Small Savings Schemes Interest Rates Revised For 4th Quarter (January-March) Of Financial Year 2017-18

- Posted By Amritesh

- On December 31st, 2017

- Comments: 3 responses

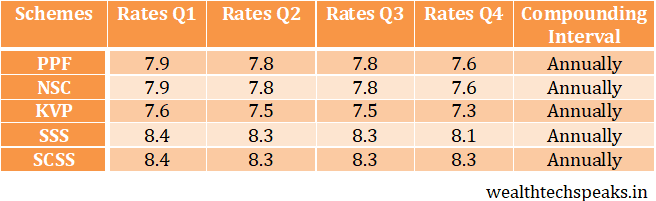

The Government has revised the Small Savings Scheme interest rates, which is reviewed on quarterly basis. The new rates are applicable from 1st January,’18 till 31st March,’18. The rates will now be determined at par with rates of Government Securities.

Latest Small Savings Interest Rates 2019-20

The 0.2% rate cut has been announced for the last quarter. The rates have been falling rather frequently in the last few quarters. Despite the rate cuts, investment in Public Provident Fund (PPF) and other investment schemes remains attractive when compared with other fixed return instruments. In my opinion, Individuals should look at other lucrative investment options as Mutual Funds and Bonds.

Small Saving Scheme Interest Rates (Click on link below to read more about the Schemes)

Public Provident Fund (PPF): Rate has been revised to 7.6% for the period 1st January,’18 till 31st March,’18. Government has also permitted premature closure of PPF account in genuine cases, such as serious ailment, higher education of children, etc applicable to accounts which have completed 5 years from the date of opening. However, a penalty of 1% reduction in interest payable on whole deposit is imposed in case of premature withdrawal.

National Savings Certificate (NSC): The 5 year NSC will earn an interest of 7.6% from 1st January,’18 as compared 7.8% earned previously. The interest to be compounded annually.

Kisan Vikas Patra (KVP): The rate have been revised to 7.3% for the Quarter ending 31st March,’18. The interest is compounded annually.

Sukanya Samriddhi Scheme (SSS): The rate has been revised to 8.1% till 31st March,’18.

Senior Citizen Savings Scheme (SCSS): The rate has been retained at 8.3% till 31st March,’18.

Post Office Schemes: Rates have also been revised on Post Office Term Deposits of 1 year, 2 years, 3 years, 5 years as 6.6%, 6.7%, 6.9% and 7.4% respectively. Monthly Income Scheme (MIS) will also earn an interest of 7.4%. However, the Savings deposit will continue to fetch returns at the rate of 4%.