Atal Pension Yojana (APY) to be discontinued for Taxpayers

- Posted By Amritesh

- On August 31st, 2022

- Comments: 9 responses

Government recently announced the discontinuation of guaranteed low-cost retirement benefit plan Atal Pension Yojana (APY) for the taxpayers. The new rule is set to come in force from 01st October, 2022. Earlier, the scheme was open to all the individuals above the age of 18 years. APY is an affordable retirement plan introduced by the Government to provide basic means of living to the individuals working in unorganized sector having limited access to investment products. However, it is observed that individuals from higher income group have also enrolled under the scheme. Government had already introduced National Pension Scheme (NPS) for organized sector and taxpayers.

National Pension Scheme: Low Cost Retirement Plan

The decision to debar tax payers from the APY is largely taken to prevent the misuse of the scheme and cater to the economically weaker section of the society. The move is aimed at encouraging taxpayers to subscribe to the National Pension Scheme (NPS) rather than restrict themselves to APY for the purpose of retirement planning. However, Taxpayers who have already subscribed or will subscribe to APY by 30th September will be able to continue under the scheme.

What is Atal Pension Yojana (APY)?

Atal Pension Yojana (APY) was introduced in May, 2015 with the aim to establish social security system for the masses in the country. The scheme offers affordable retirement plan to financially weak, under privileged and individuals working in unorganized sector who have limited access to similar financial products. The scheme is administered by Pension Fund Regulatory and Development Authority (PFRDA).

#APY was available to all Bank Account holders falling under the age bracket of 18-40 years.

#Subcribers are required to make periodic contribution under the scheme based on the entry age and pension amount opted for by the respective Individual.

APY Retirement Scheme

#Subscribers will receive the guaranteed monthly pension amount as per subscription between Rs 1,000 to Rs 5,000/- on attaining 60 years of age.

#Monthly Pension will be available to the Subscriber and post death to the spouse, and after the demise of the spouse the entire pension corpus would be paid back to the nominee of the Subscriber.

What holds for Atal Pension Yojana (APY) Subscribers?

Taxpayers will no longer be able to subscribe to the Atal Pension Yojana (APY) on and after 01st October, 2022. Only individuals with income level below the income tax threshold will be eligible to subscribe to the scheme. The benefits under the scheme remain unchanged for the Individuals who have already subscribed under the scheme. Taxpayers who have already enrolled under the scheme or who will enroll by 30th September, 2022 will also be allowed to continue with the subscription.

Earlier, Individuals had the option of subscribing to the NPS as well as APY retirement plan. However, the new diktat rules out investment in APY for the tax payers. NPS is one of the low-cost retirement plans launched in 2004, initially for Government Employees but later on was opened up for Corporate and rest of the Citizens. The investment under APY and NPS is managed by the PFRDA.

Comparison of Government Retirement Benefit Plans

#National Pension Scheme will be the only Government backed retirement plan available to the Taxpaying Individuals, post 30th September, 2022.

#National Pension Scheme offers far more flexibility to the investors in comparison to the Atal Pension Yojana.

#Tax Paying Individuals may investment in retirement oriented mutual (retirement funds), annuity plans as top-up to NPS and other investments.

#Individuals may park their funds in Public Provident Fund, Equity Mutual Funds, Fixed Deposits which may also serve as Retirement corpus.

What is National Pension Scheme (NPS)?

National Pension Scheme (NPS) is a low-cost flagship retirement plan introduced with the objective of catering to wide strata of the society. Currently following schemes under NPS;

Government, Corporate, Swavalamban (Unorganized Sector) and All Citizen Model caters all interested/eligible investors under the scheme.

#Indian Citizen or Overseas Citizen of India/NRIs aged between 18-70 is eligible to join the scheme.

National Pension Scheme: Knowhow

#Individuals can easily enroll under the scheme either via the online mode or the offline mode.

#Two types of account are available under NPS, Tier-1 (Primary Pension Account) and Tier-2 (Optional Investment Account).

#Initial Investment to open the account is Rs 500/-, while Minimum Contribution every year under the Scheme is Rs 1,000/- for Tier- 1 account. The initial investment for Tier- 2 account is Rs 1000/- and minimum contribution is Rs 250/- every year.

