Small Savings Scheme Comparison: KVP, NSC, PPF, SSY, SCSS, Tax Saver FD

- Posted By Amritesh

- On May 17th, 2018

- Comments: 6 responses

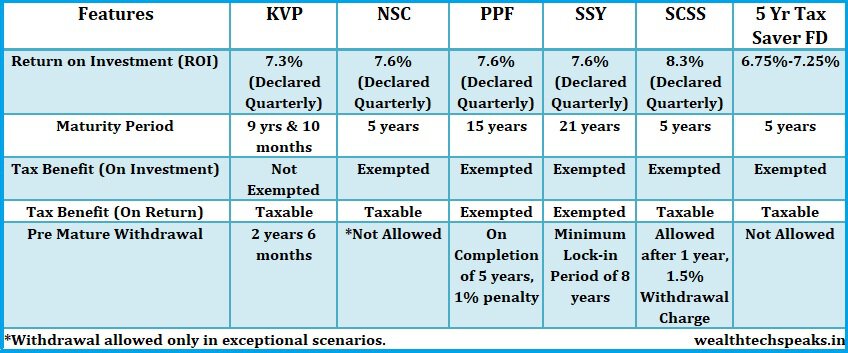

Investment in Small Savings Scheme yields guaranteed returns. Individuals invest in small savings schemes not only for guaranteed returns but also with the objective of saving tax. The interest is declared on quarterly basis on Small Savings Schemes. The Public Provident Fund (PPF), National Savings Scheme (NSC), Kisan Vikas Patra (KVP), Sukanya Samriddhi Yojana (SSY) and Senior Citizen Savings Scheme (SCSS) are some of the popular small savings schemes. In this post, comparison between KVP, NSC, PPF, SSY, SCSS and Tax Saver FD (Fixed Deposits) to understand the most attractive Savings plan in terms of return and tax benefit among fixed return investment instruments.

However, in my opinion investing in Mutual Funds is a better option as it provides better returns in the long run with shorter lock in period. One may invest in Equity, Balanced or Debt Mutual Funds depending on the future Financial Obligations and Goals.

The complete details related to the respective Small Savings Schemes is hyperlinked to the Headings.

Comparison of Small Saving Schemes: KVP, NSC, PPF, SSY, SCSS and Tax Saver FD

Kisan Vikas Patra (KVP)

Kisan Vikas Patra (KVP) is the small saving investment scheme. It is a onetime investment plan. The amount gets doubled in 9 years and 10 months depending on the rate of interest offered on the same. Currently, the interest offered for April,’18- June,’18 Quarter is 7.3%. The investment does not provide any tax benefit on investment. Even the interest earned on investment is liable to tax. Thereby, considering the interest and tax implications, one should avoid investing in KVP.

National Savings Certificate (NSC)

National Savings Certificate is a popular investment scheme. The lock-in period for the investment is 5 years. The investment is eligible for tax deductions. However, the cumulative interest earned is taxable at the time of maturity. The interest offered under NSC is 7.6% currently, for April,’18- June,’18. Similar to other small saving investment plans, the interest on NSC is declared on quarterly basis. The interest is compounded annually.

Public Provident Fund (PPF)

One of the best investment plans for the investors. The lock-in period of investment is on the higher side, 15 years. The interest offered on the investment is 7.6% April,’18- June,’18. PPF interest is also announced on quarterly basis. However, the biggest advantage of investing in PPF is that in terms of taxation it falls under the EEE (Exempt, Exempt, Exempt) regime. This implies that not only the investment, but the interest earned as well as the maturity proceeds is exempted from tax.

Pre mature withdrawal is allowed on completion of 5 years, but 1% interest is deducted for each year as penalty.

Sukanya Samriddhi Yojana (SSY)

This option is only available to investors having a girl child. The scheme is offering returns of 8.1% on investment aimed at meeting the education/marriage expenses of the girl child. The investment is eligible for tax deductions U/S 80C. Parents of a girl child may invest in the scheme which comes with provision of partial withdrawal to meet the higher education expenses of the child in the future. The tenure of the scheme is for 21 years. However, the Contribution may be made for initial 15 years, post opening of the account.

Senior Citizen Savings Scheme (SCSS)

One of the viable investment options for Senior Citizen is the SCSS, offering 8.3% guaranteed return on investment. The maximum amount which may be invested under the scheme is Rs 15 lakhs for the tenure of 5 years. The investment in the scheme also qualifies for deduction U/S 80C. Only senior citizens (60 years and above) are eligible to invest in the scheme. However, Individuals opting for Voluntary retirement may invest in the scheme from 55 years of age. Retired Defense Personnel may invest in the scheme on completing 50 years of age.

The return offered on the deposit is the highest among the Small Savings Schemes.

Tax Saver Fixed Deposits (FD)

Tax Saver Term Deposits offer return in the range of 6% to 7% for a minimum tenure of 5 years. The rates may vary slightly from Bank to Bank, but in general the return is less compared to other small savings scheme. The Tax Benefit is available on Investment under Section 80C. However, the interest earned is taxable in the hands of the depositor.

The interest rate offered is less when compared to the other Small Savings schemes, the return is also taxable in the hands of the depositor making it an unproductive investment scheme for the Individuals. Senior Citizens are offered slightly higher returns on the deposits.

Best Small Savings Investment Scheme: KVP, NSC, PPF, SSY, SCSS and Tax Saver FD

As observed from the above comparison of KVP, NSC, PPF, SSY, SCSS and Tax Saver FD. Investment in SCSS is beneficial for the Senior Citizens while SSY offers decent return when planning for future of a Girl Child. For rest, Public Provident Fund (PPF) is the best small saving investment scheme, as it offers tax free return along with tax deduction on investment in the Scheme. But as I said earlier, investment in Small Savings Scheme offers mediocre returns. Hence, to maximize return on investment one should also look to invest in Mutual Funds along with Small Savings investment.