Plan Your Investment: Be Wise, Choose Wise!!!

- Posted By Amritesh

- On June 26th, 2018

- Comments: 3 responses

“Investment”, if you go by the meaning of the word, it simply implies the “the act or process of investing money for profit”, it is simple isn’t it???

Well with respect to personal finance, the honest answer is a “Yes” and a “No”, the same will be explained as I continue further. Just at the end of the year 2015, Standard and Poor’s Financial Services released the findings of the Global Financial Literacy Survey, according to the report close to 76% of the Indian adults do not properly relate to the key financial concepts.

It is very important to understand the term “Investment” in real term. Individuals without any “Financial Plan” may think this post is not for them but trust me, “If one does not plan for the future, in all likelihood the future may just not exist for them.”

Understanding “Investment” in Financial Planning

Savings

Majority of us think that Savings, Insurance and Investment imply the same, but in reality, it is not so. Ideally, Investment is aimed at earning favorable returns, whereas Insurance secures against unforeseen risks and Savings is the liquidity at disposal post expenses.

Savings is the difference between the earnings and expenses. It is the liquid fund available which may be divested in Insurance and Investment Plans.

Insurance

Insurance provides protection against any possible eventuality. In my opinion, every Individual should invest in Life and Health Insurance cover. Term Plan is a pure Life Insurance scheme which offers higher coverage at affordable premiums. Furthermore, rising medical costs also make it very important to invest in a Health Insurance Plan which would take care of the treatment costs in case of any eventuality.

Investment

Traditionally, Individuals were advised to invest in Public Provident Fund (PPF), National Savings Certificate (NSC) or Endowment Insurance Plans as they offer guaranteed returns on investment, but no more. Interest on PPF and NSC is now linked with Government Bond announced on quarterly basis, while Endowment Insurance Plans offer meager 3%-5% return on maturity. With Retail Inflation hovering around 5% (4.87% to be precise), it implies that only 2%- 3% appreciation of wealth over a period of time.

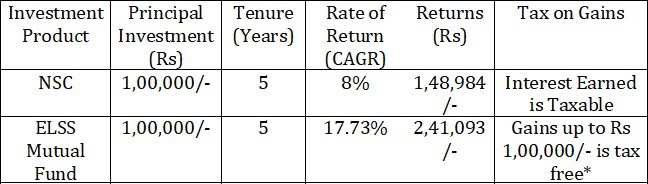

Ideal Investment Option: In my opinion, Investment in Mutual Funds is a better alternative as diversification of fund not only mitigates risk but also provides opportunity to earn better returns. Over the years the Mutual Funds have performed exceedingly well. As per Association of Mutual Funds in India (AMFI) latest data, CRISIL-AMFI Equity Fund Performance Index earned Compounded Annual Growth Rate (CAGR) of 11.80% return in 10 years and 17.73% return in 5 years.

The table above illustrates that investment in ELSS Mutual Fund not only offers better return but is tax efficient as well.

*Gains above Rs 1 lakh is taxed @10% without indexation benefit.

Financial Planning: One Should Keep in Mind

Term Insurance/Health Insurance: Life and Health Insurance is must for every Individual as it mitigates the unforeseen risk.

Plan Future Events: Major events (new house, marriage, child’s education, new car, holiday plans, etc) are part and parcel of one’s life. Pre- planning for such events is very essential otherwise it could lead to financial stress.

Retirement Plan: It is of utmost importance for an Individual to plan for their retirement. Post retirement, in all likelihood the earning opportunity is going to shrink, thus one needs have an alternative plan to maintain the flow of income which would suffice the financial requirement.

In my opinion, one may be able to build a retirement corpus with a strategic investment plan. Ideally, small but regular investment in Mutual Fund over a long term would be the best way to create the Retirement Fund. Investment in Mutual Fund through Systematic Investment Plan (SIP) allows small but regular investment into the fund. The power of compounding ensures good returns while diversification of fund mitigates risk and periodic investment ensures rupee cost averaging.

I hope now you have understood as to why I had answered in “Yes” and “No” to the question raised at the beginning of the article.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Readers are advised to research further to have more clarity on the topic. It is very important to do your own analysis and consult your Financial Advisor before making any investment based decision.