#Income Tax benefit is available on investment in Tier-1 scheme. However, no such benefit is available under Tier-2 scheme.

#Currently, 8 Fund Managers are enrolled to manage the investments under NPS. Investors need to choose anyone of the Fund Manager to manage their investments.

#Investment is diversified into Equities, Corporate Bonds, Government Securities and Alternative Assets.

#Investor may choose Active or Auto choice for asset allocation. Maximum exposure to Equity is restricted to 75% under both the option for asset allocation.

#On attaining the age of 60 years, investor may withdraw 60% of the fund as lumpsum and the remaining 40% may be utilized to purchase an annuity pension plan from any of the registered Pension Fund. Investors also have the option to continue with investment till the age of 75 years.

Roadmap for Investors: Atal Pension Yojana (APY)

As of 31st July, NPS accounts for more than 1.61 crore subscribers with Asset Under Management (AUM) close to ₹7.5 lakh crore whereas, APY has more than 3.90 crore subscribers with AUM close to ₹22.3k crores.

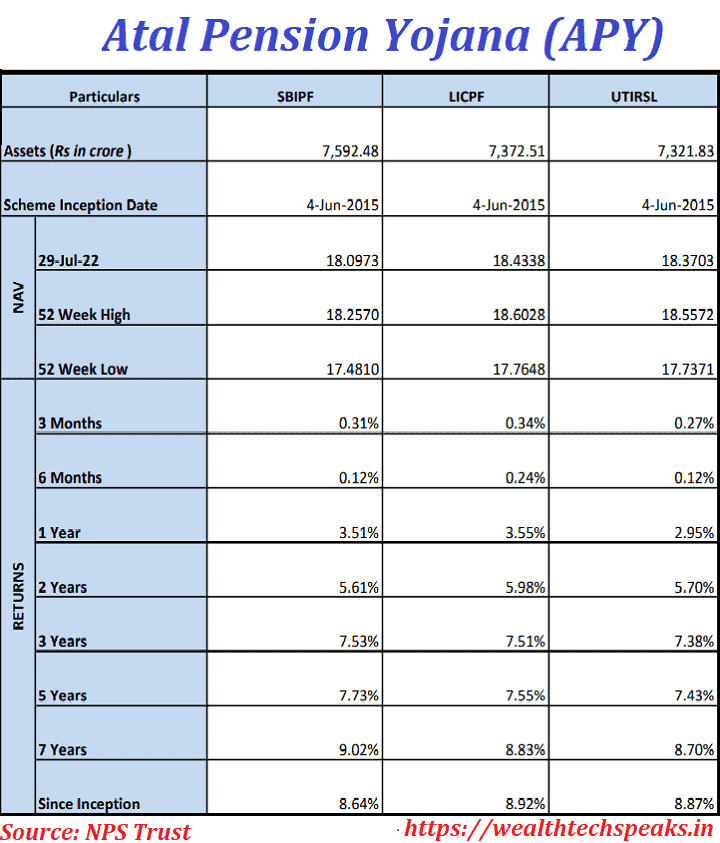

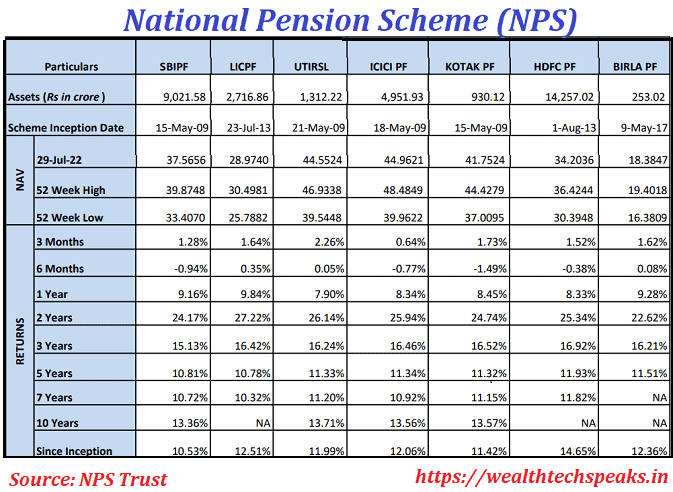

As depicted in the chart, the NPS return on investment since the inception till 31st July, 2022 is around 12% in the Equity segment. Whereas, APY has delivered close to 9% return since its inception. Compared to returns offered on Small Savings Schemes, the returns on both the retirement plan is quite impressive.

