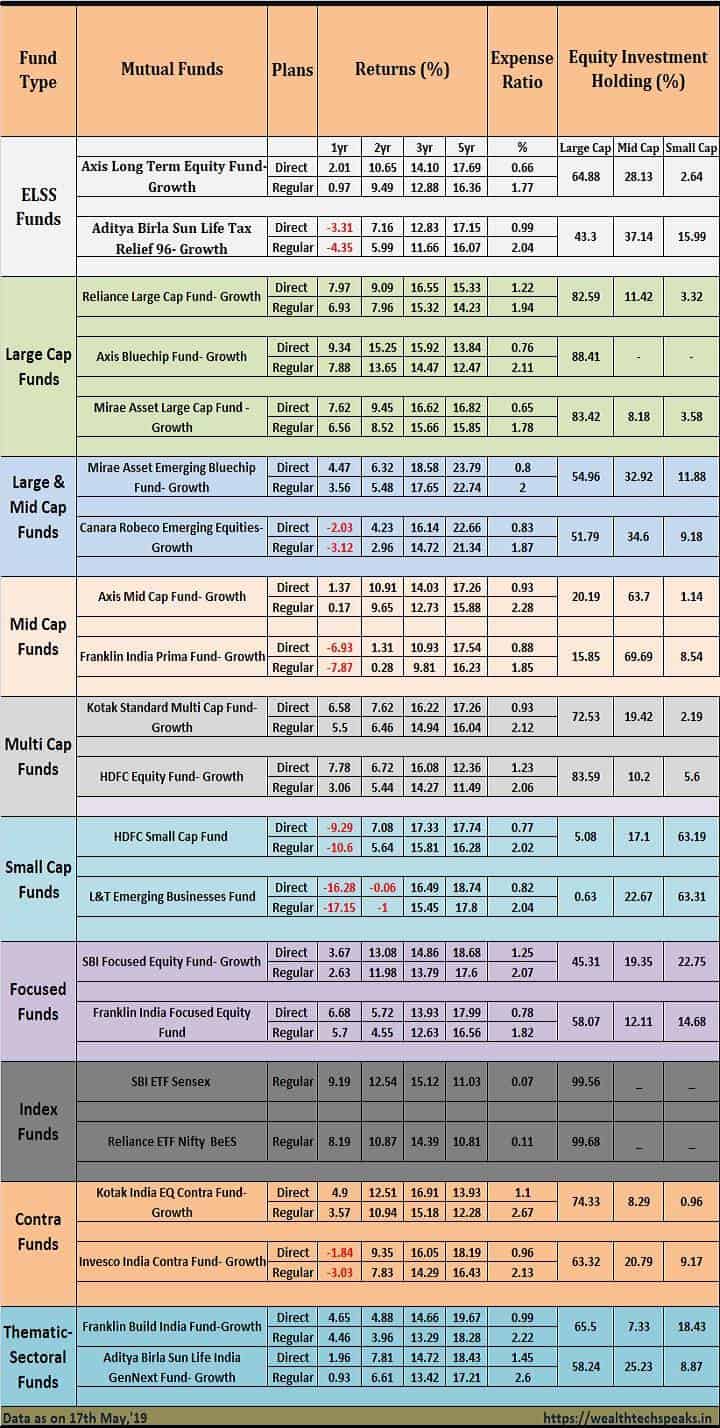

Equity Linked Saving Schemes (ELSS)

Tax Saving Mutual Fund schemes is popular among the Individuals looking for pure investment product with shorter lock-in period. ELSS Mutual Funds have been covered in my previous post as well the link has been shared below.

Top ELSS Mutual Funds FY 2019-20

Investment in ELSS Fund is eligible for deduction U/S 80C up to the maximum limit of Rs 1,50,000/-. The capital gains up to Rs 1,00,000/- in a Financial Year is exempted from Long Term Capital Gain tax.

