Small Savings Schemes Interest Rates FY 2020-21

- Posted By Amritesh

- On January 4th, 2021

- Comments: one response

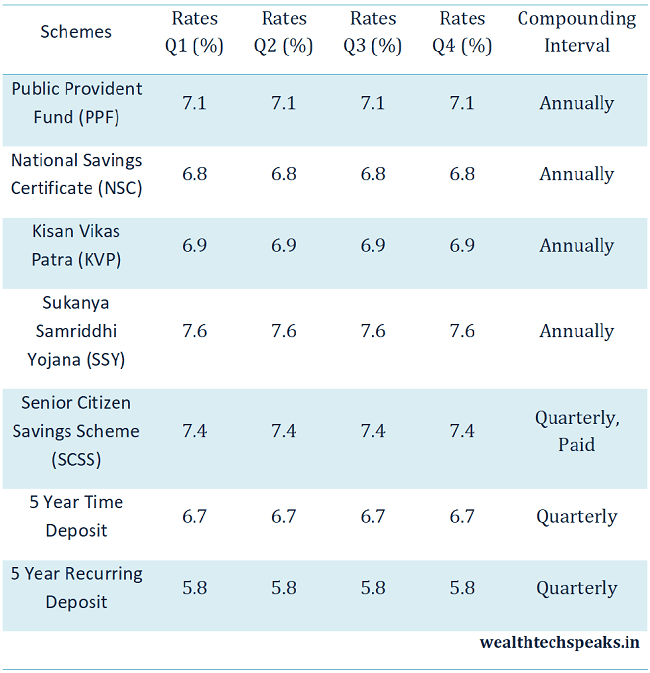

Small Savings Schemes interest rates remain unchanged for the last Quarter of Financial Year (FY) 2020-21. The interest rate on popular Savings Schemes like Kisan Vikas Patra (KVP), Public Provident Fund (PPF) and National Savings Certificate (NSC) received steep cuts at the beginning of the Financial Year. The rates were reduced in the range of 70-140 basis points (0.7%- 1.4%) in the 1st quarter of the Financial Year. The interest rate has remained stable despite the current economic scenario combined with the repo rate cut announced by the Reserve Bank of India (RBI). Government had decided to align the small savings interest rates with the relevant market rates of Government Securities. The rates are now recalibrated every quarter in order to maintain it at par with the current market rates.

The repo rate was cut to 4.4% in March, 2020 and again to 4% in the month of May, 2020. Government aims to provide a level playing field to the Banks by aligning the deposit rates to the market rates. Banks have reduced the interest rates on Term & Recurring Deposits since RBI has lowered the benchmark rate. The interest rates on Small Savings Schemes are marginally higher as compared to rates offered on Banks Deposits, along with Tax Benefits on Selected Small Savings Schemes. The Central Bank (RBI) had clamored for interest rate revision as it is leading to distortion in rate structure. However, it is a concern for the Small Savings Investors who rely heavily on these schemes.

Small Savings Schemes Interest Rates for FY 2019-20

The most popular tax saving scheme Public Provident Fund will continue to offer 7.1% return on Investment for the period ending 31st March, 2021. Similarly, 5 Year National Savings Certificate (NSC) will earn 6.8% return on the investment. Small Savings Schemes such as PPF, NSC, SSY offer risk free return along with tax benefits to risk adverse investors. Thus Small Savings Scheme is popular among low risk appetite individuals. The revised interest rates may impact the retirement plans of Senior Citizens due to drastic cut in interest rates.

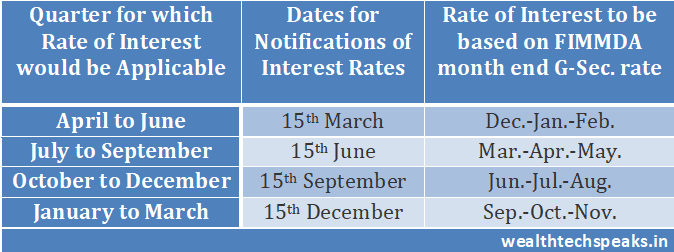

The Government announces the deposit rates across all Small Savings Scheme on quarterly basis. The current interest rates are applicable from 1st January, 2021 till 31st March, 2021. The interest rates are now determined at par with rates of Government Securities.

Small Savings Scheme Interest Rates applicable on various Savings Scheme (Click on link below to read more about the Schemes)

Public Provident Fund (PPF): Investment in PPF will earn 7.1% return for the quarter ending 31st March, 2021. Government has also permitted premature closure of PPF account in genuine cases, such as serious ailment, higher education of children, etc applicable to accounts which have completed 5 years from the date of opening. However, a penalty of 1% in interest payable on whole deposit is imposed in case of premature withdrawal.

National Savings Certificate (NSC): The 5 year NSC will receive an interest of 6.8% on fresh investment made on or after 1st April, 2020. The interest is compounded annually.

Kisan Vikas Patra (KVP): KVP investment will fetch 6.9% return on fresh investment made on or after 1st April, 2020. The interest is compounded annually. Maturity period is 124 months.

Income Tax Slabs & Rates for Financial Year 2020-21

Sukanya Samriddhi Yojana (SSY): Scheme introduced for empowerment of the Girl child will earn 7.6% interest on investment for quarter ending 31st March, 2021.

Senior Citizen Savings Scheme (SCSS): The interest rate offered to the senior citizen still remains respectable despite the economic challenges, last quarter of FY 2020-21 will offer 7.4% return on deposits. The scheme is aimed at the welfare of the senior citizens.

Post Office Schemes: Interest Rates on Post Office Term Deposits of 1 year, 2 year and 3 years will continue to earn interest of 5.5% in the last Quarter of current FY. Term Deposits of 5 years will earn interest at 6.7% for the concerned period. Monthly Income Scheme (MIS) will fetch 6.6% on deposits. Savings deposit will continue to earn 4% return on deposits.

This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

The prediction of performance of earnings forecasts, and the levels of financial disclosure by European firms