Tax paying Individuals may subscribe to the NPS instead of APY as exposure to equity may be customized for better returns. Contribution to the NPS is unrestricted, subscribers do not have any upper limit cap on contribution to the Fund. Even though, liquidity is an issue under both the schemes but NPS does offer partial withdrawal option on completion of stipulated conditions laid out for the same. Investors are free to choose their Fund Manager with the option to review and switch, if required.

Income Tax Slabs & Rates for Financial Year 2022-23

As it was pointed out earlier, retirement requires long term planning, relying on just one retirement product is not a wise decision. Individuals should also look at alternatives such as Mutual Funds, PPF and other investment products to achieve their financial goals. Moreover, the maximum pension under APY is Rs 5,000/- per month which may not be able to meet the cost of living of taxpayers. Hence, Government has decided to force the taxpayers think beyond APY.

Individuals looking to invest in Mutual Funds may connect at admin@wealthtechspeaks.in for investment guidance and advice. We do offer investment in regular Mutual Fund schemes for the interested investors.

Do subscribe to our WealthTech Speaks YouTube Channel & also our Blog as it keeps us motivated to post new content. In case you are interested in investing in Stocks, get your free Demat today (Click Here).

WealthTech Speaks or any of its authors are not responsible for any errors or omissions, accuracy, completeness, timeliness or for the results obtained from the use of this information. This article is for informational and promotion purpose only. Readers are advised to research further to have detailed knowledge on the topic. It is very important to do your own analysis and consult your Financial Advisor before arriving at any conclusion.

Hello there, simply turned into alert to your blog thru Google, and located that it’s truly informative. I am gonna watch out for brussels. I will be grateful should you continue this in future. Many other folks might be benefited out of your writing. Cheers!

Yet another issue is that video gaming has become one of the all-time greatest forms of recreation for people of various age groups. Kids engage in video games, and also adults do, too. Your XBox 360 is one of the favorite gaming systems for people who love to have hundreds of activities available to them, plus who like to play live with others all over the world. Many thanks for sharing your opinions.

Hello! I just wanted to ask if you ever have any issues with hackers? My last blog (wordpress) was hacked and I ended up losing several weeks of hard work due to no back up. Do you have any methods to protect against hackers?

I’m in awe of the author’s capability to make complicated concepts accessible to readers of all backgrounds. This article is a testament to her expertise and passion to providing valuable insights. Thank you, author, for creating such an compelling and insightful piece. It has been an unforgettable experience to read!

I used to be able to find good info from your blog posts.

Thanks for another fantastic post. Where else could anyone get that kind of info in such a perfect way of writing? I’ve a presentation next week, and I’m on the look for such information.

Throughout the awesome scheme of things you actually secure a B- just for effort and hard work. Exactly where you actually misplaced us was first in all the specifics. You know, they say, details make or break the argument.. And it could not be much more correct in this article. Having said that, let me say to you exactly what did deliver the results. The writing can be incredibly convincing which is probably why I am taking an effort in order to opine. I do not really make it a regular habit of doing that. Second, although I can see a jumps in logic you come up with, I am definitely not convinced of just how you seem to unite your ideas that produce the conclusion. For the moment I will subscribe to your position however hope in the future you actually link your facts much better.

One more thing. I believe that there are numerous travel insurance web-sites of trustworthy companies that permit you to enter your trip details and find you the prices. You can also purchase your international travel insurance policy on the internet by using the credit card. Everything you need to do should be to enter the travel particulars and you can begin to see the plans side-by-side. Just find the program that suits your budget and needs after which use your bank credit card to buy the idea. Travel insurance on the internet is a good way to take a look for a respectable company with regard to international travel cover. Thanks for giving your ideas.

I was able to find good info from your blog posts.