Kushal Tradelink Equity: Potential Investment Option for Retail Investors

- Posted By Amritesh

- On April 11th, 2016

- Comments: 3 responses

Investing in Stock Market in never an easy thing to do as you have so many stocks across sectors and it is very difficult to ascertain as to how the stock will perform over a period of time. Today I will review Kushal Tradelink, a BSE Small Cap Stock which seems to be an interesting pick and Individuals may have a serious look at it as it has been doing really well over the past few months and the fundamentals also look very promising. Thereby, Retail investors may look to invest in the stock and make decent returns.

The company is currently listed in BSE Index and is in process to be listed in NSE very soon.

In this post, I will try and have a close look at Company’s Business, Financial Performance, Stock Performance and brief on Fundamentals.

Company Profile

The Company was setup in 2000 and has established themselves as a major eco friendly paper supplier and trader in the country. The company deals in wide range of Paper products which are being used extensively across industry. Company has got 3 mills in Gujarat apart from having two subsidiaries operational in Singapore and UAE.

Some of the relevant paper products of the company are:

Kraft Paper: Used for grocery bags, multiwall sacks.

Duplex Board: Used for Packaging and making boxes.

Waste Paper: Recycling the papers.

Newsprint Paper: Printing of Magazines.

Reel Paper & Copier Paper: Primarily used for Packaging and Flexi Print.

Financial Performance

The company has done reasonably well ever since its inception. The company is backed by strong financial performance over the past few years. Consolidated revenue from operations for the year 2015 increased by 43.20% to Rs 43366.52 Lacs as compared to Rs 30283.73 Lacs in the year 2014 and the Consolidated Profit after Tax (PAT) increased by 46.48% to Rs 657.35 Lacs as compared to Rs 448.77 Lacs in the year 2014. Consolidated Earning Per Share (EPS) was recorded at Rs 2.77, which is higher as compared to that of last year.

Company has declared interim dividend twice, 40% in January,’16 and 60% in March,’16 which will be reflected in Financial Report of 2015-16. One should keep a close eye on the performance of the firm’s last year’s financial report as it will form the basis for investment.

KUSHAL TRADELINK | |||

Particulars | Consolidated Account (Fig in Lakhs) | ||

2013-14 | 2014-15 | ||

Revenue from Operations | 30251.85 | 43300.76 | |

Other Income | 31.88 | 65.76 | |

Total Revenue | 30283.73 | 43366.52 | |

Total Expenditure | 29614.69 | 42444.5 | |

Profit Before Tax | 669.04 | 922.02 | |

Profit After Tax (PAT) | 448.77 | 657.35 | |

Earning Per Share (EPS) | 2.2 | 2.77 | |

Stock Performance

Kushal Tradelink has a market cap of Rs 1,485.20 crores and has been able to remain profitable despite facing competition from the established units. This augurs well for the business.

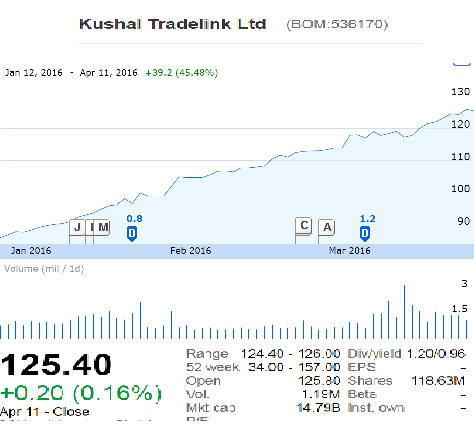

The stock is being traded actively with average daily volume being close to 10 lac shares.

Over the past 6 months the stock has spiked up over 100% largely due to the strong financial performance and fundamentals. The stock holds a lot of promise going by the financial performance and strong industry penetration.

Let’s look at Stock’s performance over last 3 months:

Fundamental Outlook

The Stock looks to be heading in right direction as the firm has got multi core contracts from leading firms, Rs 250 crore deal with Adron Enterprise (Adani Group of companies), Rs 200 crore deal with Shree Rama newsprint, Rs 1000 crore with Bungee India apart from deals with other 1500+ SME firms across India.

Hence, Retail Investors should consider this stock for investment in the future. I will keep a close watch on the movements of the stocks and will update with latest financial reports and news which I come across. Over the period the Investors have realized the stock as a good investment option and large number of investor have invested in the stocks.

Disclaimer:Please treat this post as a starting point of my research and do not conclude it for investment. It is also advisable to consult your financial advisor before investing.

Note: This article has been sponsored by the respective Business House.

Note: This article has been sponsored by the respective Business House.

www.amritfinaa.blogspot.com

Subscribe

Login

3 Comments

oldest