Best Performing ELSS Mutual Funds for Investment in 2018-19

- Posted By Amritesh

- On January 9th, 2018

- Comments: no responses

Equity Linked Savings Scheme (ELSS) is Tax Saving Mutual Fund Investment Scheme. The investment in the scheme is eligible for Income Tax Deduction U/S 80C up to the maximum limit of Rs 1,50,000/-. However, the maximum limit is inclusive of other investment schemes eligible for deduction under Section 80C. ELSS has the shortest lock in period of 3 years among other tax saving investment plans. The returns on the ELSS are market linked which is moderately volatile, but investment over long period is considered safe. ELSS has potential to earn higher returns when compared to fixed return instruments. Furthermore, In Fixed Income Schemes returns are restricted which may not be sufficient to counter the inflationary trend. Thus ELSS provides the opportunity for better returns. In this post, I pick my Top ELSS Mutual Funds For 2018-19.

Equity Linked Savings Scheme: Reasons to Invest

ELSS is also being considered as the preferred Investment option with the falling interest rates in the Small Savings Schemes. Based on the past performance and benchmarks, Mutual Funds provide better returns compared to Fixed Return instruments.

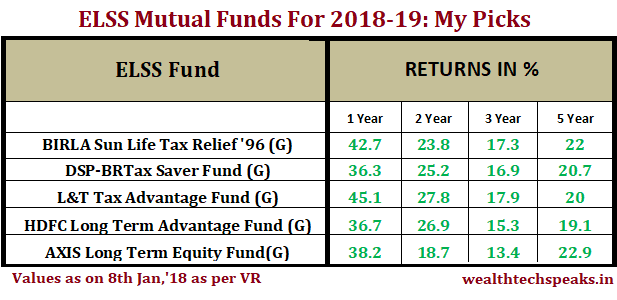

In this post, the Top ELSS Mutual Fund for 2018-19 has been compiled based on the financial/performance data collected from various sources. Here are the Top ELSS Mutual Funds for 2018-19, in my opinion.

Individuals/Investors are requested to consult their respective Financial Advisor before investing.

Equity Market is expected to remain robust thereby providing opportunity to earn better returns on Investment.

Investing in ELSS Funds

Investing in ELSS Fund should be done by setting realistic Financial Goals and reasonable time horizon to achieve the same.

Investment may be done in lumpsum or regular instalments via Systematic Investment Plan (SIP). SIP is an ideal option to invest as it helps to balance out in case of adverse market scenarios.

Patience is the key to achieve decent returns on Investment. One should not panic when market under performs and should consult their respective advisor before taking any decision.

Investing in numerous plans should be avoided as it may prove to be counterproductive and one may end up investing in identical funds.

The suggestion for Investment is based on the following parameters adopted to shortlist the top ELSS Mutual Funds for 2018-19.

Consistency: Funds which has performed consistently over a period of time has been taken into consideration. It should be ensured that the investment is made in funds which have the optimum balance to provide decent returns as well as minimize the risk.

Asset Under Management (AUM): It may not appear as a critical factor. However, it lends creditability to the Fund which is crucial for the Investment. It provides cue about the performance of the Fund. Some large AUM may witness slow growth over short duration but they do tend to perform well over the long term.

Future Potential: Past Performance does help us to understand the performance of the Fund. However, it does not ensure that the fund would continue to perform in the future as well. Thus one should look into the concentration of the Fund and accordingly opt for investment. Funds diversify the investments into Large, Mid and Small Cap equities. Thus the risk and return may be determined by the nature of investment.

Standard Deviation: It is the measurement of the volatility of the fund’s return with respect to the average. It determines the deviation in fund’s return with respect to the mean return of the scheme. Lower deviation means less volatility for the Fund.

This article is for informational purpose only. Readers are advised to research further to have more clarity on the topic. It is very important to do your own analysis and consult your Financial Advisor before making any investment based decision.