Small Savings Schemes Interest Rates: Q4 2019-20

- Posted By Amritesh

- On January 15th, 2020

- Comments: 4 responses

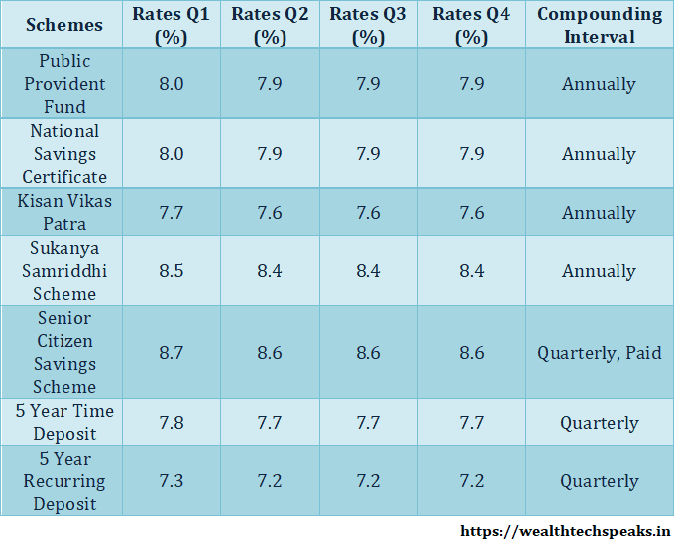

Small Savings Schemes interest rates remain unchanged for the 4th Quarter of the Financial Year (FY) 2019-20. The interest rate on popular Savings Schemes like Kisan Vikas Patra (KVP), Public Provident Fund (PPF) and National Savings Certificate (NSC) has been retained for the current period; the rates were reduced by 10 basis points (0.1%) in the 2nd quarter of the Financial Year. Government had decided to align the small savings interest rates with the relevant market rates of Government Securities. The rates are now recalibrated every quarter in order to maintain it at par with the current market rates. The interest rates on Small Savings Schemes are marginally higher as compared to rates offered on Banks Deposits, along with Tax Benefits on Selected Schemes. The Central Bank (RBI) had been clamoring for revision in rates as it is leading to distortion in rate structure.

Government is trying to provide a level playing field to the Banks by aligning the deposit rates to the market rates. Banks have reduced the interest rates on Term & Recurring Deposits since RBI has lowered the benchmark rate. However, it is relief for the investors as the Small Savings Scheme Interest Rates remain unchanged.

Small Savings Schemes Interest Rates for Financial Year 2018-19

Government had revised the interest rate in the 2nd quarter by 10 basis points as the repo rates received multiple cuts this year. The interest rate was last raised by up to 0.4% in the 3rd Quarter (October- December) of the Financial Year 2018-19.

For the current quarter (Q4 of FY 2019-20), the most popular tax saving scheme Public Provident Fund will offer 7.9% return as compared to 8% return in the 1st Quarter of FY 2019-20. Similarly, 5 Year National Savings Certificate (NSC) will also earn 7.9% return on the investment. Small Savings Schemes such as PPF, NSC, Sukanya Samriddhi Yojana (SSY) offer risk free return along with tax benefits to risk averse investors. Thus Small Savings Scheme is popular among low risk appetite individuals.

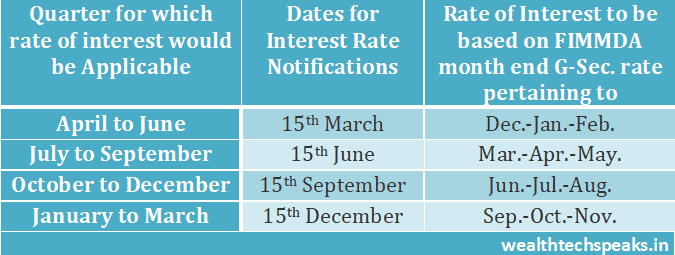

The Government announces the deposit rates across all Small Savings Scheme on quarterly basis. The current rates are applicable from 1st January,’20 till 31st March,’20. The interest rates are now determined at par with rates of Government Securities.

Small Savings Schemes Interest Rates applicable on various Savings Scheme (Click on link below to read more about the Schemes)

Public Provident Fund (PPF): Investment in PPF will earn 7.9% return for the quarter ending 31st March,’20. Government has also permitted premature closure of PPF account in genuine cases, such as serious ailment, higher education of children, etc applicable to accounts which have completed 5 years from the date of opening. However, a penalty of 1% reduction in interest payable on whole deposit is imposed in case of premature withdrawal.

National Savings Certificate (NSC): The 5 year NSC will receive an interest of 7.9% from 1st July,’19 as compared to 8% earned previously. The interest is compounded annually.

Kisan Vikas Patra (KVP): KVP investors will fetch 7.6% return for the Quarter ending 31st March,’20. The interest is compounded annually. Maturity period is 113 months.

Sukanya Samriddhi Scheme (SSS): Scheme introduced for empowerment of the Girl child will earn 8.4% interest on investment for quarter ending 31st March,’20.

Senior Citizen Savings Scheme (SCSS): The interest rate has been retained at 8.6% till 31st March,’20. The scheme is aimed at the welfare of the senior citizens.

Post Office Schemes: Interest Rates on Post Office Term Deposits of 1 year, 2 year and 3 years is retained at 6.9% for the second quarter of the FY. Term Deposits of 5 years will earn interest at 7.7% for the concerned period. Monthly Income Scheme (MIS) will fetch 7.6% on deposits. Savings deposit will continue to earn 4% return on deposits.

This article is for informational purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

I am sure this piece of writing has touched all the internet

visitors, its really really fastidious article on building up new weblog.

Its like you read my mind! You seem to understand so much about this,

such as you wrote the e book in it or something. I think that you just could do with a few p.c.

to pressure the message house a little bit, but instead of that, that is

great blog. A great read. I will certainly be back.

Hi there to every single one, it’s truly a pleasant for me to visit this

web site, it includes priceless Information.

стоимость строительства индивидуального дома