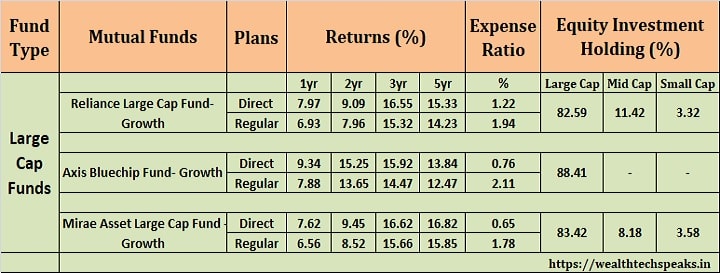

Large Cap Funds

Large Cap Mutual Fund invest larger chunk of the investment pool in companies with larger market capitalization. These large cap stocks are regarded as moderately volatile when compared to other funds and is expected to earn good returns with relatively less risk. The investment in these funds is considered stable and normally preferred by Investors with lower risk appetite. At least 80% of the assets of Large Cap funds are invested in Large Cap equities.

Large & Mid Cap Funds

The fund primarily concentrates on the large and mid cap stocks. The objective is to maximize return along with adequate balance to the portfolio. The fund is balanced between Large and Mid Cap stocks, with at least 35% of assets diverted in Large & Mid Cap stocks respectively.

Due to higher exposure to the Mid Cap, the fund is relatively more volatile when compared to Large Cap Fund.

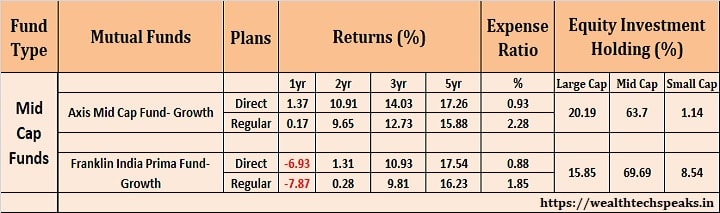

Mid Cap Funds

The fund primarily focuses on mid cap stocks and is considerably volatile in nature as it comprises of emerging stocks which is expected to perform well in the future. Investment in Mid Cap Fund comes with high risk high return concept. The risk tolerance for the investors in Mid Cap Fund is fairly high, Individuals looking for higher returns on investment generally invest in Mid Cap Funds. Since these funds comprise mainly of emerging funds they tend to react sharply to the market sentiments.

Minimum 65% of assets need to be invested in Mid Cap stocks.

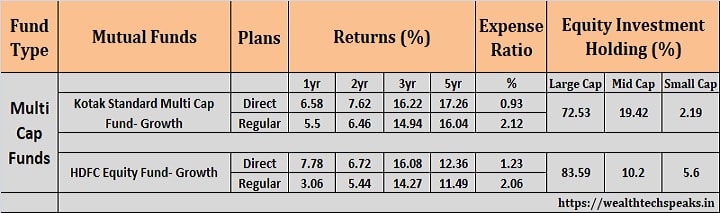

Multi Cap Funds

These funds spread across different market capitalization in a bid to maximize returns. These funds carry moderate risk as the exposure to mid and small is restricted. The fund attempts to milk the growth in the mid & low cap market while mitigating risk with the investment in Large Cap stocks. Minimum 65% of the assets are invested in Equity or Equity Oriented Funds.

These funds appeal to individuals with low risk appetite.

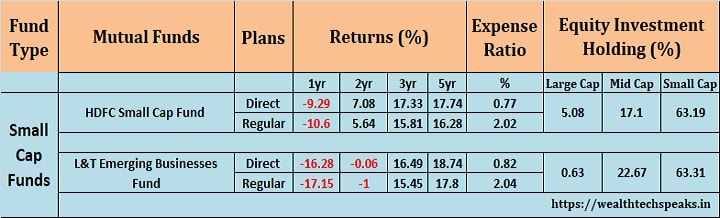

Small Cap Funds

These funds have enormous potential to grow in the future as they are young and emerging businesses. However, they are also faced with challenge to survive and bear any possible consequence of economic downturn. Investment in Small Cap is considered very risky but with potential of higher returns.

