Small Savings Schemes Interest Rates For 4th Quarter (January-March) Of Financial Year 2018-19

- Posted By Amritesh

- On January 5th, 2019

- Comments: one response

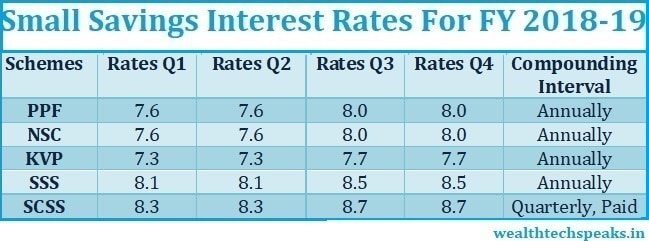

Government has retained the Small Savings interest rates on popular Savings Scheme for the last quarter of the Financial Year. Government had raised the interest rates for the 3rd Quarter of FY 2018-19 following higher yield on the Government Securities. Thus, Investors will benefit from the hike in interest rates on some of the popular investment schemes.

Latest Small Savings Interest Rates 2019-20

The interest was raised by up to 0.4% for the 3rd Quarter (October- December) of the Financial Year 2018-19. The most popular tax saving scheme Public Provident Fund scheme offers 8% return as compared to 7.6% return in the 2nd quarter of FY. Thereby, scheme gains more appeal among risk adverse investors. Similarly, 5 Year National Savings Certificate (NSC) will also earn 8% return on the investment.

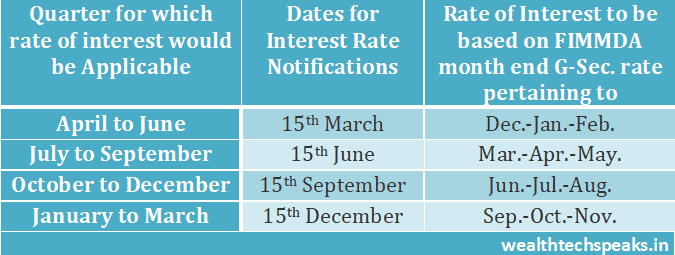

The Government announces the deposit rates across all Small Savings Scheme on quarterly basis. The current rates are applicable from 1st January,’19 till 31st March,’19. The interest rates are now determined at par with rates of Government Securities.

Small Savings Interest Rates on various Savings Scheme (Click on link below to read more about the Schemes)

Public Provident Fund (PPF): Rate has been revised to 8% for the period 1st October,’18 till 31st March,’19. Government has also permitted premature closure of PPF account in genuine cases, such as serious ailment, higher education of children, etc applicable to accounts which have completed 5 years from the date of opening. However, a penalty of 1% reduction in interest payable on whole deposit is imposed in case of premature withdrawal.

National Savings Certificate (NSC): The 5 year NSC will earn an interest of 8% from 1st October,’18 as compared 7.6% earned previously. The interest is compounded annually.

Kisan Vikas Patra (KVP): The interest rate has been retained at 7.7% for the Quarter ending 31st March,’19. The interest is compounded annually.

Sukanya Samriddhi Scheme (SSS): The rate has been revised to 8.5% till 31st March,’19. The scheme is aimed towards the welfare of a girl child.

Senior Citizen Savings Scheme (SCSS): The rate has been retained at 8.7% till 31st March,’19. The scheme is aimed at the welfare of the senior citizens.

Post Office Schemes: Rates have been revised on Post Office Term Deposits of 1 year and 3 years to 7%, from 6.9% and 7.2% respectively. However, Term Deposits of 2 years and 5 years will continue to fetch returns at 7% and 7.8% respectively. Monthly Income Scheme (MIS) will draw an interest of 7.7% on deposits. Savings deposit will continue to earn returns at the rate of 4%.

Notification issued by the Ministry of Finance, Department of Economic Affairs

Small Savings Interest Rates is adjusted on quarterly basis in alignment with Government Securities rates.

This article is for informational purpose only. Readers are advised to research further to have more clarity on the topic. It is very important to do your own analysis and consult your Financial Advisor before making any investment based decision.

Online poker