The Investors require very high risk tolerance to invest in Small Cap Fund. Minimum of 65% of the assets is allocated to Small Cap stocks.

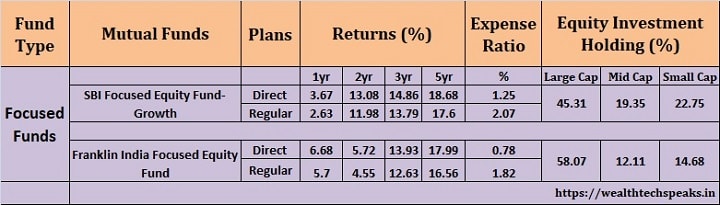

Focused Funds

These fund focus on limited number of stocks. This may be spread across the Large, Mid, Multi and Small Cap stocks. The maximum number of equities allowed under Focused Fund is 30 stocks. This enables the Fund Managers to choose the best funds for investment. However, as the concentration of the fund is restricted to limited stocks, any wrong selection is bound to impact the returns significantly.

Minimum 65% of assets are invested in Equity & Equity Related Instruments.

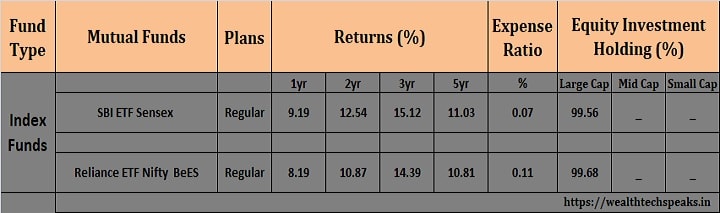

Index Funds

Index Funds is passively managed mutual funds which observes the popular stock indices such as BSE Sensex and NSE Nifty. The movements in these indices impact the performance of the Fund. These funds are relatively less risky and the Expense Ratio is lowest among the Mutual Funds. The performance is close to the benchmark since it tracks the indices. These funds are less volatile and similar to large cap funds.

Minimum 95% of the investment is allocated to securities of particular index.

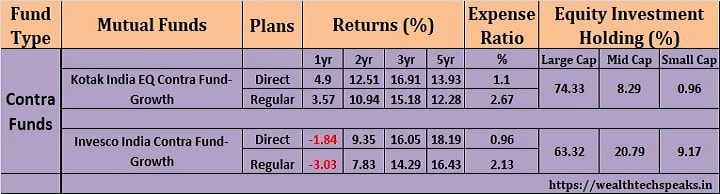

Contra Funds

These are against the tide mutual funds. Low performing stocks are picked up for investment after thorough research anticipating that they will outperform the benchmark in the future. The contrarian view of the capital market is highly risky in the short run but is considered less volatile in the long run. These funds should be considered for long term investments.

Minimum 65% of the assets are invested in Equity & Equity Oriented Funds.

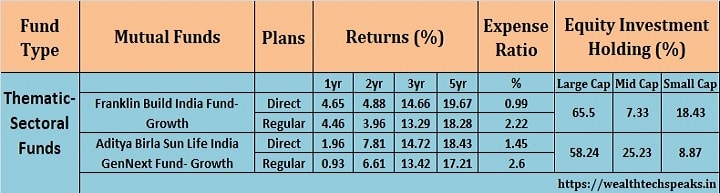

Thematic /Sectoral Fund

The fund focuses on specific sectors and banks on these sectors of the economy to outperform. The concentration on specific stocks and industry makes the investment highly risky but could be highly rewarding if the sector performs well. However, one should be careful about investing in such volatile funds.

Minimum 80% of the asset is invested in specific sector/industry.

So these were my picks as Top Equity Mutual Funds Investment in FY 2019-20.

This article is for informational purpose only, aiming to provide brief idea about Top Performing Equity Mutual Funds, in personal capacity of the author. Investment in Equity Mutual Funds or Equity Oriented Funds is subject to market risks. Readers are advised to research further to have more clarity on the topic. Blog or the Author do not claim expertise on the subject. It is very important to do your own study and consult your Investment Advisor before making any investment related decision.